After an interesting week last week, it looks like we’re knocking on the door of the way down. It’s almost like there’s a door that the markets are knocking on, except on the other side is just the edge of the cliff, that we’re about to step off of.

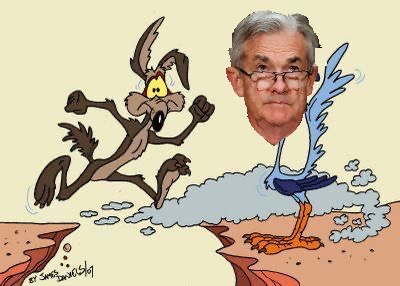

The effects of the Covid virus have made global economic numbers dismal, earnings numbers were not fantastic & we learned that the Fed has begun to step back even further on their Treasury QE buying… Roadrunner Powell’s about to send Wall St. Coyote off the cliff potentially.

Lots Of Earnings Calls On Deck For This Week

Over 1,600 companies will be reporting earnings this week, which should add a lot of noise to the current situation. Based on everything that we saw last week, I’m not buying that we’re going to see anything good come from these calls, but there is enough volume of them to cause some chop for sure (upwards or downwards in this instance).

Considering that a majority of all positive market movement these days is coming from FAANG stocks, this should open up the stage for more fallout.

We’re Technically Closer There Than You Think

After looking at some of the last few month’s charts, we may be closer to the edge of the diving board than we think. Most of our market action these days is dictated on the open of the day, and then trades relatively floundery the rest of the day in one way or the other.

Looking at the charts for the S&P 500 & NASDAQ, a 2.5-3% gap down day could be the exact thing to trigger the next market downfall.

This will make market opens more interesting to watch, as a 2% gap down open already has stocks playing 1st & Goal for a fallout..

We’re playing with dynamite at a time where Fed Officials are stoking the fire, almost like a controlled burning of a building that will lead to the downfall of the block once the neighbors join in…

What I’ll Be Doing

I am still maintaining my short positions, I don’t see things turning around anytime soon, and I’m not convinced that we’ll find a miracle market mover this week either.

Headlines regarding state’s reopening may help soften some of the blows we are about to take, but after Gillead’s drug botch & earnings call, I don’t know that markets are too inclined to move on drug optimism as much as they were.

Factor in the other elements listed above & I don’t see this being a prime time to be buying stocks long, however, it is a great time to start putting together a “wish-list” and expected buy-in ranges for when things start to settle down after the next decline…