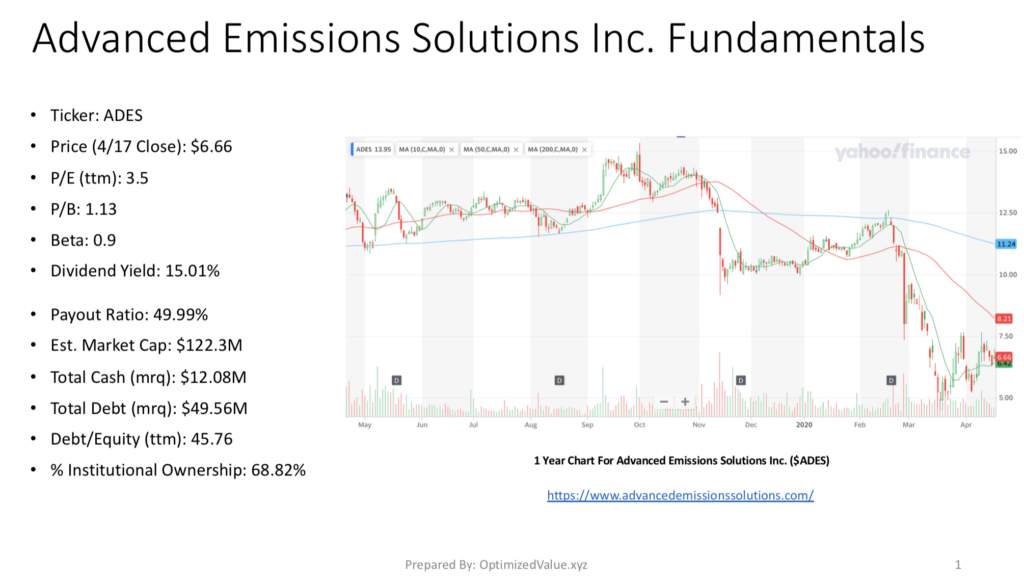

This week I had a look into Advanced Emissions Solutions Stock, which trades under the ticker $ADES. ADES is a micro-cap stock that offers strong fundamentals & an excellent, safe dividend yield. I conducted my research over the weekend on 4/20/20, when the price was at $6.66, and all numbers in this article are reflective of that date.

ADES Stock Offers Strong Fundamentals

ADES trades at a P/E (ttm) of 3.5 & a P/B of 1.13, with a Beta of 0.9. These are very attractive levels, especially when compared to the averages of their Sector, Industry & Sub-Industry (below).

Their lower than average Beta ensure less volatility, with steady growth coming mostly from company performance, given that it is a Micro-Cap with an Estimated Market Cap of $122.3M.

Given the market fallout from COVID-19, there has been a noticeable shift into stocks that have great fundamentals, good, sustainable dividends & low-levels of debt in comparisson to their cash levels.

ADES’s Total Cash (mrq) is $12.08M, with a Total Debt (mrq) of $49.56M & a Debt/Equity (ttm) of 45.76.

Despite their small size limiting the potential for larger investors, ADES still has a 68.82% Institutional Ownership.

Examining ADES’s Stock Dividend

One of their most appealing fundamentals is their generous 15.01% Dividend Yield, which is paid out quarterly. What is especially appealing about it is that their Payout Rate is 49.99%, showing that they should be able to maintain that high level of interest payments to holders of their stock. In turbulent times this is especially helpful, as it provides a performance cushion if you intend to hold it for the entire year.

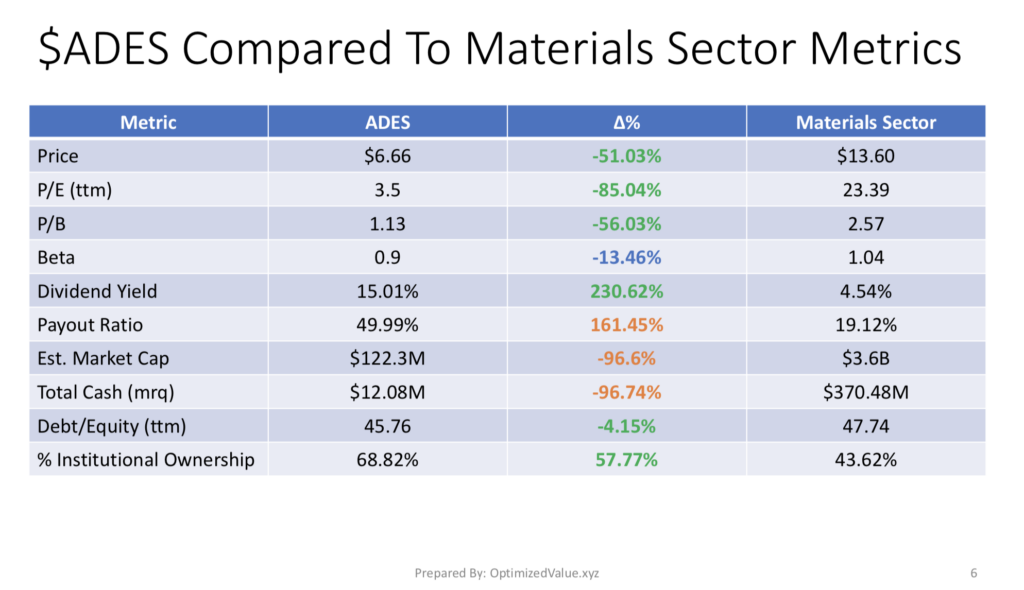

How ADES Stock Compared To Other Materials Sector Stocks

ADES stock costs 51% less than the average Materials Sector stock, trading at an 85% lower Price-To-Earnings Ratio (ttm), and 56% less than their Price To Book Value.

Their Dividend Yield is 230%+ better than the average Materials Sector stock, with a 4.15% better Debt/Equity (ttm) Ratio & a 57% higher than average % Institutional Ownership, all very strong metrics.

Their Payout Ratio is higher than the average, but still is maintable, which shouldn’t worry investors, and as mentioned earlier, as they are a Micro-Cap stock their Market Cap is 96% less than average, as is their Total Cash.

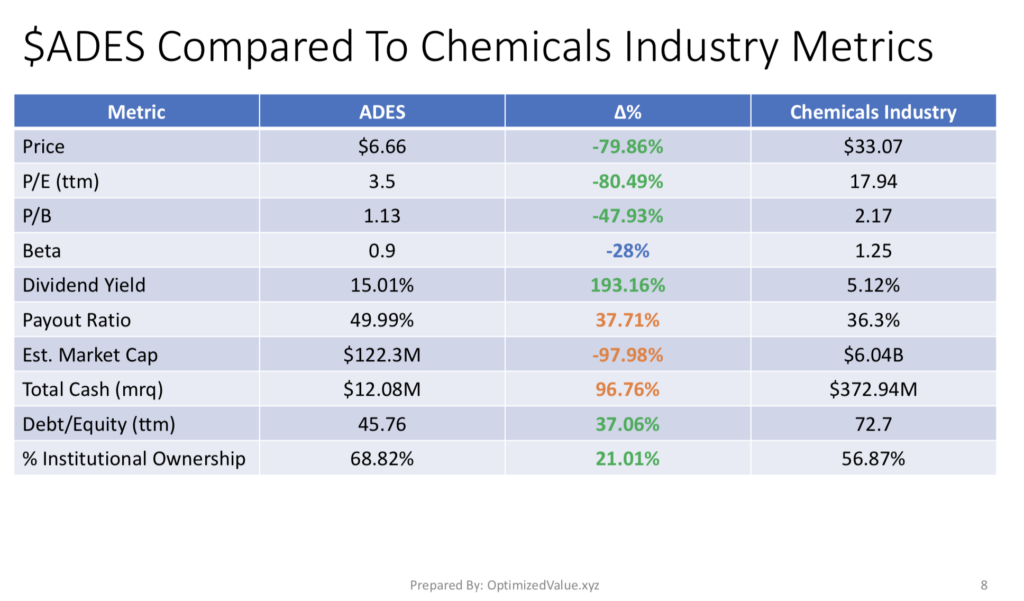

How Advanced Emissions Solution Stock Compares To Other Chemical Industry Stocks

When compared to the Chemical Industry average metrics, ADES has a 80% lower price/share, with an 81% lower P/E (ttm), a 48% lower P/B, and a fantastic 193% higher Dividend Yield, paying out 37% higher than average.

Their Beta is 28% less than average, partially because they are 97% smaller by Market Cap than the average Chemical Industry stock.

Despite this, as their Debt/Equity is 37% partnered with the above advantages, they have 21% more Institutional Ownership than the average Chemicals industry stock.

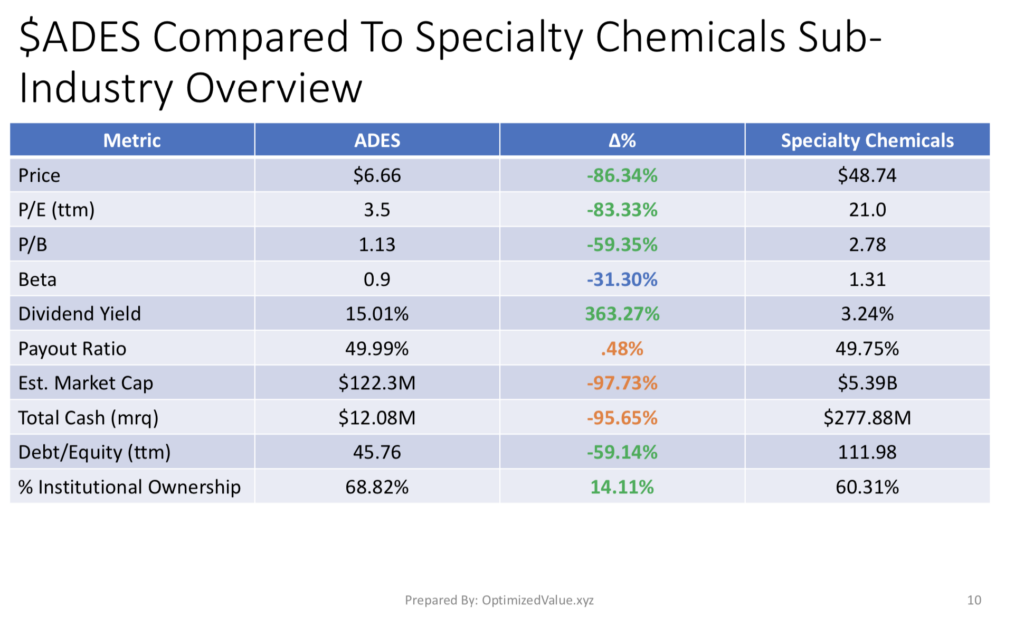

ADES Stock Vs. Specialty Chemicals Sub-Industry Stock Fundamentals

ADES is also a much stronger player than the average Specialty Chemicals Sub-Industry stock. Price/Share is 86% less, with an 83% less P/E(ttm) & a 59% less P/B.

Their Dividend is 362% higher than the average Specialty Chemicals stock, with 14% higher Institutional Ownership & 59% better Debt/Equity (ttm).

Their 31% lower Beta makes these numbers especially appealing in these tough times for the market.

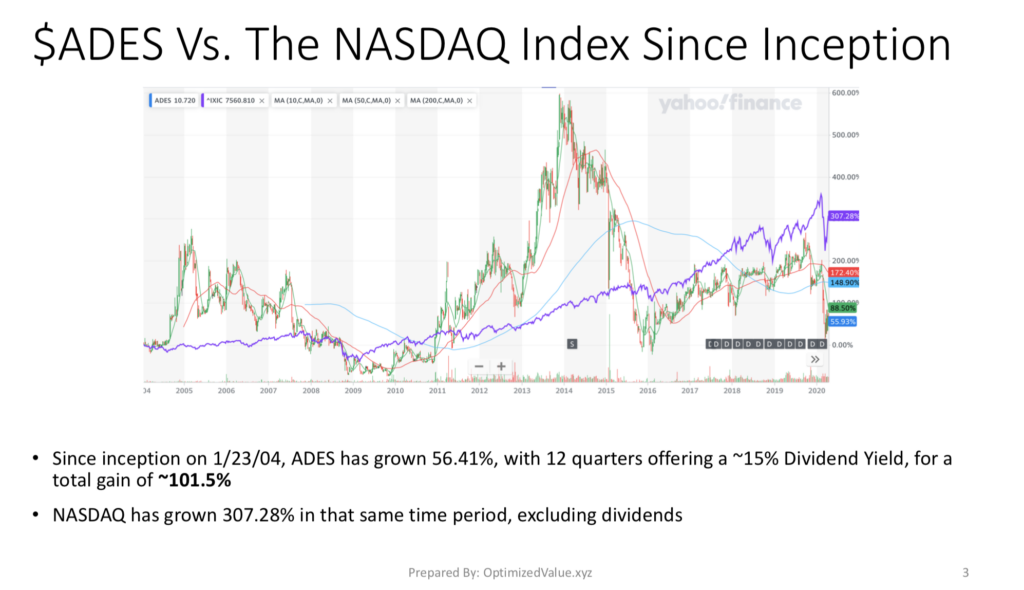

ADES Stock’s Historic Performance Vs. The S&P 500 & NASDAQ

ADES Stock has grown 56.41% since it first started trading on 1/23/04, and for 3 years (12 quarterly payouts) it has yielded a dividend of ~15%, totaling 101.5% in growth.

The S&P 500 has grown 150% over that same period, however when you compare the charts and consider the fundamentals & company type, there is a lot of opportunity to outperform.

The NASDAQ has grown 307% in that time.

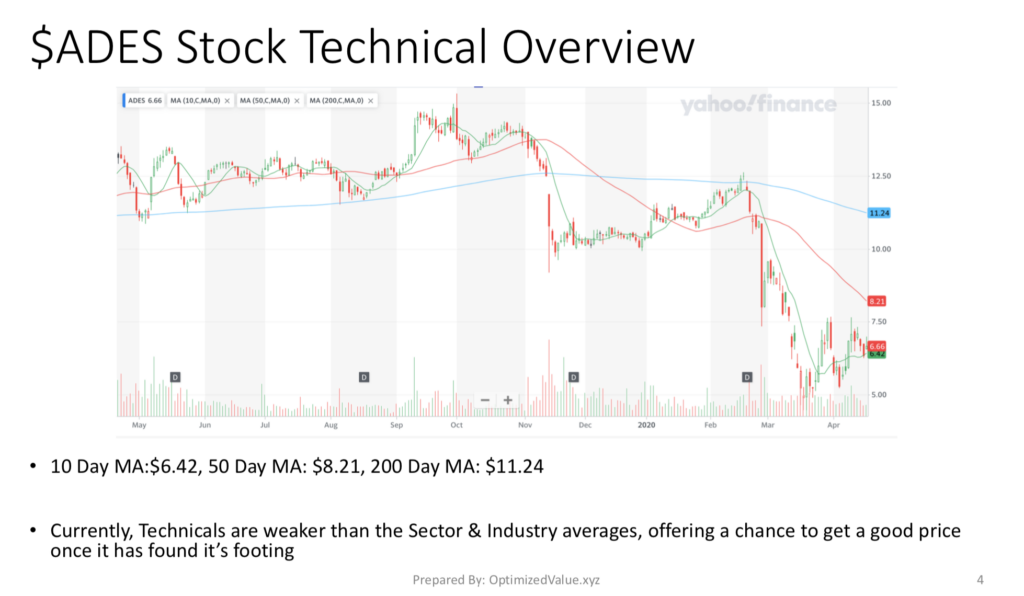

Examining ADES Stock’s Technical Metrics & Chart

ADES’s 10-Day Moving Average is $6.42, with its 50-day Moving Average at $8.21 & it’s 200-Day Moving Average of $11.24.

This is weaker than the average across its Sector & Industries, which is why it is a good time to begin looking at an entry-point while it establishes it’s bottom in weakness.

Overall Assessment Of ADES

I like the fundamentals of ADES, especially when compared to it’s peers. While it’s technicals aren’t looking too great, neither are the rest of the markets’, and it appears that this is an opportunity to buy a fundamentally strong company at a great discount.

After finishing my research I placed a Buy order to fill at $6/share, which filled yesterday morning around 11:30 AM.

I plan to hold onto this for a while, as it’s 15%+ dividend yield is a great safety cushion given these volatile times if I hold onto it for the year.

Plus, a micro-cap name like this just needs a couple of big headlines to takeoff running, as typically these companies are lesser known to most traders/investors, which provides extra strength once they make the news for good reason and everyone comes piling in.

*** Please note that as mentioned above I have a long position in this stock, and always conduct your own due-diligence before marking investments & trades ***

For The Complete PDF Report: