Earnings calls continued last week, while focuses on bonds, energy & supply chains continued to tie up the news feeds.

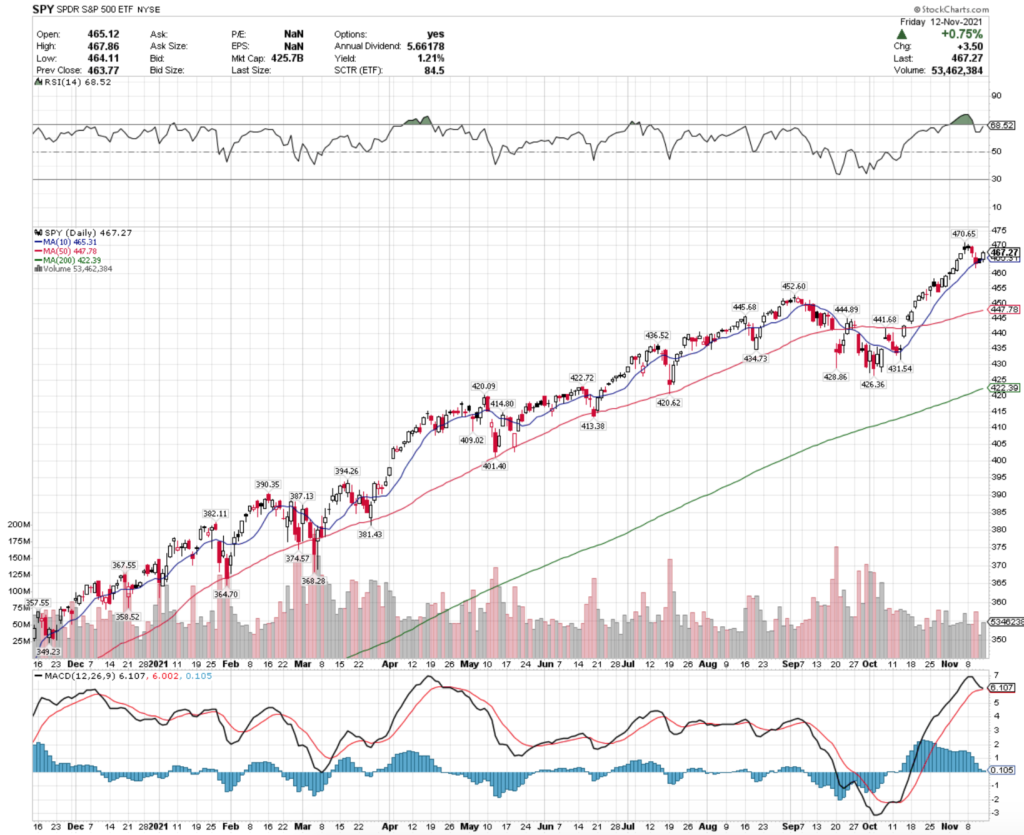

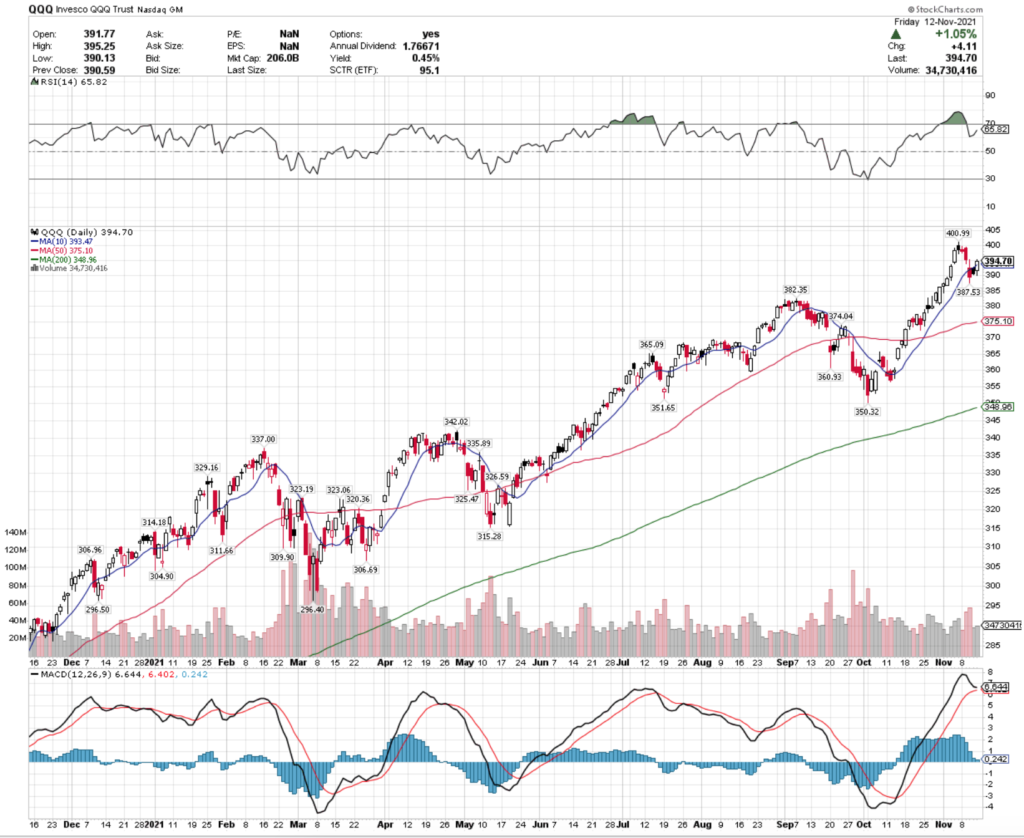

A bit of the built up buying pressure was released from the S&P 500 & NASDAQ, both of whose RSI’s dipped back below overbought territory.

More correcting looks apparently based on the curves of both indexes’ MACD lines, shown in the charts below for the SPY & QQQ ETFs.

SPY, the S&P 500 ETF’s MACD is about to bearishly crossover, and QQQ’s for the NASDAQ is also bearishly curved, with the crossover to come in the coming days.

Given their high RSI’s, it is certainly time for a little more pullback from a technical perspective.

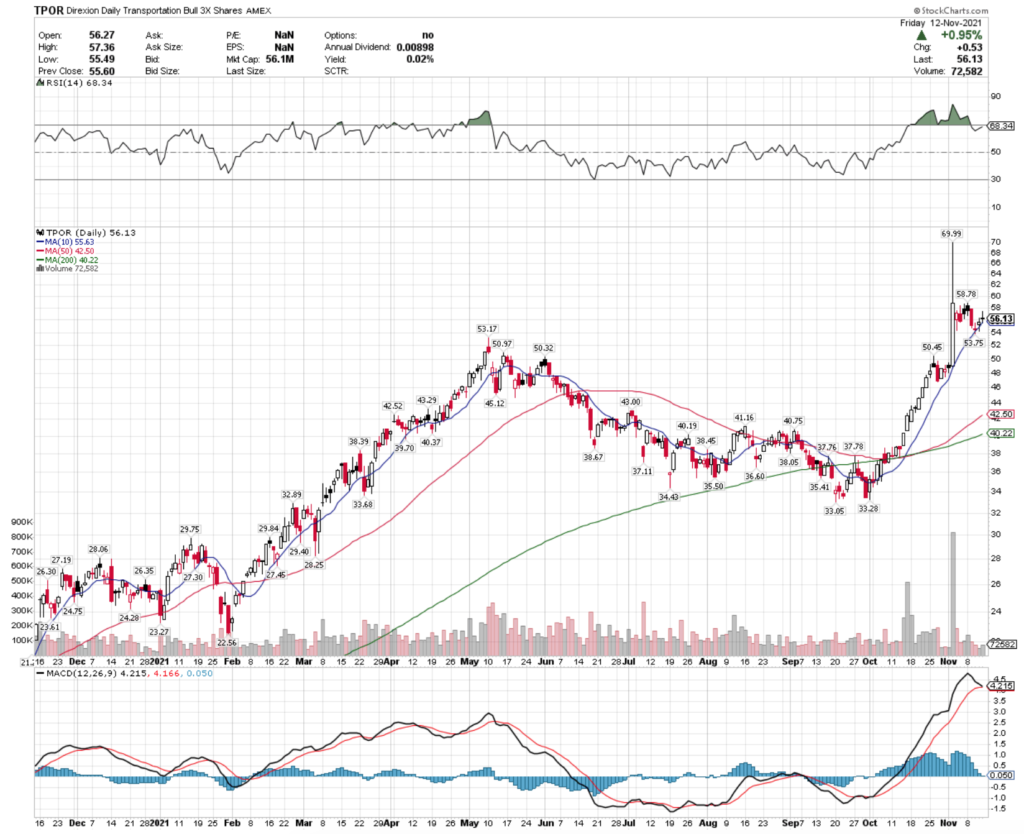

Transportation (TPOR), Blockchain & Data Transformation (BLOK), Lithium (LIT) & Financials (FAS) ETFs All Among The Bullish Recent Performers

Transportation stocks contained in the ETF TPOR all have had a good performing November to date.

While their MACD is about to bearishly cross, there looks to be a new range establishing here as their RSI evens out, possibly making space for a new position’s entry.

Volume has certainly tapered off after their major outperforming day.

Blockchain & Data Transformation stocks have also done well in recent weeks, earning BLOK a spot amongst our top rated ETFs by technicals recently.

Recent volumes have been above average for the year, as their share price evens back out after touching a new high for the year.

Another MACD to watch, but again, their RSI also needed to simmer a bit from being overbought for a period of days.

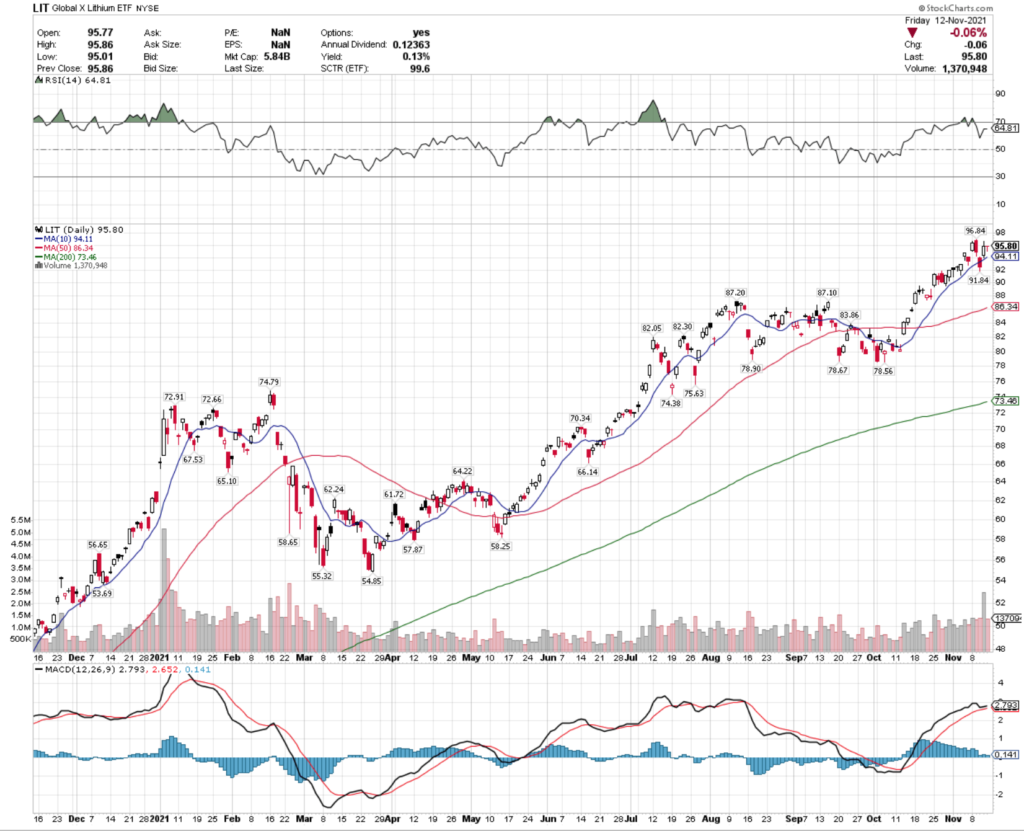

Lithium names have also been performing well, with more room to run in the near-term.

Watching LIT ETF’s MACD it appears that there may be another near-term bump in the making, as their RSI is still not in overbought territory.

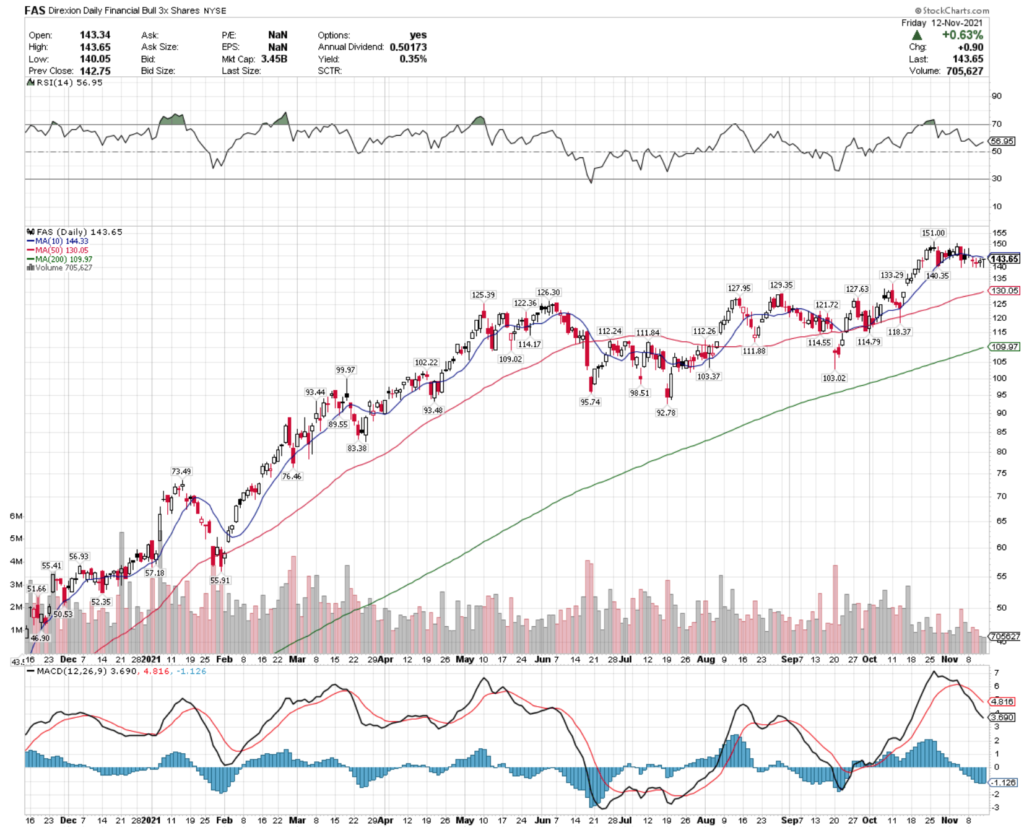

Financial names have remained steady, although FAS has dipped a bit this week.

This may be a good point of entry into a new position for FAS.

With their MACD already bearish & an RSI approaching neutral, this looks to be a time where planning an entry will be beneficial as a trade or investment.

The recent price decline is on below average volume, implying that it is more centered around profit taking & not a major fundamental issue.

Asia Pacific High Yield Bond (KHYB), International Online Retail (XBUY), Yen (YCL) & South Korea (FLKR) ETFs Are Among The Most Bearish Names Recently

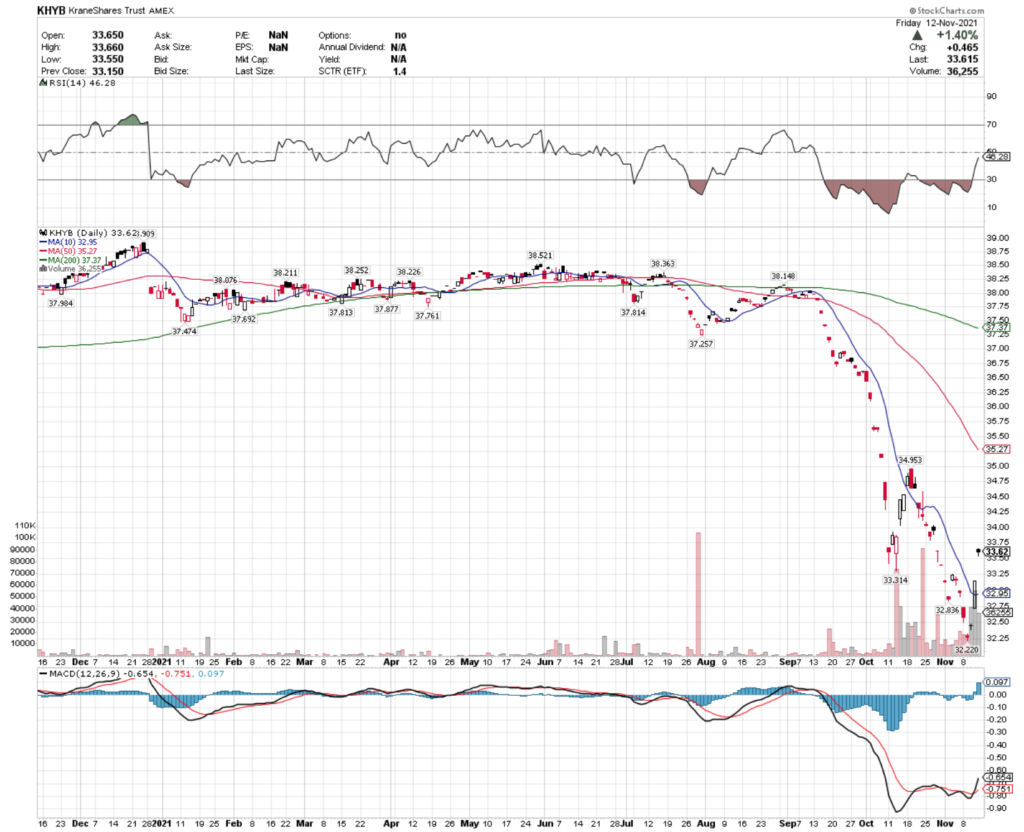

Not surprisingly, Asian High Yield bond ETF KHYB is underperforming recently amid the Evergrande scandal & news that other companies are in similar trouble.

Volume continues to trade above average for KHYB, with a neutral RSI & bullish MACD, but this is not a name that looks to be out of the woods just yet.

International Online Retail ETF XBUY has also suffered recent underperformance, making a new low for the year recently.

With a neutral RSI & relatively flat MACD this will be a name to watch, as it tries to break out above its 50 Day Moving Average.

Yen ETFs have also struggled recently, with YCL being one of the recent under-performers in our technical scans.

While YCL trading volume recently has been light compared to the rest of the year, there may be more pain in the near-term for this name based on the curve in their MACD.

YCL has been making higher lows & higher highs of recent, but is still trading at the bottom of its price range for the year.

Their RSI is slightly oversold though, which may signal an impending bounce.

FLKR, the South Korea focused ETF has also been having tough times recently, especially after a large decline last week.

Their MACD & RSI are both relatively neutral, and recent volumes have been below average for the year.

They still face downward pressure from their moving averages, but are showing signs of reversing course in the near-term.

Tying It All Togher

This will be another week of earnings calls, political theater & discussions about inflation & supply chains across the globe.

Based on the charts we’ve looked at, there may be more correcting of price levels in the near-term, with many technical indicators running hot at the moment.

Retail sales & housing starts numbers will be interesting to watch, with both of those industries being mentioned in our weekly lists recently.

It will also be interesting to see how seasonal employment begins to impact reported numbers, with mall Santas & Christmas-time help beginning to be hired.