This week looks to start off on a slow note, pending any overnight news, with no US economic data being presented until PPI numbers Tuesday morning.

Import price levels will be interesting to see, especially given that ports are still backed up & going to unique unloading strategies to account for winter weather.

While ships will be using less fuel by traveling slower from Asia, there will be additional costs as many of these journeys are now 7-10 days longer than normal.

Wednesday also has the homebuilder index numbers, and the FOMC announcement, and Thursday will shed light into unemployment, housing starts, as well as manufacturing data such as the PMI.

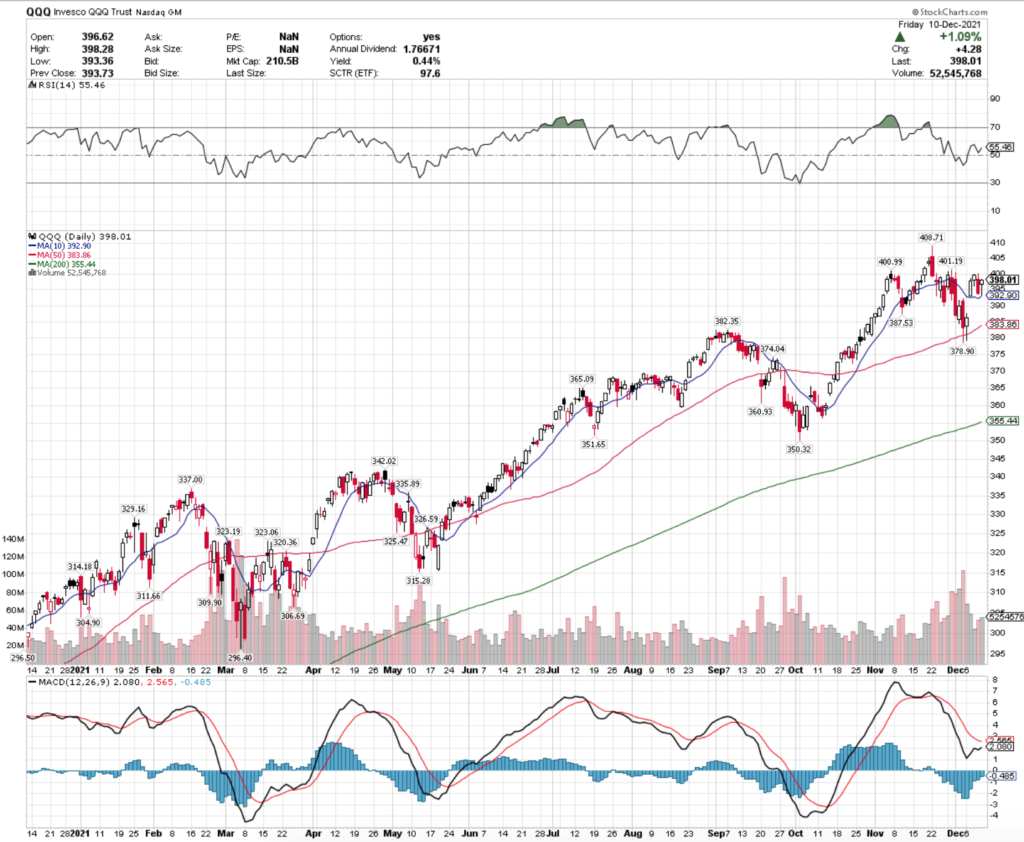

Last week the NASDAQ gapped back up to around the levels it was at at the end of November.

Volume got back above the year’s average, but their MACD is still bearish/flattening out, with the 10 Day Moving Average just below the bottom range of Friday’s low price.

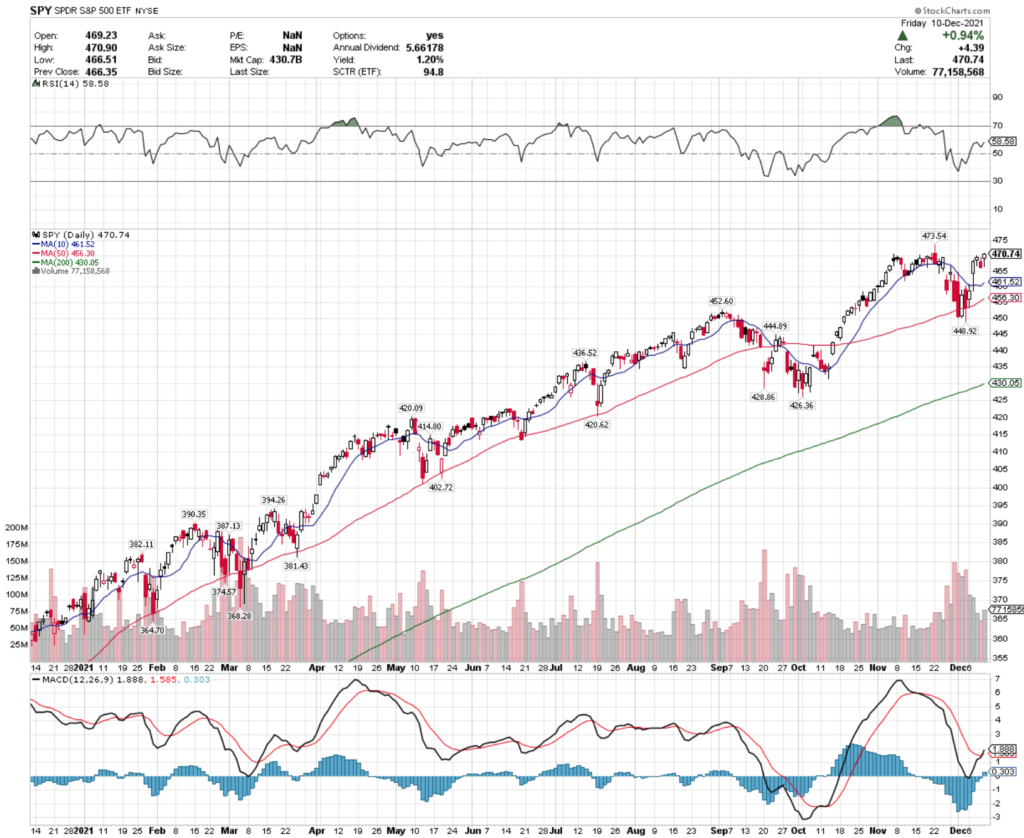

SPY looks to have more momentum, with a bullish MACD crossover last week on slightly above average volume, settling in for the week <1% off of all time highs.

However, it will be interesting to see if this climb can continue on into a Christmas rally.

US Home Construction (ITB), Rare Earth/Strategic Metals (REMX), Healthcare (CURE) & Consumer Goods (UGE) ETFs All Leading The Way Bullishly

US Home Construction ETF ITB is showing expectations that the homebuilder data this week will be good, as it continues its bullish climb.

Look for their RSI to drop a bit in the near-term, as it is currently overbought at 73.

Three of their last 4 sessions have closed lower than they opened, which is an interesting sentiment point, but their MACD looks strong still.

REMX, an ETF that tracks companies that produce, mine & refine rare earth & strategic metals has had a strong year.

While they’ve stalled out a bit in this current quarter, there may be a good entry point for a position in the near-future, with the 10 Day MA being bullishly crossed by their price level Friday.

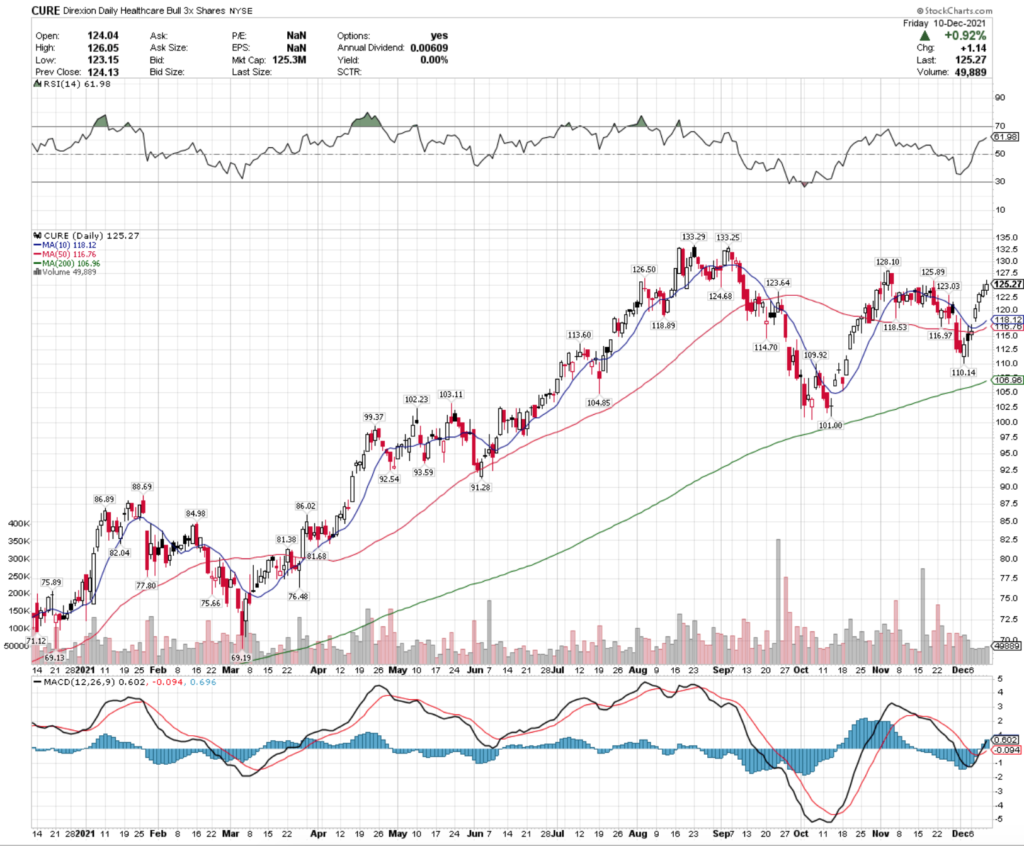

CURE, the Direxion Daily Healthcare Bull 3X Shares ETF has had a strong year, including 7 consecutive days of gains.

With an RSI that is still relatively neutral/beginning to look overbought, there looks to be more near-term momentum for this & other similar names.

Their recent volumes have been slightly above average as well, with a bullish MACD crossover in the middle of last week also there to provide additional upward momentum.

UGE has also had a solid year, with a 44% increase excluding dividends.

While volumes recently have been low, their MACD appears to begin to be turning bullish, which paired with a neutral RSI could set them up for solid short-term momentum.

China Internet (CWEB), Physical Palladium (PALL), Fallen Knives (NIFE) & Emerging Market eCommerce (EWEB) ETFs Have All Lagged Bearishly

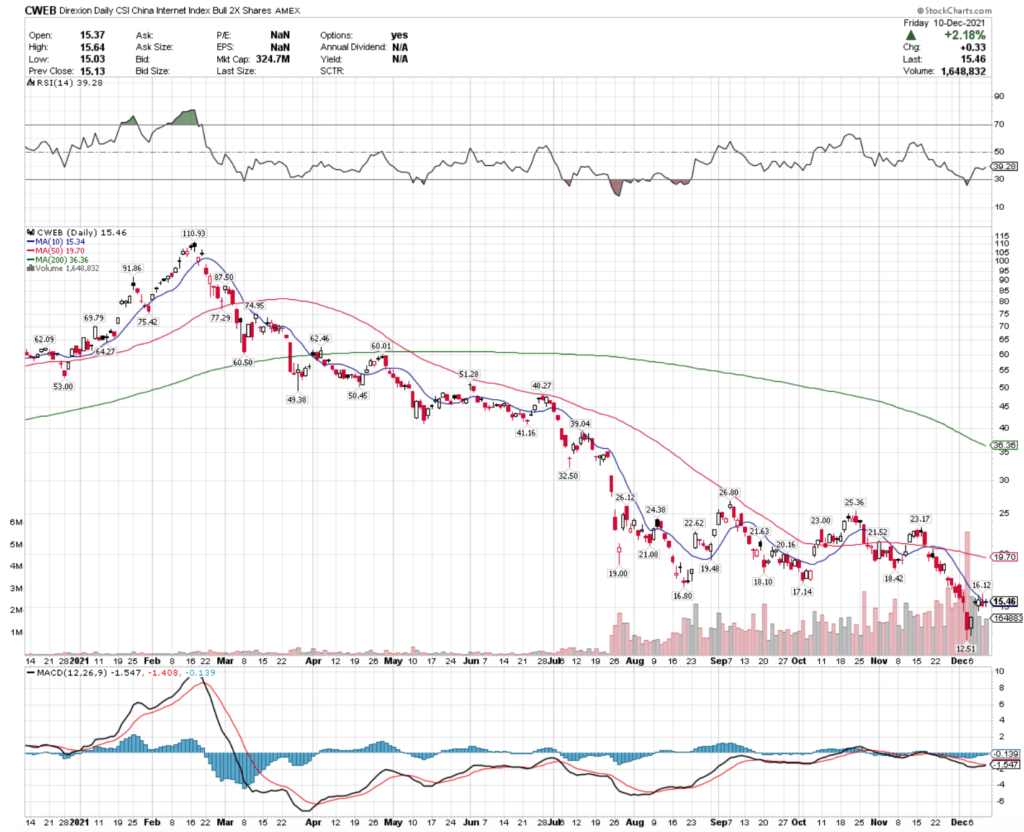

CWEB, the Direxion Daily CSI China Internet Index Bull 2X ETF has had a difficult year, losing ~75% of its share price in the last year.

Volume has increased substantially for CWEB since mid-summer, and there could be a change in price direction in the near-term, with a bullish MACD crossover impending, and an oversold RSI.

Physical Palladium names have also had a difficult year, with the end of November & early-December seeing more losses.

Two gaps down to end the last week looks like they may still have more pain in the near-term, however they have not fallen to the lows that they saw in late November, and have an oversold RSI.

NIFE is an ETF that tracks stocks that have recently fallen, but have strength in their financials that can make them rebound to outperformance.

What is interesting about NIFE is that they offer a 5.76% dividend yield, which is higher than most names that we cover in this section.

Their MACD is beginning to look healthier, but it is tough to say if this will be able to turn around in the near-term or not based on their overly light volume of recent.

They also tend to move in gaps up or down, which also makes it a bit speculative.

EWEB ETF is another under-performer for the year, which tracks emerging markets internet & eCommerce stocks.

Emerging markets have been an area of concern in many sectors this year, with EWEB’s holdings being no different.

This ETF may get some upward momentum in the near-term courtesy of their MACD about to crossover bullishly, and their RSI is oversold.

However, most of the last 4-5 months has been on extremely light trading volume when compared with the rest of the year’s chart, signaling that the sentiment there is still somewhat a “wait & see”.

Tying It All Together

This week will be interesting as markets will have a lot of data to digest, as well as updates related to COVID variants.

I will be most interested in seeing what types of trading volumes we see, with people beginning to prepare for the holidays, while also trimming gains or losses from 2021’s returns.

Overall, it looks to be an interesting week ahead.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACTS FOR ANY OF THE ETFs LISTED ABOVE ***