Texas Instruments, Inc. stock trades under the ticker TXN & has shown recent bullishness that traders & investors should look closer into.

TXN stock closed at $176.22/share on 3/8/2023.

Texas Instruments, Inc. TXN Stock’s Technical Performance Broken Down

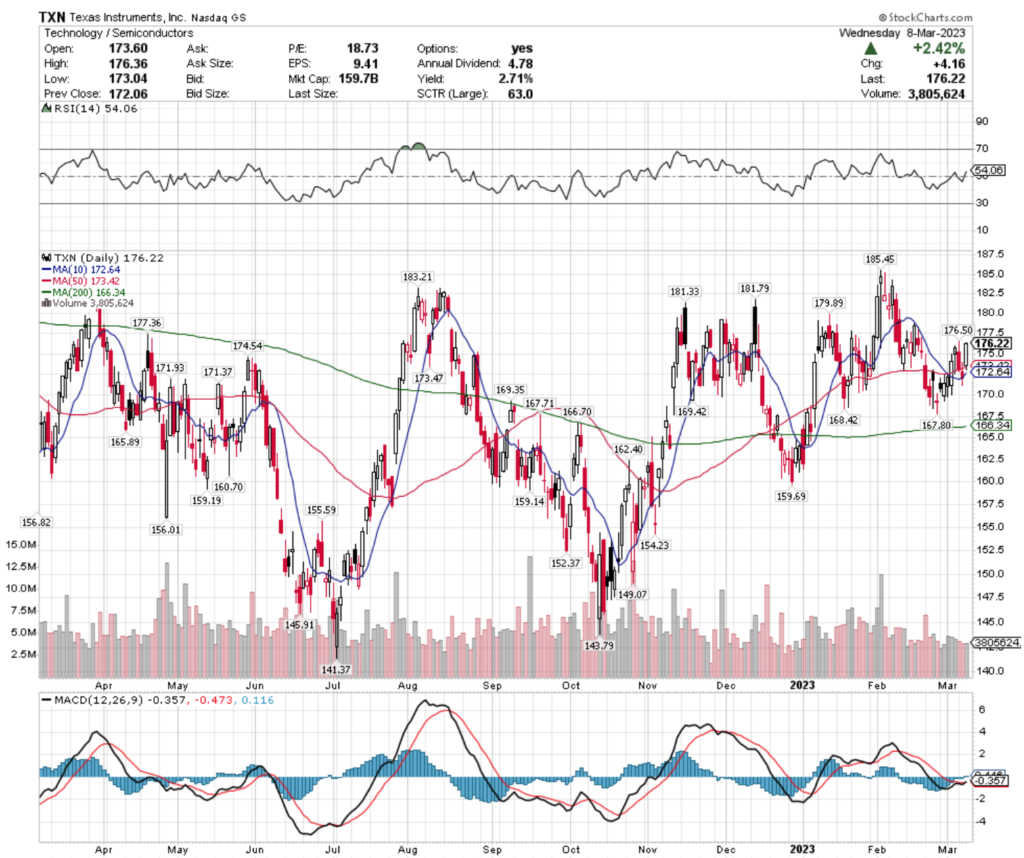

TXN Stock Price: $176.22

10 Day Moving Average: $172.64

50 Day Moving Average: $173.42

200 Day Moving Average: $166.34

RSI: 54.06

MACD: -0.357

Yesterday, TXN stock completed a bullish MACD crossover, gaining +2.42% on the day’s session.

Recent trading volumes have been about average compared to the year prior & their RSI is neutral, after they’ve spent much of the last month in a consolidation range.

TXN stock has support at the $174.54, $173.47 & $173.42 (50 day moving average), as they try to break out above their $176.50, $177.36 & $179.89/share resistance levels.

Texas Instruments, Inc. TXN Stock As A Long-Term Investment

Long-term oriented investors will like TXN stock’s 18.39 P/E (ttm), but may find their 10.76 P/B (mrq) to be a bit rich.

Investors should look for more reasons behind their recently reported -3.4% Quarterly Revenue Growth Y-o-Y, as well as their -8.2% Quarterly Earnings Growth Y-o-Y.

Their balance sheet looks appealing, with $9.07B of Total Cash (mrq) & $9.15B of Total Debt (mrq).

TXN stock pays a 2.73% dividend, which appears to be sustainable in the long-run, as their payout ratio is 49.84%.

88% of TXN stock’s outstanding share float is owned by institutional investors.

Texas Instruments, Inc. TXN Stock As A Short-Term Trade Using Options

Traders with shorter time horizons can trade options to profit from price movements in TXN stock’s price, while protecting their portfolio from volatility.

I am looking at the contracts with the 4/21 expiration date.

The $175, $170 & $160 call options are all in-the-money, listed from highest to lowest level of open interest.

The $180, $185 & $190 puts are also all in-the-money, with the former strike being more liquid than the latter two.

Tying It All Together

TXN stock has many interesting characteristics that traders & investors are sure to find appealing.

Investors will like their balance sheet & dividend yield, but may want to look deeper into their recent growth metrics.

Traders will like their recent technical performance & how liquid their options are.

All-in-all, it is worth taking a closer look into TXN stock to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN TXN STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***