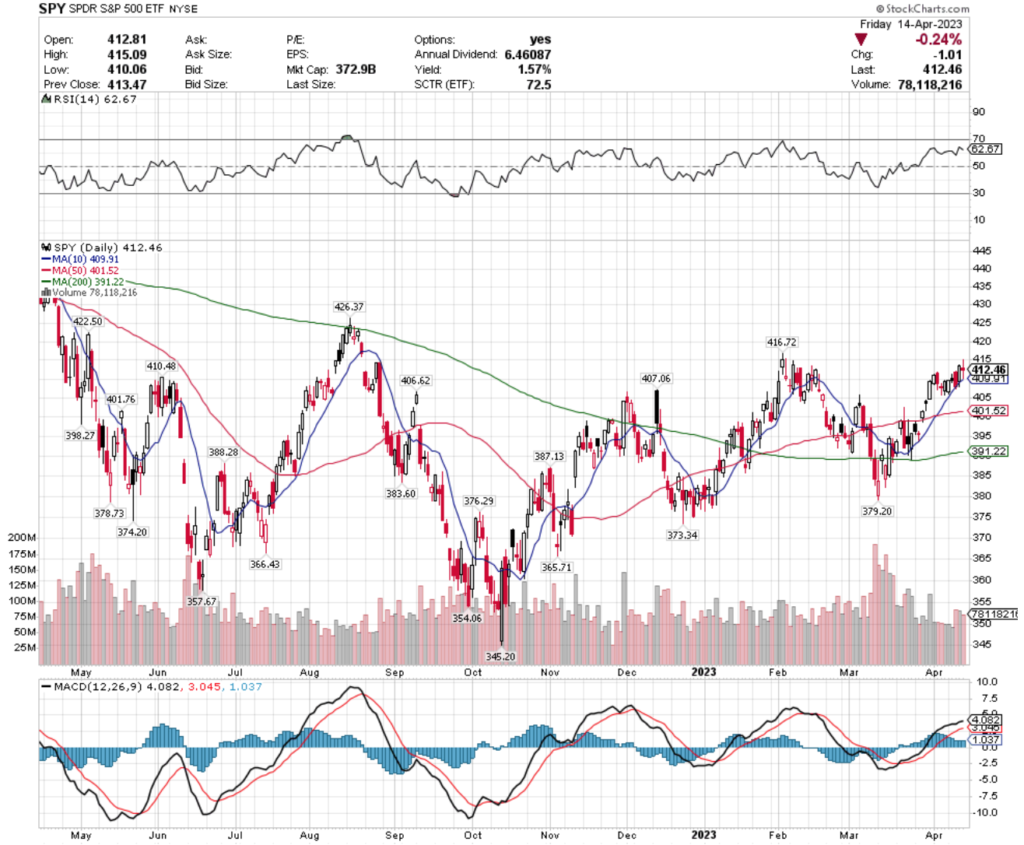

SPY, the SPDR S&P 500 ETF added +0.23% over the past week as investors digested & reacted to earnings calls, CPI/PPI data & more, being less favorable than NASDAQ stocks for the week, but outperforming the small cap Russell 2000 index.

While Friday’s spinning top candle’s open & closing prices stayed near the top of Thursday’s candle’s range, it remained inside of it, signaling hesitance among investors at the $415/share level.

Their RSI is closer to overbought than neutral, with some room to consolidate & cool off & their MACD looks poised to roll over bearishly in the near-term.

Trading volumes have been about average compared to the year prior for SPY & I’ll be watching their nearest support/resistance levels in the coming week for clues as to the S&P’s next moves.

SPY has support at the $410.48, $409.91 (10 day moving average) & $407.06/share price levels,with resistance at the $416.72, $422.50 & $426.37/share price levels.

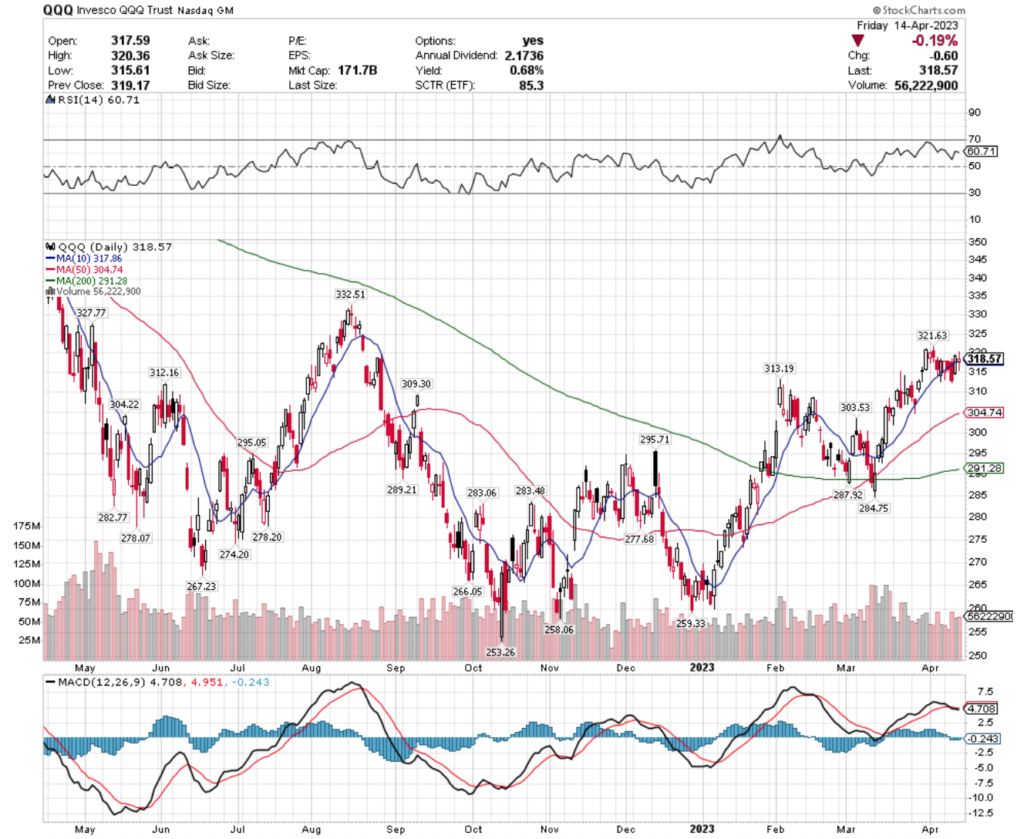

QQQ, the Invesco QQQ Trust ETF gained +1.7% over the past week, faring the best of the indexes for the week.

Their MACD crossed over bearishly mid-week & Friday’s spinning top candlestick is also similar to SPY’s, signaling investors are not certain about the $320/share price level on QQQ.

Their RSI is also above 60, with room to cool off in the near-term & their recent trading volumes have been about average compared to the year prior.

QQQ has support at the $317.86 (10 day moving average), $313.19 & $312.16/share price levels, which will be areas of interest to watch this week, with resistance overhead at the $321.63, $327.77 & $332.51/share price levels.

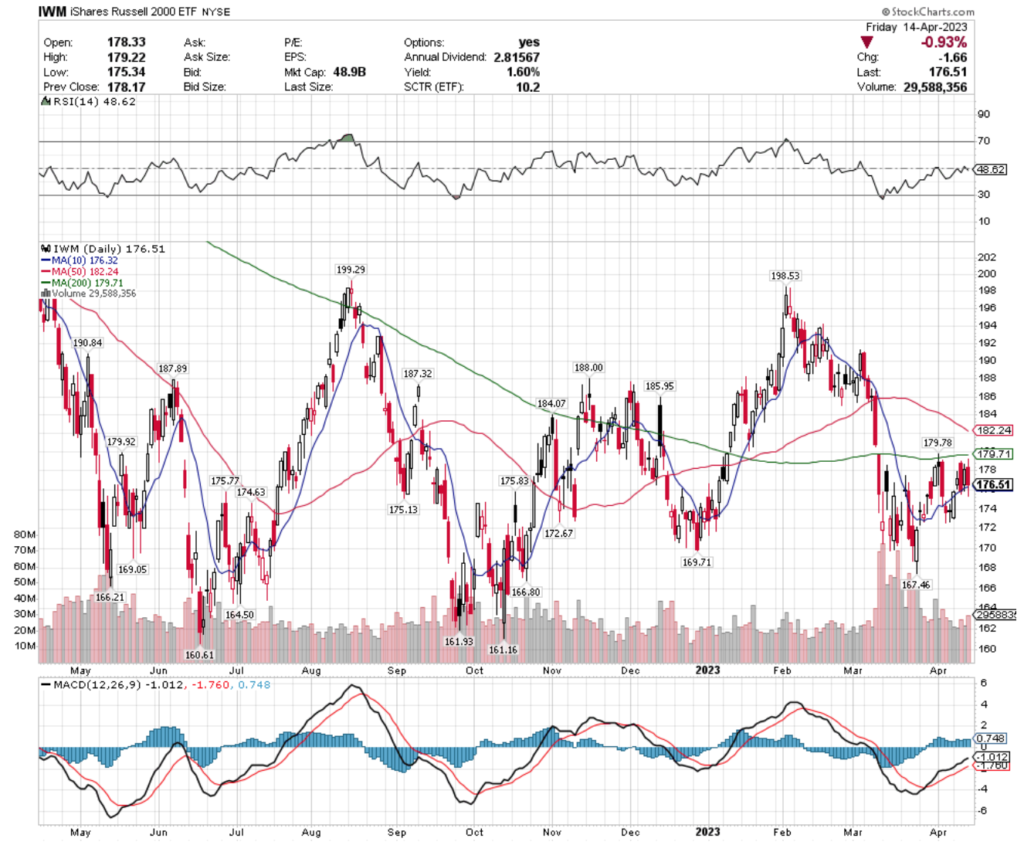

IWM, the iShares Russell 2000 ETF shed -0.13% over the past week, as investors were more interested in larger cap S&P 500 stocks & the tech heavy NASDAQ index last week.

They remained in a tight range all week, trading at about average volume compared to the year prior.

Their RSI is neutral & MACD is still bullish, but beginning to signal a loss of steam, which will make seeing their reactions to support levels this week important for figuring out where the index goes next.

IWM has support at the $176.32 (10 day moving average), $175.83, $175.77 & 175.13/share price levels, with resistance at the $179.71 (200 day moving average), $179.78, $179.92 & $182.24/share (50 day moving average) price levels.

Let’s dive into some of the best & worst performing sectors & geo-locations based on this week’s technical performance rating data!

South Korea (KORU), U.S. Home Construction (ITB), United Kingdom (EWU) & Energy (ERX) Are All Bullishly Leading The Markets

KORU, the Direxion Daily South Korea Bull 3x Shares ETF has lost -40.35% over the past year, but posted an impressive +111.18% rebound from their 52 week low in October of 2022 (ex-distributions for long-term holders).

Last week’s multiple gap up days have pushed their RSI to close to overbought conditions last week, with trading volumes being above average compared to the year prior.

Their MACD still looks strong, but with only 0.82% in the form of annual distribution for long-term share holders, it appears best to wait & see how they behave at support levels before entering or adding to a position (unless using options as insurance).

KORU has support at the $9.43, $9.25, $9.23 & $8.93 (10 day moving average), with resistance overhead at the $9.66, $9.96, $10.08 & $10.33/share price levels.

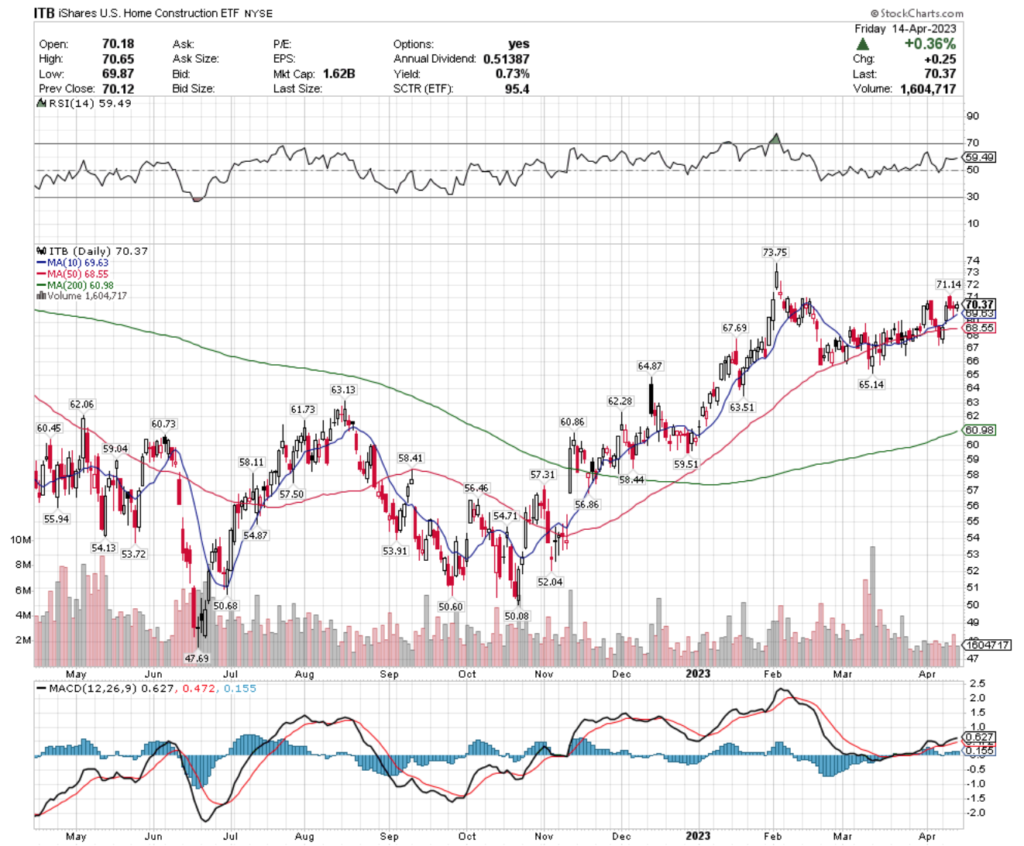

ITB, the iShares U.S. Home Construction ETF has climbed +24.33% over the past year, improving +46.54% from their 52 week low in June of 2022 (ex-distributions).

Their RSI had been relatively flat around 59 as they’ve been slowly building up from a consolidation period, but their MACD is not signaling near-term strength.

Add in their below average trading volumes of recent compared to the past year & it appears that market participants are not overly optimistic about ITB in the near-term.

With only a 0.73% cushion in the form of their distribution yield, unless using an options strategy it would be best to wait & see how they too behave at support levels in the coming weeks.

ITB has support at the $69.63 (10 day moving average), $68.55 (50 day moving average), $67.69 & $65.14/share price levels, with resistance at the $71.14 $73.66, $73.75 & $74.44/share price levels.

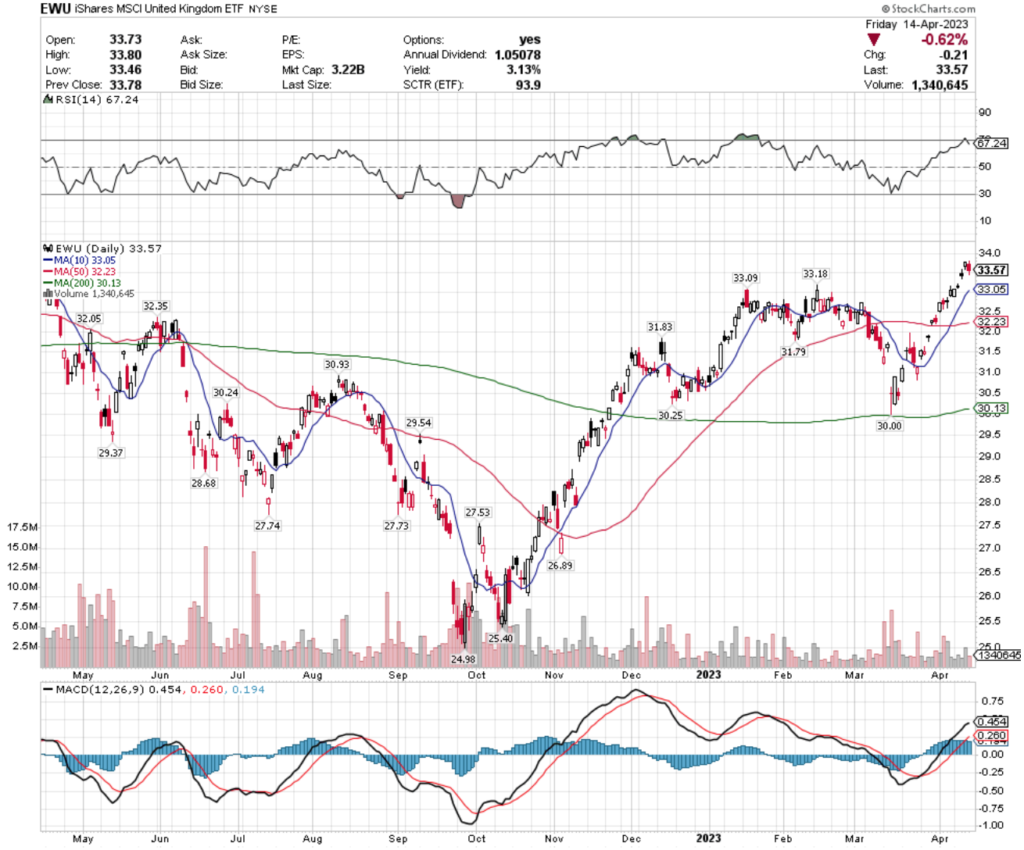

EWU, the iShares MSCI United Kingdom ETF has gained +2.21% over the past year, with +32.37% returns from their 52 week low in September 2022 (ex-distributions).

Their RSI has just crossed out of overbought territory after a few weeks of strong price performance, but the lighter than average volume they’ve traded on recently shows there is still some reservations among investors in EWU.

While their MACD looks strong with the recent trend, it is beginning to also signal near-term consolidation, implying investors should be defensive.

EWU has a 3.13% distribution yield for long-term shareholders each year, but that will only provide protection from losses until the $32.52 price level, signaling it best to have an options strategy in place as insurance, or wait to enter after seeing their behavior at support levels.

EWU has support at the $33.18, $33.09, $33.05 (10 day moving average) & $32.35/share price level, with resistance at the $33.64 & $33.95/share price levels.

ERX, the Direxion Daily Energy Bull 2x Shares ETF has added +6.6% over the past year, gaining +65.3% since their 52 week low in July of 2022 (ex-distributions).

Their RSI is on the overbought end of neutral, after a gap up two weeks ago propelled them ~+9%, but their MACD is beginning to hint at signs of near-term weakness & consolidation on the horizon.

ERX’s volumes have been far below average recently, which also suggests that there is limited good sentiment left in the near-term.

While their 2.53% distribution yield will reward long-term shareholders with a cushion, their behavior at support levels will be critical for establishing when it is wisest to enter, unless hedging with options.

ERX has support at the $64.34, $63.37, $62.54 & $62.45/share (10 day moving average) price levels & resistance at the $64.77, $65.12, $67.05 & $67.35/share price level.

Real Estate (VNQ), Space (UFO), Israel (ISRA) & MidCap Dividends (DON) Are All Bearishly Lagging The Market

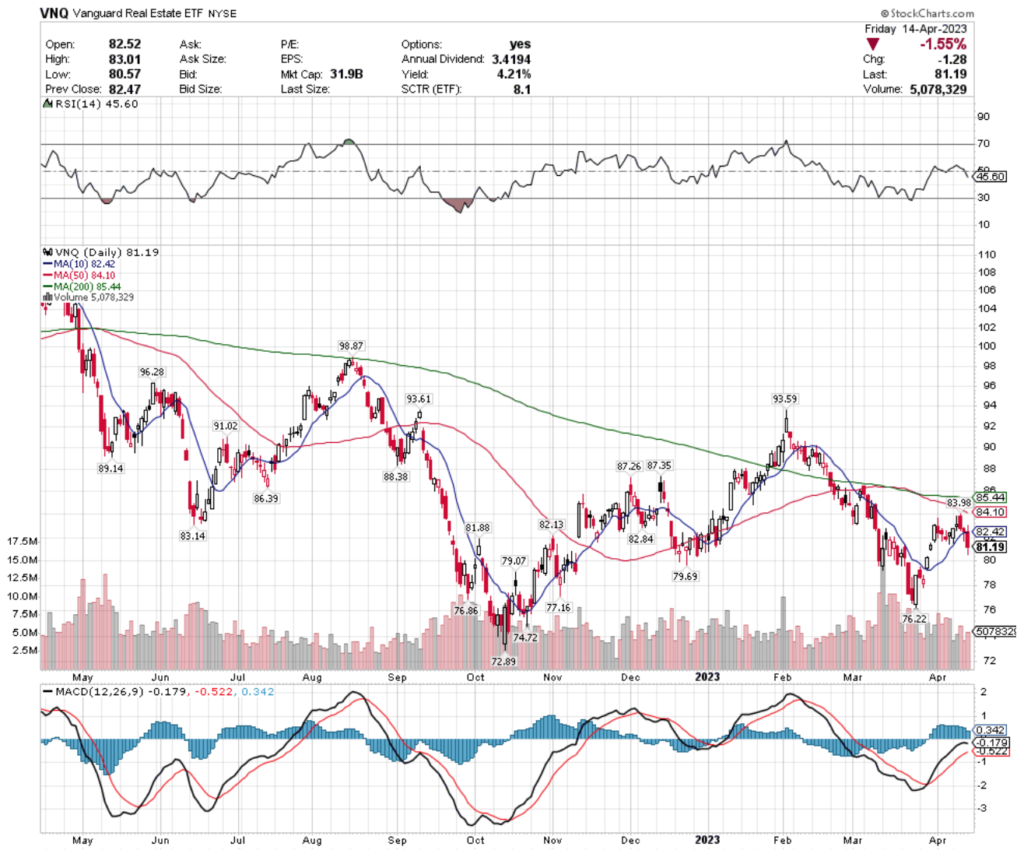

VNQ, the Vanguard Real Estate ETF has dropped -21.88% over the past year, losing -28.4% from their 52 week high in April of 2022, but rebounding +8.75% from their 52 week low in July of 2022 (ex-distributions).

Despite a recent rally in late March, VNQ’s MACD is signaling a bearish crossover is imminent & their RSI is trending bearishly away from the neutral level.

Recent trading volumes have been about average compared to the year prior, confirming the sentiment & while their distribution yield is 4.21%, this seems like a situation best to approach with caution in the near-term.

VNQ’s behavior at support levels will give clues into when an entry would be better (unless employing an options strategy), with support at the $79.69, $79.07, $77.16 & $76.86/share price levels & resistance at the $81.88, $82.13, $82.42 (10 day moving average) & $82.84.

UFO, the Procure Space ETF has lost -24.44% over the past year, which coincidentally was its high point in the past 52 weeks, but has rebounded +7.21% from their 52 week low in October of 2022 (ex-distributions).

Their MACD is beginning to indicate a bearish rollover, but their RSI is still neutral.

Volume sentiment is tough to gauge, as this is not the most particularly liquid security, & their most recent price movements have been to consolidate in the $18.50-19 range since the end of March.

UFO pays a 2.36% distribution for long-term holders, which provides some relief, but there seems to be uncertainty on their horizon as well, making insurance against losses (buying puts or selling calls) & an eye on support levels for entry imperative.

UFO has support at the $18.59, $18.02, $17.55 & $17.48/share price level, with resistance at the $18.79, $18.86 (10 day moving average), $19.07 & $19.08/share price levels.

ISRA, the VanEck Vectors Israel ETF has declined -21.63% over the past year, shedding -23.96% from their 52 week high in April of 2022, but scraping back +3.94% from their 52 week low in March of 2023 (ex-distributions).

They too have an MACD flashing warnings signs, after consolidating into a $35-35.50 price range over the past few weeks.

Recent trading volumes have been below average compared to the year prior & their RSI is bearishly declining, signaling investors should be cautious & wait to see how they behave at support levels before creating a new position or adding to an existing one.

With only a 1.38% distribution yield for long-term holders, there is limited cushion for protection unless you employ an options strategy defensively to protect/profit from near-term losses.

ISRA has support at the $34.79, $34.48 & $33.77/share price level, with resistance at the $35.30, $35.44 (10 day moving average), $35.45 & $35.62/share price levels.

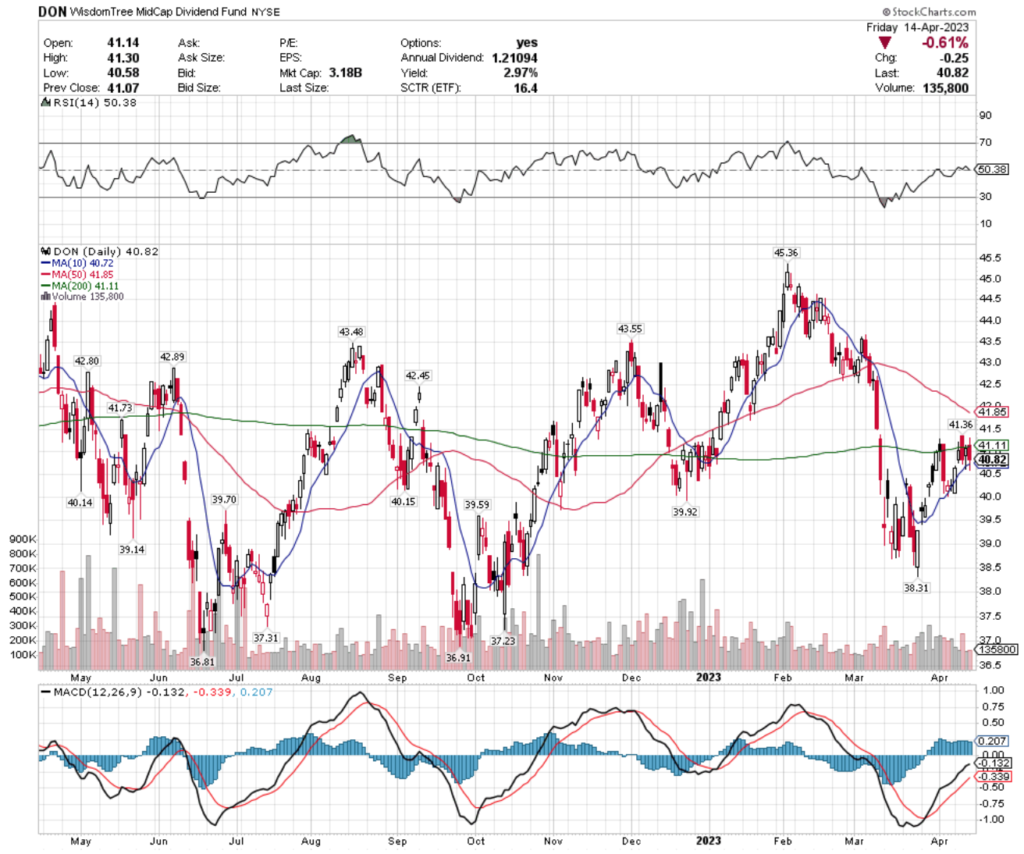

DON, the Wisdom Tree MidCap Dividend Fund ETF has lost -4.6% over the past year, falling -10.81% from their 52 week high in April of 2022, while gaining back +8.94% since their 52 week low in September of 2022 (ex-distributions).

Their recent volumes have been below average & their RSI is neutral, but their MACD is beginning to show signs of bearishly rolling over.

DON pays a 2.97% distribution yield, which provides some cushion for a price consolidation, but they too are in a “wait & see” period to see how they behave against their support levels in the near-term.

DON has support at the $40.72 (10 day moving average), $40.15, $40.14 & $39.92/share price levels & resistance at the $41.11 (200 day moving average), $41.36, $41.73 & $41.85/share (50 day moving average) price levels.

Tying It All Together

Next week kicks off with the Empire State Manufacturing data at 8:30 am on Monday, followed by Homebuilder Confidence Index data at 10 am & at 12:45 pm Richmond Fed President Tom Barkin speaks.

Tuesday we hear Housing Starts & Building Permits data at 8:30 am, with Fed Governor Michelle Bowman speaking at 1 pm.

Wednesday is the Fed Beige Book at 2 pm & New York Fed President Williams speaking at 7 pm.

Things pick up the pace Thursday with Initial Jobless Claims, Continuing Jobless Claims & Philadelphia Fed Manufacturing Survey data reported at 8:30 am, followed with Existing Homes Sales & U.S. Leading Economic Indicators at 10 am.

Thursday afternoon we hear from many Fed speakers, starting with Fed Governor Christopher Waller & Cleveland Fed President Loretta Mester speaking at 12 pm, Dallas Fed President Lorie Logan & Fed Governor Michelle Bowman speaking at 3 pm & at 5 pm Atlanta Fed President Raphael Bostic speaks.

Friday the week winds down with S&P Flash U.S. Services PMI & S&P Flash U.S. Manufacturing PMI data at 9:45 am & Fed Governor Lisa Cook speaking at 4:35 pm.

Additionally, there will be many notable earnings calls throughout the week including Monday’s Charles Schwab, J.B. Hunt Transport Services, M&T Bank & State Street reporting.

Tuesday’s calls include Bank of America, Netflix, BNY Mellon, Fulton Financial, Goldman Sachs, Lockheed Martin & Johnson & Johnson.

Wednesday we hear from Tesla, Abbott Labs, Baker Hughes, Discover Financial Services, IBM, Travelers, Morgan Stanley & Las Vegas Sands.

AT&T, Blackstone, American Express, Phillip Morris International, Seagate Technology & Rite Aid are set to report earnings on Thursday & on Friday we hear updates from Freeport-McMoran, SAP, Procter & Gamble, and more.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACTS IN SPY, QQQ, IWM, KORU, ITB, EWU, ERX, VNQ, UFO, ISRA, or DON AT THE TIME OF PUBLISHING THIS ARTICLE ***