XLE, the Energy Select Sector SPDR Fund ETF has advanced +9.8% over the past year, gaining +14.46% since their 52-week low in January of 2024, while currently sitting -8.7% below their 52-week high set in April of 2024 (all figures exclude distributions).

Some of their top holdings include Exxon Mobil Corp. (XOM), Chevron Corp (CVX), ConocoPhillips (COP), Williams Cos. Inc. (WMB), EOG Resources Inc. (EOG), ONEOK Inc. (OKE), Schlumberger Ltd. (SLB), Phillips 66 (PSX), Kinder Morgan Inc. (KMI) & Marathon Petroleum Corp. (MPC)

Below is a brief technical analysis of XLE, as well as a price level:volume sentiment analysis of the price levels XLE has traded at over the ~2 years.

Included in this data is also their recent support & resistance levels so that readers can gain insight into how strong/weak these support/resistance levels may be in the future, based on past investor behavior.

It is not intended to serve as financial advice, but rather as an additional tool to reference while performing your own due diligence on XLE.

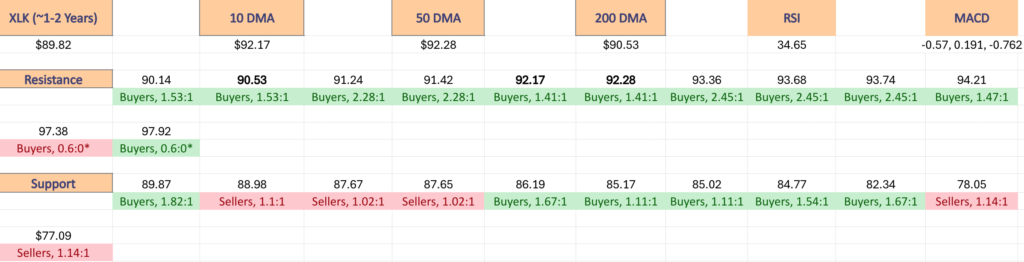

XLE, The Energy Select Sector SPDR Fund ETF’s Technical Performance Broken Down

Their RSI is trending towards the oversold 30-level & sits at 34.65, while their MACD is bearish following the declines of the past two weeks.

Volumes over the past week & a half have been -19.86% lower than the previous year’s average level (11,968,750 vs. 14,934,861.66), as market participants as a whole have been less active than normal while major indexes sit near all-time highs.

Last Monday continued the steep slide that XLE’s prices took in the previous week after the previous Friday’s session took a breather with a spinning top candle, indicating uncertainty among market participants.

The next day the selling continued with the session closing to form a bearish harami pattern with the prior day’s session.

Wednesday confirmed that risk-off was still on, when the session opened lower & on the highest volume of the past couple of weeks drifted down to briefly cross the 50 day moving average’s support, but was able to recover a little bit to close just above the 50 DMA.

Thursday there was a brief moment of calm again as the eye of the storm produced a doji candle that opened and closed as a slightly advancing session, but while the volume behind it was stronger than all but one of the previous week’s sessions, it was not strong enough to mark a reversal.

Friday ended the week with a risk-off into the weekend session, as the day opened lower & broke through the 50 DMA’s support on stronger volume than Thursday’s advancing session, indicating that the bearish sentiment was no where near over yet.

Monday opened higher & tested briefly above the resistance of the 50 day moving average, before ultimately tumbling lower.

This Tuesday exposed the real lack of confidence in the energy sector, as much like Monday the session opened higher, but proceeded to decline through the support of the 200 day moving average, marking extreme bearish sentiment as the long-term trend line was broken.

Wednesday currently looks to be another eye of the hurricane type of session, as the session opened in-line with the 200 DMA, tested higher & lower but ultimately closed as a doji.

Despite having similar volume to the two prior days’ sessions, there was not enough push for XLE’s trend to reverse, which led to today’s gap down open that as of 12:35 PM has produced a -0.45% daily return.

Given how strong this decline has been it is important to understand how investors have behaved historically at different price levels XLE has traded at in order to assess the strength of their support/resistance levels.

The section below lays out how the buyers & sellers have met at each price level XLE has traded at over the past ~2 years.

While it is not indicative of future performance, history repeats itself & or rhymes & this can be used as a barometer to anticipate how market participants may behave when faced with these price levels again.

Price Level:Volume Sentiment Analysis For XLE, The Energy Select Sector SPDR Fund ETF

The top table below shows the support & resistance levels of XLE from the past year’s chart, as well as their price level:volume sentiment at each from data covering the past ~2 years, using Wednesday 11/20/24’s mid-session price for their price & moving averages/other technicals.

The moving averages are denoted with bold.

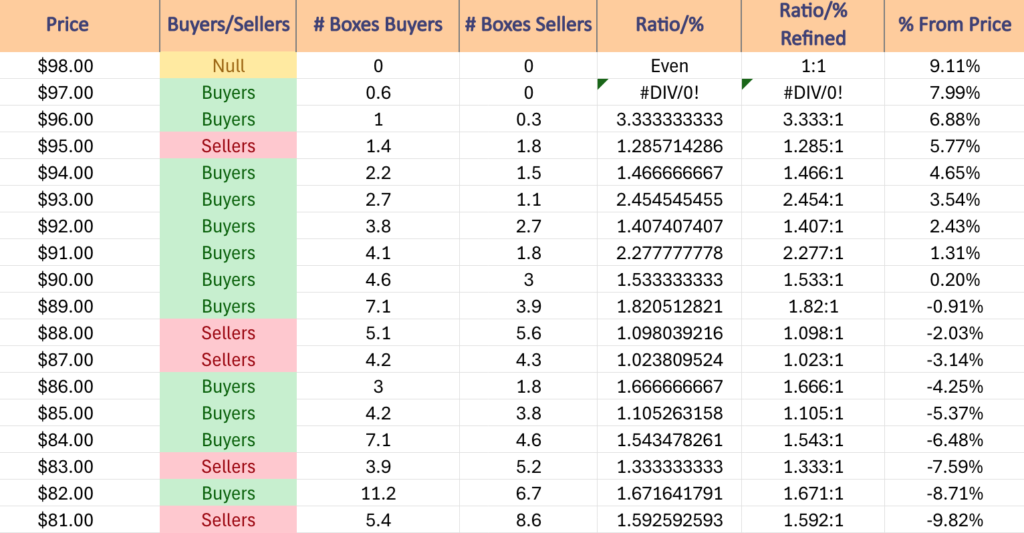

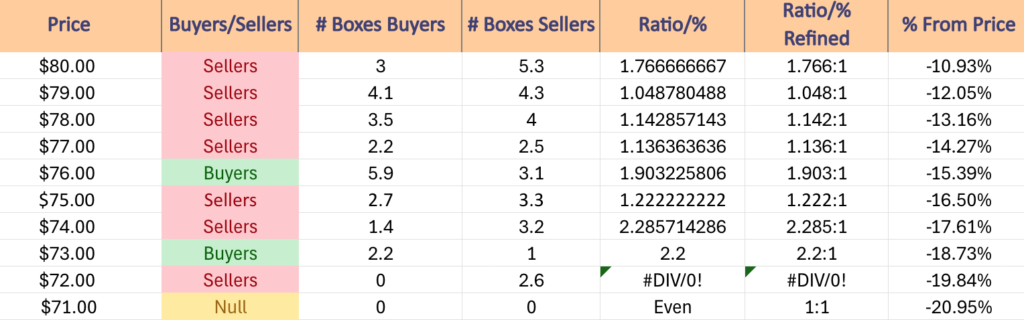

The next charts show the volume sentiment at each individual price level XLE has traded at over the past ~2 years.

Beneath them is a copy & pasteable list of the same data, where the support/resistance levels are denoted in bold.

All ratios with “0” in the denominator are denoted with a “*”.

NULL values are price levels that had limited trading volume, whether it be due to gaps, quick advances or they are at price extremes; in the event that they are retested & there is more data they would have a distinct “Buyers”, “Sellers” or “Even” title.

This is not intended as financial advice, but rather another tool to consider when performing your own research & due diligence on XLE.

$98 – NULL – 0:0*, +9.11% From Current Price

$97 – Buyers – 0.6:0*, +7.99% From Current Price

$96 – Buyers – 3.33:1, +6.88% From Current Price

$95 – Sellers – 1.29:1, +5.77% From Current Price

$94 – Buyers – 1.47:1, +4.65% From Current Price

$93 – Buyers – 2.45:1, +3.54% From Current Price

$92 – Buyers – 1.41:1, +2.43% From Current Price – 10 & 50 Day Moving Averages**

$91 – Buyers – 2.28:1, +1.31% From Current Price

$90 – Buyers – 1.53:1, +0.2% From Current Price – 200 Day Moving Average*

$89 – Buyers – 1.82:1, -0.91% From Current Price – Current Price Level*

$88 – Sellers – 1.1:1, -2.03% From Current Price

$87 – Sellers – 1.02:1, -3.14% From Current Price

$86 – Buyers – 1.67:1, -4.25% From Current Price

$85 – Buyers – 1.11:1, -5.37% From Current Price

$84 – Buyers – 1.54:1, -6.48% From Current Price

$83 – Sellers – 1.33:1, -7.59% From Current Price

$82 – Buyers – 1.67:1, -8.71% From Current Price

$81 – Sellers – 1.59:1, -9.82% From Current Price

$80 – Sellers – 1.77:1, -10.93% From Current Price

$79 – Sellers – 1.05:1, -12.05% From Current Price

$78 – Sellers – 1.14:1, -13.16% From Current Price

$77 – Sellers – 1.14:1, -14.27% From Current Price

$76 – Buyers – 1.9:1, -15.39% From Current Price

$75 – Sellers – 1.22:1, -16.5% From Current Price

$74 – Sellers – 2.29:1, -17.61% From Current Price

$73 – Buyers – 2.2:1, -18.73% From Current Price

$72 – Sellers – 2.6:0*, -19.84% From Current Price

$71 – NULL – 0:0*, -20.95% From Current Price

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN XLE AT THE TIME OF PUBLISHING THIS ARTICLE ***