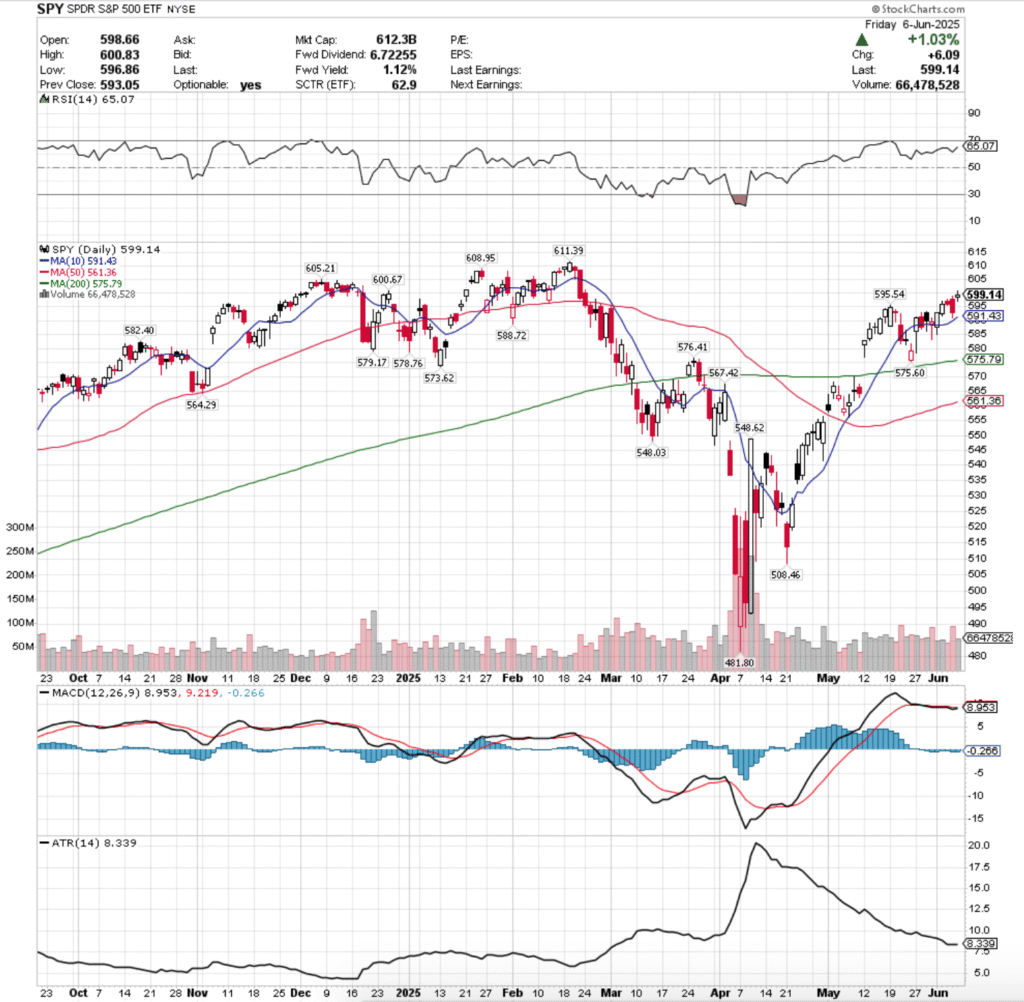

SPY, the SPDR S&P 500 ETF gained +1.65% last week, while the VIX closed the week at 16.77, indicating an implied move of +/-1.06% & an implied one month move of +/-4.85%.

Their RSI is trending higher towards overbought levels, sitting currently at 65.07, while their MACD is bearish, but is relatively flat in the wake of last week’s performance.

Volumes were +19.32% higher than the prior year’s average levels (68,316,000 vs. 57,254,701), which adds an interesting twist to the week, given that the highest volume session was a declining day.

Last week opened up on Monday in-line with the 10 day moving average, temporarily broke down through its support, before rallying into the close to close near the day’s high for a gain of +0.56%.

Tuesday that trend continued, as the session opened near Monday’s close & there was a risk-on appetite & SPY managed to close out +0.57%.

Wednesday is where trouble began to brew for SPY & market participants began to show a bit of anxiety & uncertainty, as the week’s lowest volume session resulted in a spinning top candle & closed -0.03% lower on the day after a gap up open.

The indecision marked by the spinning top is important, as SPY was <1% from that key resistance level of $600.67/share that we pointed out last week as an area of interest.

Thursday continued this, as SPY opened higher, before declining -0.48% on the strongest volume of the week & forming a bearish engulfing pattern with Wednesday’s candle.

While the support of the 10 day moving average managed to hold up, the day’s lower shadow indicates that there was a bit of unease among market participants & cracks were beginning to form.

Friday opened on a gap higher, but closed as a spinning top, indicating that there was quite a bit of indecision & uncertainty heading into the weekend, even though the session advanced +1.03%.

Friday’s high was able to temporarily break just above the previously noted $600.68/share resistance level, but was unable to gain any type of footing there & declined to close below it.

Heading into the new week, that will be a key area for any upside potential, as it is the gatekeeper for SPY’s all-time highs.

This level will likely be at least retested in the coming week, and as mentioned in prior months there will need to be a significant increase in consistent advancing volume to break above this resistance level.

Data for historic volume sentiment at these levels are skewed towards Buyers because of the nature of all-time highs, so it will require a more hands on approach to viewing trends in volume in the next week for any upside price movements.

There is a great deal of focus on today’s trade meeting between the US & China in London, as well as inflation data that comes in the form of CPI & PPI later this week.

There are also going to be clues about the state of the consumer when J.M. Smucker & Chewy report earnings, and Oracle’s report may also have potential to move the market in the short-term.

However, given that the Fed speakers have mostly all hinted at rates staying higher for longer/being in no rush to cut rates based on current data, it is difficult to see much of an upside catalyst in the near-term.

The consolidation case for SPY continues to be oscillations around the 10 day moving average until there is an upside or downside catalyst to force a breakout.

In the event that this is the way things play out, there is reason to watch the 50 day moving average’s approach to the 200 DMA, as a golden cross here may provide a temporary bump to SPY’s price as the medium-term trendline crosses over the long-term trend line bullishly.

In the event that his happens, pay attention to day-over-day volume trends to gain insight into how market participants are positioning themselves & what the future sentiment is likely to be.

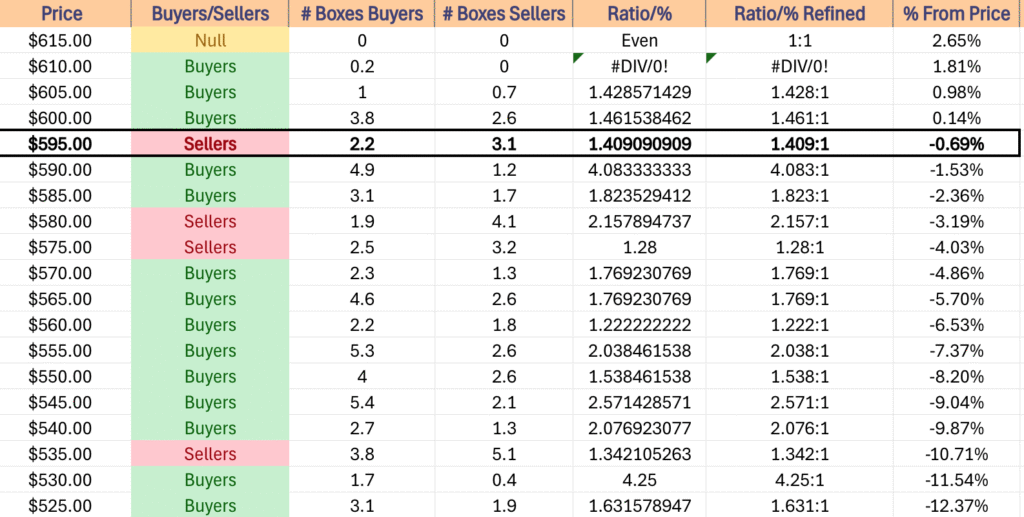

To the downside there is an interesting set up, as over the past ~3 years the price zone that SPY is in has historically been dominated by the Sellers.

In the event that this trend continued they find support at the 10 day moving average, which is in a Buyer zone, as is their next support level as well.

Should these get tested though, the significance of the short-term trendline breaking down may force more selling in SPY (particularly if that 50 DMA golden cross doesn’t occur in the meantime) which then puts SPY’s next (4th) support level in a Seller zone.

In the event of decline, look at the 200 DMA’s support level, which sits -3.9% from the closing price of Friday’s session.

If the long-term trend is tested again & doesn’t hold up, we are likely going to see continued declines in the near-to-mid term.

The table below provides more volume sentiment data that may be useful in assessing the strength/weakness of support/resistance levels in re-tests.

SPY has support at the $595.54 (Volume Sentiment: Sellers, 1.41:1), $591.43 (10 Day Moving Average, Volume Sentiment: Buyers, 4.08:1), $588.72 (Volume Sentiment: Buyers, 1.82:1) & $582.40/share (Volume Sentiment: Sellers, 2.16:1) price levels, with resistance at the $600.67 (Volume Sentiment: Buyers, 1.46:1), $605.21 (Volume Sentiment: Buyers, 1.43:1), $608.95 (Volume Sentiment: Buyers, 1.43:1) & $611.39/share (All-Time High, Volume Sentiment: Buyers, 1.43:1) price levels.

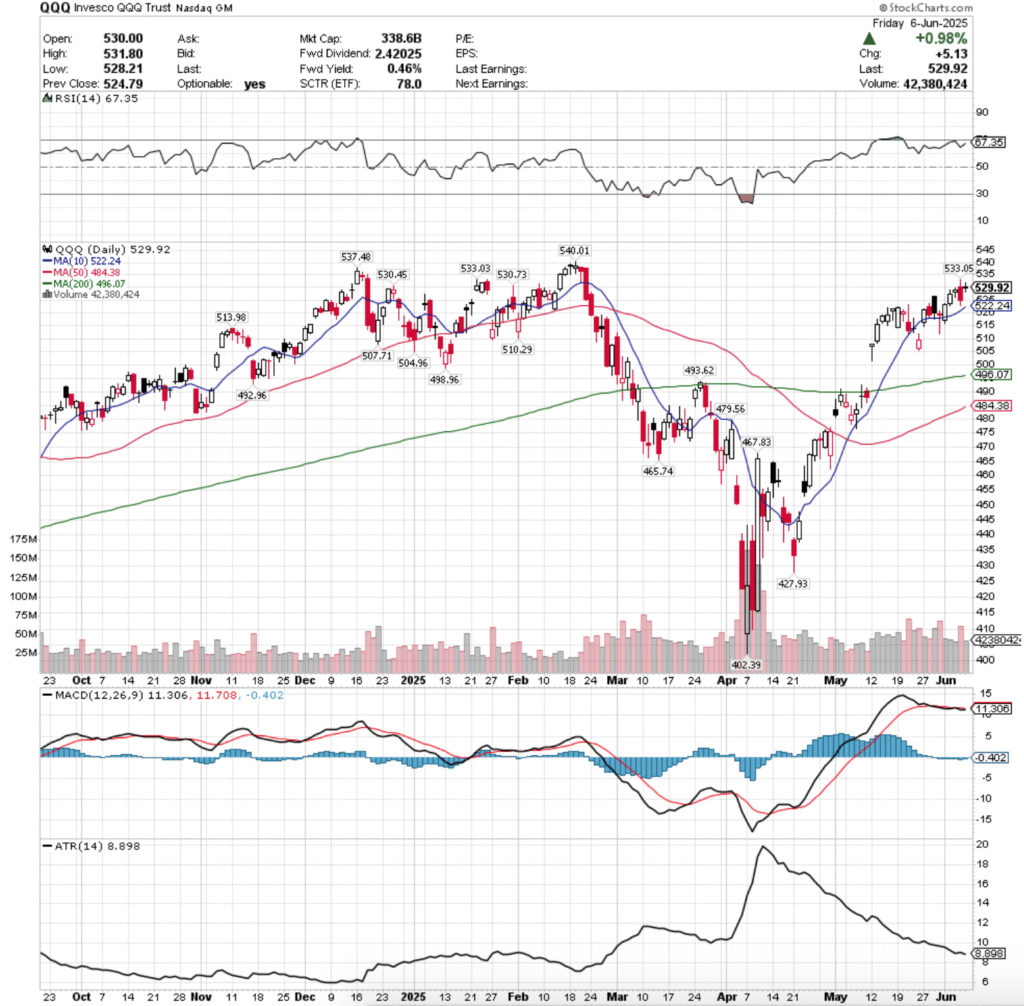

QQQ, the Invesco QQQ Trust ETF added +2.08% last week, as the tech-heavy index was able to muster some gains while closing in on its all-time high.

Their RSI is advancing towards the overbought level of 70, sitting currently at 67.35, while their MACD is bearish, but moving relatively flat after last week’s performance.

Volumes were +22.86% higher than the prior year’s average levels (46,790,000 vs. 38,083,028), which like SPY’s above has a little air of caution around it.

Monday QQQ opened just below the resistance of the 10 day moving average, but was able to break above it & close for an advancing session on the week’s second highest volume (highest for advancing sessions).

Tuesday opened on a gap higher & the march higher continued throughout the session, with the small lower shadow & longer upper shadow indicating that there had been a bit of profit taking during the session.

Wednesday though signaled a tale of caution on the horizon, as market participants began to be a little uneasy about how close QQQ had approached its all-time high & the session opened on a gap up, but closed as a hanging man candle (bearish).

Thursday confirmed this sentiment, when a gap higher open tested higher to reach $533.05/share, before profit taking commenced & QQQ formed a bearish engulfing pattern on a declining session with the week’s highest volume & QQQ closed down -0.75%.

The high volume can certainly be attributed to short-term & intraday profit taking, but it also is beginning to look like market participants are beginning to show signs of nervousness, as Friday’s candle showed.

Friday wound the week down in an interesting manner, as despite the session closing up +0.98%, there were many signs of weakness heading into the weekend.

Firstly, the session closed as a doji that’s real body was contained in the upper portion of Wednesday’s candle.

While the session advanced day-over-day, it closed lower than it opened, owing the adance to the jump in opening price from Thursday’s close.

This formed a bearish harami cross, indicating that there is still quite a bit of negative sentiment out there for QQQ & that there was a limited amount of risk being willing to be taken into the weekend.

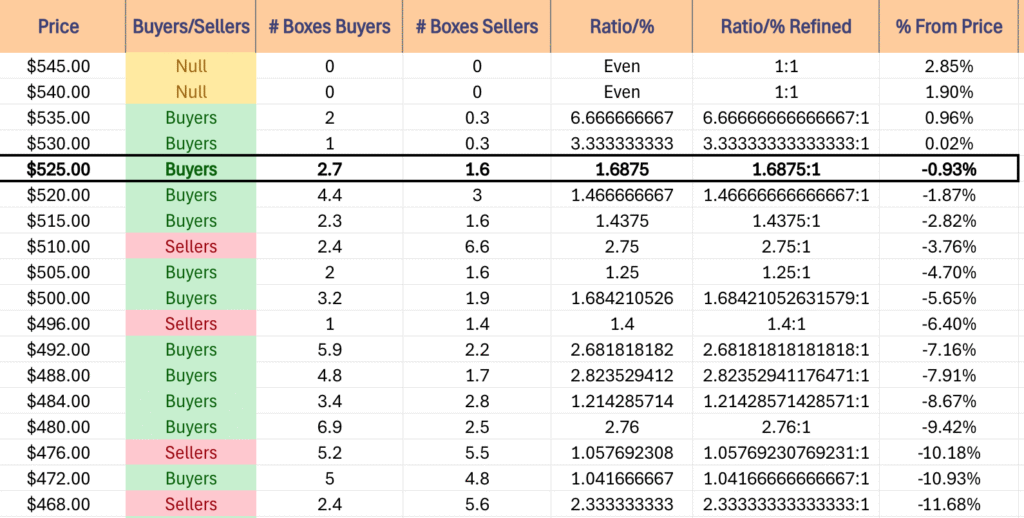

This week, to the upside QQQ is still below the $530-530.99 & $533-533.99/share resistance zones as of Friday’s close, which will be the primary target to watch.

The good news, is that there is Buyer sentiment historically in these zones, but the bad news is that it is attributed to the fact that they’re so close to QQQ’s all-time high, so the ratio will ultimately be diluted over time & re-tests.

Like SPY, there will need to be sustainable, higher advancing volumes in the coming week to power through those zones higher & should they be broken above but volumes are weak the rally should be viewed with skeptical brow.

It will also be wise to watch the 50 DMA as it approaches the 200 DMA, as in the event of a golden cross there may be a bump to the upside as the mdeium-term trendline crosses bullishly through the long-term trend line.

The consolidation case is still oscillations around the 10 day moving average, with a keen eye open in the event that we see an island top from the gap in early May.

In the event that there is downside movement, look to see that window be filled, with a re-test of the 200 day moving average likely, especially given the Seller pressure below Friday’s closing price.

Should we get one, the 200 DMA is in a Seller dominated zone historically, which adds a bit of trouble for the long-term trend.

The table below can help assess the strength/weakness of QQQ’s support/resistance levels in the event of re-tests.

QQQ has support at the $522.24 (10 Day Moving Average, Volume Sentiment: Buyers, 1.47:1), $513.98 (Volume Sentiment: Sellers, 2.75:1), $510.29 (Volume Sentiment: Sellers, 2.75:1) & $507.71/share (Volume Sentiment: Buyers, 1.25:1) price levels, with resistance at the $530.45 (Volume Sentiment: Buyers, 3.33:1), $530.73 (Volume Sentiment: Buyers, 3.33:1), $533.03 (Volume Sentiment: Buyers, 3.33:1) & $533.05/share (Volume Sentiment: Buyers, 3.33:1) price levels.

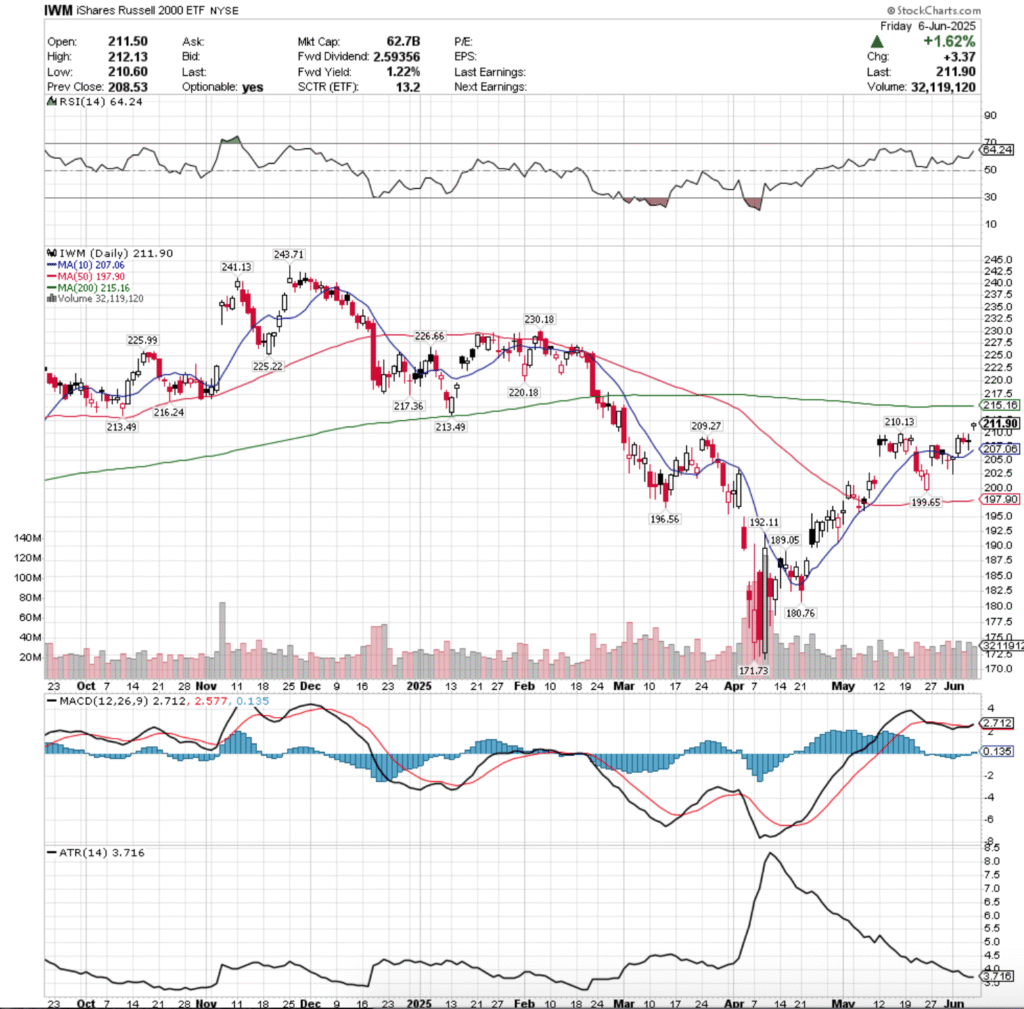

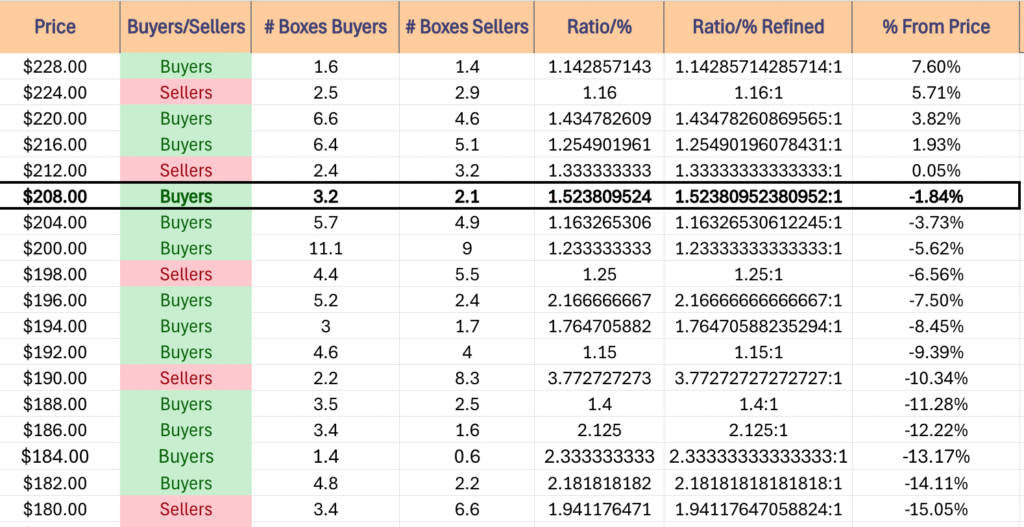

IWM, the iShares Russell 2000 ETF advanced +3.33% last week, faring the strongest of the major four index ETFs after a few slumping weeks at the back of the pack.

Their RSI is trending higher towards overbought levels, sitting currently at 64.24, while their MACD crossed over bullishly on Friday on account of the day’s gap up session.

Volumes were +7.83% higher than the prior year’s average (32,636,000 vs. 30,265,697), which while IWM advanced the most last week, is not necessarily a great picture given the gappy nature of the week.

Monday the small cap index opened below the 10 DMA, tested down to ~$202.50, before ending the day as a hammer candle & signaling that there was a bit of juice in the tank for IWM after weeks of underperforming the 3 other majors.

Tuesday opened on a gap up, tested briefly down to the support of the 10 day moving average, before powering higher on the highest volume of the week.

Wednesday saw some profits taking after the gains of the previous two days, as the day’s high was $210.01 & from there saw losses, closing down day-over-day -0.28%.

Wednesday’s volume was the lowest of the week, but given the underperformance that IWM has had relative to the other major indexes that’s not necessarily a bad sign.

Thursday saw another high volume session similar to Monday’s, but the day closed +0.04% as a doji, indicating that there was a bit of uncertainty looming over IWM.

This was confirmed Friday when IWM opened on a gap up, stayed within a relatively tight range for the day & closed out as a hanging man.

This indicated that there was not much interest in carrying risk into the weekend, and also formed a window that will need to be closed in the coming week(s).

The upside case for IWM moving forward relies around whether or not they can break above the 200 day moving average, changing their long-term trend.

This brings with itself some challenges, as the 200 DMA & the resistance level between it & the price both reside in Seller dominated price zones, which will require a bit of advancing volume to get through.

The consolidation case looks currently like oscillations around the 10 DMA, dipping into the window caused by Friday & breaching closer to the 200 DMA until we see a downside or upside catalyst.

The downside case occurs if there is some declining momentum as IWM fills Friday’s gap, which in turn would turn attention to he $199.65/share support level & the 50 day moving average.

IWM has support at the $210.13 (Volume Sentiment: Buyers, 1.52:1), $209.27 (Volume Sentiment: Buyers, 1.52:1), $207.06 (10 Day Moving Average, Volume Sentiment: Buyers, 1.16:1) & $199.65/share (Volume Sentiment: Sellers, 1.25:1) price levels, with resistance at the $213.49* (2 Touch-Points, Volume Sentiment: Sellers, 1.33:1), $215.16 (200 Day Moving Average, Volume Sentiment: Sellers, 1.33:1), $216.24 (Volume Sentiment: Buyers, 1.26:1) & $217.36/share (Volume Sentiment: Buyers, 1.26:1) price levels.

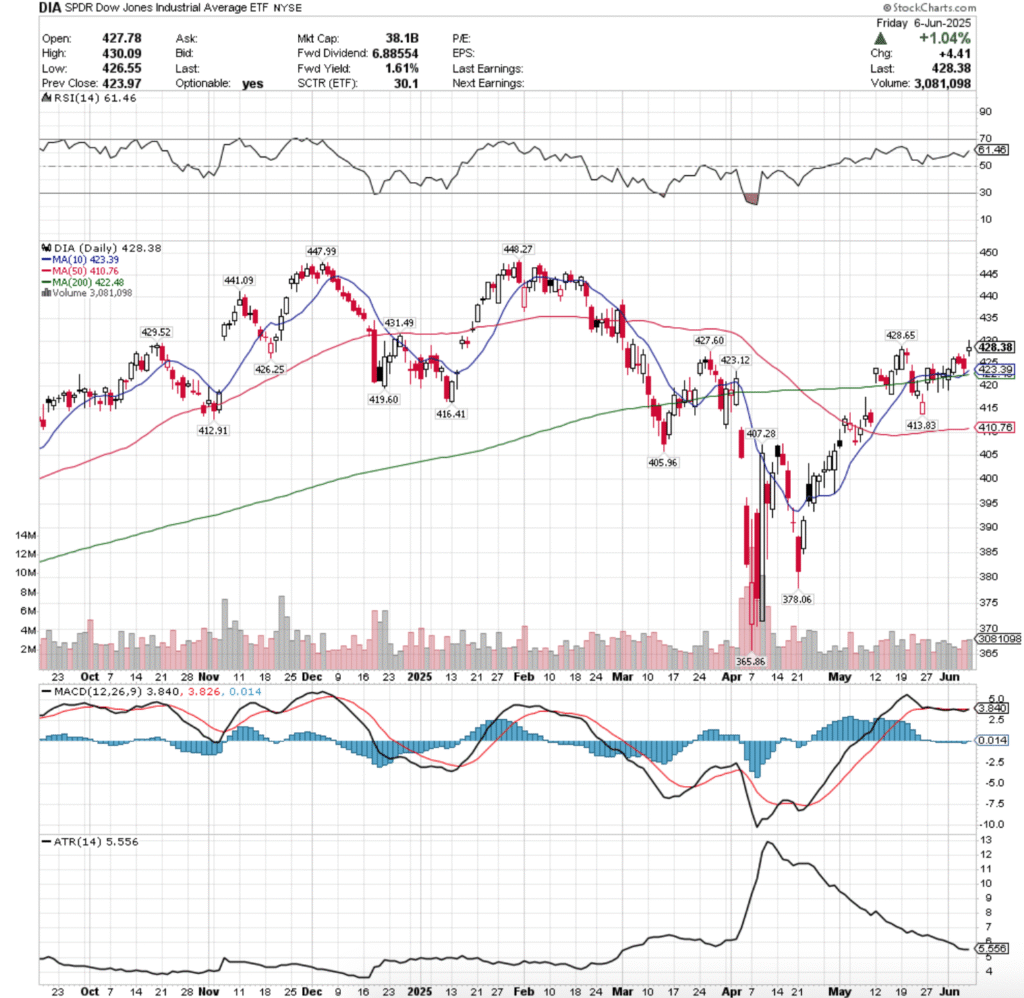

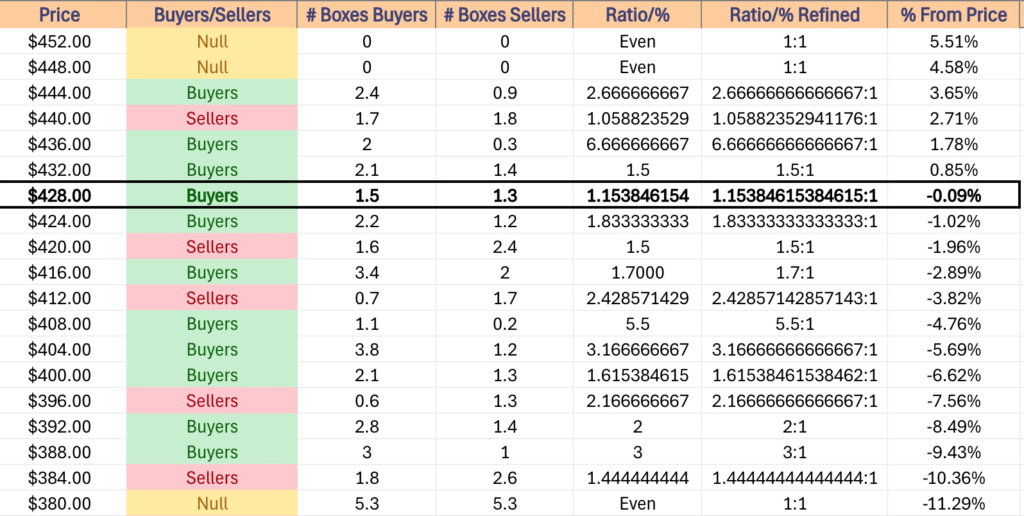

DIA, the SPDR Dow Jones Industrial Average ETF struggled last week & only gained +1.31%, the lowest increase of the major four index ETFs.

Their RSI is climbing higher & currently at 61.46, while their MACD is bearish but flat after the consolidation period of most of May that DIA’s been in.

Volumes were -16.28% lower than the prior year’s average (2,652,000 vs. 3,167,729), indicating that the “Buy & Hold” sentiment mentioned in the previous few weeks’ notes is still alive & well as the blue chip index investors are in a state of uncertainty.

DIA began the week just below its 10 day moving average’s resistance, tested below $420/share, before advancing to break out above all of its moving averages.

Tuesday followed suit & tested lower briefly, but support of the 10 & 200 DMA’s held up, enabling DIA to advance & close above $425/share.

Wednesday exposed that there was still some doubts about DIA’s strength, as the session opened higher, but profit taking quickly forced prices lower for a declining session.

Thursday was much the same, but market participants didn’t let DIA cross bearishly across the 10 & 200 day moving averages, but the day resulted in a decline, as the profit taking fueled the second highest volume session of the week.

Friday looked an awful lot like IWM’s chart (not surprising, as we’ve been noting now here weekly it seems), where DIA opened on a gap up, temporarily broke above the $430/share level, but ended the session as a spinning top candle on the week’s highest volume.

While that participation rate heading into a weekend might be seen by some as a sign of optimism & bullishness, looking at the declining volume of the two prior days doesn’t inspire a lot of confidence.

To the upside, the $428.65/share level will be an area of interest, along with the $429.52 & $431.49/share price levels.

These are historically Buyer dominated levels, but DIA has been more skewed towards Buyers in general as the Blue Chip index has maintained demand over the years as a safer haven than other indexes.

In the event that these levels are broken through, the $440-443.99/share zone is Seller dominated historically, which will pose an interesting problem for DIA, as it is the gatekeeper to their all-time high.

The consolidation case here looks interesting, as it involved oscillations around the 10 & 200 DMA’s simultaneously, awaiting the catalyst to the upside or the downside.

The overall market sentiment will be especially apparent based on what happens should that situation occur, as the proximity between the long & short term trend lines is quite narrow.

Any move towards the downside will be interesting to watch, as there’s solid Buyer sentiment at their next two support levels, before the following two enter Seller territory, and then the 50 day moving average comes into view.

If the 50 DMA is tested & breaks down, the $405.96/share level is the next place to begin looking for DIA, but this of course assumes a decline.

DIA has support at the $427.60 (Volume Sentiment: Buyers, 1.83:1), $426.25 (Volume Sentiment: Buyers, 1.83:1), $423.39 (10 Day Moving Average, Volume Sentiment: Sellers, 1.5:1) & $423.12/share (Volume Sentiment: Sellers, 1.5:1) price levels, with resistance at the $428.69 (Volume Sentiment: Buyers, 1.15:1), $429.52 (Volume Sentiment: Buyers, 1.15:1), $431.49 (Volume Sentiment: Buyers, 1.15:1) & $441.09/share (Volume Sentiment: Sellers, 1.06:1) price levels.

The Week Ahead

Monday kicks the new week off with Wholesale Inventories data at 10 am.

Calavo Growers & Casey’s General report earnings after Monday’s close.

NFIB Optimism Index data is released on Tuesday at 6 am.

Academy Sports + Outdoors, Core & Main, J.M. Smucker & United Natural Foods report earnings before Tuesday’s opening bell, with GameStop, Dave & Buster’s, GitLab & Stitch Fix all reporting after the session’s close.

Wednesday gives us insight into inflation with Consumer Price Index, Core CPI, CPI Year-over-Year & Core CPI Year-over-Year data at 8:30 am, before Monthly U.S. Federal Budget data at 2pm.

Chewy & SailPoint report earnings before Wednesday’s opening bell, followed by Oracle & Oxford Industries after the closing bell.

Initial Jobless Claims, Producer Price Index, Core PPI, PPI Year-over-Year & Core PPI YEar-over-Year data are released Thursday at 8:30 am.

Lovesac reports earnings on Thursday before the session opens, followed by Adobe & RH after the session’s close.

Friday the week winds down with Consumer Sentiment (prelim) data at 10 am.

There are no major earnings reports due out of Friday.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***