American Financial Group Inc. stock trades under the ticker AFG & is a member of the property-casualty insurance industry.

AFG stock closed at $131.48/share on 10/5/2021, after showing bullishness during a volatile past couple of weeks.

Breaking Down American Financial Group Inc. AFG Stock’s Technicals

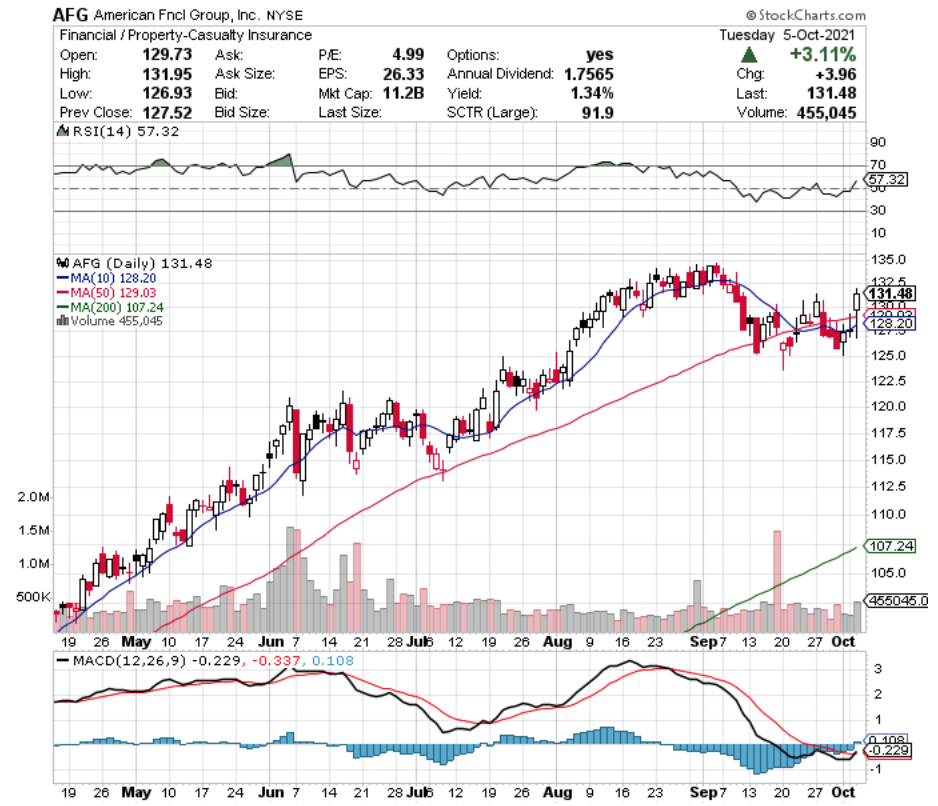

AFG Stock Price: $131.48

10 Day Moving-Average: $128.20

50 Day Moving-Average: $129.03

200 Day Moving-Average: $107.23

RSI: 57.3

MACD: -0.229

Yesterday, AFG completed a bullish MACD crossover, while also breaking out above its 50 Day Moving-Average.

With an RSI of 57, there is still more room for AFG to continue climbing in the near-term, with added support coming from the 10 Day MA about to cross the 50 Day MA bullishly.

The next level AFG will test is $133.20.

American Financial Group Inc. AFG Stock As A Long-Term Investment

Long-term investors may like AFG stock for its valuation, with a P/E (ttm) of 9.16 & a P/B of 2.

With a Beta of 0.97, AFG should not move as aggressively as broader markets in times of volatility.

With Total Cash (mrq) of $3.39B & Total Debt (mrq) of $2.11B, AFG’s balance sheet also looks appealing.

American Financial Group Inc.’s stock pays a 1.53% Dividend Yield, which looks very safe as their Payout Ratio is 13.5%.

American Financial Group Inc. AFG Stock As A Short-Term Trade Using Options

AFG stock has options that traders can use to hedge off the market’s recent volatility, while still taking advantage of AFG’s positive momentum.

I am looking at the 10/15 expiration dated contracts, looking at the $130 & $131 calls.

These are not very liquid, with low Open Interest, but they are already in-the-money.

From a puts perspective, the $135 strike price looks safe, with the $131 being at-the-money & possibly breaking into the money if market volatility continues on the next few weeks, making them worth holding for a hedge.

Tying It All Together

Overall, American Financial Group Inc. stock has many opportunities for short-term traders & long-term investors.

In the near-term, they are enjoying bullish momentum that looks to continue, despite the broader market’s performance.

In the long-term, AFG’s valuation, debt levels & dividend yield all look appealing for investors.

Regardless of your trading style, AFG stock is worth taking a closer look at.

*** I DO NOT OWN SHARES OF AFG STOCK ***