Caseys General Store, Inc. stock trades under the ticker CASY & has shown recent bullishness that traders & investors should research further into.

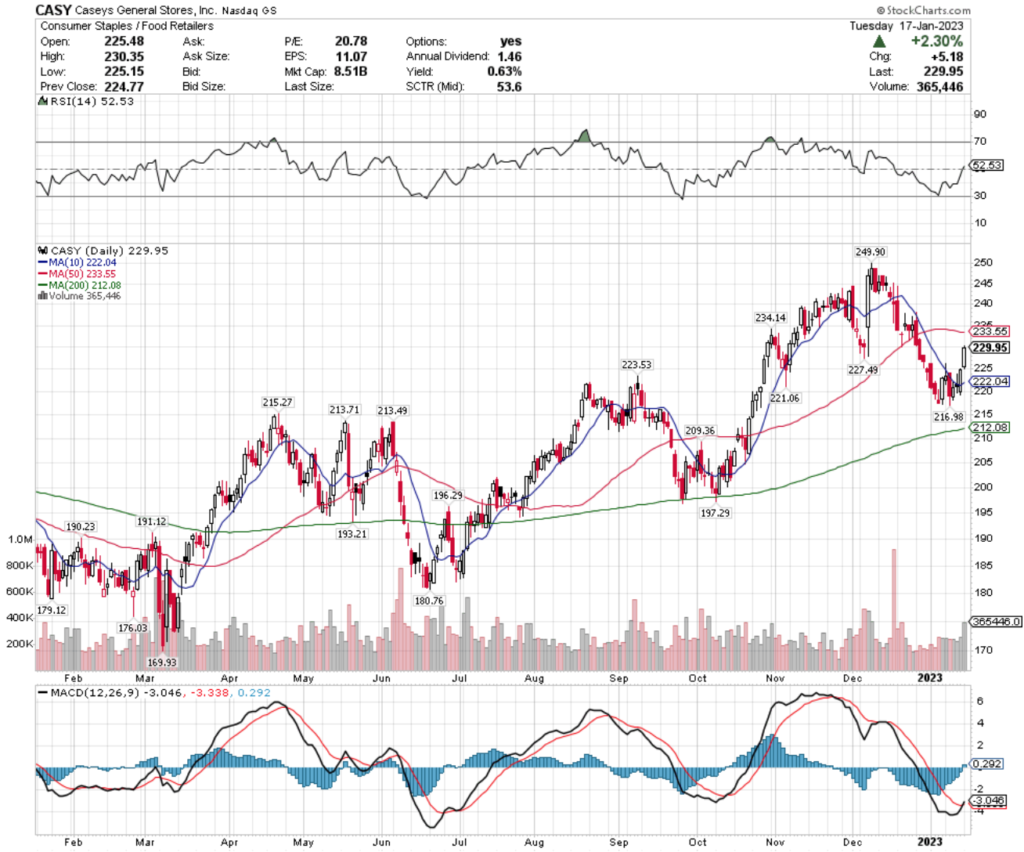

CASY stock closed at $229.95/share on 1/17/2023.

Caseys General Store, Inc. CASY Stock’s Technical Performance Broken Down

CASY Stock Price: $229.95

10 Day Moving Average: $222.04

50 Day Moving Average: $233.55

200 Day Moving Average: $212.08

RSI: 52.53

MACD: -3.046

Yesterday, CASY stock completed a bullish MACD crossover, gapping up +2.3% for the day’s session.

Recent trading volumes have been about average compared to the year prior, and their RSI is neutral, signaling that they may have more short-term momentum to come.

CASY stock has support at the $227.49 & $223.53/share price level, as they try to break out above the $233.55 & $234.14/share resistance levels.

Caseys General Store, Inc. CASY Stock As A Long-Term Investment

Long-term oriented investors will like CASY stock’s 20.3 P/E (ttm), but will find their 3.33 P/B (mrq) to be a bit higher than they’d like.

They recently reported 21.9% Quarterly Revenue Growth Y-o-Y, with 42.1% Quarterly Earnings Growth Y-o-Y.

Their balance sheet will require a more thorough examination, with $414.8M of Total Cash (mrq) & $1.67B of Total Debt (mrq).

CASY stock pays a 0.65% dividend, which appears to be sustainable in the long-run, as their payout ratio is 13.19%.

87.24% of CASY stock’s outstanding share float is owned by institutional investors.

Caseys General Store, Inc. CASY Stock As A Short-Term Trade Using Options

Traders with shorter time horizons can trade options to profit from CASY stock’s price movements, while protecting their portfolios from volatility.

I am looking at the contracts with the 2/17 expiration date.

The $220, $210 & $195 call options are all in-the-money, listed from highest to lowest level of open interest.

The $230, $240 & $260 puts are also all in-the-money, with the former strikes being more liquid than the latter.

Tying It All Together

CASY stock has many interesting characteristics that traders & investors will find appealing.

Investors will like their recent growth & dividend yield, but may want to look closer into the makeup of their balance sheet.

Traders will like their recent technical performance, but may wish their options were a bit more liquid.

Overall, it is worth taking a closer look into CASY stock to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR OPTIONS POSITIONS AROUND CASY STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***