Dynex Capital Inc. stock trades under the ticker DX & has shown recent bullishness that traders & investors should take a closer look into.

DX stock is trading at $16.09/share as I write this on 3/9/2022.

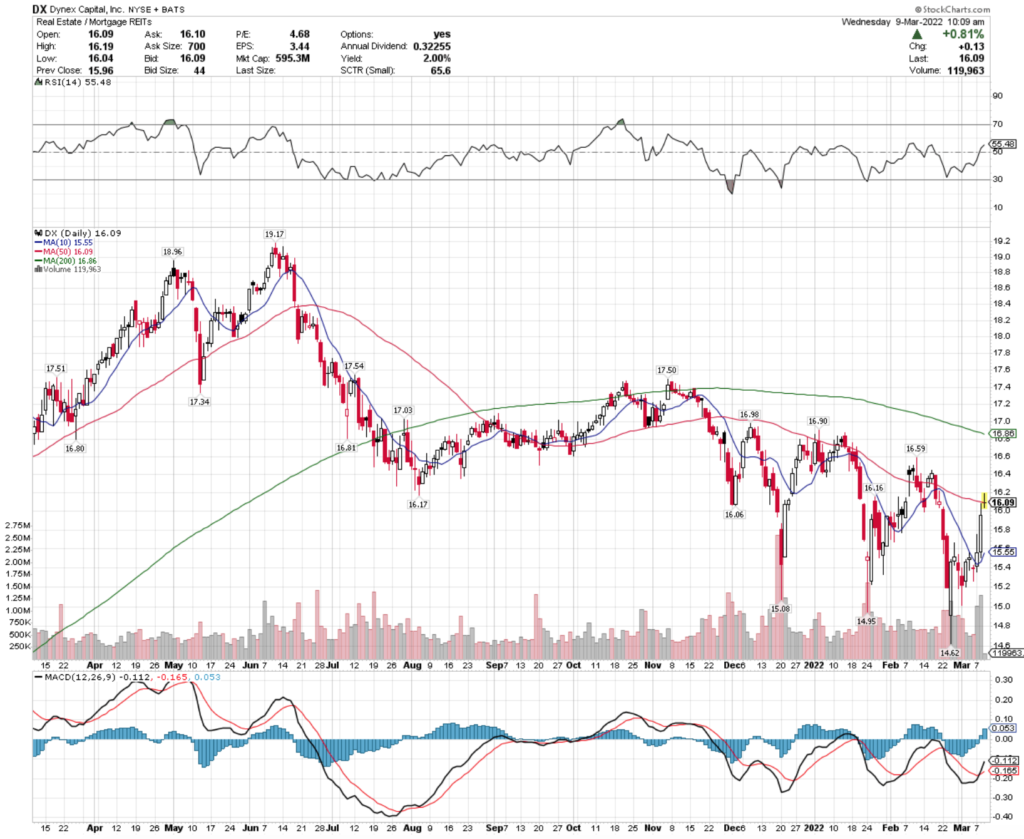

Dynex Capital Inc. DX Stock’s Technicals Broken Down

DX Stock Price: $16.09

10 Day Moving Average: $15.55

50 Day Moving Average: $16.09

200 Day Moving Average: $16.86

RSI: 55.5

MACD: -0.159

Yesterday, DX stock completed a bullish MACD crossover, and today broke out above its 50 Day Moving Average.

With a relatively neutral RSI & above average trading volumes recently, they look set to continue climbing higher in the near-term.

I will be watching them at the $16.27 & $16.53 resistance levels.

Dynex Capital Inc. DX Stock As A Long-Term Investment

Long-term oriented investors will find DX stock’s valuation metrics appealing, with a P/E (ttm) of 5.58 & a P/B (mrq) of 0.86.

DX stock’s most recent Quarterly Revenue Growth Y-o-Y was disappointing at -56.4%, and their Quarterly Earnings Growth Y-o-Y was -65.2%.

Their balance sheet will require a closer examination, with Total Cash (mrq) of $373.99M & Total Debt (mrq) of $2.85B.

Their last debt ratings from Moody’s are over a decade old, and were all in the speculative/junk range.

DX stock pays a 9.77% dividend, which appears to be relatively safe, as their payout ratio is 56%.

~42% of DX’s total outstanding share float is held by institutional investors.

Dynex Capital Inc. DX Stock As A Short-Term Trade Using Options

Short-term oriented traders can trade DX options to hedge against volatility & profit from price movements in any direction.

I am looking at the contracts with the 3/18 expiration date.

The $15 calls look appealing, as the $12.50 strike price has no open interest.

The $17.50 calls have healthy liquidity, but require a ~9% jump in 9 days to be at-the-money.

The $20 & $17.50 puts also look appealing, as the $22.50’s have no open interest.

Tying It All Together

Overall, DX stock has many interesting characteristics that traders & investors should research further.

Long-term investors will like their dividend yield & valuation metrics, but may be weary of their balance sheet.

Short-term traders will like their current momentum, but be disappointed by their open interest levels on many of the strike price levels of their options contracts.

DX stock is worth taking a closer look into, regardless of your trading style.

*** I DO NOT OWN SHARES OF DX STOCK ***