eBay Inc. stock trades under the ticker EBAY & is a member of the specialty consumer services industry.

EBAY stock closed at $75.05/share on 10/8/2021, after showing bullish signals & momentum that are worth taking a closer look at.

eBay Inc. EBAY Stock’s Technicals Broken Down

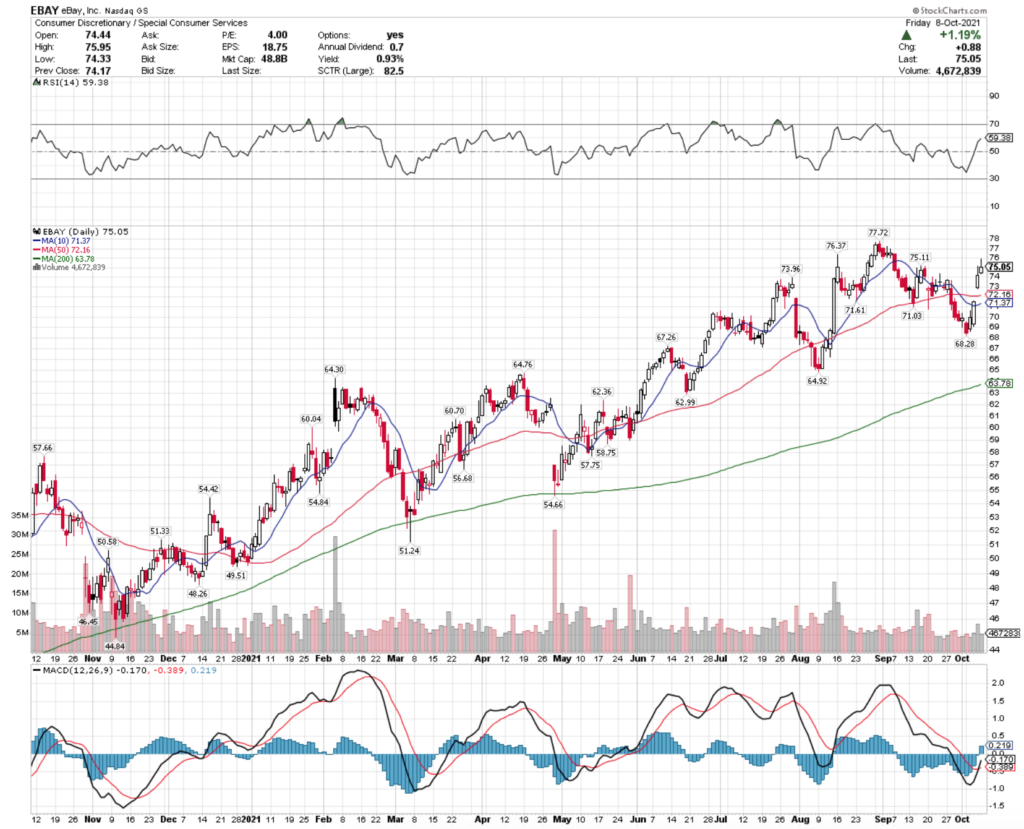

EBAY Stock Price: $75.05

10 Day Moving-Average: $71.37

50 Day Moving-Average: $72.16

200 Day Moving-Average: $63.78

RSI: 59.4

MACD: -0.17

After completing a bullish MACD crossover on Friday, EBAY stock looks ready to break through the $75.11-mark & begin testing the $76.65-range.

There looks to be added momentum coming from the 10 Day Moving Average approaching the 50 Day MA bullishly, with only ~1% between the two MA’s.

Their volume recently has been below average for the year, which is expected given the broader market volatility & uncertainty.

eBay Inc. EBAY Stock As A Long-Term Investment

Investors may find EBAY’s valuation appealing for a technology company, with a P/E (ttm) of 21.33.

EBAY’s P/B is 3.49, with 14.02% Quarterly Revenue Growth Y-o-Y.

Investors will also like EBAY’s balance sheet, with Total Cash (mrq) of $17.22B & Total Debt (mrq) of $9.35B & a Total Debt/Equity (mrq) of 71.8.

EBAY stock has 94% % Institutional Investors, which some investors like as a sign of confidence that other large investors are owners of the name.

eBay Inc. stock also offers a dividend yield of 0.92%, with a safe payout ratio of 20.7%.

eBay Inc. EBAY Stock As A Short-Term Trade Using Options

Traders can use options to take advantage of EBAY’s upward momentum, while hedging off risks associated with broader market volatility.

I am looking at the 10/15 expiration dated options.

The $74 & $75 calls look appealing, and have adequate open interest for selling them by the end of the week upon expiration.

The $75 & $76 puts also look appealing as a means of hedging against wider market volatility, while still making some profits on EBAY’s performance.

Tying It All Together

Overall, there are numerous advantages in EBAY stock for traders of all styles & time frames.

Long-term investors may like EBAY’s valuation, debt & cash levels, as well as their dividend yield.

Short-term traders will like their current momentum, as well as the liquidity on their options contracts.

Traders & investors should look to take a deeper dive into eBay Inc.’s stock, regardless of their trading strategy is.

*** I DO NOT OWN SHARES OF EBAY STOCK***