J.B. Hunt Transport Services Inc. stock trades under the ticker JBHT & has shown recent bullishness that traders & investors should take a closer look into.

JBHT stock closed at $193.01/share on 2/15/2022.

J.B. Hunt Transport Services, Inc. JBHT Stock’s Technicals Broken Down

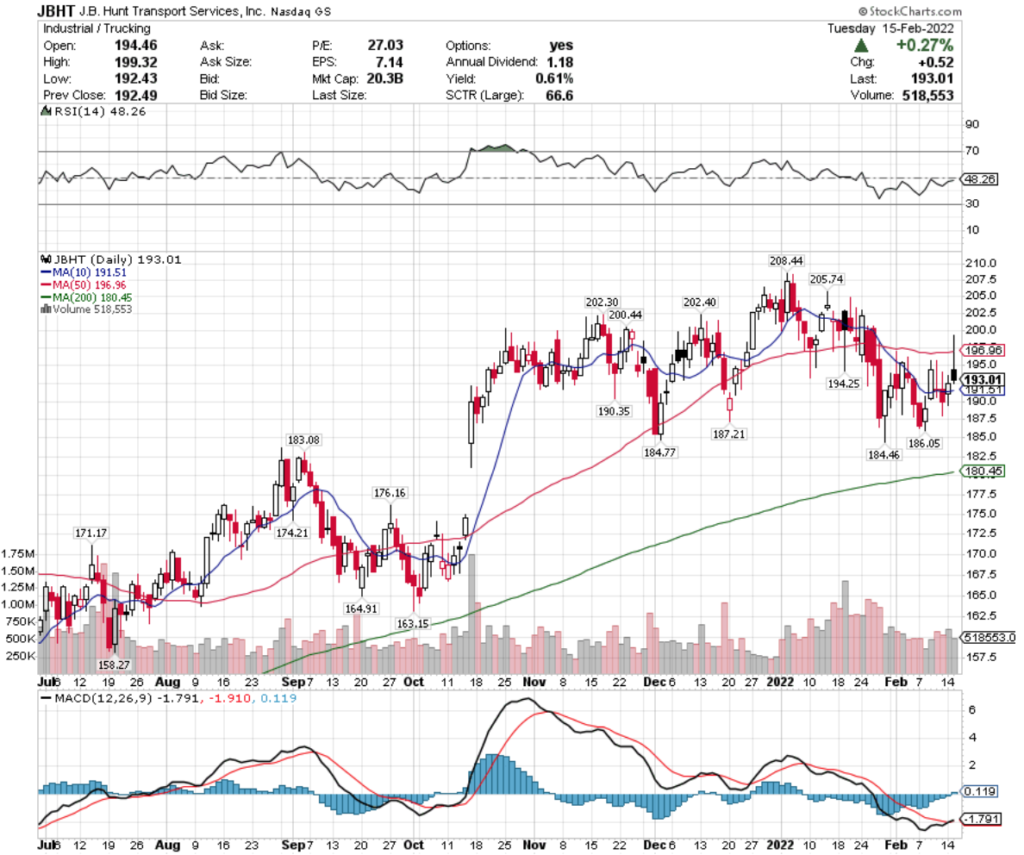

JBHT Stock Price: $193.01

10 Day Moving Average: $191.51

50 Day Moving Average: $196.96

200 Day Moving Average: $180.45

RSI: 48.26

MACD: -1.791

Yesterday, JBHT stock completed a bullish MACD crossover, while also breaking out above its 10 day moving average.

2022’s trading volume so far has been above average, and their RSI is just below neutral, showing room for more momentum in the near-term.

Their next test of resistance is $197.35, followed by $201.03.

J.B. Hunt Transport Services Inc. JBHT Stock As A Long-Term Investment

Investors will find JBHT to have fair valuation metrics, with a P/E (ttm) of 26.96, although their P/B (mrq) is a bit rich at 6.49.

JBHT stock had 27.7% Quarterly Revenue Growth Y-o-Y, as well as 57.3% Quarterly Earnings Growth Y-o-Y.

Their balance sheet will require a closer examination though, with $355.55M in Total Cash (mrq) & $1.3B in Total Debt (mrq).

They offer a modest dividend of 0.61%, which looks very safe as JBHT stock’s payout ratio is 16.5%.

74.3% of JBHT stock’s outstanding share float is held by institutional investors.

J.B. Hunt Transport Services Inc. JBHT Stock As A Short-Term Trade Using Options

Short-term traders can profit from JBHT stock’s current momentum by trading options.

I am looking at the contracts with the 3/18 expiration date.

The $190 & $195 calls look interesting, although very illiquid, with low levels of open interest.

The $195 & $200 puts also look appealing, but very illiquid too.

I expect to see more contracts written after this week’s expiration date passes on Friday.

Tying It All Together

JBHT stock has many interesting characteristics that traders & investors should find appealing.

Traders will like their current trajectory of momentum, but will be looking for more liquidity in their March dated options.

Investors will like their valuation metrics, but would certainly appreciate a dividend hike.

Overall, JBHT stock is worth taking a closer look into, regardless of your trading style.

*** I DO NOT OWN SHARES OF JBHT STOCK ***