Kellogg Co. stock trades under the ticker K & has shown recent bullishness that traders & investors should take a closer look into.

K stock closed at $68.58/share on 1/31/2021.

Kellogg Co. K Stock’s Technical Performance Broken Down

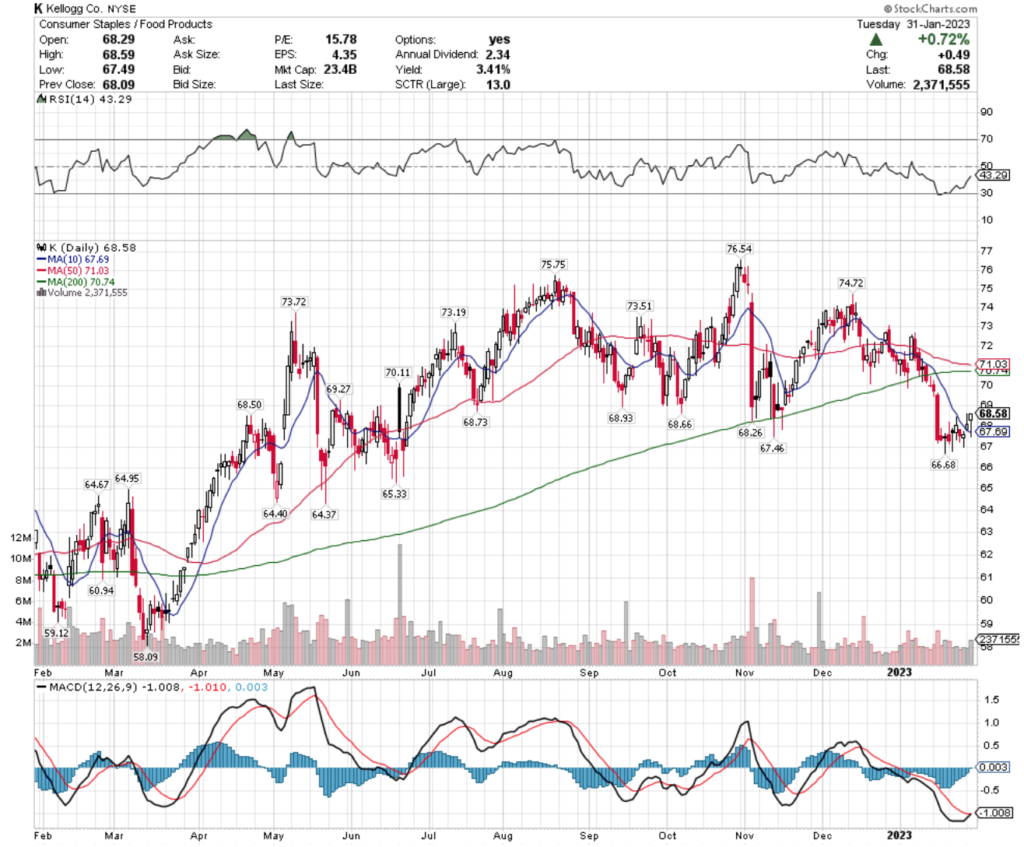

K Stock Price: $68.58

10 Day Moving Average: $67.69

50 Day Moving Average: $71.03

200 Day Moving Average: $70.74

RSI: 43.29

MACD: -1.008

Yesterday, K stock completed a bullish MACD crossover, gaining 0.72% on the day.

Recent trading volumes have been below average compared to the year prior, and their RSI is still on the oversold side at 43, signaling that there is still uncertainty as to the near-term market valuation of K stock.

Yesterday’s candlestick is a hanging man, signaling bearish sentiment.

K stock has support at the $68.50 & $68.26/share price levels as they try to break out above their $68.66-8 & $68.93/share resistance levels.

Kellogg Co. K Stock As A Long-Term Investment

Long-term oriented investors will like K stock’s 15.52 P/E (ttm), but may find their 5.38 P/B (mrq) to be a bit rich.

They recently reported 8.9% Quarterly Revenue Growth Y-o-Y, with 1% Quarterly Earnings Growth Y-o-Y.

Their balance sheet will warrant a more thorough review before investing, with a reported $375M of Total Cash (mrq) & $7.39B of Total Debt (mrq).

K stock pays a 3.42% dividend, which appears to be sustainable in the long-run as their payout ratio is 53.56%.

85.4% of K stock’s outstanding share float is owned by institutional investors.

Kellogg Co. K Stock As A Short-Term Trade Using Options

Traders focused on a shorter time horizon can trade options to profit from K stock’s price movements, while protecting their portfolio from volatility.

I am looking at the contracts with the 3/17 expiration date.

The $67.50, $65 & $62.50 call options are all in-the-money, listed from highest to lowest level of open interest.

The $75, $70 & $72.50 puts are also all in-the-money, with the former being more liquid than the latter strikes.

Tying It All Together

K stock has many interesting attributes that traders & investors are sure to like.

Investors will like their dividend yield, but may want to get a more thorough understanding of the structure of their balance sheet before investing.

Traders will like how liquid their options are, as well as their recent technical performance.

All-in-all, it is worth taking a closer look at K stock to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR HAVE OPTIONS CONTRACTS IN K STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***