It’s been a volatile month & a half since our last volume sentiment check in, which has provided some retests of the new higher price levels that the major index ETFs have traded at.

Yesterday, the VIX closed at 17.35, indicating an implied one day move of +/-1.09% & an implied one month move of +/-5.01% for the S&P 500, as expectations for near-term volatility have been amped up.

This makes it a great time to check in & see how the major four index ETFs have traded at from a volume sentiment perspective at each price level they’ve covered in recent history.

This will provide an understanding of how prices may behave when certain support & resistance levels are reached & tested again in the future.

Each section below contains a view of each index ETF’s chart (for a technical breakdown of each ETF’s chart please see this past weekend’s market review note), as well as a list of their current one year support & resistance levels with the volume sentiment noted beneath it on the table.

There is an additional table beneath this table with each price level’s sentiment, as well as a typed text version below that is able to be copied & pasted.

Note that “NULL, 0:0*” values denote areas that each name has traded at but with limited volume data to work with from a comparison standpoint in terms of creating a ratio of buyers:sellers (or vice versa).

Also, prices that do have a ratio of Buyers:Sellers (Sellers:Buyers) where the denominator is 0 are denoted with an asterisk “*” as well.

In the written lists of the price levels & volume sentiments the price levels that contain support & resistance levels are marked in BOLD.

Recall that at price extremes such as the highs that we have recently hit there will tend to be skewed data due to the small sample size & factor that into how you interpret each price level’s reported sentiment.

This is intended to serve as an additional tool, similar to a barometer to use during your due diligence process & is not meant to replace doing your own research & is not financial advice.

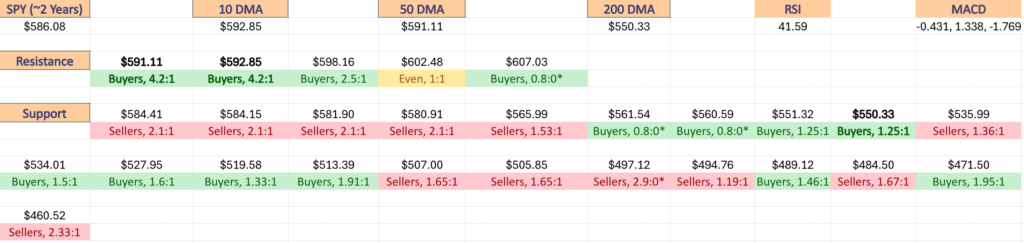

Price Level:Volume Sentiment Analysis For SPY, The SPDR S&P 500 ETF

SPY, the SPDR S&P 500 ETF has been giving back its post U.S. Election gains for much of the last 6 weeks.

The middle & end of December saw some elevated volume, but for the most part market participation has still be dramatically muted since April of 2024 vs. previous years.

With their 10 day moving average bearish down on the 50 DMA, there look to be more near-term declines on the horizon, with sparse support levels near their current price.

With this in mind, it is worth looking at how investors have behaved over the past few years at each price level to see if it lends clues into how they may choose to behave again in the near-future.

Below is a list of the volume sentiments at each price level SPY has traded at over the past 2-3 years.

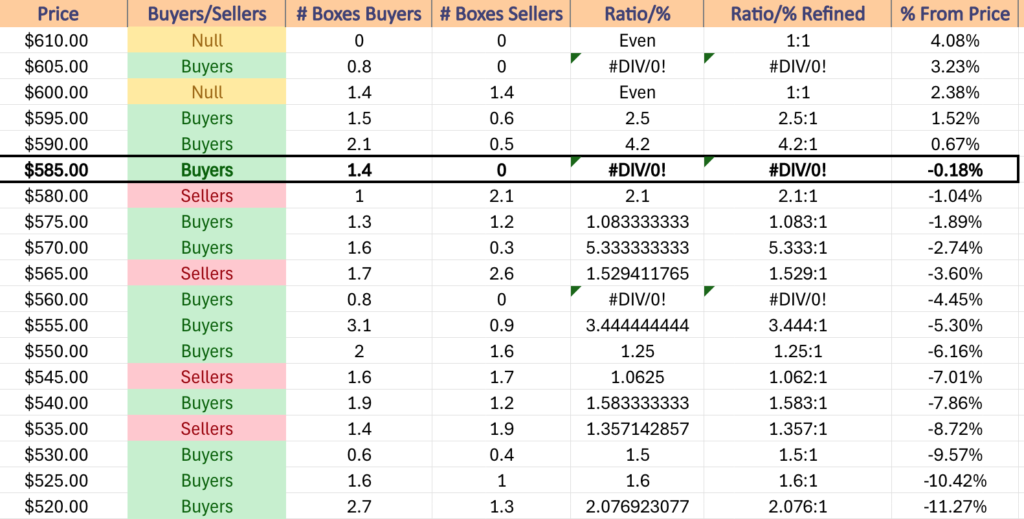

$610 – NULL – 0:0*, +4.08% From Current Price Level

$605 – Buyers – 0.8:0*, +3.23% From Current Price Level

$600 – Even – 1:1, +2.38% From Current Price Level

$595 – Buyers – 2.5:1, +1.52% From Current Price Level

$590 – Buyers – 4.2:1, +0.67% From Current Price Level – 10 & 50 Day Moving Averages**

$585 – Buyers – 1.4:0*, -0.18% From Current Price Level – Current Price Level*

$580 – Sellers – 2.1:1, -1.04% From Current Price Level

$575 – Buyers – 1.08:1, -1.89% From Current Price Level

$570 – Buyers – 5.33:1. -2.74% From Current Price Level

$565 – Sellers – 1.53:1, -3.6% From Current Price Level

$560 – Buyers – 0.8:0*, -4.45% From Current Price Level

$555 – Buyers – 3.44:1, -5.3% From Current Price Level

$550 – Buyers – 1.25:1, -6.16% From Current Price Level – 200 Day Moving Average*

$545 – Sellers – 1.06:1, -7.01% From Current Price Level

$540 – Buyers – 1.58:1, -7.86% From Current Price Level

$535 – Sellers – 1.36:1, -8.72% From Current Price Level

$530 – Buyers – 1.5:1, -9.57% From Current Price Level

$525 – Buyers – 1.6:1, -10.42% From Current Price Level

$520 – Buyers – 2.08:1, -11.27% From Current Price Level

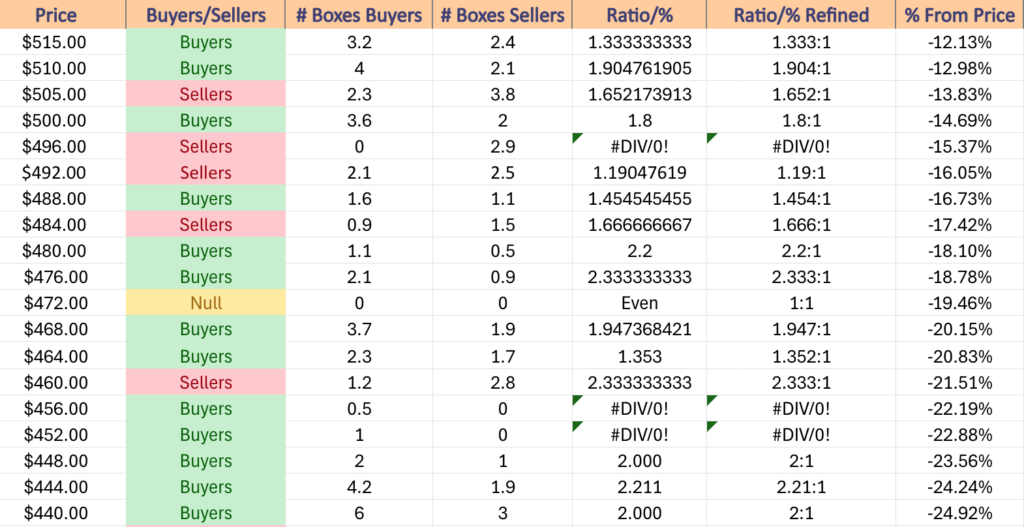

$515 – Buyers – 1.33:1, -12.13% From Current Price Level

$510 – Buyers – 1.9:1, -12.98% From Current Price Level

$505 – Sellers – 1.65:1, -13.83% From Current Price Level

$500 – Buyers – 1.8:1, -14.69% From Current Price Level

$496 – Sellers – 2.9:0*, -15.37% From Current Price Level

$492 – Sellers – 1.19:1, -16.05% From Current Price Level

$488 – Buyers – 1.45:1, -16.73% From Current Price Level

$484 – Sellers – 1.67:1, -17.42% From Current Price Level

$480 – Buyers – 2.2:1, -18.1% From Current Price Level

$476 – Buyers – 2.33:1, -18.78% From Current Price Level

$472 – NULL – 0:0*, -19.46% From Current Price Level

$468 – Buyers – 1.95:1, -20.15% From Current Price Level

$464 – Buyers – 1.35:1, -20.83% From Current Price Level

$460 – Sellers – 2.33:1, -21.51% From Current Price Level

$456 – Buyers – 0.5:0*, -22.19% From Current Price Level

$452 – Buyers – 1:0*, -22.88% From Current Price Level

$448 – Buyers – 2:1, -23.56% From Current Price Level

$444 – Buyers – 2.21:1, -24.24% From Current Price Level

$440 – Buyers – 2:1, -24.92% From Current Price Level

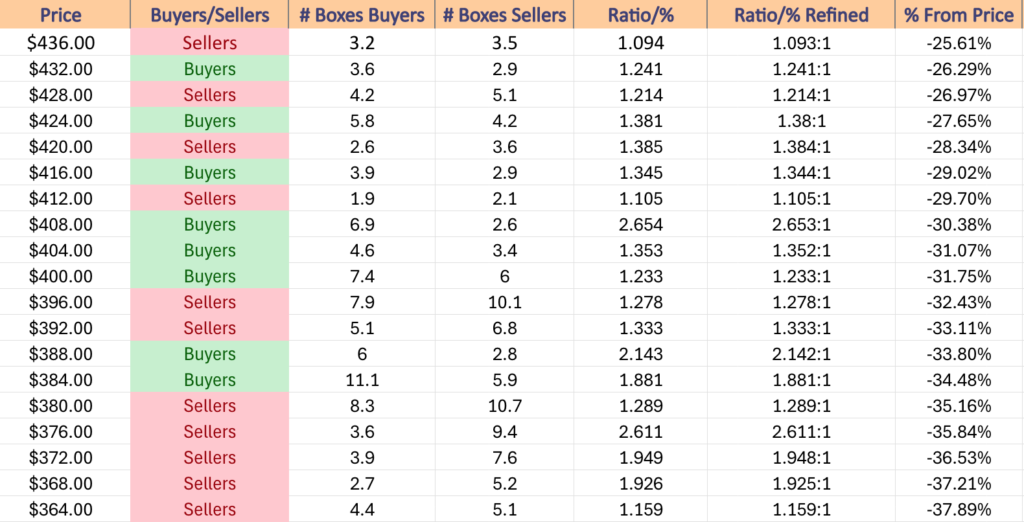

$436 – Sellers – 1.09:1, -25.61% From Current Price Level

$432 – Buyers – 1.24:1, -26.29% From Current Price Level

$428 – Sellers – 1.21:1, -26.97% From Current Price Level

$424 – Buyers – 1.38:1, -27.65% From Current Price Level

$420 – Sellers – 1.38:1, -28.34% From Current Price Level

$416 – Buyers – 1.34:1, -29.02% From Current Price Level

$412 – Sellers – 1.11:1, -29.7% From Current Price Level

$408 – Buyers – 2.65:1, -30.38% From Current Price Level

$404 – Buyers – 1.35:1, -31.07% From Current Price Level

$400 – Buyers – 1.23:1, -31.75% From Current Price Level

$396 – Sellers – 1.28:1, -32.43% From Current Price Level

$392 – Sellers – 1.33:1, -33.11% From Current Price Level

$388 – Buyers – 2.14:1, -33.8% From Current Price Level

$384 – Buyers – 1.88:1, -34.48% From Current Price Level

$380 – Sellers – 1.29:1, -35.16% From Current Price Level

$376 – Sellers – 2.61:1, -35.84% From Current Price Level

$372 – Sellers – 1.95:1, -36.53% From Current Price Level

$368 – Sellers – 1.93:1, -37.21% From Current Price Level

$364 – Sellers – 1.16:1, -37.89% From Current Price Level

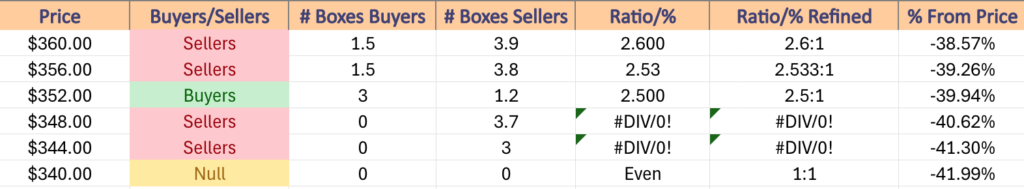

$360 – Sellers – 2.6:1, -38.57% From Current Price Level

$356 – Sellers – 2.53:1, -39.26% From Current Price Level

$352 – Buyers – 2.5:1, -39.94% From Current Price Level

$348 – Sellers – 3.7:0*, -40.62% From Current Price Level

$344 – Sellers – 3:0*, -41.3% From Current Price Level

$340 – NULL – 0:0*, -41.99% From Current Price Level

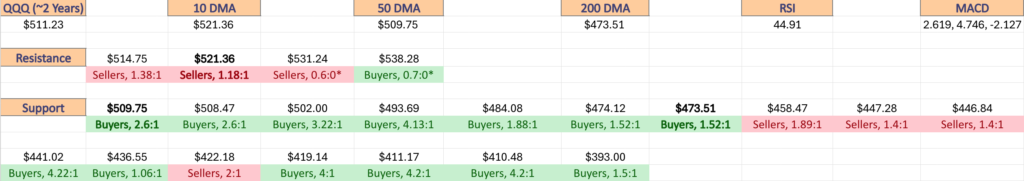

Price Level:Volume Sentiment Analysis For QQQ, The Invesco QQQ Trust ETF

QQQ, the Invesco QQQ Trust ETF has continued to trade in a similar manner as SPY, although their recent volumes have been lower as there is a bit of caution in the air around the tech-heavy index.

Their recent declines have caused there to be less one year support levels than at our last check in, which will make it all the more important to have an understanding of how they’ve behaved at each price level previously.

Below is a list of their support & resistance levels from a one year chart, and their volume sentiment at each price level they’ve traded at over the past ~2 years.

$540 – NULL – 0:0*, +5.63% From Current Price Level

$535 – Buyers – 0.7:0*, +4.65% From Current Price Level

$530 – Sellers – 0.6:0*, +3.67% From Current Price Level

$525 – Buyers – 2.86:1, +2.69% From Current Price Level

$520 – Sellers – 1.18:1, +1.72% From Current Price Level – 10 Day Moving Average*

$515 – Sellers – 1.33:1, +0.74% From Current Price Level

$510 – Sellers – 1.38:1, -0.24% From Current Price Level – Current Price Level*

$505 – Buyers – 2.6:1, -1.22% From Current Price Level – 50 Day Moving Average*

$500 – Buyers – 3.22:1, -2.2% From Current Price Level

$496 – Buyers – 2:0*, -2.98% From Current Price Level

$492 – Buyers – 4.13:1, -3.76% From Current Price Level

$488 – Buyers – 1.57:1, -4.54% From Current Price Level

$484 – Buyers – 1.88:1, -5.33% From Current Price Level

$480 – Buyers – 1.24:1, -6.11% From Current Price Level

$476 – Sellers – 1.52:1, -6.89% From Current Price Level

$472 – Buyers – 1.52:1, -7.67% From Current Price Level – 200 Day Moving Average*

$468 – Sellers – 1.23:1, -8.46% From Current Price Level

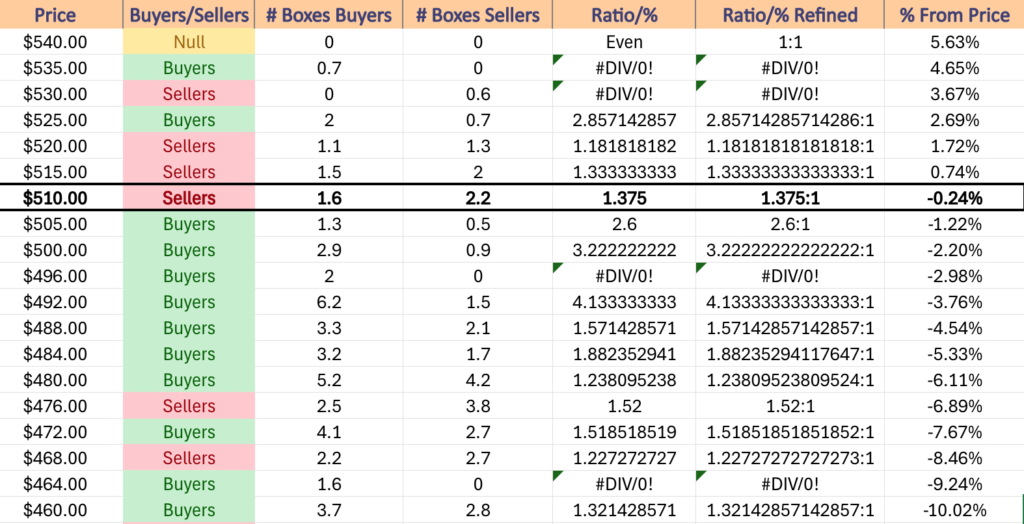

$464 – Buyers – 1.6:0*, -9.24% From Current Price Level

$460 – Buyers – 1.32:1, -10.02% From Current Price Level

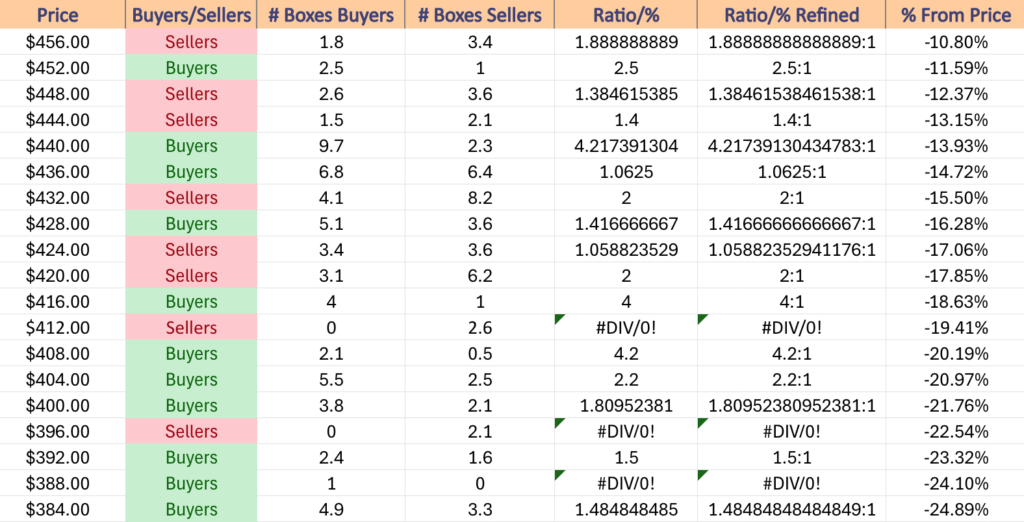

$456 – Sellers – 1.89:1, -10.8% From Current Price Level

$452 – Buyers – 2.5:1, -11.59% From Current Price Level

$448 – Sellers – 1.39:1, -12.37% From Current Price Level

$444 – Sellers – 1.4:1, -13.15% From Current Price Level

$440 – Buyers – 4.22:1, -13.93% From Current Price Level

$436 – Buyers – 1.06:1, -14.72% From Current Price Level

$432 – Sellers – 2:1, -15.5% From Current Price Level

$428 – Buyers – 1.42:1, -16.28% From Current Price Level

$424 – Sellers – 1.06:1, -17.06% From Current Price Level

$420 – Sellers – 2:1, -17.85% From Current Price Level

$416 – Buyers – 4:1, -18.63% From Current Price Level

$412 – Sellers – 2.6:0*, -19.41% From Current Price Level

$408 – Buyers – 4.2:1, -20.19% From Current Price Level

$404 – Buyers – 2.2:1, -20.97% From Current Price Level

$400 – Buyers – 1.81:1, -21.76% From Current Price Level

$396 – Sellers – 2.1:0*, -22.54% From Current Price Level

$392 – Buyers – 1.5:1, -23.32% From Current Price Level

$388 – Buyers – 1:0*, -24.1% From Current Price Level

$384 – Buyers – 1.49:1, -24.89% From Current Price Level

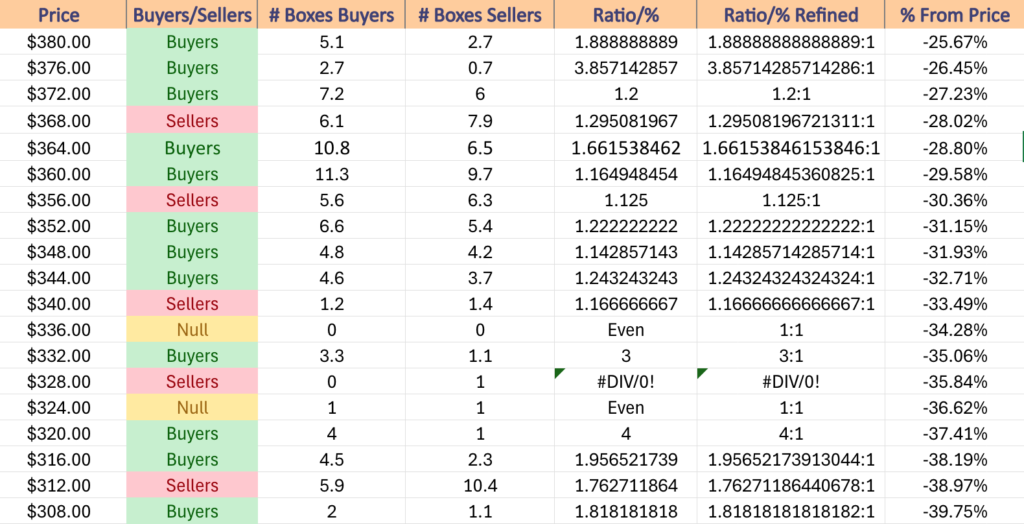

$380 – Buyers – 1.89:1, -25.67% From Current Price Level

$376 – Buyers – 3.86:1, -26.45% From Current Price Level

$372 – Buyers – 1.2:1, -27.23% From Current Price Level

$368 – Sellers – 1.3:1, -28.02% From Current Price Level

$364 – Buyers – 1.66:1, -28.8% From Current Price Level

$360 – Buyer s- 1.17:1, -29.58% From Current Price Level

$356 – Sellers – 1.13:1, -30.36% From Current Price Level

$352 – Buyers – 1.22:1, -31.15% From Current Price Level

$348 – Buyers – 1.14:1, -31.93% From Current Price Level

$344 – Buyers – 1.24:1, -32.71% From Current Price Level

$340 – Sellers – 1.17:1, -33.49% From Current Price Level

$336 – NULL – 0:0*, -34.28% From Current Price Level

$332 – Buyers – 3:1, -35.06% From Current Price Level

$328 – Sellers – 1:0*, -35.84% From Current Price Level

$324 – Even – 1:1, -36.62% From Current Price Level

$320 – Buyers – 4:1, -37.41% From Current Price Level

$316 – Buyers – 1.96:1, -38.19% From Current Price Level

$312 – Sellers – 1.76:1, -38.97% From Current Price Level

$308 – Buyers – 1.82:1, -39.75% From Current Price Level

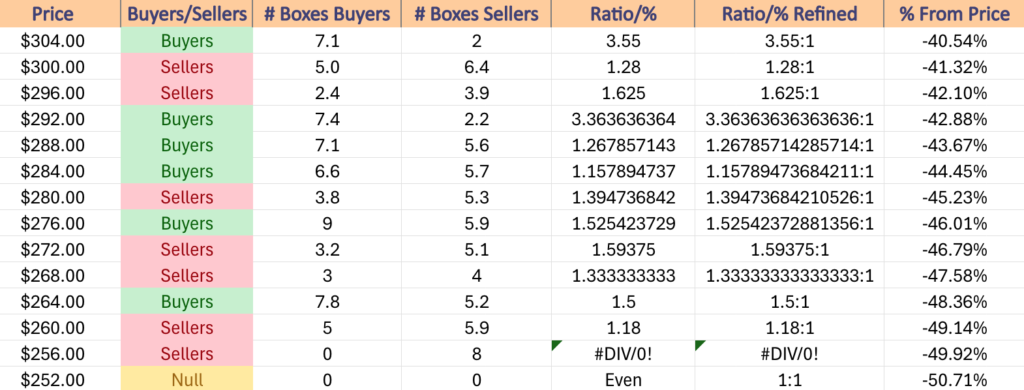

$304 – Buyers – 3.55:1, -40.54% From Current Price Level

$300 – Sellers – 1.28:1, -41.32% From Current Price Level

$296 – Sellers – 1.63:1, -42.1% From Current Price Level

$292 – Buyers – 3.36:1, -42.88% From Current Price Level

$288 – Buyers – 1.27:1, -43.67% From Current Price Level

$284 – Buyers – 1.16:1, -44.45% From Current Price Level

$280 – Sellers – 1.4:1, -45.23% From Current Price Level

$276 – Buyers – 1.53:1, -46.01% From Current Price Level

$272 – Sellers – 1.59:1, -46.79% From Current Price Level

$268 – Sellers – 1.33:1, -47.58% From Current Price Level

$264 – Buyers – 1.5:1, -48.36% From Current Price Level

$260 – Sellers – 1.18:1, -49.14% From Current Price Level

$256 – Sellers – 8:0*, -49.92% From Current Price Level

$252 – NULL – 0:0*, -50.71% From Current Price Level

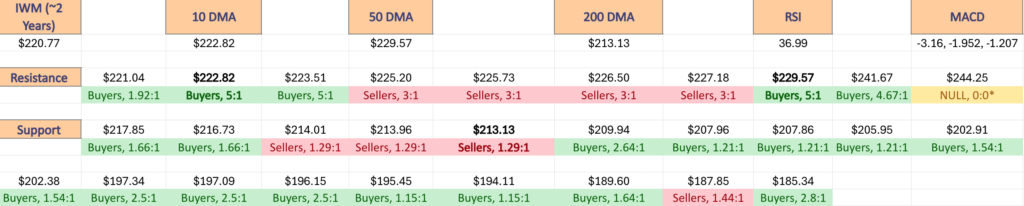

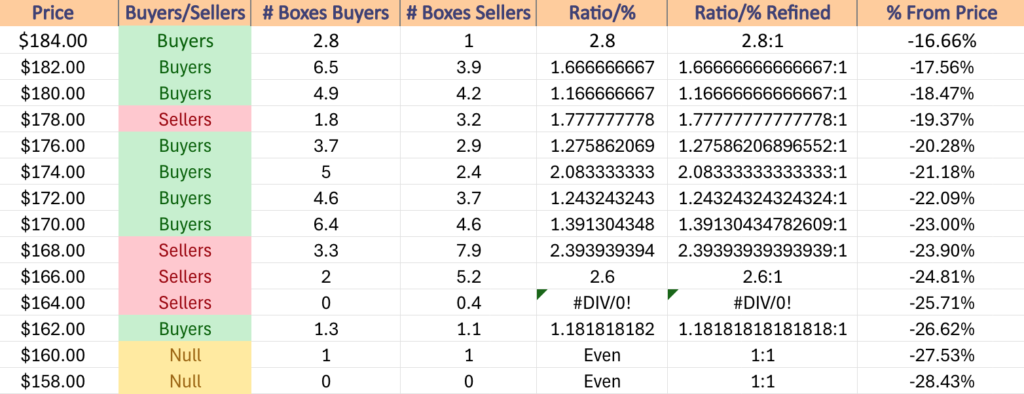

Price Level:Volume Sentiment Analysis For IWM, The iShares Russell 2000 ETF

IWM, the iShares Russell 2000 ETF has seen steeper declines than SPY or QQQ since November, but has traded at more consistent volumes compared to a year ago than the former two index ETFs.

The small cap index’s 10 day moving average recently crossed bearishly through their 50 day moving average & prices have consolidated 3.67% above their 200 DMA’s support level.

Given their price’s proximity to the long-term trend line, the information below is important to know in the event of a retest of their support levels.

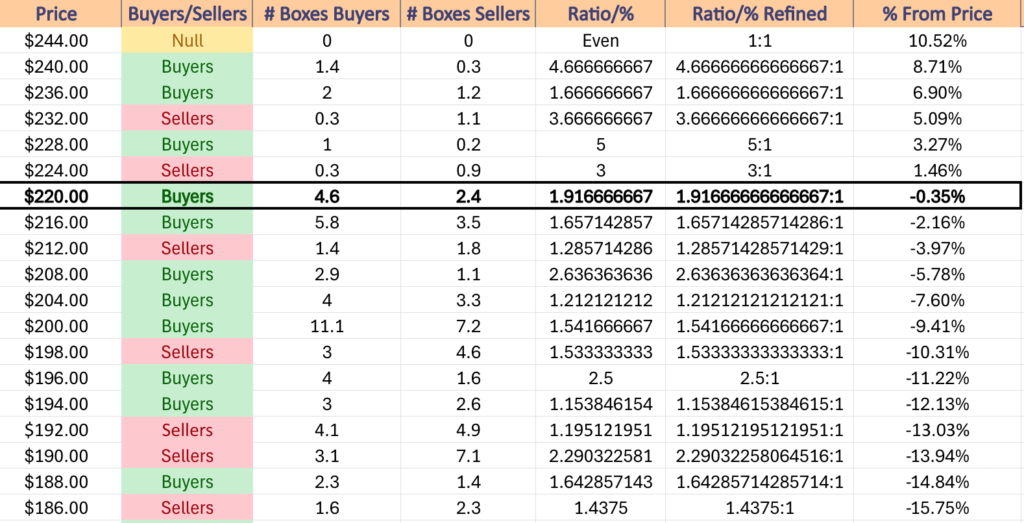

$244 – NULL – 0:0*, +10.52% From Current Price Level

$240 – Buyers – 4.67:1, +8.71% From Current Price Level

$236 – Buyers – 1.67:1, +6.9% From Current Price Level

$232 – Sellers – 3.67:1, +5.09% From Current Price Level

$228 – Buyers – 5:1, +3.27% From Current Price Level – 50 Day Moving Average*

$224 – Sellers – 3:1, +1.46% From Current Price Level

$220 – Buyers – 1.92:1, -0.35% From Current Price Level – Current Price Level, 10 Day Moving Average**

$216 – Buyers – 1.66:1, -2.16% From Current Price Level

$212 – Sellers – 1.29:1, -3.97% From Current Price Level – 200 Day Moving Average *

$208 – Buyers – 2.64:1, -5.78% From Current Price Level

$204 – Buyers – 1.21:1, -7.6% From Current Price Level

$200 – Buyers – 1.54:1, -9.41% From Current Price Level

$198 – Sellers – 1.53:1, -10.31% From Current Price Level

$196 – Buyers – 2.5:1, -11.22% From Current Price Level

$194 – Buyers – 1.15:1, -12.13% From Current Price Level

$192 – Sellers – 1.2:1, -13.03% From Current Price Level

$190 – Sellers – 2.29:1, -13.94% From Current Price Level

$188 – Buyers – 1.64:1, -14.84% From Current Price Level

$186 – Sellers – 1.44:1, -15.75% From Current Price Level

$184 – Buyers – 2.8:1, -16.66% From Current Price Level

$182 – Buyers – 1.67:1, -17.56% From Current Price Level

$180 – Buyers – 1.17:1, -18.47% From Current Price Level

$178 – Sellers – 1.78:1, -19.37% From Current Price Level

$176 – Buyers – 1.28:1, -20.28% From Current Price Level

$174 – Buyers – 2.08:1, -21.18% From Current Price Level

$172 – Buyers – 1.24:1, -22.09% From Current Price Level

$170 – Buyers – 1.39:1, -23% From Current Price Level

$168 – Sellers – 2.39:1, -23.9% From Current Price Level

$166 – Sellers – 2.6:1, -24.81% From Current Price Level

$164 – Sellers – 0.4:0*, -25.71% From Current Price Level

$162 – Buyers – 1.18:1, -26.62% From Current Price Level

$160 – Even – 1:1, -27.53% From Current Price Level

$158 – NULL – 0:0*, -28.43% From Current Price Level

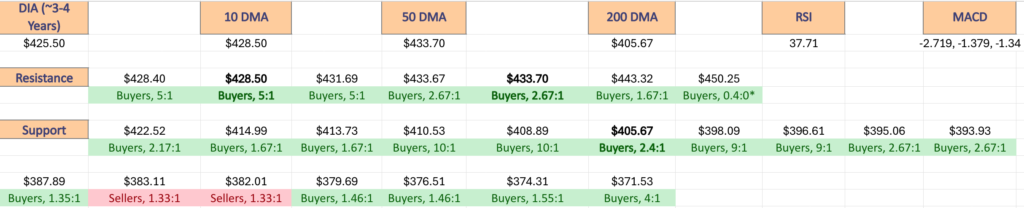

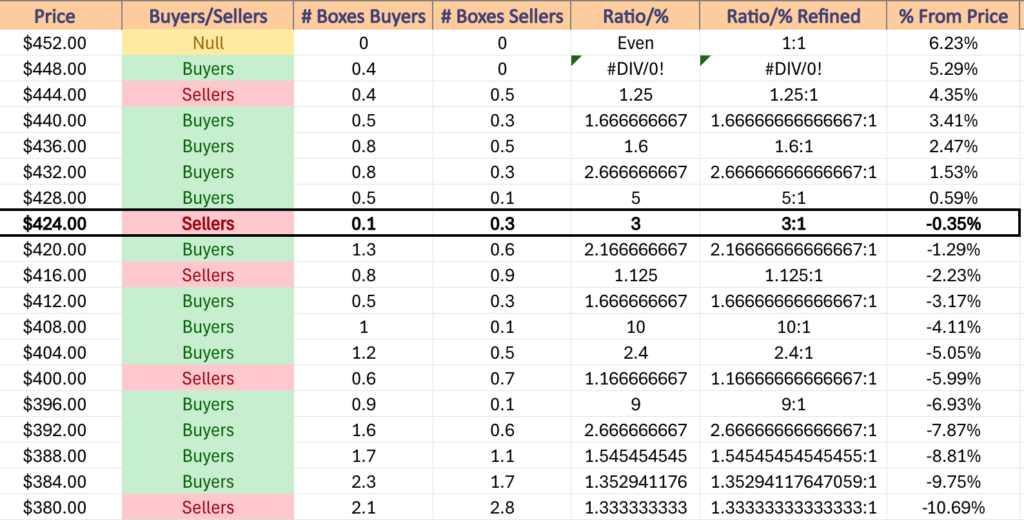

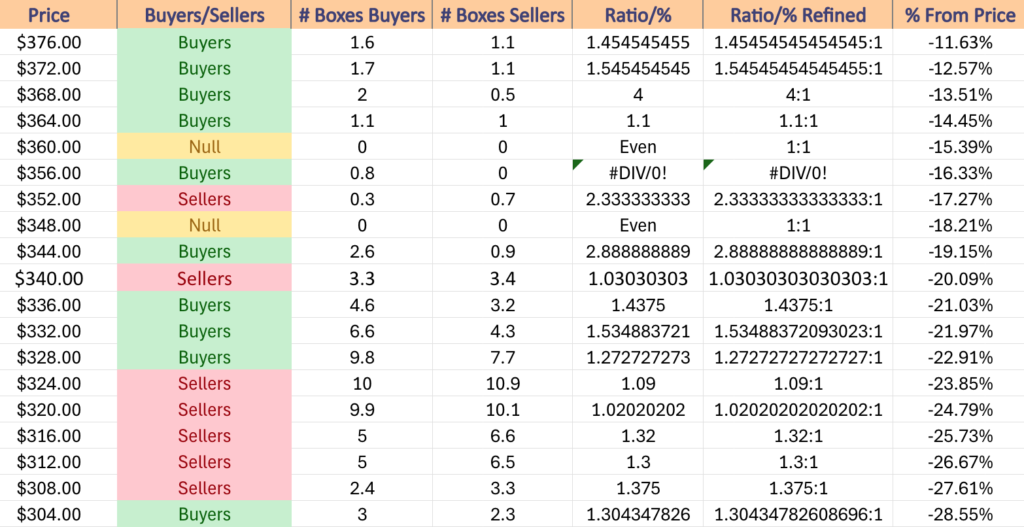

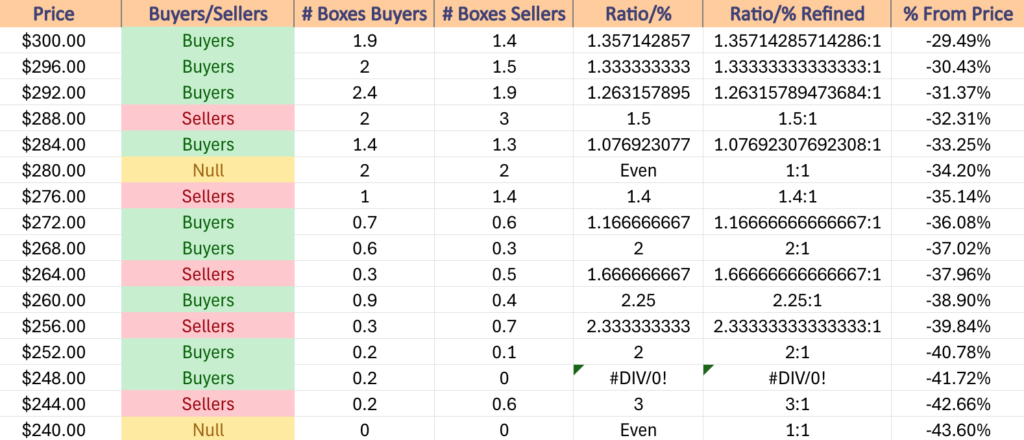

Price Level:Volume Sentiment Analysis For DIA, The SPDR Dow Jones Industrial Average ETF

DIA, the SPDR Dow Jones Industrial Average ETF has continued to trade like IWM, as the blue chip index & small cap index have shared similar trading characteristics over the past year.

This may not continue as volatility heats up due to the differences between the components of each index, making the tables below important for assessing the strength of support levels in the near-term.

$452 – NULL – 0:0*, +6.23% From Current Price Level

$448 – Buyers – 0.4:0*, +5.29% From Current Price Level

$444 – Sellers – 1.25:1, +4.35% From Current Price Level

$440 – Buyers – 1.67:1, +3.41% From Current Price Level

$436 – Buyers – 1.6:1, +2.47% From Current Price Level

$432 – Buyers – 2.67:1, +1.53% From Current Price Level – 50 Day Moving Average*

$428 – Buyers – 5:1, +0.59% From Current Price Level – 10 Day Moving Average*

$424 – Sellers – 3:1, -0.35% From Current Price Level – Current Price Level*

$420 – Buyers – 2.17:1, -1.29% From Current Price Level

$416 – Sellers – 1.13:1, -2.23% From Current Price Level

$412 – Buyers – 1.67:1, -3.17% From Current Price Level

$408 – Buyers – 10:1, -4.11% From Current Price Level

$404 – Buyers – 2.4:1, -5.05% From Current Price Level – 200 Day Moving Average*

$400 – Seller s- 1.17:1, -5.99% From Current Price Level

$396 – Buyers – 9:1, -6.93% From Current Price Level

$392 – Buyers – 2.67:1, -7.87% From Current Price Level

$388 – Buyers – 1.55:1, -8.81% From Current Price Level

$384 – Buyers – 1.36:1, -9.75% From Current Price Level

$380 – Sellers – 1.33:1, -10.69% From Current Price Level

$376 – Buyers – 1.46:1, -11.63% From Current Price Level

$372 – Buyers – 1.55:1, -12.57% From Current Price Level

$368 – Buyers – 4:1, -13.51% From Current Price Level

$364 – Buyers – 1.1:1, -14.45% From Current Price Level

$360 – NULL – 0:0*, -15.39% From Current Price Level

$356 – Buyers – 0.8:0*, -16.33% From Current Price Level

$352 – Sellers – 2.33:1, -17.27% From Current Price Level

$348 – NULL – 0:0*, -18.21% From Current Price Level

$344 – Buyers – 2.89:1, -19.15% From Current Price Level

$340 – Sellers – 1.03:1, -20.09% From Current Price Level

$336 – Buyers – 1.44:1, -21.03% From Current Price Level

$332 – Buyers – 1.54:1, -21.97% From Current Price Level

$328 – Buyers – 1.27:1, -22.91% From Current Price Level

$324 – Sellers – 1.09:1, -23.85% From Current Price Level

$320 – Sellers – 1.02:1, -24.79% From Current Price Level

$316 – Sellers – 1.32:1, -25.73% From Current Price Level

$312 – Sellers – 1.3:1, -26.67% From Current Price Level

$308 – Sellers – 1.38:1, -27.61% From Current Price Level

$304 – Buyers – 1.3:1, -28.55% From Current Price Level

$300 – Buyers – 1.36:1, -29.49% From Current Price Level

$296 – Buyers – 1.33:1, -30.43% From Current Price Level

$292 – Buyers – 1.26:1. -31.37% From Current Price Level

$288 – Sellers – 1.5:1, -32.31% From Current Price Level

$284 – Buyers – 1.08:1, -33.25% From Current Price Level

$280 – Even – 1:1, -34.2% From Current Price Level

$276 – Sellers – 1.4:1, -35.14% From Current Price Level

$272 – Buyers – 1.17:1, -36.08% From Current Price Level

$268 – Buyers – 2:1, -37.02% From Current Price Level

$264 – Sellers – 1.67:1, -37.96% From Current Price Level

$260 – Buyers – 2.25:1, -38.9% From Current Price Level

$256 – Sellers – 2.33:1, -39.84% From Current Price Level

$252 – Buyers – 2:1, -40.78% From Current Price Level

$248 – Buyers – 0.2:0*, -41.72% From Current Price Level

$244 – Sellers – 3:1, -42.66% From Current Price Level

$240 – NULL – 0:0*, -43.6% From Current Price Level

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***