XLI, the Industrial Select Sector SPDR Fund ETF has had a strong year, advancing +20.69% Y-o-Y, including a 22.09% gain since its 52-week low in January of 2024 & sits currently just -4.65% below its 52-week high set in November of 2024 (all figures distributions).

Some of XLI’s biggest holdings include General Electric (GE), Caterpillar Inc. (CAT), RTX Corp. (RTX), Honeywell International Inc. (HON), Uber Technologies Inc. (UBER), Union Pacific Corp. (UNP), Eaton Corp PLC. (ETN), Boeing Co. (BA), Automatic Data Processing (ADP) & Deere + CO. (DE).

Industrials had a difficult December, but were able to bounce back temporarily during January, but have not found stable footing to continue their advance.

Monday’s gap down session also did not help the floundering sector ETF & it will be interesting to see what happens to XLI as earnings season continues.

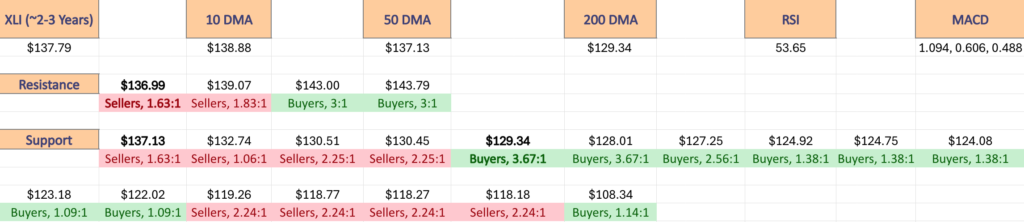

Below is a brief technical analysis of XLI, as well as a price level:volume sentiment analysis of the price levels XLI has traded at over the ~2-3 years.

Included in this data is also their recent support & resistance levels so that readers can gain insight into how strong/weak these support/resistance levels may be in the future, based on past investor behavior.

It is not intended to serve as financial advice, but rather as an additional tool to reference while performing your own due diligence on XLI.

XLI, The Industrial Select Sector SPDR ETF’s Technical Performance Broken Down

Their RSI is trending back towards neutral & currently sits at 53.65, while their MACD is bullish, but has curled over heading bearishly towards the signal line & their histogram is signaling weakness after Monday’s gap down session.

Volumes over the past week & a half have been +4.55% above the prior year’s average level (8,872,857.14 vs. 8,486,944.44), which is a slight cause for concern given that most of those sessions have shown declines.

Last Tuesday opened up the short holiday week on a gap up session following the previous Friday’s doji close.

Tuesday’s advance also came on the highest volume that XLI has seen so far in 2025.

Wednesday there was some profit taking after XLI opened on a gap up but wound up closing the session lower, before Thursday saw another advance.

Both Wednesday & Thursday were on light volumes, indicating that there was some hesitancy among market participants & signaling that there was a high likelihood that the window created by Tuesday’s session was likely to be closed soon.

Friday confirmed this, when XLI opened slightly below Thursday’s close & continued down to close below Thursday’s opening price & showed a lower shadow that indicated that there was more downside appetite.

Monday the fireworks started as the session opened on a gap down with the second highest volume of 2025 to date & the day resulted in a spinning top.

While the session managed to close higher than it opened, there was still a lot of uncertainty & negative sentiment given that the day’s candle was a spinning top & the declining volume was so high.

This theme continued on Tuesday when XLI opened higher, but began to decline & tested & broke through the support of the 10 day moving average, but managed to close relatively in-line with it on volumes that eclipsed most of the previous week’s.

Tuesday’s candle formed a bearish engulfing pattern with Monday’s & signaled that there is further weakness on the horizon for XLI.

This was confirmed Wednesday, when sellers came out in larger numbers than the previous day to test the 10 DMA’s resistance, get rejected & continue lower for a decline of -0.34%.

XLI’s price is now between the 10 & 50 day moving averages where it is likely to stay for the coming days in a consolidation range unless there is news on the earnings or economic data front that force a breakout in either direction.

Any upside movement will require a significant increase in volume to remain sustainable in the wake of the recent sell-off of XLI.

It is also important to note that once prices break down below the $137.13 support level there is no support for another -3.12% & the entire walk down is through price zones that over the past ~2-3 years have been dominated by Sellers.

It is also worth noting that the 10 DMA’s resistance is in a historically Seller dominated zone as well, which will make it more difficult to break out from.

The following section lays out XLI’s one year support/resistance levels, as well as their Buyer:Seller (Seller:Buyer) ratios at each price level that they’ve traded at over the past ~2-3 years, which can be used as a barometer for estimating the expected strength/weakness of each of the support/resistance levels.

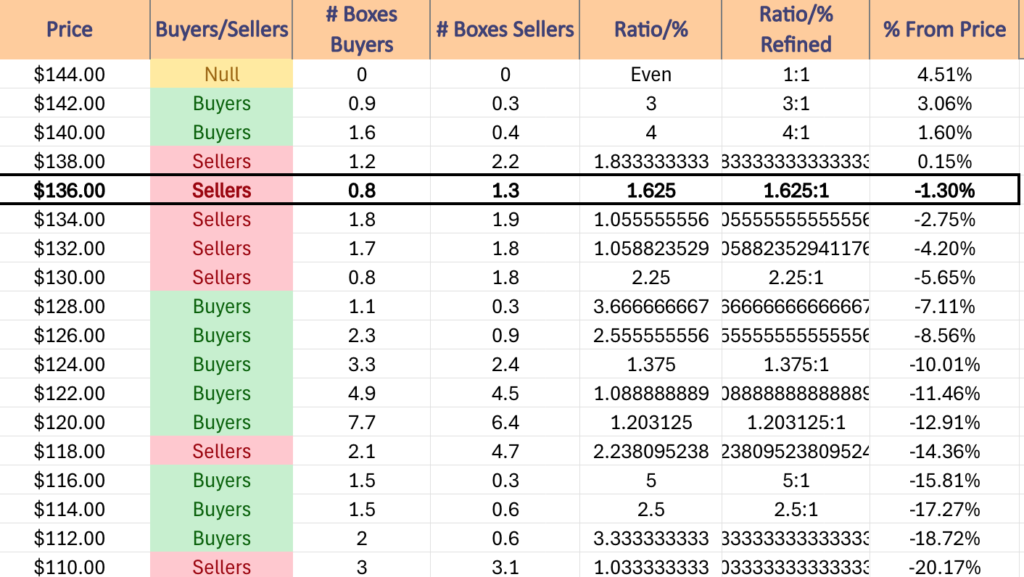

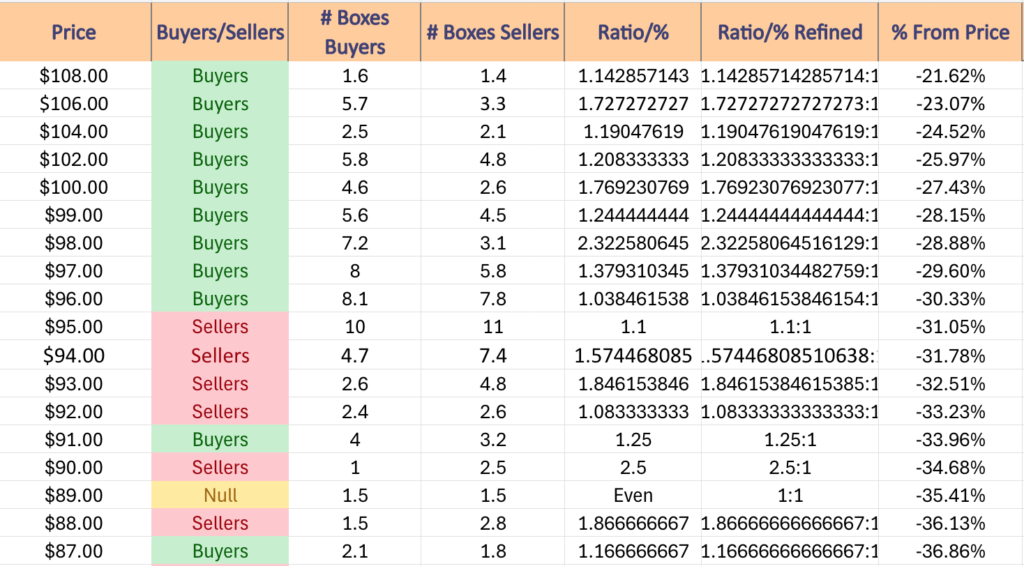

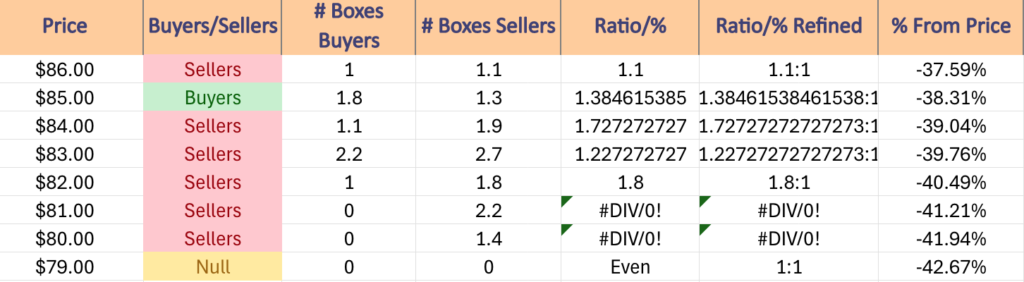

Price Level:Volume Sentiment For XLI, The Industrials Select Sector SPDR ETF

The top table below shows the support & resistance levels of XLI from the past year’s chart, as well as their price level:volume sentiment at each from data covering the past ~2-3 years, using Wednesday 1/29/2025’s closing data for their price & moving averages/other technicals.

The moving averages are denoted with bold.

The next charts show the volume sentiment at each individual price level XLI has traded at over the past ~2-3 years.

Beneath them is a copy & pasteable list of the same data, where the support/resistance levels are denoted in bold.

All ratios with “0” in the denominator are denoted with a “*”.

NULL values are price levels that had limited trading volume, whether it be due to gaps, quick advances or they are at price extremes; in the event that they are retested & there is more data they would have a distinct “Buyers”, “Sellers” or “Even” title.

This is not intended as financial advice, but rather another tool to consider when performing your own research & due diligence on XLI.

$144 – NULL – 0:0*, +4.51% From Current Price Level

$142 – Buyers – 3:1, +3.06% From Current Price Level

$140 – Buyers – 4:1, +1.6% From Current Price Level

$138 – Sellers – 1.83:1, +0.15% From Current Price Level – 10 Day Moving Average*

$136 – Sellers -1.63:1, -1.3% From Current Price Level – Current Price Level & 50 Day Moving Average**

$134 – Sellers – 1.06:1, -2.75% From Current Price Level

$132 – Sellers – 1.06:1, -4.2% From Current Price Level

$130 – Sellers – 2.25:1, -5.65% From Current Price Level

$128 – Buyers – 3.67:1, -7.11% From Current Price Level – 200 Day Moving Average*

$126 – Buyers – 2.56:1, -8.56% From Current Price Level

$124 – Buyers – 1.38:1, -10.01% From Current Price Level

$122 – Buyers – 1.09:1, -11.46% From Current Price Level

$120 – Buyers – 1.2:1, -12.91% From Current Price Level

$118 – Sellers – 2.24:1, -14.36% From Current Price Level

$116 – Buyers – 5:1, -15.81% From Current Price Level

$114 – Buyers – 2.5:1, -17.27% From Current Price Level

$112 – Buyers – 3.33:1, -18.72% From Current Price Level

$110 – Sellers – 1.03:1, -20.17% From Current Price Level

$108 – Buyers – 1.14:1, -21.62% From Current Price Level

$106 – Buyers – 1.73:1, -23.07% From Current Price Level

$104 – Buyers – 1.19:1, -24.52% From Current Price Level

$102 – Buyers – 1.21:1, -25.97% From Current Price Level

$100 – Buyers – 1.77:1, -27.43% From Current Price Level

$99 – Buyers – 1.24:1, -28.15% From Current Price Level

$98 – Buyers – 2.32:1, -28.88% From Current Price Level

$97 – Buyers – 1.38:1, -29.6% From Current Price Level

$96 – Buyers – 1.04:1, -30.33% From Current Price Level

$95 – Sellers – 1.1:1, -31.05% From Current Price Level

$94 – Sellers – 1.57:1, -31.78% From Current Price Level

$93 – Sellers – 1.85:1, -32.51% From Current Price Level

$92 – Sellers – 1.08:1, -33.23% From Current Price Level

$91 – Buyers – 1.25:1, -33.96% From Current Price Level

$90 – Sellers – 2.5:1, -34.68% From Current Price Level

$89 – Even – 1:1, -35.41% From Current Price Level

$88 – Sellers – 1.87:1, -36.13% From Current Price Level

$87 – Buyers – 1.17:1, -36.86% From Current Price Level

$86 – Sellers – 1.1:1, -37.59% From Current Price Level

$85 – Buyers – 1.39:1, -38.31% From Current Price Level

$84 – Sellers – 1.73:1, -39.04% From Current Price Level

$83 – Sellers – 1.23:1, -39.76% From Current Price Level

$82 – Sellers – 1.8:1, -40.49% From Current Price Level

$81 – Sellers – 2.2:0*, -41.21% From Current Price Level

$80 – Sellers – 1.4:0*, -41.94% From Current Price Level

$79 – NULL – 0:0*, -42.67% From Current Price Level

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN XLI AT THE TIME OF PUBLISHING THIS ARTICLE ***