Regeneron Pharmaceuticals, Inc. stock trades under the ticker REGN & has recently shown some bullish signals that traders & investors should take a closer look into.

REGN stock closed at $624.92/share on 1/28/2022, trading on slightly above average volume.

Regeneron Pharmaceuticals, Inc. REGN Stock’s Technicals Broken Down

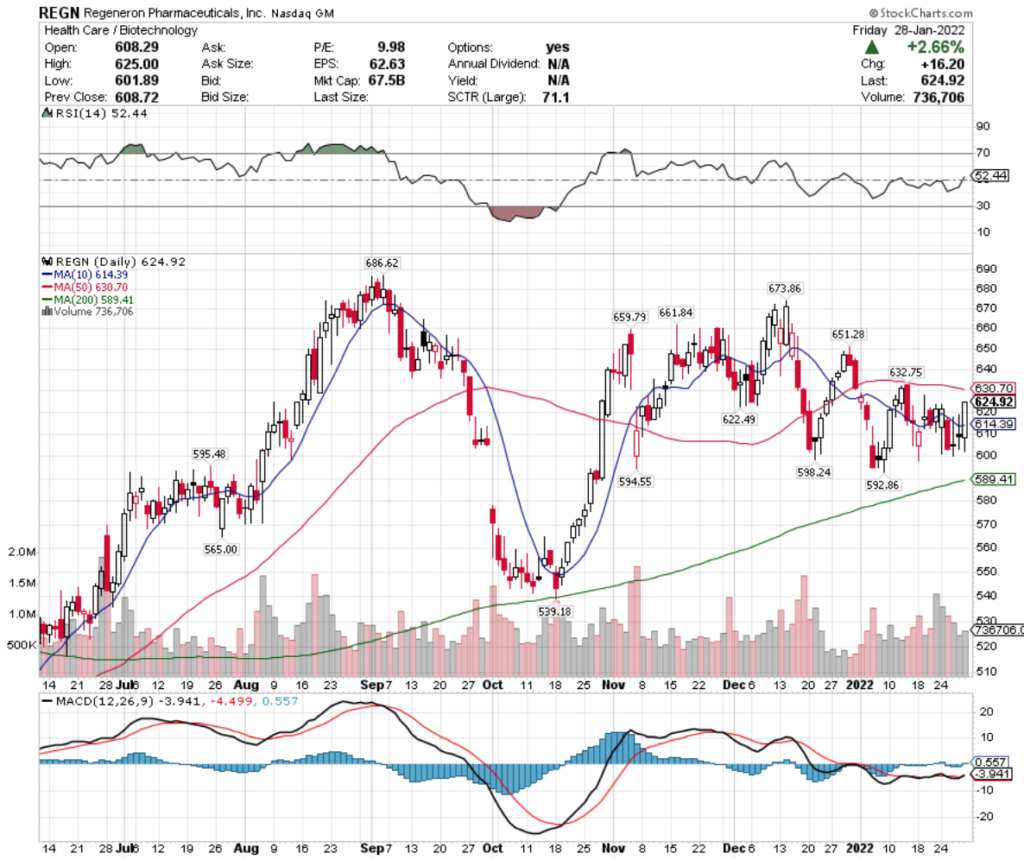

REGN Stock Price: $624.92

10 Day Moving Average: $614.39

50 Day Moving Average: $630.70

200 Day Moving Average: $589.41

RSI: 52.44

MACD: -3.941

REGN stock completed a bullish MACD crossover yesterday, while also breaking out above its 10 Day Moving Average.

Despite the broader market indexes falling in January 2022, their price has remained relatively flat in the $592.86-$632.75 price range.

They will need to break out above the $633-price level to go on to test the $651.28-level.

Regeneron Pharmaceuticals, Inc. REGN Stock As A Long-Term Investment

Investors may find REGN stock’s P/E (ttm) appealing at 9.7, however their P/B (mrq) is a bit rich at 3.77.

REGN experienced 50.5% Quarterly Revenue Growth Y-o-Y, with 93.8% Quarterly Earnings Growth Y-o-Y.

REGN stock’s balance sheet looks appealing, with Total Cash (mrq) of $5.79B & Total Debt (mrq) of $2.7B.

Their Beta is very low at 0.17, signaling that they move in a much less volatile manner than the broader market indexes.

Despite not offering a dividend yield, 87.6% of REGN stock’s total share float is held by institutional investors.

Regeneron Pharmaceuticals, Inc. REGN Stock As A Short-Term Trade Using Options

Traders can use REGN options in order to capitalize on their momentum, as well as ward off broader market volatility.

I am looking at the contracts with the 2/18 expiration date.

The $620 & $625 call options both look interesting, although lacking in liquidity.

The $630 & $640 puts also look appealing, but have the same low levels of open interest.

Tying It All Together

REGN stock has many interesting characteristics for both long-term focused investors & short-term oriented traders.

Investors will like their balance sheet & valuation, although may be disappointed that they do not pay a dividend.

Traders will like their near-term bullish momentum, however the lack of liquidity in their options may be a cause of concern to some.

REGN stock is worth taking a closer look at, regardless of your trading style.

*** I DO NOT OWN SHARES OF REGN STOCK ***