Robinhood traders have become an interesting group of market participants, often making headlines as a collective after the COVID lockdowns.

This weekend I took a look at the names that made up their 100 Most Popular Stocks & ETFs list to get an idea of the types of names that they’re trading.

While the name infers that there will be 100 securities, there are only 98, as my Fidelity data screener does not cover two of the names, which was odd as usually it goes the other way around.

Breaking Down What Securities Robinhood Traders Prefer To Own

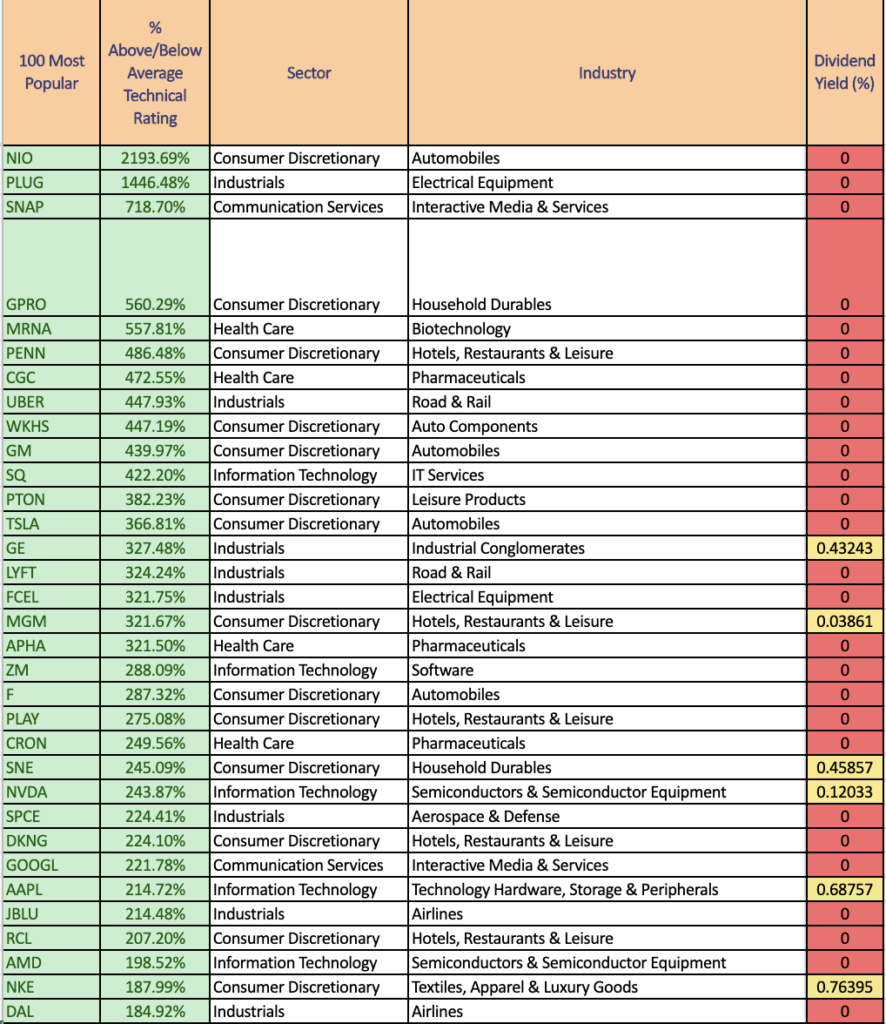

Most of the companies that you see listed in the Top 100 list are household names. UBER, F, JPM & KO are all on the list, along with some lesser known names such as WKHS, NIO & NKLA.

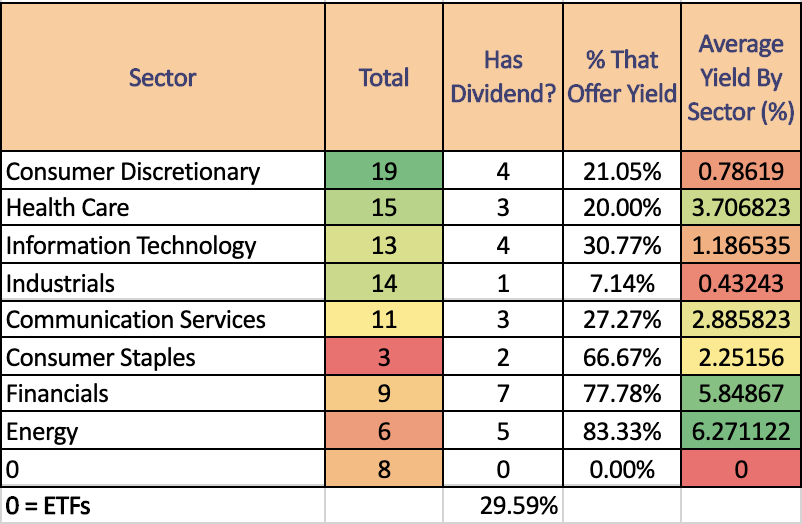

8 Sectors & 34 Industries are included in this list, along with ETFs.

Only 29% of all securities held offer a dividend yield, and using our Technical Rating Formula, 56 securities are above average for their technical performance rating, with 42 securities falling below the average technical rating.

ETFs are included in the list as well, but are being counted as their own unique sector & industry as there is diversity within each ETF on the list, which will be published in order of technical performance later in the article.

Examining The Robinhood Top 100 Owned Securities List By Sector

By sector, the names favor Consumer Discretionary stocks, such as PTON, TSLA & DKNG, with less emphasis going to Consumer Staples stocks, such as BYND, KO & WMT.

Healthcare (APHA, PFE & SRNE) & Information Technology (MSFT, WORK & ZM) are the second & third most popular sectors, while Energy (HAL, KOS & XOM) & Financials (WFC, IVR & BRK/B) are the second & third least owned sectors (not including ETFs, 0 in the chart above).

This makes sense, given that most retail investors are looking for products & names that they either use, or have an interest in, and or that they hear about often in the news (especially when the headlines are beneficial).

As to be expected, Energy sector stocks have the highest average Dividend Yield, followed by Financials & then Healthcare, with ETFs not offering a dividend, and the bottom three yielding sectors being Industrials, Consumer Discretionary & Information Technology.

From a Technical Rating standpoint, Consumer Discretionary has the highest average (which may be impacted by largest sample size), followed by Industrials & Information Technology.

The worst performing sectors from a technical perspective were Energy, Financials & Consumer Staples, with ETFs having the second worst performance.

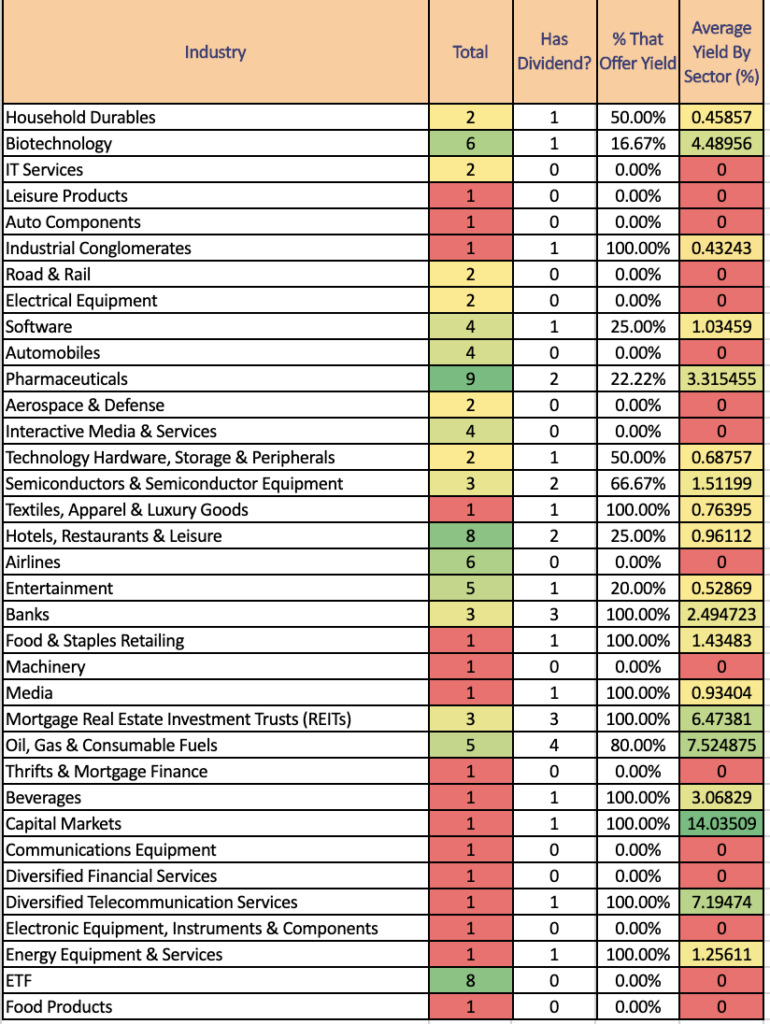

Breaking Down The Top 100 Robinhood Stocks By Industry

A really interesting point when we get down into the Industries that these securities are in, is that Pharmaceuticals is the top owned Industry (somewhat expected), trailed by Hotels, Restaurants & Leisure, ETFs & Biotechnology & Airlines.

This somewhat surprised me, as more countries are announcing more COVID measures, so I’m guessing that that trend will be shifting in the not-to-distant future.

The highest yielding industry is Capital Markets, followed by Oil, Gas & Consumable Fuels, & Diversified Telecommunication Services.

From a Technical Rating perspective, Electrical Equipment is the highest rated Industry, followed by Automobiles & Auto Components, while the worst faring Industries are Machinery, Food Products, ETFs & Entertainment.

Who Are The Best Technical Performers Of The Robinhood Top 100 List?

Now, onto what everyone was waiting for, the good stuff.

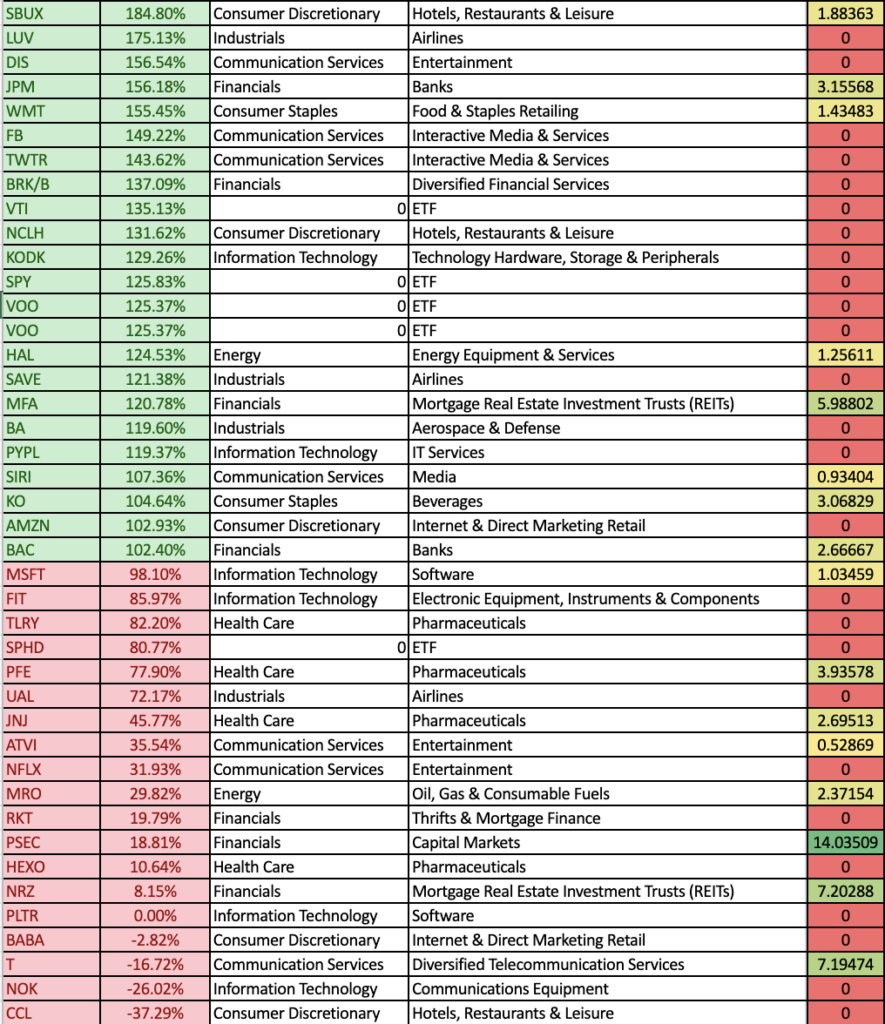

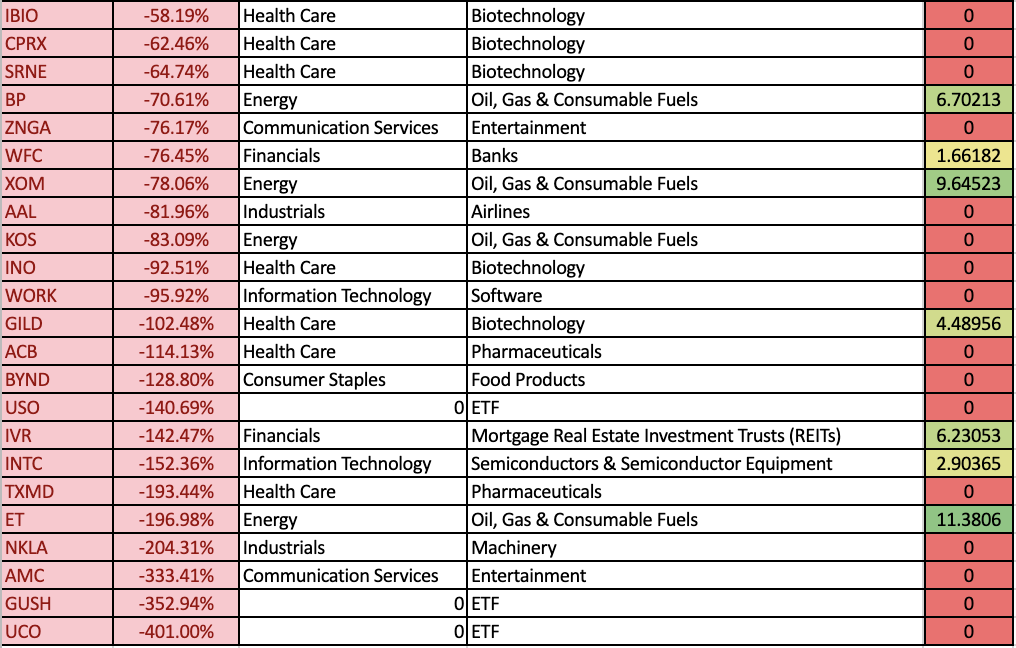

I have ranked the stocks that were in the Robinhood Top 100 Most Owned list below (barring the two that Fidelity did not have data for, so 98 total names), along with how far above or below average their Technical Rating was (not going to give away all the good stuff 😉 ).

The Top 10 of the list are NIO, PLUG, SNAP, GPRO, MRNA, PENN, CGC, UBER, WKHS & GM.

The Bottom 10 by technical performance are UCO, GUSH, AMC, NKLA, ET, TXMD, INTC, IVR, USO & BYND.

What’s most interesting about this list, is it breaks down how many people outside of the markets look at different companies, sectors & industries, as stock indexes are at all-time highs & the world still has growing concerns regarding COVID-19, the US Election results & more.

It will be interesting seeing how this list shifts in the coming weeks to months.