Terex Corp. stock trades under the ticker TEX & has shown recent bullishness that traders & investors should research further into to find an appropriate entry-point for when market volatility subsides.

TEX stock closed at $44.84/share on 4/14/2023.

Terex Corp. TEX Stock’s Technical Performance Broken Down

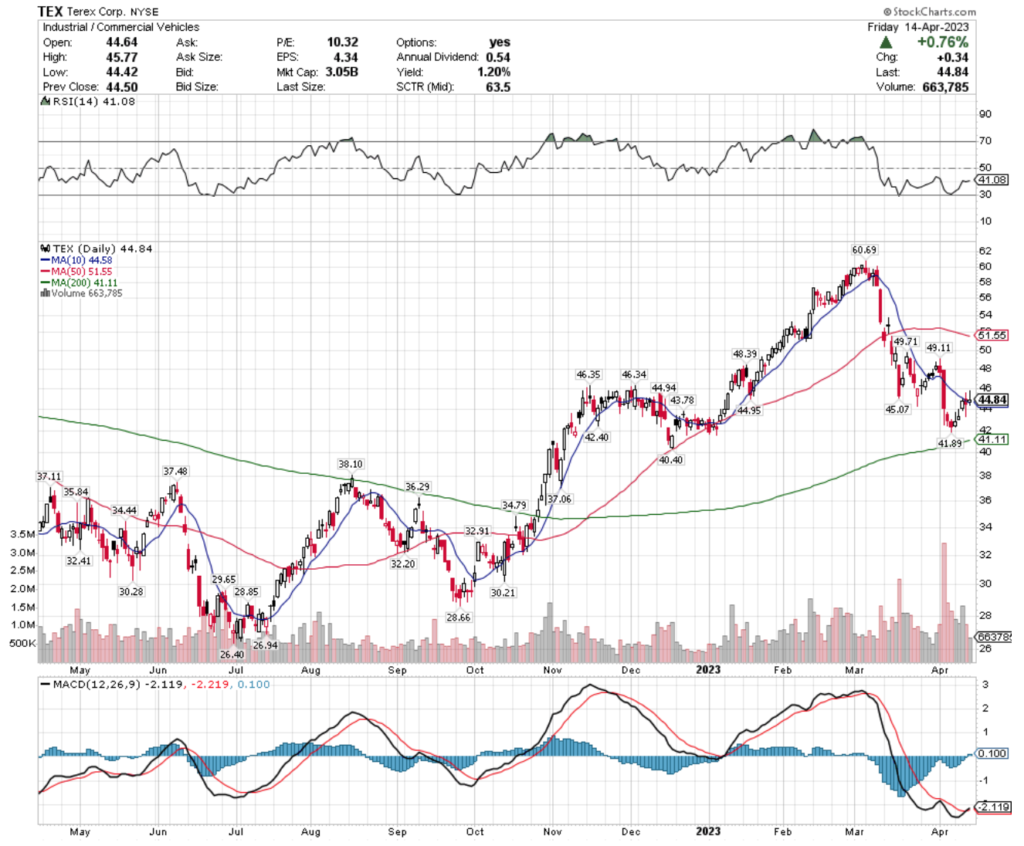

TEX Stock Price: $44.84

10 Day Moving Average: $44.58

50 Day Moving Average: $51.55

200 Day Moving Average: $41.11

RSI: 41.08

MACD: -2.119

On Friday, TEX stock completed a bullish MACD crossover, gaining +0.76% on the day’s session.

Recent trading volumes have been above average compared to the year prior & their RSI is climbing back from oversold conditions after a series of down days 2 weeks ago.

The real bodies of their most recent three candlesticks signal that there is uncertainty around TEX stock’s value currently, making it important to watch how they behave at support levels to figure out where to enter once markets become less volatile.

TEX stock has support at the $44.58 (10 day moving average), $43.78, $42.40 & $41.89/share price levels, with resistance at the $44.94, $44.95, $45.07, $46.35 & $46.34/share price levels.

Terex Corp. TEX Stock As A Long-Term Investment

Long-term oriented investors will like TEX stock’s 10.38 P/E (ttm), but may find their 2.58 P/B (mrq) to be a bit too rich.

They recently reported 23% Quarterly Revenue Growth Y-o-Y, with 56.8% Quarterly Earnings Growth Y-o-Y.

Their balance sheet may require a more thorough review, with $304.1M of Total Cash (mrq) & $864.6M of Total Debt (mrq).

TEX stock pays a modest 1.17% dividend, which appears to be sustainable in the long-run, as their payout ratio is 12.04%.

90.12% of TEX stock’s outstanding share float is owned by institutional investors.

Terex Corp. TEX Stock As A Short-Term Trade Using Options

Traders with shorter time horizons can trade options to profit from TEX stock’s price movements, while protecting their portfolios from volatility.

I am looking at the contracts with the 5/19 expiration date.

The $42, $41 & $43 call options are all in-the-money, listed from highest to lowest level of open interest.

The $45, $47 & $48 puts are also in-the-money, with the former being more liquid than the latter strikes.

Tying It All Together

TEX stock has many interesting attributes that traders & investors will find appealing once markets become less volatile.

Investors will like their sustainable dividend & recent growth metrics.

Traders will like their recent technical performance.

Overall, it is worth taking a closer look into TEX stock to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACTS POSITIONS IN TEX STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***