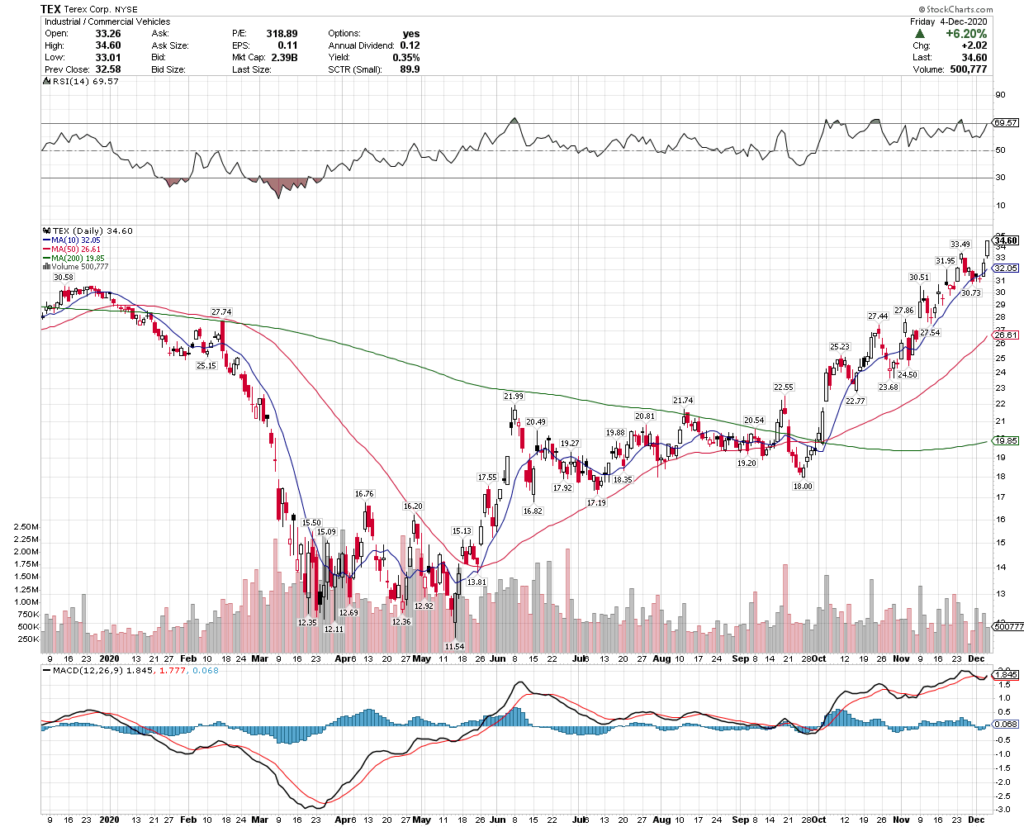

Terex Corporation stock trades under the ticker TEX & closed at $34.60 on 12/4/2020.

TEX stock has shown technical strength over the last couple of months & experienced a gap up day on 12/4 – making it worth taking a closer look at for short-term traders & investors alike.

Terex stock has options, making it easier for traders to capitalize on their short-term momentum, while also being able to hedge against any larger market declines that may impact their share price.

TEX Stock Price: $34.60

10 Day Moving-Average: $32.05

50 Day Moving-Average: $26.61

200 Day Moving-Average: $19.86

RSI: 70

While Terex’s RSI is a bit high at 70, there still looks to be room to climb for their shares.

I am looking at the $34 calls, as well as the $34 puts for a hedge, as they begin to establish a new range after their recent gap up.

Overall, TEX stock still seems to have room to run, giving traders of all different time frames an opportunity for profit.

*** I DO NOT OWN SHARES OF TEX STOCK ***