Tesla Inc. stock trades under the ticker TSLA & has shown recent bullishness that traders & investors should take a closer look into.

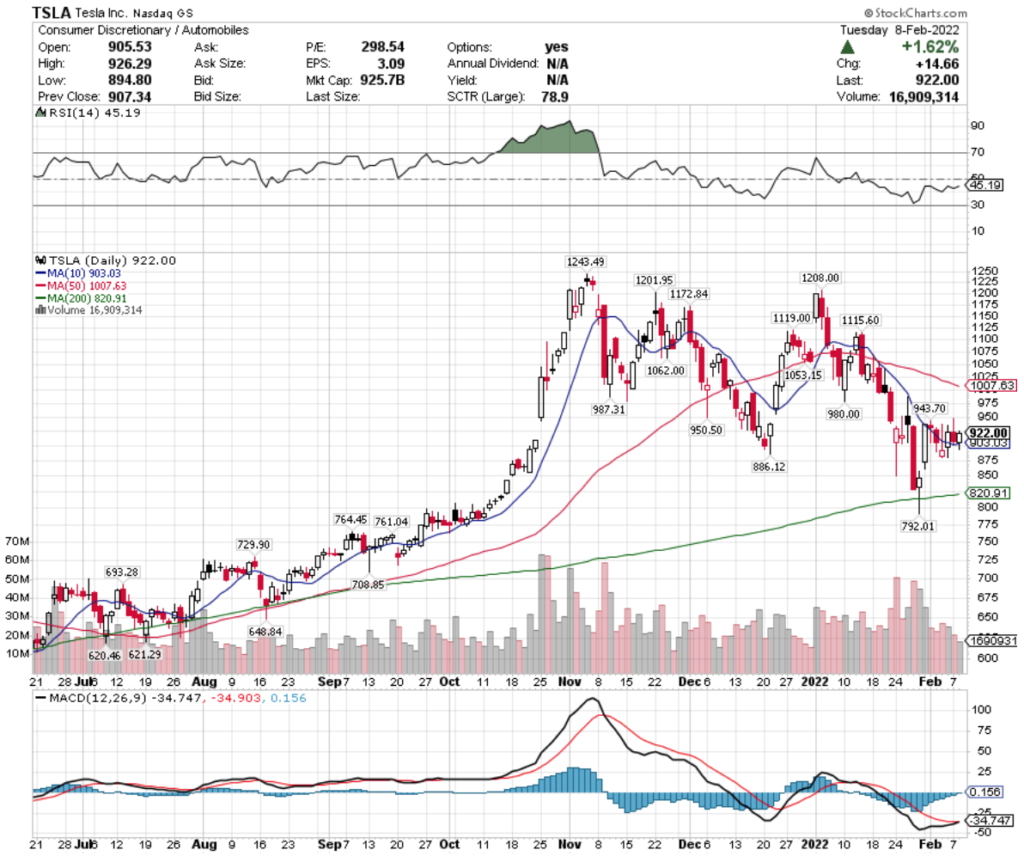

TSLA closed at $922/share on 2/8/2022.

Tesla Inc. TSLA Stock’s Technicals Broken Down

TSLA Stock Price: $922

10 Day Moving Average: $903.03

50 Day Moving Average: $1,007.63

200 Day Moving Average: $820.91

RSI: 45.19

MACD: -34.747

Yesterday, TSLA completed a bullish MACD crossover, trading on about average volume compared to the last year.

Their 10 Day Moving Average is ~12% below their 50 Day MA still, but with their RSI still below neutral, there looks to be more room for momentum in the coming days.

TSLA stock will need to break above the $947.77/share, before testing the $987/share level.

Tesla Inc. TSLA Stock As A Long-Term Investment

Investors may find TSLA stock’s valuation metrics to be too rich, with a P/E (ttm) of 294.59 & a P/B (mrq) of 34.66.

TSLA stock’s Quarterly Revenue Growth Y-o-Y is 64.9%, with 759.6% Quarterly Earnings Growth Y-o-Y.

Investors may want to look deeper into TSLA stock’s balance sheet, but will like it at first glance, with Total Cash (mrq) of $17.71B & Total Debt (mrq) of $6.83B.

They do not offer a dividend yield, and their beta is 2.01, meaning that they tend to move more aggressively & volatilely than the average market indexes.

42.32% of TSLA stock’s total share float is held by institutional investors.

Tesla Inc. TSLA Stock As A Short-Term Trade Using Options

TSLA stock has options that can be used by traders to take advantage of their price movements in either direction, while also hedging against volatility.

I am looking at the contracts with the 2/18 expiration date.

The $940 & $945 calls look interesting, and are fairly liquid with open interest levels just under 1,000 contracts each.

The $990 & $985 puts also look appealing, although they do have slightly less open interest.

Tying It All Together

Overall, TSLA stock has many interesting characteristics that traders & investors may find appealing.

Investors may find their balance sheet interesting, but may also be put off by their valuation metrics & lack of a dividend.

Traders will like their current momentum, as well as the liquidity of their options contracts.

TSLA stock is worth taking a closer look at, regardless of your trading style.

*** I DO NOT OWN SHARES OF TSLA STOCK ***

All numbers here taken from Yahoo Finance****