Tractor Supply Co. stock trades under the ticker TSCO & closed at $203.52/share on 10/19/2021.

TSCO stock has shown recent bullishness that traders & investors should take a closer look at in order to take advantage of profit opportunities.

Breaking Down Tractor Supply Co. TSCO Stock’s Technical Performance

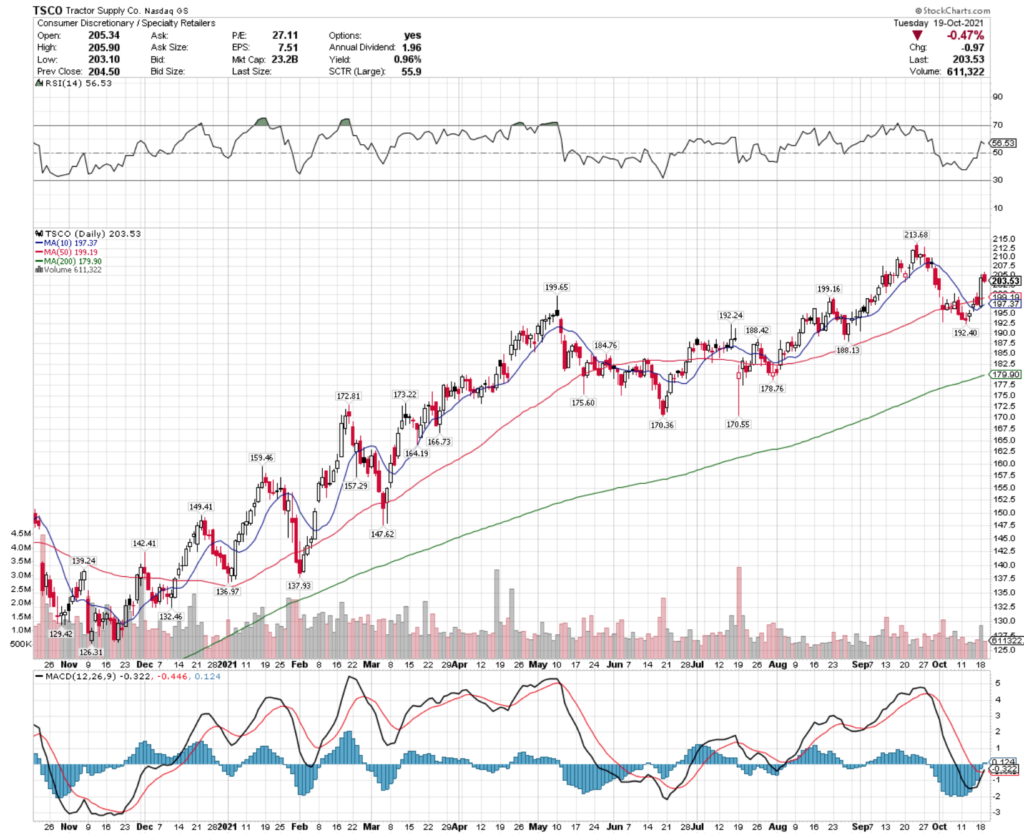

TSCO Stock Price: $203.53

10 Day Moving-Average: $197.37

50 Day Moving-Average: $199.19

200 Day Moving-Average: $179.90

RSI: 56.5

MACD: -0.322

TSCO stock has broken out over both its 10 & 50 Day Moving-Averages over the last couple of days, and yesterday completed a bullish MACD crossover.

Additional near-term momentum will be provided to their share price, as the 10 Day MA is ~2% away from breaking through the 50 Day MA bullishly.

With an RSI that is still fairly neutral at 56, there is still additional room to run for TSCO stock.

Tractor Supply Co. TSCO Stock As A Long-Term Investment

Investors may find TSCO stock’s valuation & fundamentals appealing as a long-term investment.

Although they have a modest P/E (ttm) of 27.3, some investors may not be comfortable with their P/B of 11.8.

TSCO had Quarterly Revenue Growth Y-o-Y of 13.4%, and offers a 0.9% Dividend Yield.

Their dividend looks safe, with a Payout Ratio of 24.5%.

TSCO has Total Cash (mrq) of $1.41B & Total Debt (mrq) of $3.8B, which may be off-putting to some investor’s risk appetite.

Despite this, they have 89% Institutional Investors.

Tractor Supply Co. TSCO Stock As A Short-Term Trade Using Options

Short-term traders may be interested in using options in order to take advantage of their current momentum, while also hedging against broader market volatility.

I am looking at the contracts that expire on 11/19, as they seem to have better Open Interest than the ones that are dated to expire sooner than that.

The $202.5 & $200 strike price calls look appealing, as they are already in-the-money.

For puts, the $210’s have the best liquidity of the options that I am looking at now, but that is likely to change as other contracts expire between now & then.

Tying It All Together

All-in-all, there are many opportunities for traders & investors to profit from TSCO stock.

Investors will like Tractor Supply Co.’s growth, dividend & valuation in the long-term.

Traders will like their current momentum, as well as the broader bullish sentiment in their options, with more open interest in the call contracts than the puts.

Overall, it is worth taking a closer look at Tractor Supply Co. TSCO stock, whether as a short-term trade or a long-term investment.

*** I DO NOT OWN SHARES OF TSCO STOCK ***