The CBOE Volatility Index is often referred to by investors & market pundits as “fear & greed index”, as it provides a view of future volatility in the near-to-mid-term that is reported as an annualized figure.

At a high level, it is calculated as a measure of at & out-of-the-money S&P 500 index options put & call contracts for the next two standard expiration dates that have over eight days until their expiration (up until there are two consecutive strike prices with no posted bid-ask pricing).

The midpoint of the bid-ask spread for the nearest at-the-money options in the series is then used to ultimately create a forward price for a synthetic option for the S&P 500 & the implied volatility of the synthetic option is what is quoted as the VIX on television & in newspapers.

The implied volatility is an annualized estimate of how much the price of the underlying security (in this case the S&P 500’s synthetic option) may move based on how market participants are currently buying & selling the security.

With this in mind, it can be inferred that there is a strong link between optimism/pessimism related to the S&P 500’s performance & the VIX reading, as more options tend to be traded when investors need protection from volatility (buying puts or selling out-of-the-money calls) leading to a higher VIX reading when the S&P 500 declines.

Using SPY as a proxy (the S&P 500 ETF) the relationship between the VIX reading, daily SPY changes & changes in trading volume will be examined in the following article.

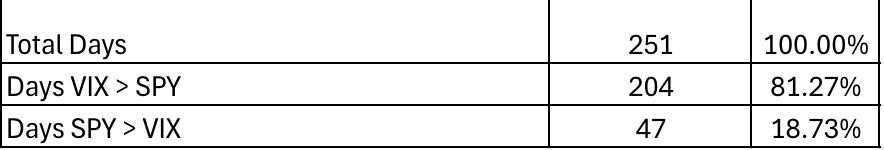

Note that the date range used for historic data was 7/10/2023 to the closing data of 7/9/2024, resulting in 251 sessions of usable data (given that the one-day implied S&P 500 move based on a VIX closing price is a reflection of tomorrow’s change, not that same day’s closing price).

Examining The Relationship Between The VIX, SPY & Daily Volume

The closing VIX reading for 7/10/2023 was 15.07, while SPY’s closing price that day was $433.595, implying that SPY would close within a range of +/-0.95% on 7/11/2023 (30 Day/1 Month implied move of +/-4.36%).

The following day SPY closed at $436.36, a change of +0.64%, meaning that it fell within the VIX’s predicted one day implied volatility.

SPY’s volume increased by 3.24% day-over-day, with 7/10/2023’s volume being 62,443,500 & 7/11/2023’s volume being 64,463,800.

As mentioned above, there were 251 total session’s used in this article (as it began being written before 7/10/2024’s close).

The VIX proved to be a fairly accurate calculation, as 81.3% (204 sessions) of the time in the past year the price of SPY closed within the range of the VIX reading, with 18.3% of the time (47 sessions) SPY outperforming it to the upside or the downside (recall that the VIX does not provide a direction of the movement, just the magnitude of it).

When looking at it from the perspective of a five day trading week, over the past year each week had about four days where SPY closed within the VIX’s predicted range, with roughly one day per week where it closed with a higher variance level than the VIX indicated (recall that it is predicting that moves will come in either direction, up or down).

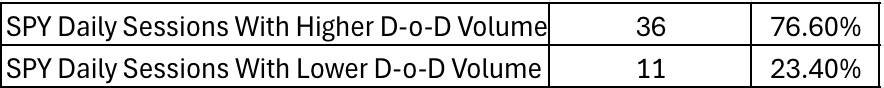

When we isolate the times that SPY closed above or below the reading that the VIX implied, we find that 76.6% of the time (36 sessions) SPY had higher volumes than the previous day.

This would be expected, as often more volatile sessions are accompanied with higher trading volume, leaving 11 sessions (23.4%) occurring on days where the day-over-day volume change was lower than the day before.

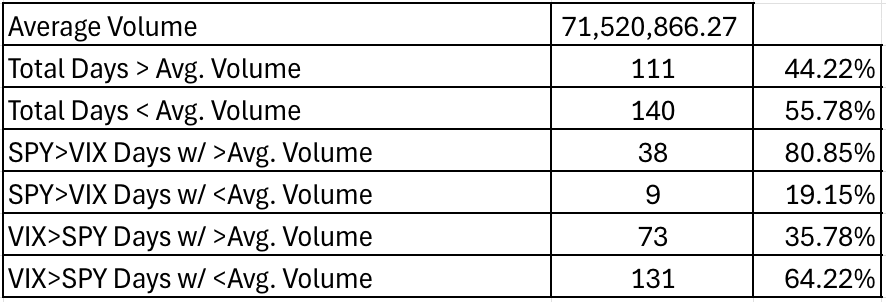

The average volume that SPY traded at during the time outlined above was 71,520,866.27, making it worth digging into how each sessions’ average volume fared in relation to SPY’s performance & the VIX.

In total, 111, or 44.2% of all days traded above that average volume quoted above, while 140 sessions (55.8%) traded below it.

For the sessions where SPY traded at a greater daily variance than what was predicted by the VIX, 80.85% of sessions (38) occurred on volumes that were above the annual average.

19.15% of sessions (9) where SPY traded outside of the predicted range of the VIX occurred on sessions with below average volume.

Looking at days where SPY closed within the range that the VIX predicted things look quite different, with only 35.8% of sessions (73) having above average volume & 64.2% of sessions (131) occurring with lower than average volume.

This can in part be explained by the dramatically larger sample size & the nature of the calculation, but was worth examining to see how the numbers fell in line with the other data points listed.

Tying It All Together

As we can see, the VIX does a pretty solid job of predicting the one day range that SPY prices will land in the following day.

While the performance may change if we changed the range to more than one year, 251 sessions is significant enough to draw conclusions from.

One thing to note is that while there has been some volatility in that sample size, the largest peak to trough drawdown was -9.5%, so expanding the sample size to include more years with greater volatility would likely change the results (such as past 2022, when there was a -26.6% decline peak to trough at the beginning of the year).

This is something that should be kept in mind in the event that there is increased volatility compared to the past year if referencing these results.

It is certainly something to keep in the back of one’s mind when watching intra-day sessions that have volumes that are higher than average out of the gate at the open/by midday, although other nearby candles & possible pattern formations should also be assessed before using it to make live predictions.

As always, this is not intended to be financial advice, just some observations about past market performance.

*** THIS IS NOT INTENDED TO SERVE AS FINANCIAL ADVICE, BUT RATHER AN ANALYSIS OF PAST MARKET BEHAVIOR – AS ALWAYS, DO YOUR OWN DUE DILIGENCE BEFORE PARTICIPATING IN FINANCIAL MARKETS ***