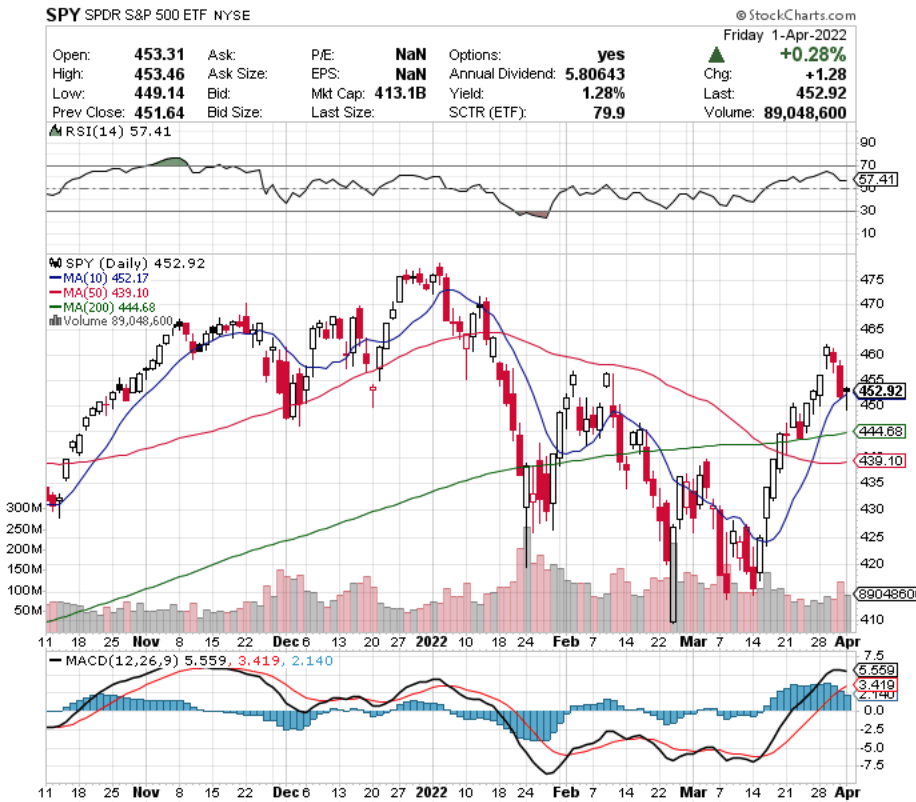

2022’s volatility has continued throughout Q1, after showing some signs of strength in mid-March.

SPY, the SPDR S&P 500 ETF‘s MACD looks set to bearishly crossover this week, signaling increased volatility in the near-term.

QQQ, the Invesco QQQ Trust ETF that tracks the NASDAQ’s performance also looks to be signaling more volatility is coming, as their MACD is also beginning to curve bearishly.

Let’s take a look at how some sectors are over & underperforming based on our daily technical performance calculations.

Global Infrastructure (IGF), Energy (ERX), Brazil (FLBR) & Steel (SLX) Have All Bullishly Led The ETF Markets

IGF, the iShares Global Infrastructure Index ETF has grown ~7% since 2022 began, in addition to their 2.24% annual dividend yield.

Most of their price gains for this year took place in March over the last few weeks, which is why their RSI is oversold.

Their MACD still looks bullish, but they may blow off some steam in the near-term, providing an entry-point for new investors.

ERX, the Direxion Daily Energy Bull 2x Shares ETF has gained 105% since mid-December 2021, in addition to their 1.14% annual dividend yield.

Their MACD bearishly crossed over last week, as they’ve begun to establish a range in the $48-58/share neighborhood.

Their last couple of weeks have been lighter than average volume, and their RSI is approaching neutral again, signaling that they may be ready to continue climbing in the near-term.

FLBR, the Franklin FTSE Brazil ETF has grown 47.2% in 2022, excluding their annual 4.63% dividend yield.

FLBR’s MACD is bearishly rolling over, and their RSI is in overbought territory.

This should lead to some short-term losses that may provide entry-points for new positions in the coming weeks.

SLX, the VanEck Vectors Steel ETF has grown 30.5% since the beginning of 2022, not including their 5.44% annual dividend yield.

Their MACD is about to bearishly cross this upcoming week, and their RSI is just below overbought values.

This is another ETF that may have good entry-points for a new position as it begins to establish a new price range after such rapid growth.

FinTech Innovation (ARKF), Regional Banks (DPST), Germany (FGM) & Egypt (EGPT) Have All Bearishly Lagged The ETF Markets

ARKF, the ARK FinTech Innovation ETF has struggled since mid-November of 2022, losing almost half of its value over the last 5 months, and not paying a dividend yield.

While they have rebounded since mid-March, a neutral RSI & MACD that is curling over bearishly are signaling that there is more pain in store for this ETF.

DPST, the Direxion Daily Regional Banks Bull 3x Shares ETF has had a very volatile past year, shedding ~39% of its value since the peak in January 2022.

Their MACD has recently cross over bearishly, and their RSI is halfway between neutral & oversold.

While they offer a 0.71% cushion in the form of their dividend, this doesn’t look like the time to begin building a position in this space just yet, given the recent higher than average trading volume.

FGM, the First Trust Germany AlphaDEX Fund ETF has lost ~20% of its price since the middle of November 2021, although it does pay a 2.09% dividend.

Their MACD is beginning to signal short-term weakness, making it important to look at their RSI for additional clues as to how their price will perform in the coming months.

EGPT, the VanEck Vectors Egypt Index ETF has lost ~21% since the beginning of 2022, not including the 3.04% dividend that they pay.

Their RSI is coming back from being oversold, although it is still low at 36.

However, their MACD looks set to bullishly cross over, signaling that they may be prime for a near-term uptrend in price.

Tying It All Together

While broader market indexes are looking like there will be an increase in short-term volatility, there are still many bullish opportunities for profits in the market.

Based on the trading volumes of many of the names I looked at, there looks to be a lot of uncertainty still about the overall direction of the markets.

The sectors & areas mentioned above all have unique opportunities compared to other ETFs, and utilizing their options can help improve profits as the market moves volatily.

*** I DO NOT OWN SHARES OF SPY, QQQ, IGF, ERX, FLBR, SLX, ARKF, DPST, FGM or EGPT ETFs ***