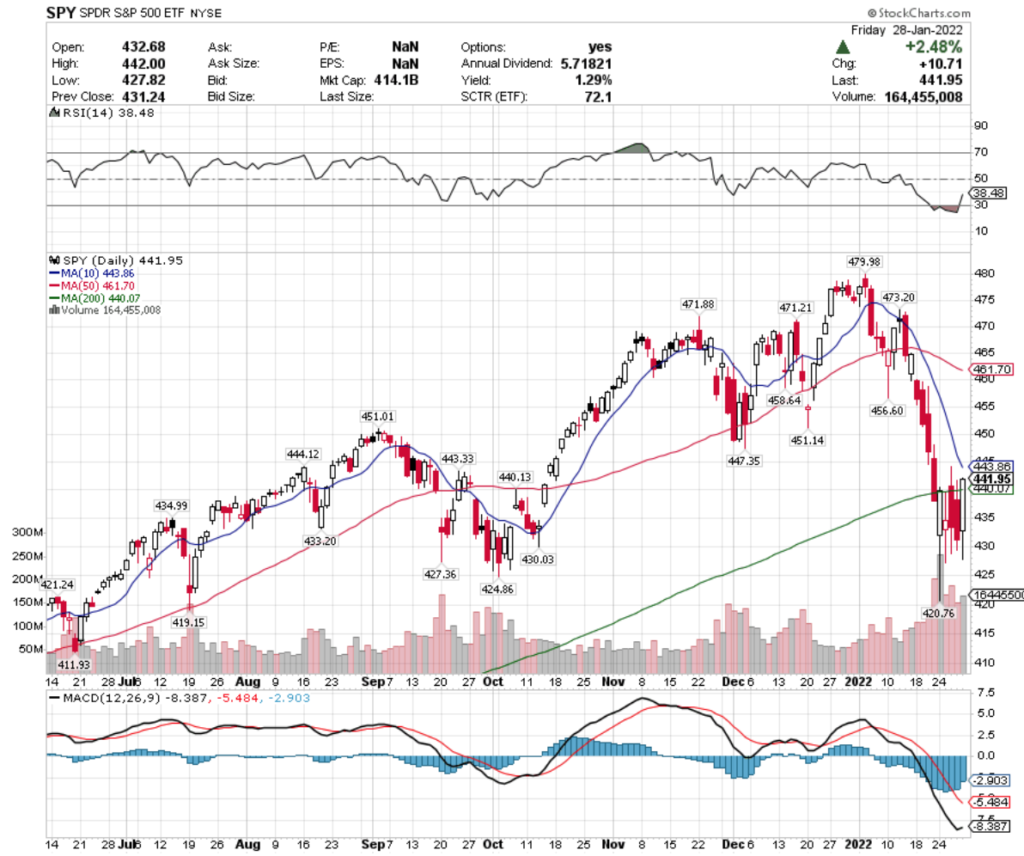

January 2022 continues to be an above average trading volume month for the major market indexes.

SPY, the S&P 500 ETF managed to stabilize this last week a bit, after spending the rest of the new year downtrending.

Looking at their RSI, it looks like there may be more selling to come in the near-term, particularly as their 10 Day Moving Average approaches their 200 Day MA bearishly.

QQQ, which tracks the NASDAQ index also was able to gather some footing, after also sliding downward into the new year.

They too look set to resume the downward movements in the near-term, as their RSI comes out of deeply oversold territory & their 50 Day Moving Average is only ~5% away from crossing bearishly through the 200 Day MA.

It still doesn’t quite look like time to be buying into the markets just yet.

Let’s dive into some of the sectors & industries that are performing the best & worst below.

Corn (CORN), Soybeans (SOYB), Palladium (PALL) & Multifactor Energy (JHME) Are All Leading The Pack

CORN, the Teucrium Corn Fund ETF has been steadily climbing since October of 2021.

With their RSI approaching being overbought & their MACD beginning to flatten out, there may be some pain on the near-term horizon here, although so far they have fared better in 2022 than the broader market indexes.

Recently though, there volumes have been lower than average when compared to the rest of the year.

SOYB, the Teucrium Soybean Fund has also enjoyed a strong end of 2021 that carried into 2022, gapping up 1.48% on Friday 1/28/2022.

With their 50 & 200 Day Moving Averages bullishly crossing, there looks to be more strength in the near-term for SOYB.

Keep an eye on their RSI though, as that will need to neutralize more as they establish a new price range.

SOYB’s volume has been above average for the last couple of months though, showing strong support in their price movement.

PALL, the Aberdeen Standard Physical Palladium Shares ETF has recovered nicely since mid-December’s ~18% drop.

While they do not have options for trading puts, there looks to be signs of continued momentum in the near-term, after their price just broke out above their 200 Day MA.

Their RSI will cool down in the near-term, but that may prove a buying opportunity, as their 10 Day MA is fast approaching the 200 Day MA, which will add additional strength & support to drive prices higher.

JHME, the John Hancock Multifactor Energy ETF has steadily grown since September, while also paying a 2.2% annual dividend.

The last few days have seen increased volumes, but their price will need more momentum to break above the $26.54 mark, which may be difficult with their RSI just about in overbought territory.

However, their MACD implies that they may be ready to keep climbing, but first they need to keep their heads above the $26.22-price level.

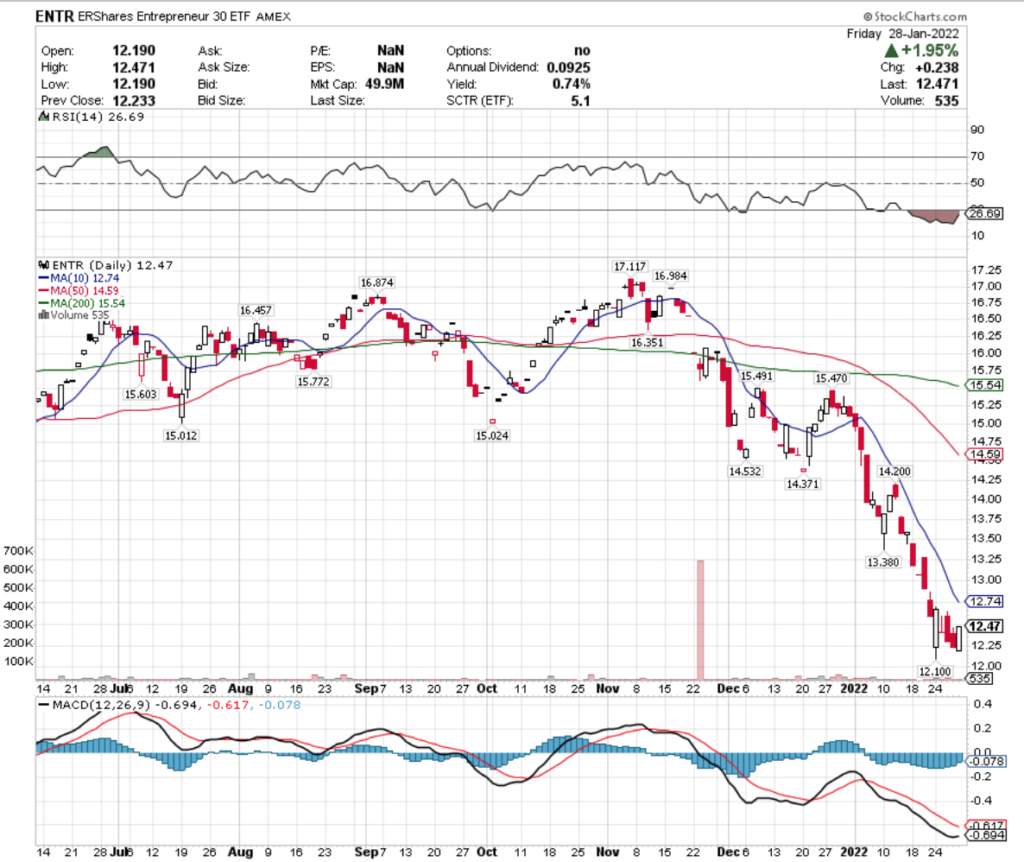

High-Growth Entrepreneurial (ENTR), Cloud Computing (SKYY), Cancer Immunotherapy (CNCR) & Clean Energy (ACES) Are All Lagging The Pack

ENTR, the ERShares Entrepreneur 30 ETF has been in relative free-fall since a large gap down in mid-November.

While their MACD looks to be turning around bullishly & their RSI is deeply oversold, I’ll be watching how they manage to keep their heads above the $12-level to begin establishing a support level.

With such a low dividend yield I don’t see any advantage into rushing into this name, until after it has built up some more momentum & strength.

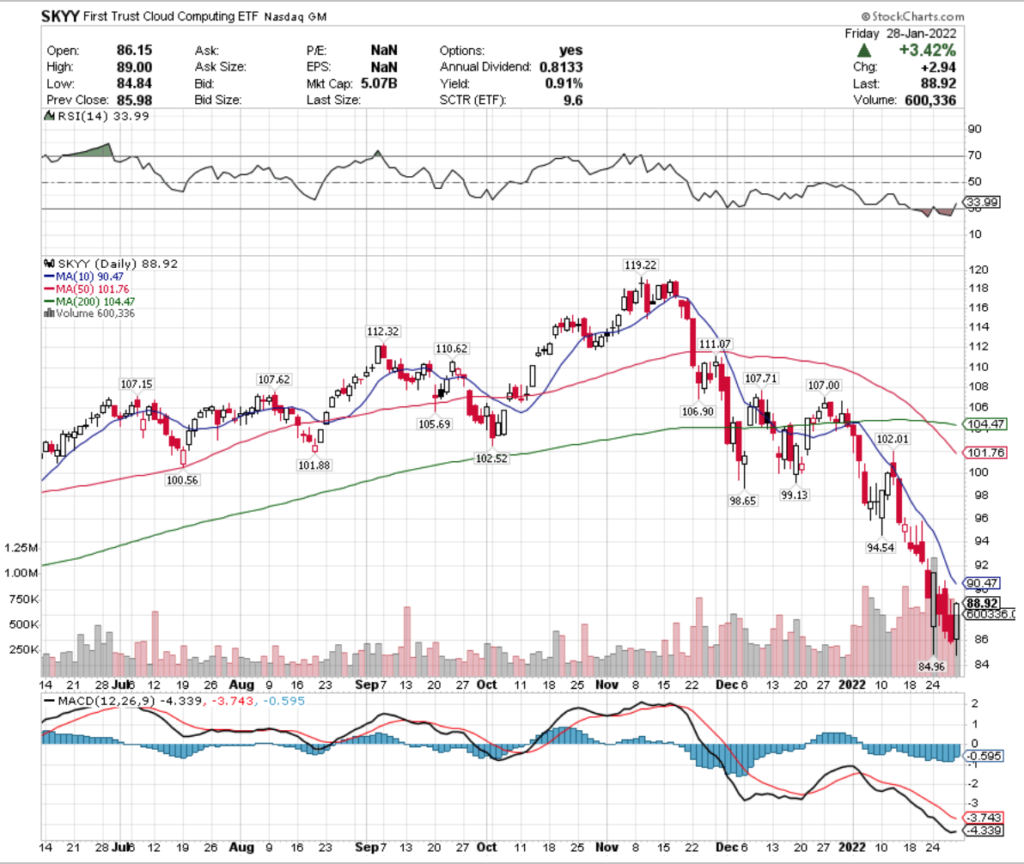

SKYY, the First Trust Cloud Computing ETF has also experienced similar troubles since mid-November 2021.

They’re going to look to settle their RSI in a more neutral area, and may begin building support off of this $85-level that we are seeing, as their MACD looks to be gearing up to turn bullish.

Their trading volumes continue to increase vs. last year’s averages, which should help them establish a floor of support.

However, given the nature of the industry that this ETF tracks I’m not sure that their <1% dividend yield will do much in terms of limiting downside risk here & we could see more pain to come as interest rates rise in the spring.

CNCR, the Loncar Cancer Immunotherapy ETF is another name that has had constant struggles since mid-November 2021.

Their RSI is deeply oversold, but it doesn’t appear clear that they are beginning to form a bottom & gain support.

While the MACD is becoming increasingly more bullish, there is still risk associated with trying to time their bottom here.

One thing of comfort, they offer a 10% annual dividend yield, giving you a cushion of protection until they reach around the $16.50 level should they continue to fall.

I’ll be keeping an eye on them & be doing more research, as the 10% yield could be very worthwhile, research pending.

ACES, the ALPS Clean Energy ETF also has faced big headwinds since mid-November 2021.

Another name that has yet to find a level of support, that also offers too low of a dividend to make trying to time the bottom in pricing worthwhile.

Their heavily-oversold RSI & MACD that is turning bullish may help solve that problem & build them support in the $48-49 neighborhood, but it’s still too early to speculate.

2022 has only seen slightly above average volume for them, which doesn’t inspire a lot of optimism & confidence.Tying It All Together

Tying It All Together

One of the most clear things that the charts are telling me as I write this is that no one really still knows what is going on.

How this uncertainty will play into the pricing of stocks & ETFs is anyone’s guess, but in times of extreme volatility like we are experiencing watching the technicals on the names you’re interested in becomes all the more vital.

Also, having exposure to quality, high-yielding dividend stocks & ETFs, as well as some of the volatility based ETN exposure is going to be very beneficial to your portfolio.

Let’s see what happens this week!

*** I DO NOT OWN ANY OF THE ETFs MENTIONED ABOVE, ALTHOUGH I DO OWN SPXS CALLS AT THE TIME OF WRITING THIS ***