SPY, the SPDR S&P 500 ETF added +1.67% this past week, while the VIX closed at 15.24 indicating an implied one day move of +/-0.96% & an implied one month move of +/-4.41%.

Their RSI is trending upward towards the overbought level again, currently sitting at 61.66, while their MACD is signaling that it’s poised for an early week bullish crossover before the Thanksgiving holiday.

Volumes were still weak, coming in -26.49% below the prior year’s average level (44,300,000 vs. 60,260,437), as market participants are still feeling a bit uneasy near these all-time high price levels.

The week started off on a optimistic, but uncertain note, as Monday’s session resulted in a spinning top that formed a bullish harami pattern with Friday’s candle on very light volume.

Tuesday opened lower but powered higher to form a bullish engulfing pattern with Monday’s candle & the volume was a bit higher, but still not the level of enthusiasm that is needed to continue to a new all-time high.

Wednesday’s session resulted in a dragonfly doji, indicating uncertainty given that it retraced the entire range of the prior day’s candle, but ultimately the day was able to close higher at the top of the session’s candle by the open.

Thursday opened on a gap up in line with the 10 day moving average’s resistance, tried higher but ultimately retraced below the close of Wednesday’s session before rallying back to close as a doji candle by the 10 DMA.

Friday opened in line with Thursday’s close but was able to close slightly higher, although indicating hesitancy & uncertainty as the low volume session closed as a spinning top candle.

This week it should be kept in mind that there are only 3.5 trading days, as Thursday is Thanksgiving & the market is closed & Friday is a half day.

Wednesday has a lot of data announcements & there are some earnings calls scheduled for early in the week that may impact SPY’s performance.

With that in mind, SPY looks primed to straddle the 10 DMA & trade around it on light, holiday week volume.

It is unlikely to get the volume needed to force a retest of the all-time high that sits ~1% above Friday’s close & if it was unable to be reached last week it seems less likely to happen on a short week when folks are traveling.

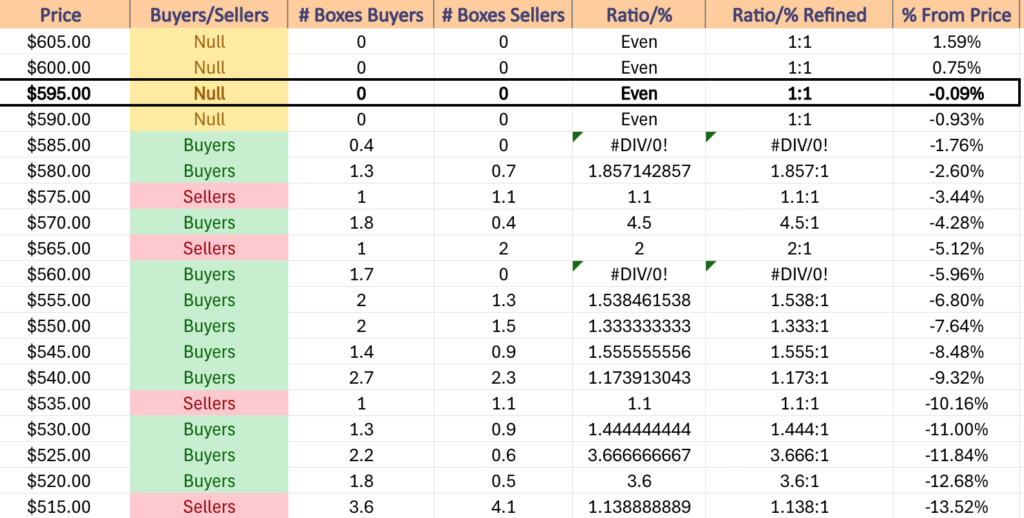

To the downside it will be interesting to see how the $590/share level holds up, given Tuesday’s close there & Wednesday’s doji candle resting right above it, but should it test any lower the chart below lists SPYs price level:volume sentiment over the past ~2 years.

SPY has support at the $593.01 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $586.12 (Volume Sentiment: Buyers, 0.4:0*), $583.86 (Volume Sentiment: Buyers, 1.86:1) & $579.21/share (50 Day Moving Average, Volume Sentiment: Sellers, 1.1:1) price levels, with resistance at the $600.17/share (All-Time High, Volume Sentiment: NULL, 0:0*) price level.

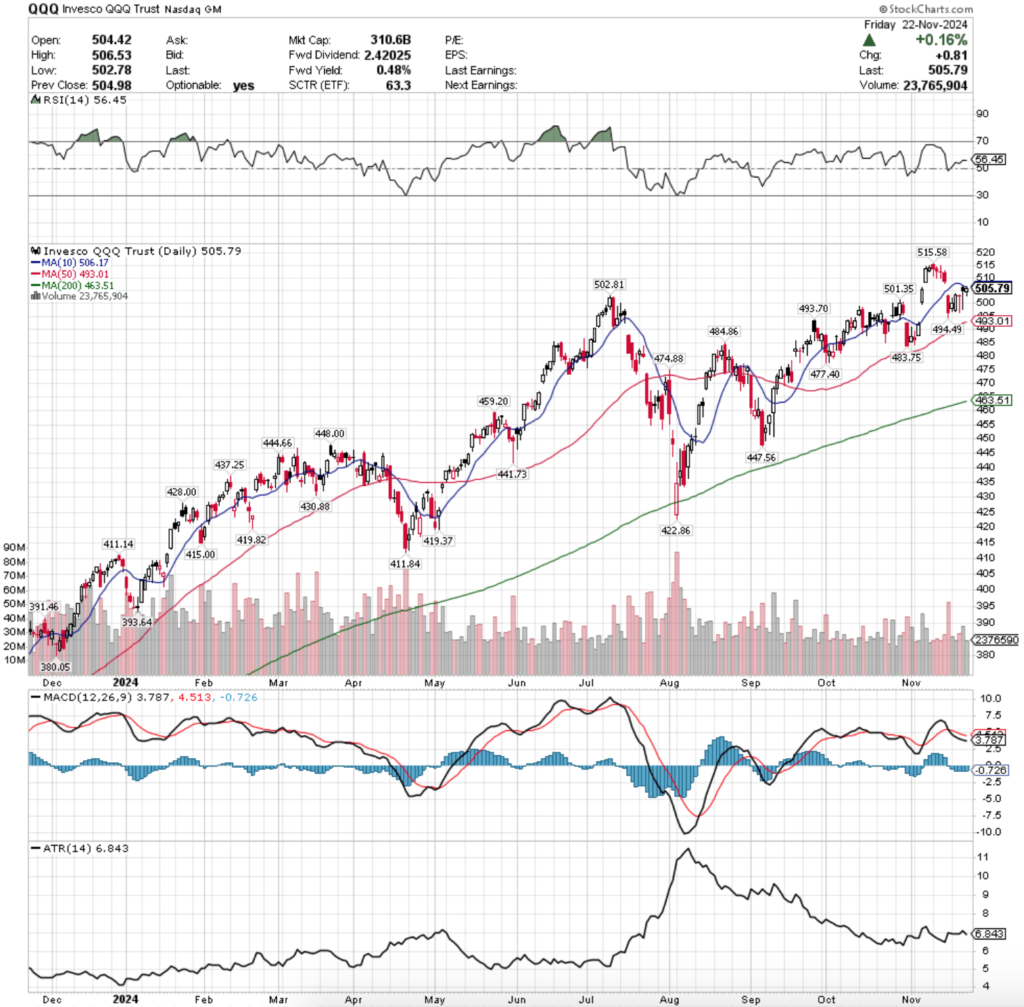

QQQ, the Invesco QQQ Trust ETF that tracks the NASDAQ 100 gained +1.86% last week, as investors were slightly more eager to pile into the tech heavy index than the S&P 500 components.

Their RSI is trending above the neutral level of 50 & sits at 56.45 but has flattened out recently, while their MACD is bearish but showing signs of a potential bullish crossover before the end of the week if the histogram shows weakness on Monday or Tuesday.

Volumes were the weakest of the major index ETFs, coming in -27.27% below the previous year’s average level (27.928,000 vs. 38,399,048), as investors are still not feeling confident about hopping back into the pool so close to all-time highs.

QQQ’s week began on a similar note to SPY’s with Monday’s candle forming a bullish harami with Friday’s & closing as a spinning top on low volume, indicating that there was a bit of uncertainty in the air.

Tuesday opened lower but was able to close higher, ending the day forming a bullish engulfing pattern with Monday’s candle, but again on weak volume.

Wednesday opened lower & tested lower than Tuesday’s lows, but was able to close in line with the open as a dragonfly doji, indicating that there was still a little upside appetite, but that people were taking profits throughout the day too.

Thursday opened on a gap higher to just beneath the resistance of the 10 day moving average, tested almost as low as Wednesday’s session’s low, but was able to rally higher to form a hanging man candle that closed lower than it opened on the highest volume session of the week.

It appears that a lot of market participants were taking profits those two days based on how low they tested, but bulls managed to push their closing prices back to the high end of the days’ ranges.

Friday left the week off on a note of bearish uncertainty for QQQ, as while the session advanced +0.16%, it resulted in a spinning top candle that was unable to break above the resistance of the 10 DMA, which has now curled over & is moving downward towards the price.

Much like SPY, QQQ is unlikely to make a run at their all-time high this week due to the short week & anticipated low volume that accompanies a holiday.

They’re likely to trade around the 10 DMA on light volume all week, pending no major news or bad data releases occur.

In the event of decline, QQQ has more local support levels than SPY which may control the rate of descent, but should that happen investors should begin watching for a bearish head & shoulders pattern, particularly given their 10 DMA is even looking like one.

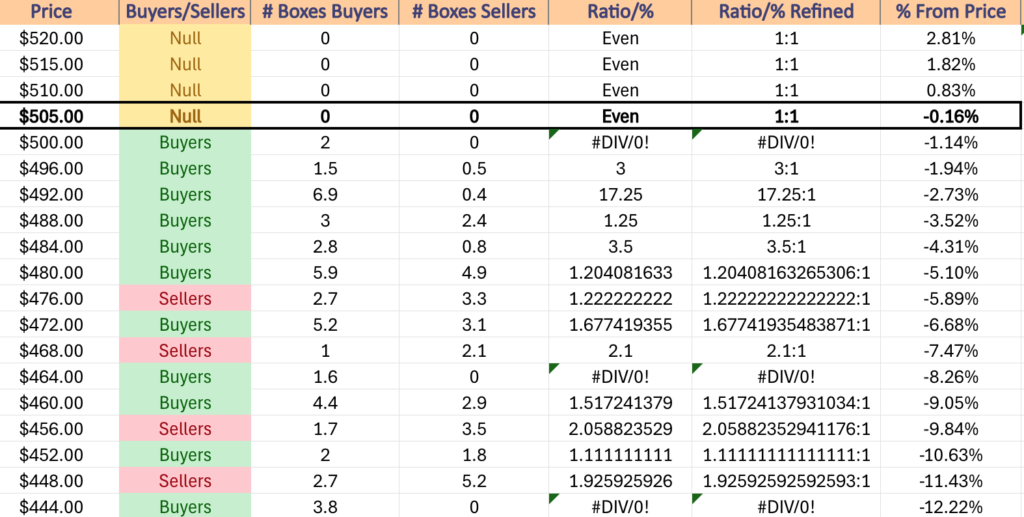

QQQ has support at the $502.81 (Volume Sentiment: Buyers, 2:0*), $501.35 (Volume Sentiment: Buyers, 2:0*), $494.49 (Volume Sentiment: Buyers, 17.25:1) & $493.70/share (Volume Sentiment: Buyers, 17.25:1) price levels, with resistance at the $506.17 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*) $515.58/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

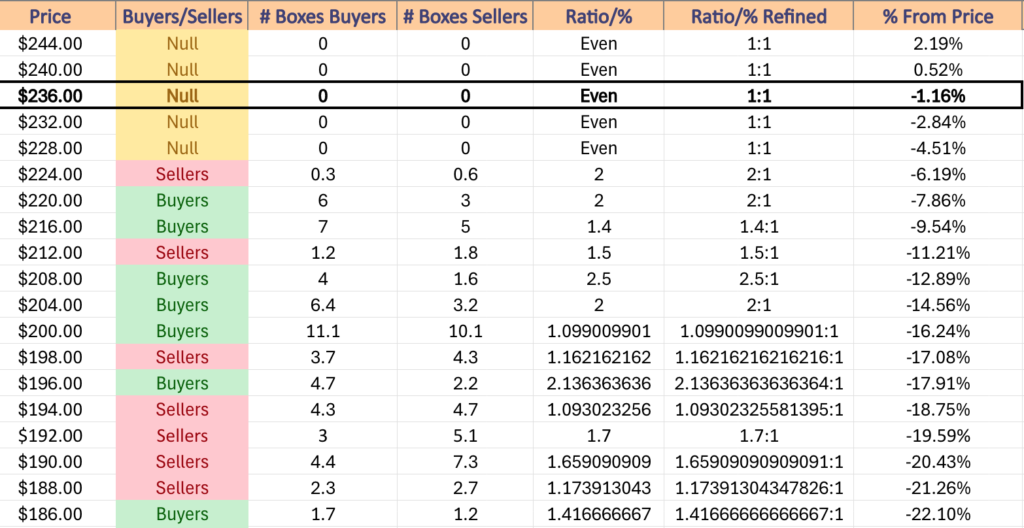

IWM, the iShares Russell 2000 ETF advanced +4.5% last week, as investors were eager to pile into the small cap index compared to the other three major index ETFs.

Their RSI is trending towards the overbought 70 level & currently sits at 64.85, while their MACD crossed over bullishly on Friday, but the histogram level is quite low which leaves room for skepticism on the strength of the crossover.

Volumes were also weak, coming in -20.59% below the prior year’s average level (26,200,000 vs. 32,994,484), as even small cap investors are feeling nervous near their all-time high.

Monday kicked the week off with bullish uncertainty, as the session created a bullish harami cross with Friday’s candle on some of the week’s highest volume.

Bullish engulfing Tuesday also hit IWM, as despite opening on a gap down the bulls came back & force the session to close above the high of Monday’s session.

Wednesday’s candle would be described as a hanging man if it occurred in an actual uptrend & not in the wake of a two day reversal, but market participants showed that there was still plenty of negative sentiment in the air, given the size of the lower shadow.

Thursday opened higher, signaled that there was some downside sentiment (or near-term profit taking) on the lower shadow, but was able to power through the 10 day moving average & close above it as there was a lot of advancing volume relative to every day that week but Monday.

Friday opened on a gap higher, briefly tested lower but the $235/share mark held strong & propelled IWM to close higher for a +1.85% gain on the day.

This week will be focused on whether or not the support of the 10 day moving avera

IWM has support at the $233.84 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $227.85 (Volume Sentiment: Sellers, 2:1), $227.17 (Volume Sentiment: Sellers, 2:1) & $226.40/share (Volume Sentiment: Sellers, 2:1) price levels, with resistance at the $242.39/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

DIA, the SPDR Dow Jones Industrial Average ETF climbed +1.99% last week, as the blue chip index was the second most favored major index ETF of the big four.

Their RSI is trending towards overbought & currently sits at 65.96, while their MACD crossed over bullishly on Friday, but the histogram level is rather muted, calling to question the strength of the signal.

Volumes were +28.8% above the previous year’s average (4,492,000 vs. 3,487,619), as investors were still feeling eager to get into the component names of the blue chip index.

Monday began the week on a note of muted uncertainty, as the day resulted in a doji candle for a slight decline on very weak volume.

Tuesday opened on a major gap down, but throughout the session bulls came in & were able to force the closing price above the open, but still for a declining session.

Wednesday was a tug of war between bulls & bears after opening on a gap up, as there was still plenty of bearish sentiment out there based on the size of the candle’s lower shadow, but the day managed to rally higher.

This set up the highest volume session of the week on Thursday, where the day opened on a gap up, there was some profit taking based on the lower shadow before powering through the 10 DMAs resistance to close above it.

The upper shadow on the day’s candle also indicated that there were market participants interested in seeing DIA continue its climb, which is what happened on Friday as another gap up session left DIA within $1.44 of its all-time high.

Based on the high volume heading into the weekend & the recent MACD bullish crossover it appears that DIA will at least break above its all-time high this week.

This brings with it a set of problems though, as once the oscillators overheat there will be profit taking from that batch of high volume we saw on Thursday & Friday & there are not that many nearby support levels for DIA.

In the event of a new ATH there would be support at $444.60 & at where ever the 10 day moving average winds up by then, as it will continue marching higher along with the price.

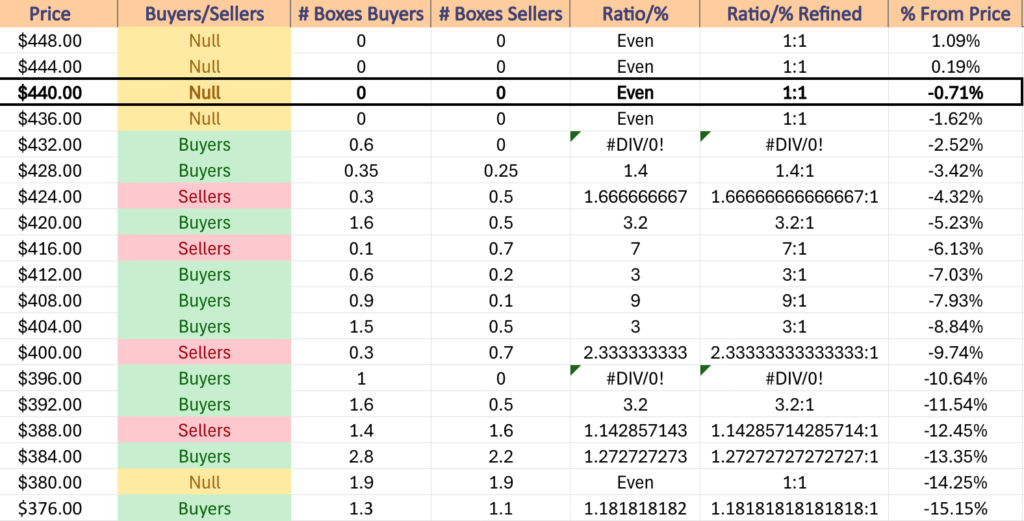

Another key area to keep an eye on in the event of a decline is that window that was created by the post-election gap up, as if the $429.64/share support level breaks down that will likely begin to fill, especially if prices enter the $424-427.99/share zone where Sellers have outpaced Buyers at a rate of 1.67:1 over the past 3-4 years.

DIA has support at the $437.68 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $432.94 (Volume Sentiment: Buyers, 0.6:0*), $429.64 (Volume Sentiment: Buyers, 1.4:1) & $426.62/share (50 Day Moving Average, Volume Sentiment: Sellers, 1.67:1) price levels, with resistance at the $444.60/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

The Week Ahead

Monday has no major economic announcements scheduled.

Bath & Body Works & Diana Shipping report earnings Monday morning before the opening bell, with Agilent Technologies, Central Garden, Enanta Pharmaceuticals, Fluence, Leslie’s, NJ Resources, Semtech, Woodward & Zoom Video Communications reporting after the closing bell.

S&P Case-Shiller Home Price Index (20 Cities) is released Tuesday at 9 am, Consumer Confidence & New Home Sales data comes out at 10 am & the Minutes of he Fed’s FOMC meeting are due out at 2pm.

Tuesday’ morning’s earnings kick off with Abercrombie & Fitch, American Woodmark, Analog Devices, Bank of Nova Scotia, Best Buy, Burlington Stores, Dick’s Sporting Goods, Embecta, J.M. Smucker, Kohl’s, Macy’s & Titan Machinery, followed by Dell Technologies, Ambarella, Arrowhead Pharmaceuticals, Autodesk, CrowdStrike, Guess?, HP Inc., Mitek Systems, Nordstrom, Nutanix, Urban Outfitters & Workday after the closing bell.

Wednesday is going to be a busy one on the data-front, starting with Initial Jobless Claims, Durable-Goods Orders, Durable-Goods minus Transportation, Advanced U.S. Trade Balance In Goods, Advanced Retail Inventories, Advanced Wholesale Inventories & GDP (first revision) are all due out at 8:30 am, followed by Personal Income (nominal), Personal Spending (nominal), PCE Index, PCE (year-over-year), Core PCE Index, Core PCE (year-over-year) & Pending Home Sales at 10 am.

Patterson Companies reports earnings before Wednesday’s opening bell, with Kroger & Zumiez set the report after the session’s close.

Thursday is Thanksgiving so there is no data to be released.

Friday brings us the Chicago Business Barometer (PMI) report at 9:45 am & there will be no earnings reports released.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***