SPY, the SPDR S&P 500 ETF slipped -2.16% last week, while the VIX closed the week at 18.36, indicating an implied one day move of +/-1.16% & a one month implied move of +/-5.31% for SPY.

Their RSI is trending back towards the neutral mark of 50 & currently sits at 46.09 following Friday’s advancing session, while their MACD is still bearish, but the histogram is declining less rapidly than earlier in the week.

Volumes were +44.71% above the prior year’s average (83,872,000 vs. 57,959,641), as market participants began jumping out of the pool following Wednesday’s FOMC interest rate decision & Fed Chair Powell’s press conference.

Monday kicked the week off on an ominous note, as the session opened higher, tested a little bit above Friday’s opening price, before heading lower on low volume to close below the open straddling the 10 day moving average’s support.

The session also resulted in a spinning top, which indicates there was a bit of indecision in the air on the part of market participants.

Tuesday the theme continued, as the session opened lower & was unable to fight higher to cross the 10 DMA’s resistance, closing the day as a doji on slightly higher volume than Monday, indicating that uncertainty & caution were still in the air, but there was brief equilibrium.

Wednesday is where things really began to unravel, as the session opened lower with the 10 Day Moving Average, briefly tested higher, before crumbling on a wide range decline on the week’s second highest volume following Chair Powell’s remarks.

What’s more alarming is how easily it broke down the support of the 50 day moving average & managed to close beneath it, which will cause the 50 DMA to curl over bearishly like the 10 DMA already has.

Thursday the pain continued, as the session opened higher & in line with the 50 DMA & briefly tested higher, before unraveling & closing just below Wednesday’s close.

While the slightly lower close means that it was not a bearish harami, it was hardly a vote of confidence & a sign that profit taking may be morphing into a more serious downwards movement in the near-to-mid term when you consider that the session’s volume had only narrowly lower volume than the prior day.

Friday’s price action also continued the skeptical view of the strength behind SPY’s recent moves.

The day opened on a lower note from Thursday, but managed to draw in the most market participants of the week, powering it above the 50 DMA’s resistance & almost reaching the 10 DMA intraday, before profits were taken & the price closed just above the 50 DMA’s support.

While Friday formed a bullish engulfing pattern with Thursday’s candle & the volume & +1.2% advance are all nice, it is still wise to approach this short week & next week with caution.

Particularly as while the volume spike & wide daily range can indicate a reversal is on the horizon, that doesn’t seem likely beyond a brief movement following the squeeze/covering Friday session.

Especially given that there’s likely not going to be much volume this week which will likely continue into next week due to the holidays creating shorter weeks.

Without some type of volume catalyst it doesn’t seem there would be any near-term rallies, particularly when you factor in the limited earnings calls & market data reports that are due for release.

Watching the relationship between Price, the 10 DMA & the 50 DMA will be a key area of focus, particularly as the window created in early November following the US Presidential Election has yet to fully fill & SPY’s oscillators are not signaling strength at the moment.

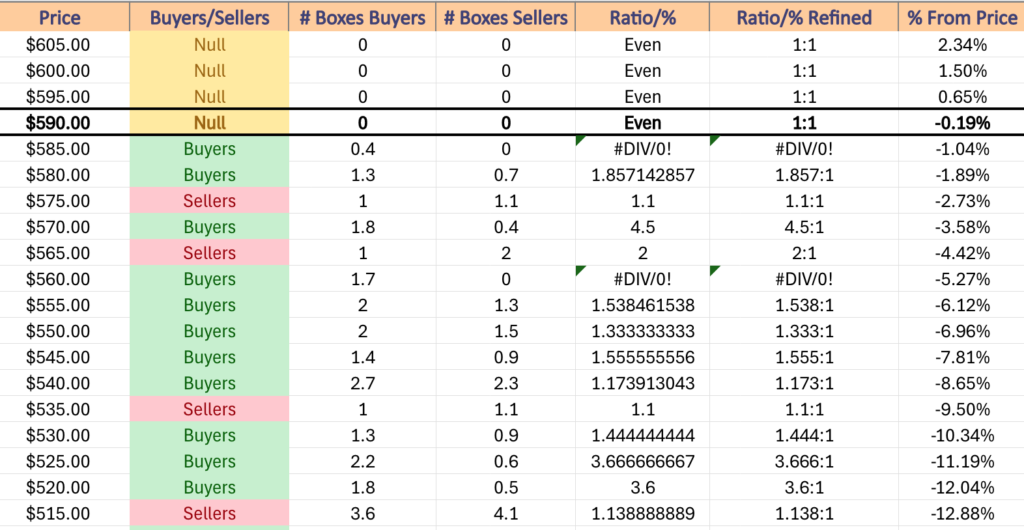

It will also be worth watching how SPY interacts with its support levels, especially given that the first one has been relatively untested & the following two are slightly more sturdy but close enough to the current price that based on the price action of last week can easily break down, leading to the fourth level, which has been Seller dominated 2:1 over the past 2-3 years.

This will also open SPY up to being ~3% from its 200 day moving average’s support, which is an important long-term trend mark.

SPY has support at the $589.40 (50 Day Moving Average, Volume Sentiment: Buyers, 0.4:0*), $584.15 (Volume Sentiment: Buyers, 1.86:1), $581.90 (Volume Sentiment: Buyers, 1.86:1) & $565.99/share (Volume Sentiment: Sellers, 2:1) price levels, with resistance at the $598.00 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $598.16 (Volume Sentiment: NULL, 0:0*) & $607.03/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

QQQ, the Invesco QQQ Trust ETF fell -2.24% last week, in a week that closely mirrored SPY’s performance.

Their RSI is trending higher & sits at 51.53, while their MACD is bearish.

Volumes were +19.35% last week vs. the previous year’s average (44,446,000 vs. 37,240,478), as market participants were eager to get out of the pool on Wednesday & Thursday, but covering activity squeezed prices higher heading into the weekend.

QQQ opened the week on a more optimistic note than SPY, but it wasn’t without some caution signals.

Particularly of note was the low volume on Monday that helped QQQ hit a fresh all-time high despite it being a more solid advancing session than SPY’s.

Tuesday’s spinning top candle arrived on low volume as well & formed a bearish harami pattern with the prior day’s candle, which is when folks began heading to the door.

Wednesday opened slightly lower, but also on the second highest volume of the week ripped down straight through the support of the 10 day moving average.

Confirmation came on Thursday when on similar volume (slightly lower) the session opened briefly higher, before continuing to decline lower than Wednesday’s lower & price broke down below the $515/share mark.

Like SPY, QQQ’s Friday morning coffee came with a side order of lower, but it was able to briefly rally intraday to test the 10 DMA’s resistance, got rejected & closed in the middle of Thursday’s range.

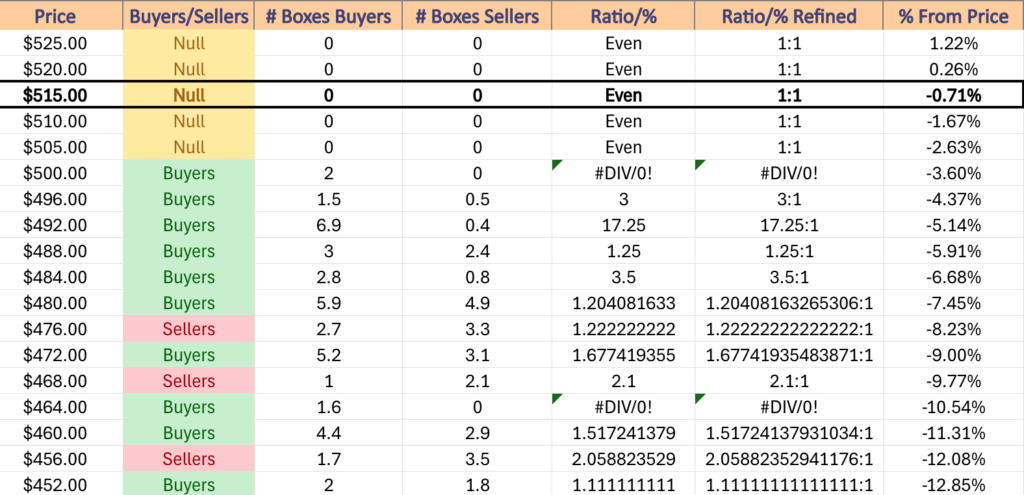

This week it will be worth watching how the relatively untested $515.58/share support level holds up, as it’s recently broken down & prices are only above it due to Friday’s session, which while it may normal constitute a reversal opportunity, seems unlikely given that it occurred heading into tumbleweed volume week(s).

The next area of focus will be on the 50 DMA, not just as it is the next support level, but because once that support breaks down QQQ will be on unstable footing.

While QQQ has more local support touch-points than SPY, at the price levels we see now if the 50 DMA breaks down they may not be as resilient of support levels as originally thought if the moving mid-term trend has broken (as we’ve seen three times already in 2024).

QQQ has support at the $515.58 (Volume Sentiment: NULL, 0:0*), $507 (50 Day Moving Average, Volume Sentiment: NULL, 0:0*), $502.81 (Volume Sentiment: Buyers, 2:0*) & $501.35/share (Volume Sentiment: Buyers, 2:0*) price levels, with resistance at the $525.32 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*) & $539.15/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

IWM, the iShares Russell 2000 ETF declined -4.78% last week, as investors were eager to jump out of the components of the small cap index.

Their RSI is rebounding from the oversold 30 mark & sits currently at 34.67, while their MACD is still bearish & near the lowest levels on its histogram.

Volumes were +40.84% above the prior year’s average last week (44,674,000 vs. 31,720,637), which is alarming given that two of the top three highest volume days were declining sessions & IWM had already been in decline for three weeks before this.

Looking at their MACD you can observe that they’ve been falling since around Thanksgiving time, so that much outflow is reason for concern.

IWM’s chart for the week closely resembles SPY & QQQ’s in terms of intraday action, so in the spirit of the holidays we’ll give the gift of brevity here.

Monday’s weak volumes on an advancing day that did not reach high enough to test the resistance of the 10 day moving average set the stage for the declines of the prior few weeks to continue, and they did on Tuesday, on volume that was slightly higher than Monday’s.

Wednesday put the nails in IWM’s coffin, as the day did manage to test the 10 DMA’s resistance, but proceeded to decline through the 50 DMA & showed more weakness than SPY & QQQ in relation to the price:moving averages relationship.

Thursday & Friday also mimicked SPY & QQQ, but more damage was done in the days leading up to them.

This coming week keep an eye on the 10 & 50 day moving averages, anticipating a bearish crossover by Christmas.

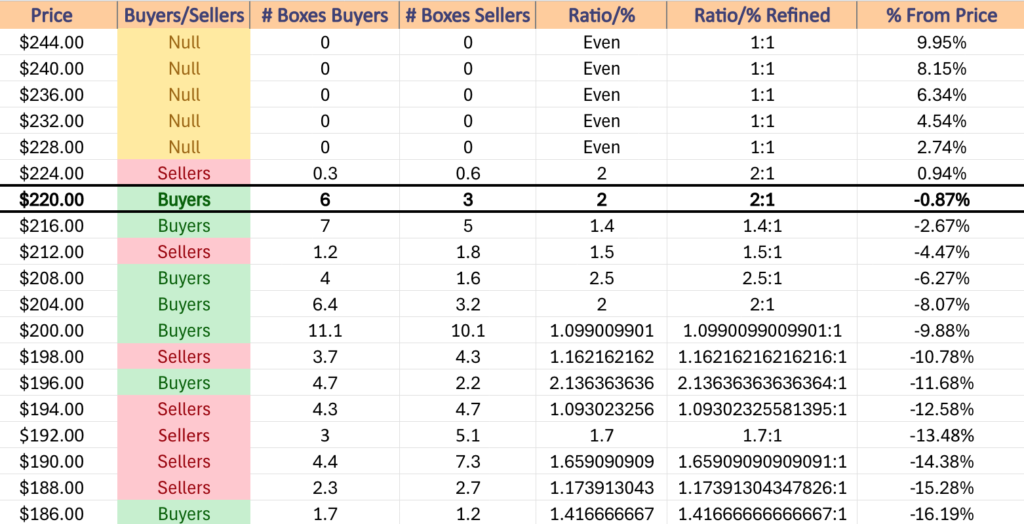

From there broader market sentiment will become more important, as while IWM’s steady oscillating around an average price to slowly climb higher gives them more support levels than other indexes, if the larger cap names are showing severe weakness the small cap names won’t be spared from pain as well.

It should also be noted that IWM is only 4.24% above its 200 DMA’s support, which if that longer term trend breaks down may lead to further declines, particularly as it currently sits in a price zone that is historically Seller dominated 1.5:1 which may cause more of a further breakdown based on how the other indexes behave.

IWM has support at the $221.04 (Volume Sentiment: Buyers, 2:1), $216.73 (Volume Sentiment: Buyers, 1.4:1), $214.01 (Volume Sentiment: Sellers, 1.5:1) & $213.96/share (Volume Sentiment: Sellers, 1.5:1) price levels, with resistance at the $223.51 (Volume Sentiment: Buyers, 2:1), $225.20 (Volume Sentiment: Sellers, 2:1), $225.73 (Volume Sentiment: Sellers, 2:1) & $226.50/share (Volume Sentiment: Sellers, 2:1) price levels.

DIA, the SPDR Dow Jones Industrial Average ETF dropped -2.46% last week, as even blue chip stocks were displeased & showing weakness in the wake of the FOMC decision.

Their RSI is climbing higher after bouncing off of the oversold 30 level last week & sits at 39.53 due to the last two sessions of the week, while their MACD is bearish & near the lower end of its histogram.

Volumes were +30.13% above the previous year’s average (4,456,000 vs. 3,424,382), which is a bearish signal given that there was only one actual bullish session on the week.

The primary difference between DIA’s week & IWM’s vs. SPY/QQQ’s is that Tuesday’s session that was supported by the 50 day moving average was on a gap down & that Thursday’s session was advancing, but that it opened higher than it closed, forming what appears as a bullish harami, but that is bearish when you consider the price action of the day.

For the sake of brevity, this week watch for the impending 10 & 50 day moving average bearish crossover, which will likely push prices lower to close the window created by the US election’s gap up.

Should this happen & oscillators get stretched out lower, keep an eye out for an emerging head & shoulders pattern with the $431.69/share from October being the left shoulder.

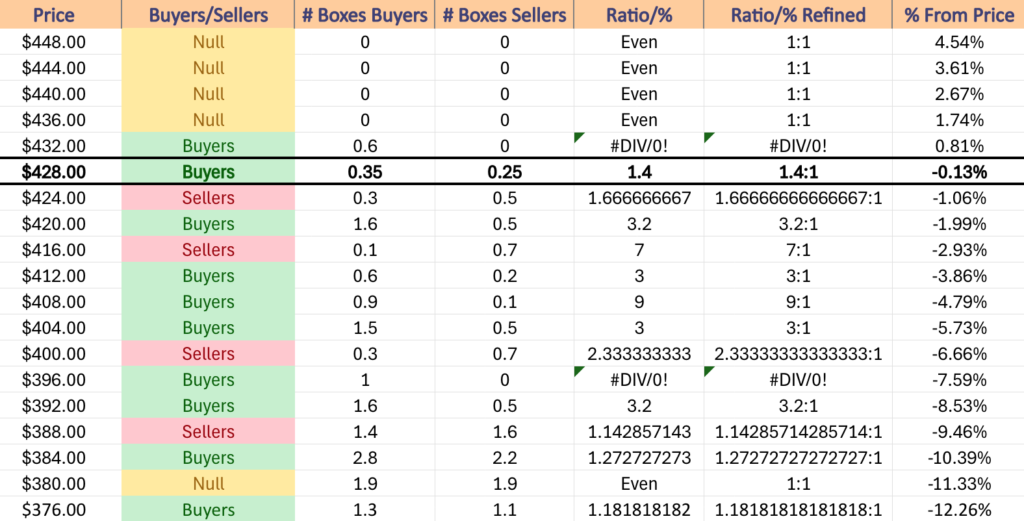

There isn’t as much support nearby for DIA vs. IWM, but given that DIA is the blue chip index it may not matter much, given that the component stocks are names that are most likely to be bought & held over the long-term anyways.

In the event of declines, it is worthwhile assessing the strength of their support levels using the table below & the ratios contained in it in order to gauge when market participants may step in to stop losses.

DIA has support at the $428.40 (Volume Sentiment: Buyers, 1.4:1), $414.99 (Volume Sentiment: Buyers, 3:1), $413.73 (Volume Sentiment: Buyers, 3:1) & $410.53/share (Volume Sentiment: Buyers, 9:1) price levels, with resistance at the $431.69 (Volume Sentiment: Buyers, 1.4:1), $433.64 (50 Day Moving Average, Volume Sentiment: Buyers, 0.6:0*), $435.08 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*) & $443.32/share (Volume Sentiment: NULL, 0:0*) price levels.

The Week Ahead

It looks to be a quiet holiday week ahead!

Monday the week kicks off with Consumer Confidence, Durable-Goods Orders & Durable-Goods minus transportation data at 8:30 am, followed by New Home Sales at 10 am.

There are no earnings reports scheduled for Monday, Tuesday or Wednesday & Tuesday the market closes at 1pm.

Tuesday & Wednesday have no major data announcements as it is the Christmas Holiday.

Initial Jobless Claims data are released Thursday morning at 8:30 am.

Friday winds the week down with Advanced U.S. Trade Balance in Goods, Advanced Retail Inventories & Advanced Wholesale Inventories data at 8:30 am.

There are no earnings reports on Thursday or Friday this week either.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***