SPY, the SPDR S&P 500 ETF gained +0.87% last week, while the VIX closed at 12.77, indicating an implied one day move of +/-0.81% & an implied one month move of +/-3.69%.

Their RSI is approaching the overbought mark & currently sits at 69.86, while their MACD is bullish, but the histogram is beginning to wane

Volumes were -45.47% lower than the previous year’s average (32,290,000 vs. 59,219,960), as market participants continue to tread cautiously so close to all-time high prices for SPY.

Things are beginning to look like the latter portion of a Jenga game with the low volumes & tight daily ranges that we have been seeing over the past few weeks.

Monday the week began on a quiet note, resulting in a low volume session that ended as a doji, indicating that there was uncertainty, but temporary equilibrium for SPY’s price, with the day’s upper shadow indicating that there was small appetite for the upside.

Tuesday featured more of the same, when the day closed as another doji candle that had a tight range for the session on even less volume than Monday.

Wednesday is where most of the week’s advancing price action came from, on account of the gap up open that came on the strongest volume of the week.

Sentiments returned to cautious on Thursday though & some profits from the gap’s jump were taken, as the session ended in a bearish harami pattern with Wednesday’s candle, indicating that there was fear on the horizon.

This carried into Friday, whose candle resembled that of the ones from earlier in the week & the week ended with a gravestone doji on a +0.19% gain for the day.

This week all eyes will be on Wednesday & Thursday for CPI & PPI data as it will lend clues as to what direction interest rates will move in (or stay the same) in the coming month.

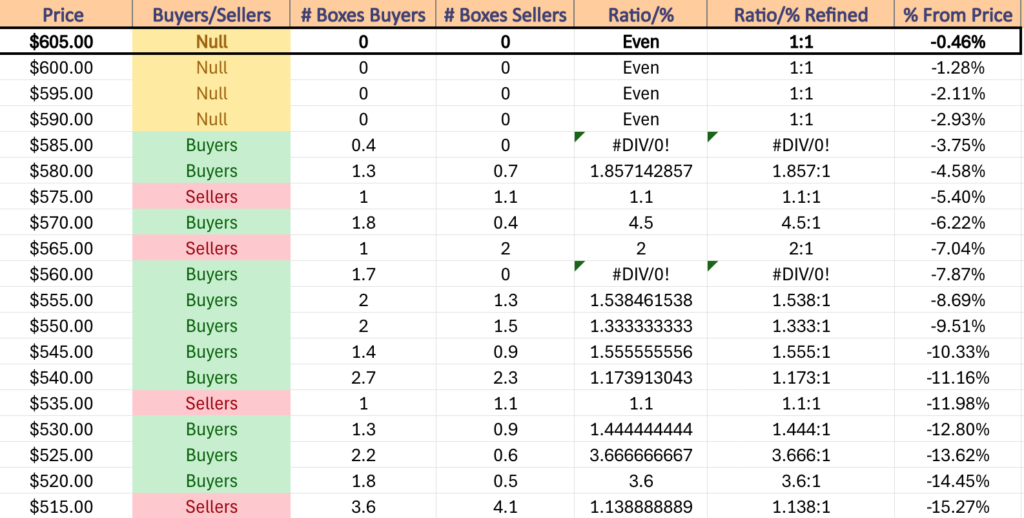

A key thing to watch will be should there be a 1% decline for SPY whether or not the $600.17/share support level holds up, as otherwise the next support level is not until $586.12, which is another -2.34% (totaling ~3.4%).

Another reason that this is important is because in the event that that level does not hold up, prices would likely pass bearishly through the 50 day moving average as well, which would open SPY up to test the window that was created in early November when prices gapped up over the 10 day moving average.

Despite the low volume the market was able to continue on & set a new all-time high last week, but that waning volume sentiment is indicating that there is a lack of confidence at the moment in SPY & it is difficult to see it climbing much higher without more volume & participation.

Due to the nature of SPY’s low volume while near all-time highs there is not much point in examining upside potential from where they sit currently & it is more important to understand how SPY may fall in the event of a decline/profit taking.

SPY has support at the $602.47 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $600.17 (Volume Sentiment: NULL, 0:0*), $586.12 (Volume Sentiment: Buyers, 0.4:0*) & $585.74/share (50 Day Moving Average, Volume Sentiment: Buyers, 0.4:0*) price levels, with resistance at the $609.07/share (All-Time High, Volume Sentiment: NULL, 0:0*) price level.

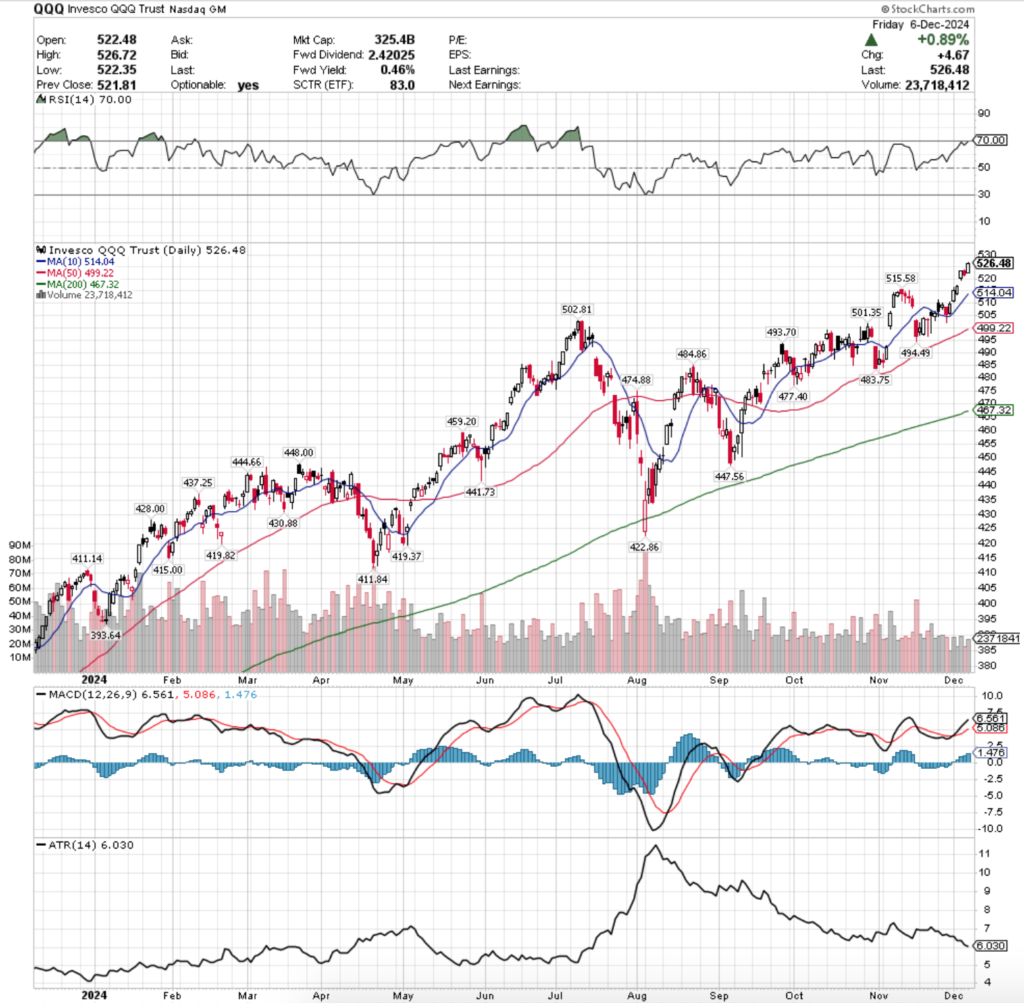

QQQ, the Invesco QQQ Trust ETF advanced +3.28%, as investors favored the tech-heavy index the most out of the major four index ETFs.

Their RSI closed at the overbought level of 70 on Friday, while their MACD remains bullish in the wake of Wednesday’s gap up session.

Volumes were -40.9% lower than the prior year’s average (22,354,000 vs. 37,825,929), as market participants were just as wary of QQQ as they were of jumping into SPY.

This should be noted, as SPY’s week featured weak volume but smaller daily ranges covered by their candlesticks compared to the broader sessions of QQQ’s week.

Monday kicked the week off on a gap up open for QQQ, which continued rising on the week’s second highest volume.

Tuesday volumes decreased but the advances continued for QQQ as prices were able to break back above the $515/share price level.

Wednesday opened on a gap up for QQQ much like it did for SPY on the week’s strongest volume, before profit taking commenced on Thursday & QQQ declined.

Friday the week closed on a high note with a new all-time high being set.

This coming week will hope to see higher volumes for QQQ, as it is difficult to continue climbing with such weak participation at all-time highs.

Even if QQQ’s price can manage to notch another all-time high this week, the current environment’s sentiment is running on fumes & is not sustainable for much longer.

QQQ’s next support level is currently -2% below Friday’s closing price, which is just above their 10 day moving average.

Should those break down there aren’t any support levels for an additional -2.5%, at which point price would be wedged between the resistance of the 10 day moving average & the support of the 50 DMA.

It should be noted that most of the support levels for the first ~8-9% of declines from QQQ’s closing price on Friday have not faced significant seller pressure over the past ~2 years, which will be something to be mindful of in the event of retests in the near-future.

QQQ has support at the $515.58 (Volume Sentiment: NULL, 0:0*), $514.04 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $502.81 (Volume Sentiment: Buyers, 2:0*) & $501.35/share (Volume Sentiment: Buyers, 2:0*) price levels, with resistance at the $526.72/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

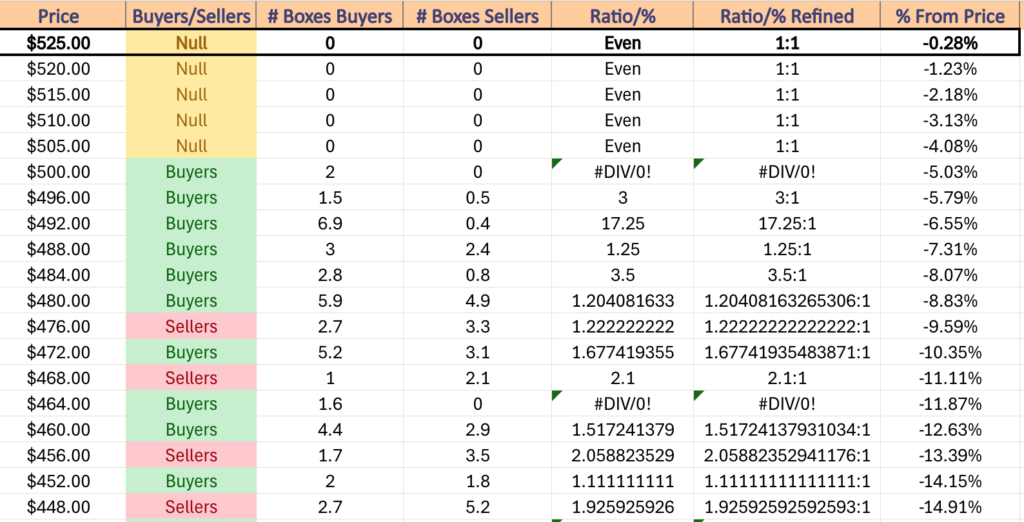

IWM, the iShares Russell 2000 ETF declined -1.22% last week, as the small cap index was the most shunned out of the major four.

Their RSI is currently at 58.53, while their MACD crossed over the signal line bearishly on Thursday.

Volumes were -33.9% lower than the prior year’s average (21,508,000 vs. 32,537,075), as market participants were even unenthusiastic about the small cap index.

Given that IWM declined on low volume it is not as bad of a sentiment reading than QQQ who advanced on even lower volume, but it is still a signal to take caution.

Monday set the stage for the week of declines, as the highest volume of the week came on a session that resulted in a hanging man candle whose lower shadow extended all the way down to the $240/share level.

Tuesday IWM’s slide continued as the session opened lower, attempted to reach the open of Monday’s session but was unable to & the rest of the session was spent in decline.

Wednesday the bleeding was temporarily halted, but there was a lot of uncertainty in the air given the week’s lowest volume session also resulted in a spinning top candle whose lower shadow was perched atop of the support of the 10 day moving average.

Thursday that support gave way shortly after the session’s open & the $237.50/share level was briefly touched, but IWM was able to close just above it, leading into Friday’s gap up open that proceeded to decline as the day wore on.

Friday’s session formed a bearish harami pattern with Thursday’s, which is troubling entering a new week when the nearest support level for IWM is -4.64% below their closing price on Friday.

The good news for IWM is that the 50 day moving average and another support level reside in the $227-228/share price range, but the bad news is that over the past ~2 years there has been 2 Sellers for every Buyer at this price level.

This is particularly bad for IWM here as this price level upon being reached has often resulted in further declines, which will be something to be mindful of in the event of a retest.

The good news in the event of a retest is that there are lots of support touch points below it, but to reach those levels the price would have to pass below the 50 day moving average’s support, placing it then below both the 10 & 50 DMAs.

IWM has support at the $227.85 (Volume Sentiment: Sellers, 2:1), $227.82 (50 Day Moving Average, Volume Sentiment: Sellers, 2:1), $227.17 (Volume Sentiment: Sellers, 2:1) & $225.87/share (Volume Sentiment: Sellers, 2:1) price levels, with resistance at the $240.43 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $242.39 (Volume Sentiment: NULL, 0:0*) & $244.98/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

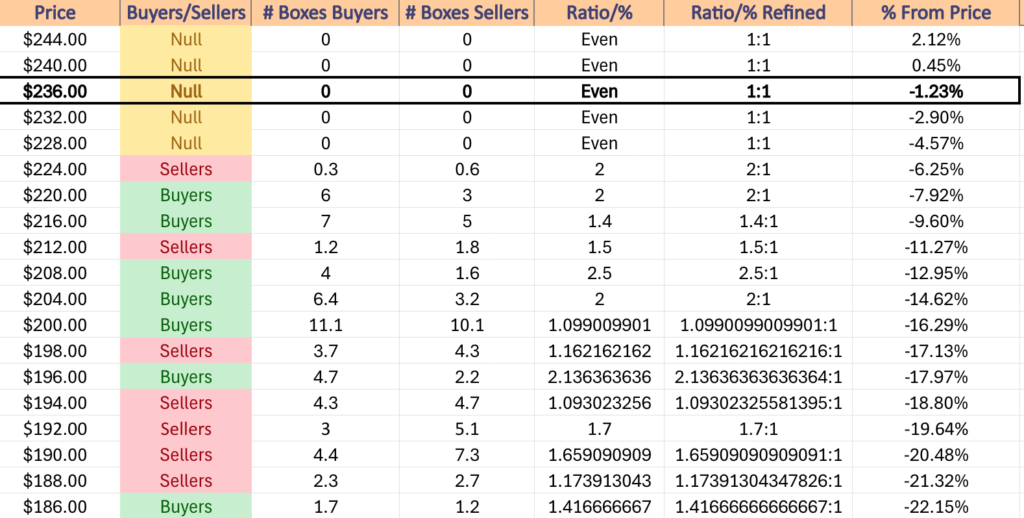

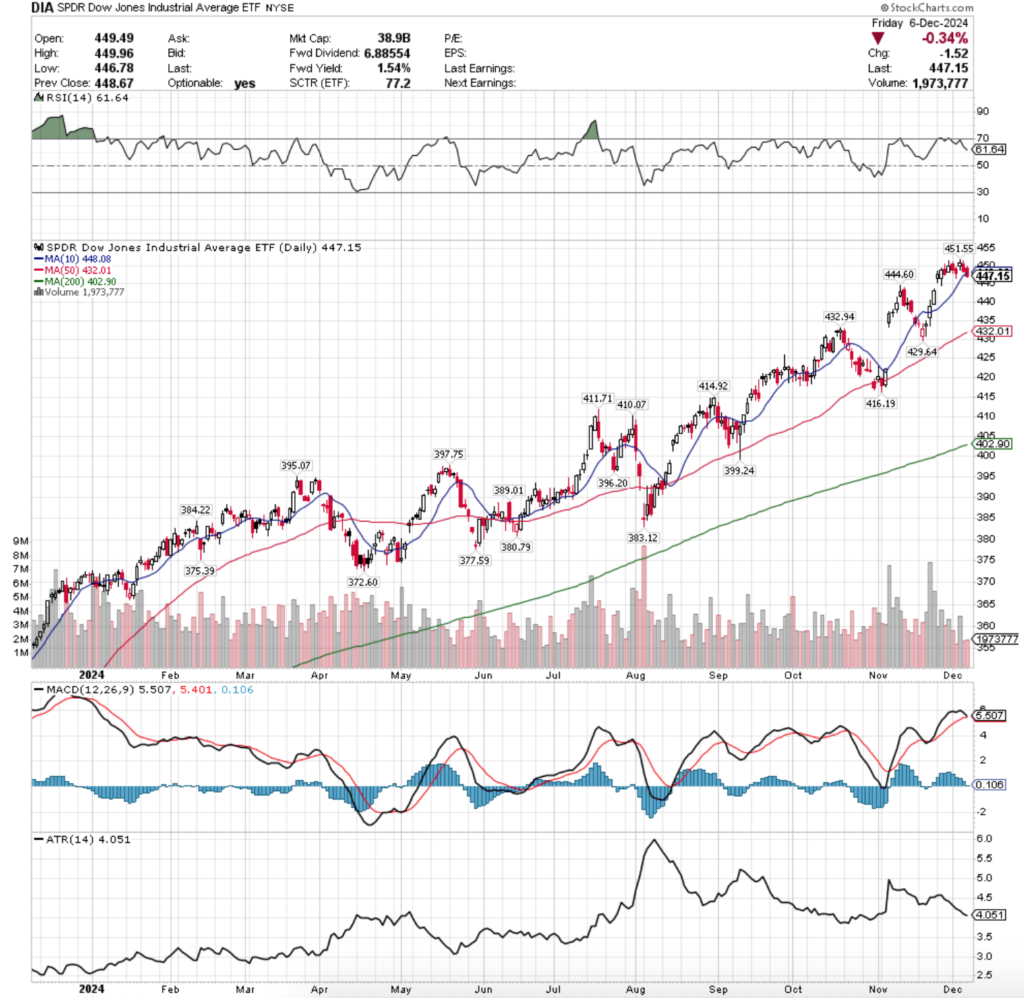

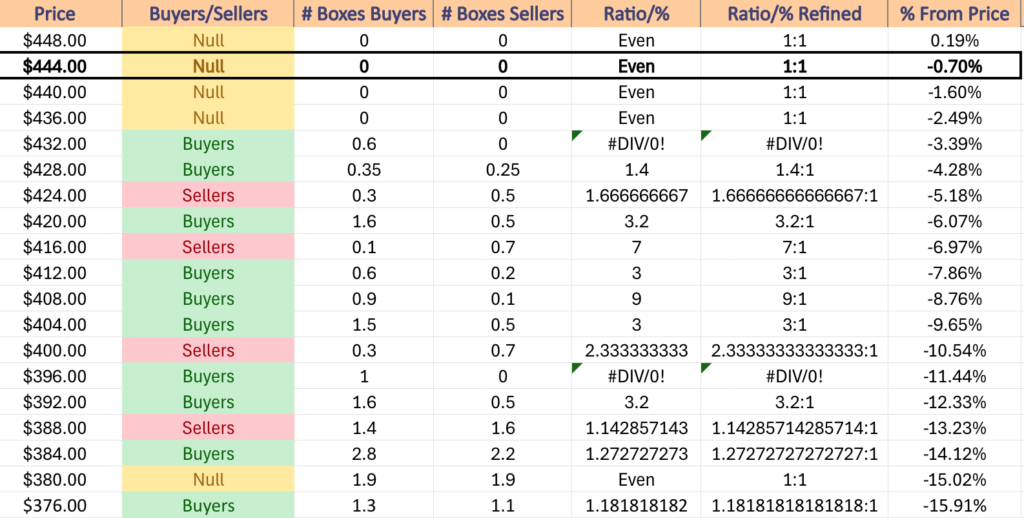

DIA, the SPDR Dow Jones Industrial Average ETF dipped -0.65%, as the blue chip index was unable to turn a positive week last week.

Their RSI is trending back towards neutral & sits currently at 61.64, while their MACD is set to cross over the signal line bearishly on Monday.

Volumes were -31% lower than the previous year’s average (2,388,000 vs. 3,460,000) & market participants were even not diving into the safety of blue chip names near these all-time highs across the major four indexes.

One thing that jumps out immediately when looking at DIA’s chart is that Friday’s close occurred below the support of the 10 day moving average while the price still sits on the island that formed two weeks ago.

Much like IWM, DIA started the week off on a foreboding note with a session that opened higher than Friday’s close, tested slightly higher briefly, before ultimately declining.

Tuesday followed suit & DIA continued lower, but managed to close down only midway through the day’s total range.

Wednesday showed some brief optimism by opening on a gap up, but uncertainty was the story coming into the close as the session ended as a spinning top candle on the highest volume of the week & a new all-time high was hit for DIA.

Thursday the declines continued, although there was an attempt made to reach the high of Wednesday & set another all-time high, but market participants did not want to assume more risk.

Risk-off sentiment continued into the weekend, as the third highest volume of the week came on Friday’s declining session that broke through the support of the 10 DMA.

This week will be important to keep an eye on the window that created the island that DIA’s been trading on for the past two weeks or so, as now that it has broken through the support of the 10 DMA it looks set to potentially fill the gap.

Another area of interest to observe is that if the $444.60/share support level is broken through in the coming days, the next support level doesn’t occur for another -2.6% (-3.6% total from Friday’s closing price).

If that breaks down then price will enter into a range where there have historically been some strong Sellers:Buyers until the $414.92/share support level is reached.

As with all of the others above, when this close to all-time highs & on such weak volumes there is not much point to describing potential upside activity.

DIA has support at the $444.60 (Volume Sentiment: NULL, 0:0*), $432.94 (Volume Sentiment: Buyers, 0.6:0*), $432.01 (50 Day Moving Average, Volume Sentiment: Buyers, 0.6:0*) & $429.64/share (Volume Sentiment: Buyers, 1.4:1) price levels, with resistance at the $448.08 (10 Day Moving Average, Volume Sentiment: ) & $451.55/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

The Week Ahead

Monday kicks the week off with Wholesale Inventories data at 10 am.

Hello Group reports earnings before Monday’s opening bell, followed by Toll Brothers, Braze, C3.ai, Casey’s General, MongoDB, Oracle, Phreesia, Vail Resorts & Yext after the session’s close.

NFIB Optimism Index data is released Tuesday at 6 am, followed by U.S. Productivity (revision) data at 8:30 am.

Tuesday morning features earnings reports from Academy Sports + Outdoors, AutoZone, Designer Brands, Ferguson, G-III Apparel, Ollie’s Bargain Outlet & United Natural Foods, with Dave & Buster’s, GameStop & Stitch Fix reporting after the closing bell.

Wednesday brings us Consumer Price Index, CPI Year-over-Year, Core CPI & Core CPI Year-over-Year data at 8:30 am, followed by Month U.S. Federal Budget data at 2pm.

Cognyte Software, Photronics & REV Group report earnings on Wednesday morning, with Adobe, Nordson & Oxford Industries reporting after the session closes.

Initial Jobless Claims, Producer Price Index, Core PPI, PPI Year-over-Year & Core PPI Year-over-Year data are all scheduled to be released Thursday morning at 8:30 am.

Thursday morning’s earnings report comes from Ciena, with Broadcom, Costco Wholesale & RH reporting after the closing bell.

Friday winds the week down with Import Price Index & Import Price Index minus Fuel data at 8:30 am & there are no noteworthy earnings reports scheduled for the day.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***