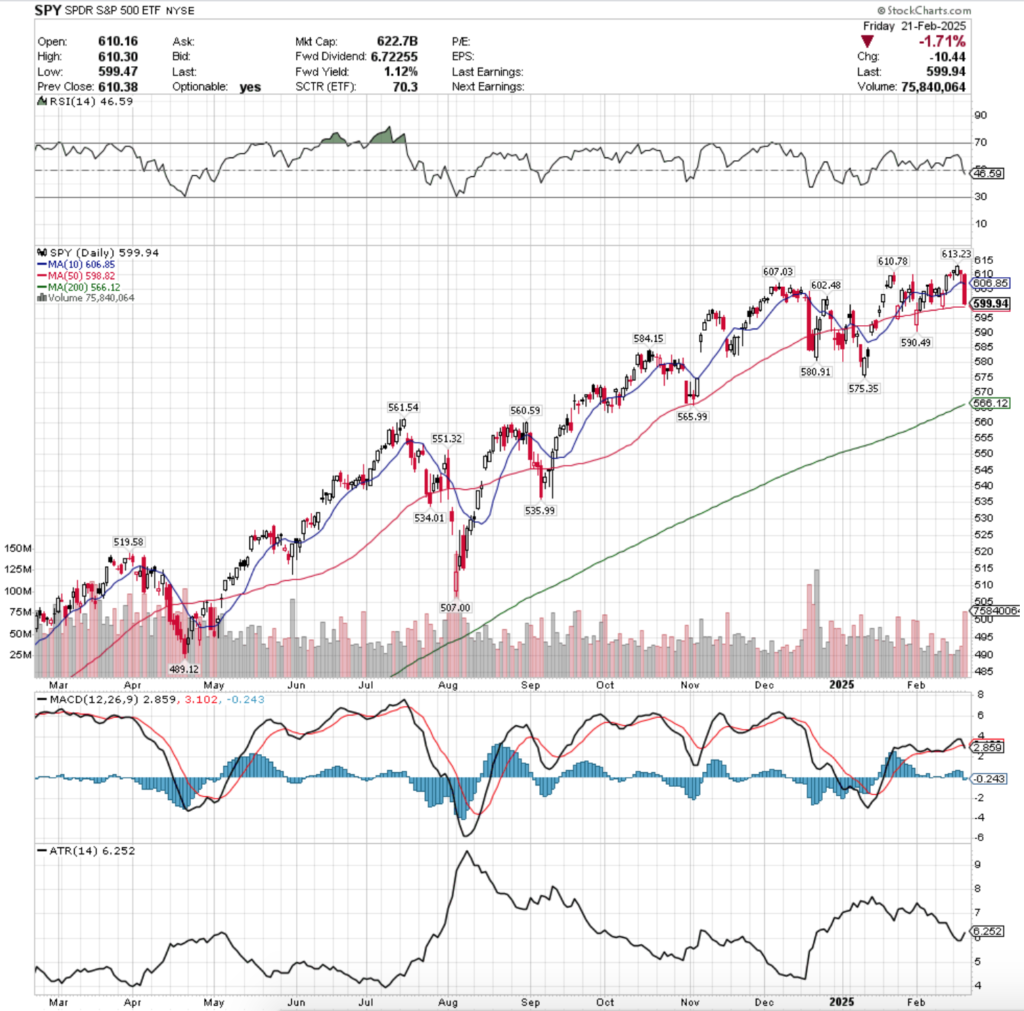

SPY, the SPDR S&P 500 ETF dropped -1.6% this week, while the VIX closed the week out at 18.21, indicating an implied one day move of +/-1.15% & an implied one month move of +/-5.26%.

The RSI just crossed bearishly through the neutral 50 mark, while their MACD crossed over bearishly on Friday.

Volumes were -19.47% lower than the previous year’s average (42,707,500 vs. 53,030,635), which carries bearish sentiment with it given that the opening two sessions of the week were advancing, but had the lowest volumes of the week.

Readers should also refer to last week’s note where we broke down the major declines in prior year’s volume from today’s levels to the same metric from one year ago to see how this weak participation rate is even worse given how much less volume this past year has seen vs. the prior year.

Tuesday kicked last week off on a rather ominous note as the extremely low volume session resulted in a hanging man candle (bearish) that also closed lower than it opened, after an opening gap up from the previous Friday’s close.

Wednesday’s candle formed a bullish engulfing pattern with Tuesday’s, but with the same low volume turnout there was nothing to get excited about for SPY.

Thursday confirmed this when SPY opened in the middle of Wednesday’s range, before plunging lower & testing the support of the 10 day moving average.

Volumes were slightly higher than the preceding two days, and the day’s candle formed a bearish harami pattern.

Friday opened lower & on the highest volume of 2025 SPY plunged through the support of their 10 day moving average & made a run lower at the 50 DMA’s support level.

As I am finishing writing this on Tuesday morning SPY has already broken through the 50 DMA, which brings us to an interesting week ahead.

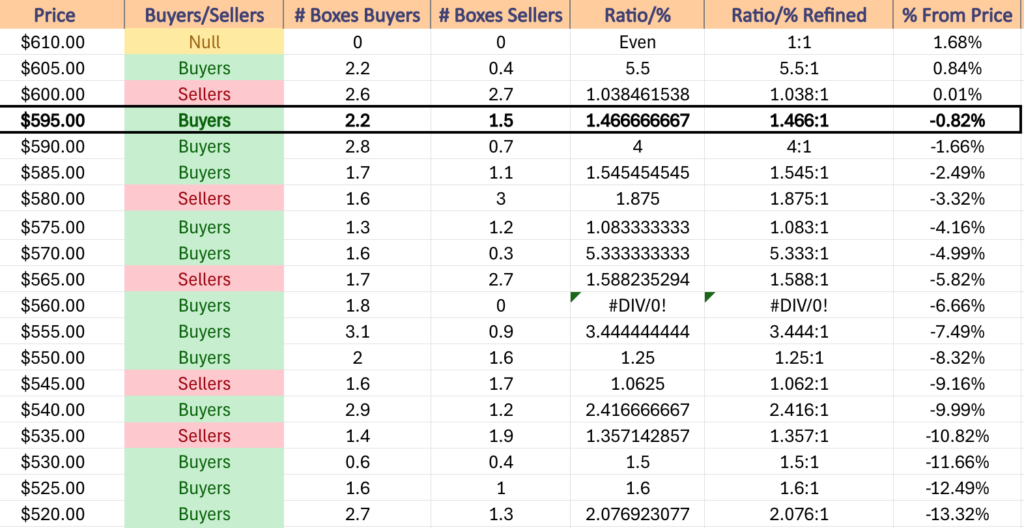

As the table below notes, there is now (Tuesday) only one support level between SPY’s current price & a price zone that has been dominated by the Sellers at a rate of 1.88:1 over the past ~2-3 years.

This makes it likely that these support levels will not be able to sustain SPY’s current declines, which would mean prices are scheduled to drop -3.32%+ from Friday’s closing price.

It seems unlikely that SPY will see any major advances this week, and the most likely outcome will be either a continued decline & or a consolidation around the 50 day moving average.

NVIDIA Corp.’s earnings call tomorrow afternoon will likely be the linchpin that dictates which of those two outcomes occurs.

It will require a massive beat in order to see a turnaround for SPY & the advances to continue, making this week’s theme to watch for is how closely aligned SPY’s price stays with their 50 day moving average.

In the event of declines & changing (lowering) of support levels, the table below is useful to measure the strength or weakness of the new support/resistance levels.

One other item that should be on readers’ radar in the coming weeks is that the 200 day moving average (long-term trend) is -5.64% below Friday’s closing price.

That long-term trend line is also located in a Seller dominated zone, meaning that SPY’s long-term trend is potentially at risk of breaking down, as Sellers have been the favorites of the $565-569.99/share zone at a rate of 1.59:1 over the past ~2-3 years.

This will be especially interesting to watch if the price remains below the 10 & 50 day moving averages for many days or if it strays too far south of them.

SPY has support at the $598.82 (50 Day Moving Average, Volume Sentiment: Buyers, 1.47:1), $590.49 (Volume Sentiment: Buyers, 4:1), $584.15 (Volume Sentiment: Sellers, 1.88:1) & $580.91/share (Volume Sentiment: Sellers, 1.88:1), with resistance at the $602.48 (Volume Sentiment: Sellers, 1.04:1), $606.85 (10 Day Moving Average, Volume Sentiment: Buyers, 5.5:1), $607.03 (Volume Sentiment: Buyers, 5.5:1) & $610.78/share (Volume Sentiment: NULL, 0:0*).

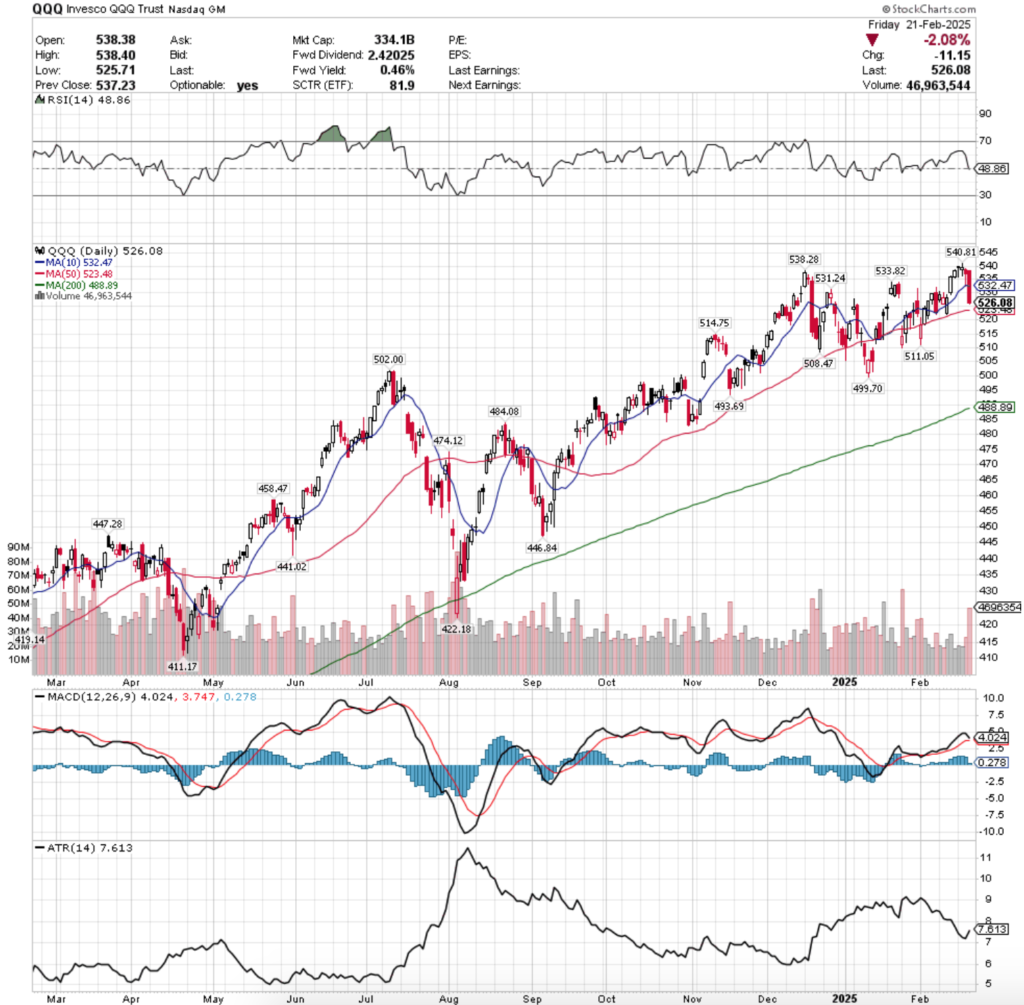

QQQ, the Invesco QQQ Trust ETF fell -2.24% last week, as the tech heavy index was not immune to the turbulence across broader markets.

The RSI also just crossed bearishly through the neutral 50-mark, while their MACD ended the week ready to bearishly crossover early this week.

Volumes were -18.83% below the previous year’s average (28,470,000 vs. 35,075,000), which much like SPY above is concerning given how low their current prior year’s average level is compared to that same metric from one year ago.

Tuesday kicked the week off in a similar manner to SPY, as QQQ opened on a gap up, but was forced lower to retrace most of the previous day’s range throughout the session on light volume & ultimately closed higher, but lower than it opened.

The uncertainty & skittishness continued into Wednesday, when another low participation session took place & the session ended as a high spinning top, indicating extreme uncertainty with a dash of nervousness among market participants.

Wednesday opened lower but was able to recover by the close & close higher on a day, but the caution lights were flashing brightly.

Thursday confirmed this when QQQ opened lower, briefly tried to climb higher, but was rejected & wound up going all the way down to test the support of the 10 day moving average.

While the support held up for Thursday, the session still resulted in a hanging man candle (bearish) & it became clear that with a little more volume there would be steeper losses on the horizon.

Friday delivered both the volume & the declines, as the third most active day of the year for QQQ fell straight through the 10 day moving average’s support, as market participants were all eager to hop out of the pool taking limited risk into the weekend.

While QQQ closed above the 50 day moving average’s support on Friday, it should be noted that it was only -0.49% below it when the session ended.

With the MACD set to crossover bearishly in the first half of this week, there will be a breakdown of QQQ’s 50 DMA.

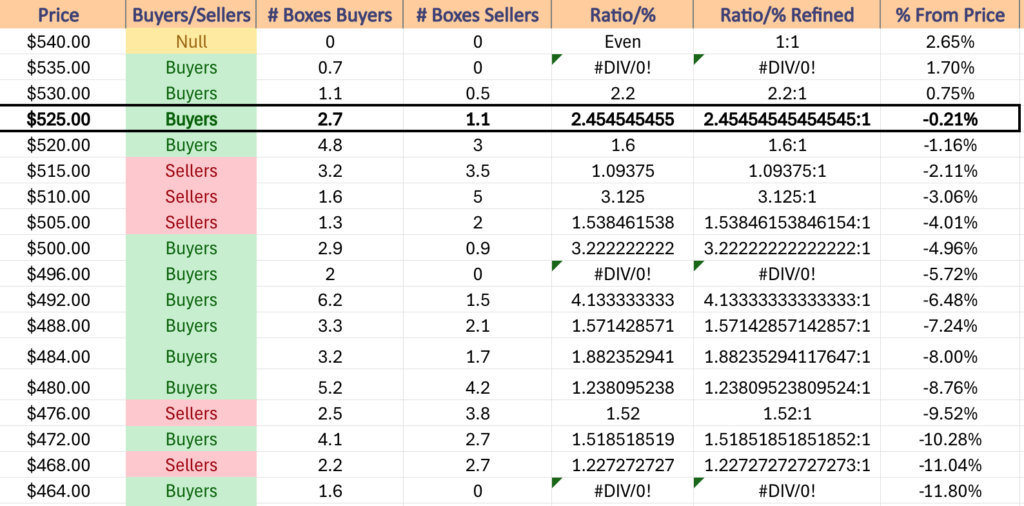

This is problematic, as the next two support levels for QQQ are in Seller dominated zones (see table below) & the lower range of the bottom zone is a -4.01% decline from Friday’s closing price.

While NVDA is sure to impact the price of QQQ this week, as we’ve published for weeks now anything to the upside that has staying power will need a big improvement in volume, else it should be viewed with skepticism.

All eyes should be watching how the price & 50 day moving average move in relation to one another this week, as pending no high volume pivot north & no outright disappointing news the best case scenario currently looks like QQQ’s price will move around straddling the 50 DMA’s support/resistance.

In the event of outright declines, the $499.70/share support level will be an area to keep an eye on as it occurs in a zone with limited data on historic selling pressure, as Buyers have typically outdone Sellers at a rate of 2:0*, which may mean we get to see more sellers emerge at this level.

It’s also important as its the second to last support level before the 200 day moving average (long-term trend) is approached by QQQ’s price, and in the event of a breakdown it appears that the long-term trend will at least be tested.

QQQ has support at the $523.48 (50 Day Moving Average, Volume Sentiment: Buyers, 1.6:1), $514.75 (Volume Sentiment: Sellers, 3.13:1), $511.05 (Volume Sentiment: Sellers, 3.13:1) & $508.47/share (Volume Sentiment: Sellers, 1.54:1), with resistance in the $531.24 (Volume Sentiment: Buyers, 2.2:1), $532.47 (10 Day Moving Average, Volume Sentiment: Buyers, 2.2:1), $533.82 (Volume Sentiment: Buyers, 2.2:1) & $538.28/share (Volume Sentiment: Buyers, 0.7:0*).

IWM, the iShares Russell 2000 ETF declined -3.62% last week, as the small cap index had the worst performance out of the major four index ETFs.

The RSI is approaching oversold territory & currently sits at 35.41, while the MACD has been bearish for the past few sessions.

Volumes were -17.72% below the prior year’s average (23,727,500 vs. 28,836,032), which is even low based on the standards of the prior two index ETF’s Y-o-Y comparisons, as IWM’s look-back comparison is only ~-15% from one year ago.

Tuesday started the week off on a positive, but worrisome note for the already battered IWM, as the week’s lowest volume session resulted in slight gains.

Wednesday saw the unraveling begin, with a gap down open that was below both the closely-knit 10 & 50 DMAs, and prices were able to run higher, temporarily breaking above each, but the day closed with low volume & in-line with the moving averages.

Thursday saw an uptick in volume, as IWM opened in-line with the 10 & 50 day moving averages, before cratering lower & leaving a lower shadow that showed that was still a lot of bearish sentiment abound.

Friday brought one of last week’s observations to the forefront quickly, as the session opened just above the 10 & 50 day moving averages, but the sellers came out at the highest level of 2025 to drive IWM’s price lower, to the point of temporarily breaking through the 200 DMA’s support.

IWM still closed just above the long-term trend line, but it became clear that there is appetite for IWM to continue lower in the near-term.

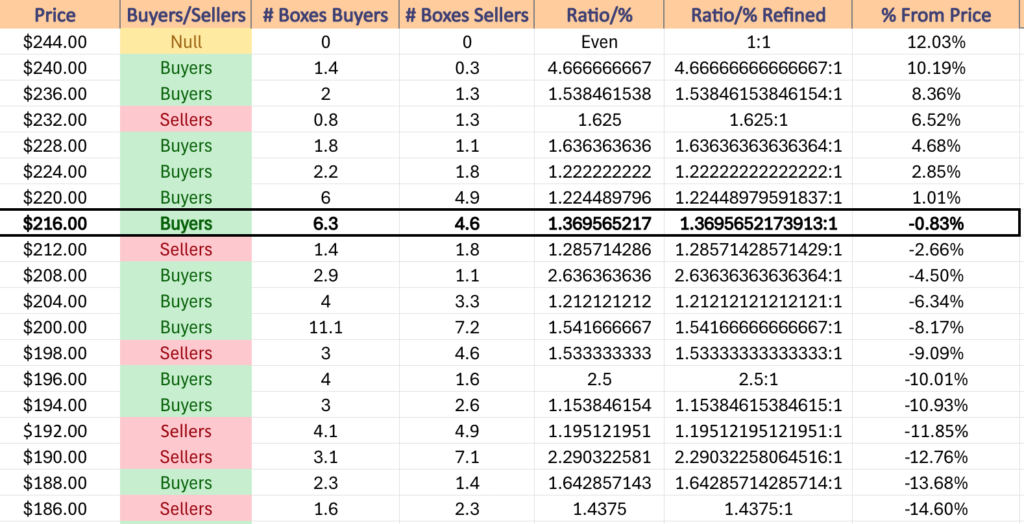

This is especially likely given that the $212-215.99/share price zone is historically a Seller’s Paradise at a rate of 1.29:1 over the past ~2-3 years.

In the event that this long-term trend does break down, it will be prudent to keep an eye on how the $208/share level holds up, as the Buyer dominated zones beneath it are not as strong as the $208-211.99 zone.

Otherwise, the current best case near-term scenario looks to be IWM oscillating around the 200 DMA while it continues its recent consolidation.

While it isn’t impossible, any upside move would need a great deal of volume behind it before it shows to have any staying power & sustainability, and it would also be stuck beneath some strong resistance levels/zones.

It would be wise to reference the table below in the coming weeks in regards to IWM’s price levels & support/resistance.

IWM has support at the $217.49 (200 Day Moving Average, Volume Sentiment: Buyers, 1.37:1), $216.73 (Volume Sentiment: Buyers, 1.37:1), $214.01 (Volume Sentiment: Sellers, 1.29:1) & $213.97/share (Volume Sentiment: Sellers, 1.29:1), with resistance at the $217.85 (Volume Sentiment: Buyers 1.37:1), $220.67 (Volume Sentiment: Buyers, 1.23:1), $221.04 (Volume Sentiment: Buyers, 1.23:1) & $223.51/share (Volume Sentiment: Buyers, 1.23:1).

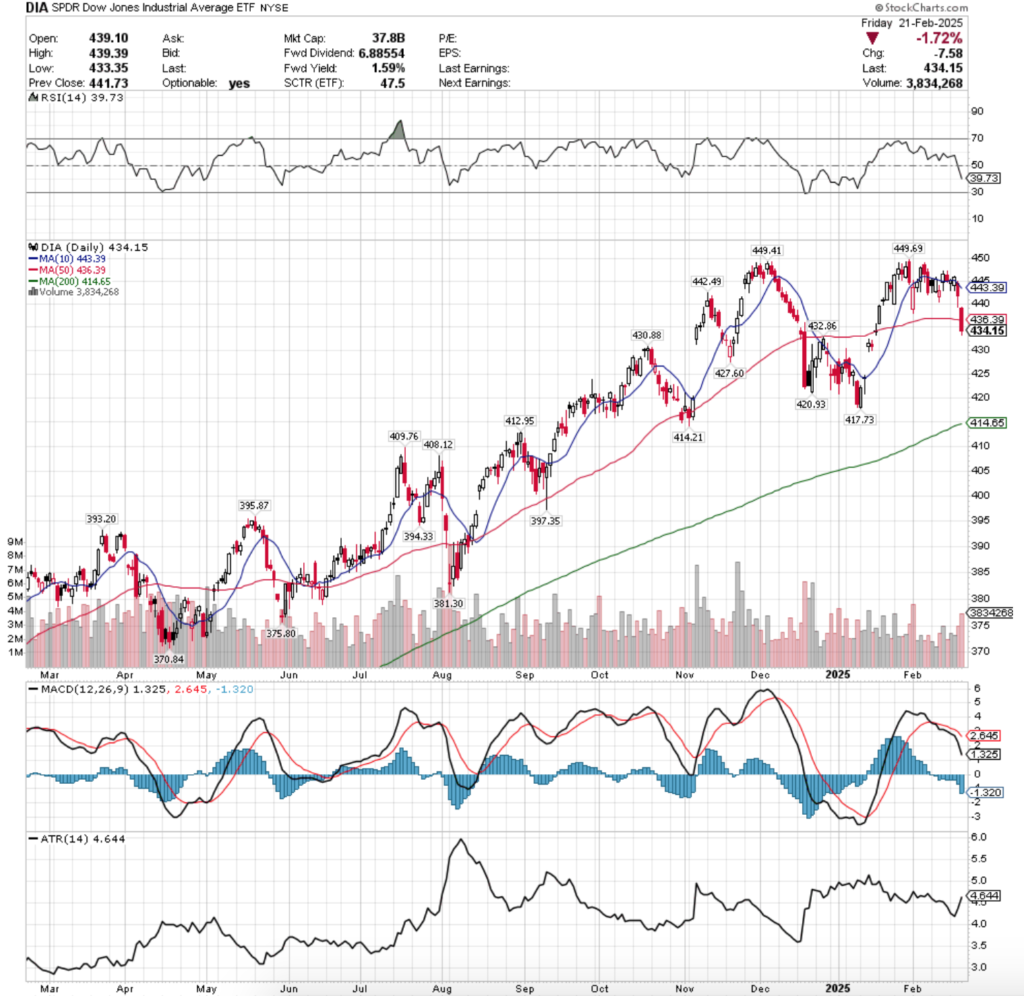

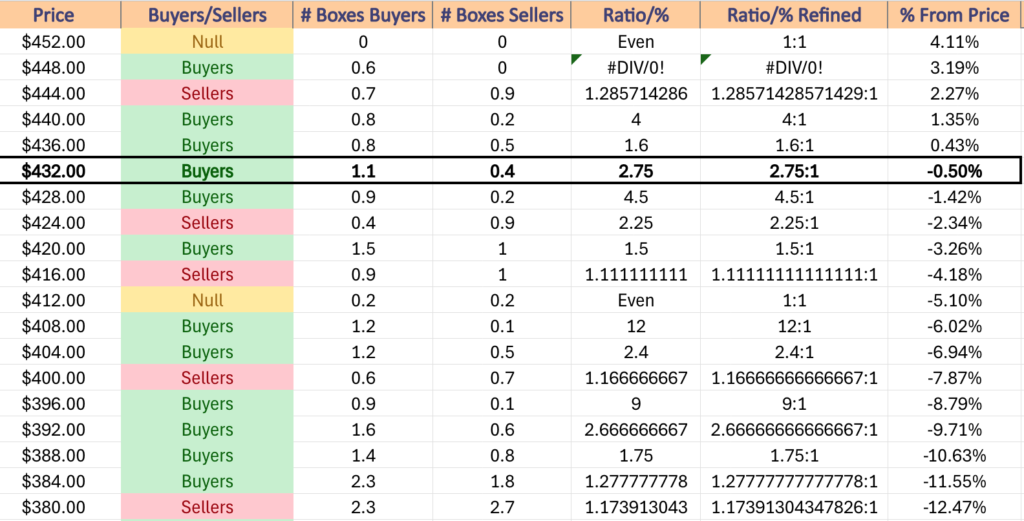

DIA, the SPDR Dow Jones Industrial Average ETF fell -2.61% last week, as even the blue chip stocks were not immune to the losses across the board.

The RSI is also approaching the oversold level of 30 & currently sits bearishly at 39.73, while the MACD has been bearish for the past couple of weeks.

Volumes were -11.62% lower than the previous year’s average (2,872,500 vs. 3,250,159), which is a warning sign given that their Y-o-Y prior year’s average volume is only down -6%, so there is a bit of fear out there.

Tuesday saw a low volume session that’s lower shadow on the day’s candle & the fact that the day closed in-line with the resistance of the 10 day moving average signaled that there was a bit of trouble ahead for DIA.

Wednesday opened on a gap lower, tested to about the same depths as Tuesday, before powering north of the 10 DMA’s resistance to close above it for an advancing session.

However, the low volume levels did not provide adequate confirmation that the move had any traction.

Thursday opened lower, near in-line with the 10 DMA’s support, before caving & at one point trading below the $440/share mark.

Volumes ticked up on Thursday, hinting that there would be a big risk-off into the weekend session.

DIA provided that on Friday, while on the highest volume of the week & second highest of the year they opened on a gap down, blew through the 50 day moving average & continued lower, closing in a daily decline of -1.72%.

With the 50 DMA broken through, it puts the long-term trend in danger, as it sits -4.5% below Friday’s closing price.

Now that the 10 & 50 DMAs are both sitting atop the price, it looks like there will be continued weakness & some profit taking in the coming week(s) for DIA.

One area of strength that they have is that there are more support touch-points along the way down to the 200 DMA re-test, but if there are broader market declines that will be of little importance.

Best case outlook for DIA for the rest of the week is a consolidation range around the 50 DMA, but there are a few windows that still haven’t been filled which may lead to a re-test of that long-term trend line sooner than most anticipate.

It would be wise to reference the table below as DIA approaches & retests support/resistance levels over the next week or two to understand how market participants have typically behaved at these levels.

DIA has support at the $432.86 (Volume Sentiment: Buyers, 2.75:1), $430.88 (Volume Sentiment: Buyers, 4.5:1), $427.60 (Volume Sentiment: Sellers, 2.25:1) & $420.93/share (Volume Sentiment: Buyers, 1.5:1), with resistance at the $436.39 (50 Day Moving Average, Volume Sentiment: Buyers, 1.6:1), $442.49 (Volume Sentiment: Buyers, 4:1), $443.39 (10 Day Moving Average, Volume Sentiment: Buyers, 4:1) & $449.41/share (Volume Sentiment: Buyers 0.6:0*).

The Week Ahead

Monday has no major economic data due for release.

BioCryst Pharmaceuticals, Clearway Energy, Domino’s Pizza, Fresh Del Monte, KBR, Owens Corning & Westlake all report earnings Monday before the opening bell, followed by Atlas Energy Solutions, Beyond, BWX Technologies, Cannae Holdings, Chegg, Civitas Resources, Clean Energy Fuels, Cleveland-Cliffs, Coterra Energy, Diamondback Energy, Douglas Dynamics, EverQuote, Goosehead Insurance, Helios Technologies, Hims & Hers Health, JBT Marel, LTC Properties, MediaAlpha, Myriad Genetics, Navitas Semiconductor, ONEOK, Primoris Services, ProAssurance, Public Storage, Quaker Chemical, Realty Income, Riot Platforms, SBA Communications, Tempus AI, Topgolf Callaway Brands, Trex, Trip.com Group, Ultra Clean Holdings, V2X, Veracyte, Viper Energy Partners, Ziff Davis & Zoom Communications, after the session’s close.

Fed President Logan speaks Tuesday at 3:20 am, followed by S&P Case-Shiller Home Price Index (20 Cities) at 9 am & Consumer Confidence at 10 am.

Tuesday’s pre-market earnings calls include Home Depot, AdaptHealth, Alcon, Amer Sports, American Tower, Archrock, Arcus Biosciences, Armstrong World Industries, Bank of Montreal, Bank of Nova Scotia, Carter’s, CECO Environmental, CG Oncology, Delek US Holdings, Diana Shipping, DigitalOcean, Driven Brands, Easterly Government Properties, Elanco Animal Health, Expro Group, GFL Environmental, Harmony Biosciences, Henry Schein, Integra, Interface, International Game Technology, Itron, Keurig Dr Pepper, Kiniksa Pharmaceuticals, Kontoor Brands, Krispy Kreme, LGI Homes, LivaNova, Novanta, Pinnacle West, Planet Fitness, Portillo’s, Public Service, Sealed Air, Sempra Energy, Shoals Technologies, Shutterstock, Super Group, TopBuild, Viking Holdings, Xenia Hotels & Xometry, with Agilon Health, AMC Entertainment, Axon, B&G Foods, Boston Beer, Caesars Entertainment, Camping World, CAVA Group, CCC Intelligent Solutions, Chord Energy, Coupang, Day One Biopharmaceuticals, ExlService, Extra Space Storage, First Solar, Flywire, Grocery Outlet, Huron Consulting, Inogen, Instacart, Interparfums, Intuit, Jack In The Box, Jazz Pharmaceuticals, Keysight Technologies, Lemonade, Light & Wonder, Lucid Group, Maravai Life Sciences, Masimo, Matson, Merit Medical, National Health, ODDITY Tech, OraSure, OUTFRONT Media, Par Pacific, Permian Resources, Playa Hotels & Resorts, PROCEPT BioRobotics, Range Resources, Revolve Group, RLJ Lodging Trust, RxSight, Skyward Specialty Insurance Group, Sprout Social, SPX Technologies, Supernus Pharma, TETRA Technologies, The Baldwin Group, Vaxcyte, WEBTOON Entertainment, Workday, Workiva, Zeta Global, ZipRecruiter & ZoomInfo all due to report after the closing bell.

Wednesday features New Home Sales data at 10 am.

ACM Research, Advance Auto Parts, AerCap, APi Group, Astec Industries, AvidXchange, Avista, Bentley Systems, Bloomin’ Brands, Brinks, CBIZ, Centuri Holdings, Clear Secure, Commscope, Dole, DT Midstream, EMCOR Group, Enovis Corp, Federal Signal, Geron, International Money Express, Janus International Group, Lantheus Holdings, Lineage, Loar Holdings, Lowe’s, Madrigal Pharmaceuticals, MGP Ingredients, National Vision, NRG Energy, ODP Corp, Option Care Health, Photronics, Rhythm Pharmaceuticals, Southwest Gas, StandardAero, Steven Madden, Taboola, The Vita Coco Company, United Parks & Resorts, Verisk Analytics & XPEL all report earnings before Wednesday’s opening bell, followed by the much anticipated Nvidia, Salesforce, Agilent Technologies, Albany International, Alphatec, Ambarella, Applied Optoelectronics, Barrett Business, Beyond Meat, Cactus, CareDx, Certara, Chemed, Chesapeake Utilities, Corcept Therapeutics, Dorman Products, eBay, Encore Capital, Energy Recovery, EPR Properties, Essential Utilities, Establishment Labs, EVERTEC, Expand Energy, FirstEnergy, Forward Air, Green Brick Partners, Greif, HEICO, Howard Hughes Holdings, Ibotta, Innovex International, Invitation Homes, IonQ, Joby Aviation, Kinetik, Kratos Defense and Security, LegalZoom.com, Magnite, MARA Holdings, Marqeta, Marriott Vacations, MYR Group, National Storage Affiliates, New Mountain Finance, Nutanix, Ormat Technologies, Ovintiv, Paramount Global, Pebblebrook Hotel Trust, Pure Storage, Root, Rush Street Interactive, Sarepta Therapeutics, Schrodinger, Seadrill, Sinclair Broadcast, Sitio Royalties, Snowflake, Stoneridge, Sun Communities, Sweetgreen, Synopsys, Talos Energy, Tandem Diabetes Care, Teladoc, TKO Group Holdings, Universal Health, Urban Outfitters, Vir Biotechnology, VSE Corp & Western Midstream who are all due to report after the closing bell.

Initial Jobless Claims, Durable-Goods Orders, Durable-Goods minus Transportation & GDP (second revision) are all due out Thursday morning at 8:30 am, followed by Pending Home Sales data at 10 am & Fed President Hammack speaking at 1:15 pm.

Thursday morning kicks off with earnings from Acushnet, ADT, American Woodmark, Ardagh Metal Packaging, Bath & Body Works, Beacon Roofing Supply, California Water, Cars.com, CIBC, Cogent Communications, Dentsply Sirona, Donaldson, Ducommun, Ecovyst, Endeavor Group, Evergy, Frontdoor, GoodRx, Gray Media, Hayward Holdings, Hilton Grand Vacations, Hormel Foods, Installed Building Products, International Seaways, J.M. Smucker, Kimbell Royalty Partners, Koppers Holdings, Life Time, LifeStance Health Group, Ligand Pharmaceuticals, Macerich, Millicom International Cellular, NCR Voyix, Nexstar, Norwegian Cruise Line, NovoCure, Papa John’s, Payoneer, PENN Entertainment, Playtika, Privia Health, Royal Bank of Canada, Scholar Rock, SITE Centers, Sotera Health, Stagwell, Starwood Property Trust, Strategic Education, TechnipFMC, Tecnoglass, TEGNA, Teleflex, Thryv, Toronto-Dominion Bank, Trimas, Vericel, Vertex, Vital Farms, Warby Parker & Warner Bros. Discovery, with Acadia Healthcare, Alignment Healthcare, Alkami Technology, Ameresco, American Healthcare REIT, Arcadium Lithium, Arcosa, Arlo Technologies, Array Technologies, Assured Guaranty, Astrana Health, Autodesk, AvePoint, Bloom Energy, Bloom Energy, Collegium Pharmaceutical, Compass Diversified, Crinetics Pharmaceuticals, CubeSmart, Cytokinetics, Definitive Healthcare, Dell Technologies, Diamondrock Hospitality, dLocal, DoubleVerify, Duolingo, Edison International, Elastic, FIGS, Inc., Fox Factory Holding, Green Dot, HP Inc., ICF International, ICU Medical, Iovance Biotherapeutics, Jamf Holding, MasTec, Metallus, Mosaic, Natera, NetApp, nLIGHT, Opendoor Technologies, Opko Health, Paramount Group, Pembina Pipeline, Perrigo, Progyny, PubMatic, Redfin, Rocket Companies, Rocket Lab USA, Solventum, SoundHound AI, Sunrun, Talen Energy, TransMedics Group, Treace Medical Concepts, Tutor Perini & Verra Mobility all scheduled to report after the closing bell.

Friday the week winds down with Personal Income, Personal Spending, PCE Index, PCE Index (Year-over-Year), Core PCE Index, Core PCE (Year-over-Year), Advanced U.S. Trade Balance in Goods, Advanced Retail Inventories & Advanced Wholesale Inventories data at 8:30 am, followed by Chicago Business Barometer (PMI) at 9:45 am, Existing Home Sales & Consumer Sentiment (final) at 10 am & Fed President Goolsbee speaking at 10:15 am.

Alpha Metallurgical Resources, ANI Pharmaceuticals, Apellis Pharmaceuticals, Chart Industries, Chart Industries, Fulgent Genetics, Integral Ad Science, Northwest Natural, Owens & Minor & PAR Technology are all due to report earnings before Friday’s opening bell.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***