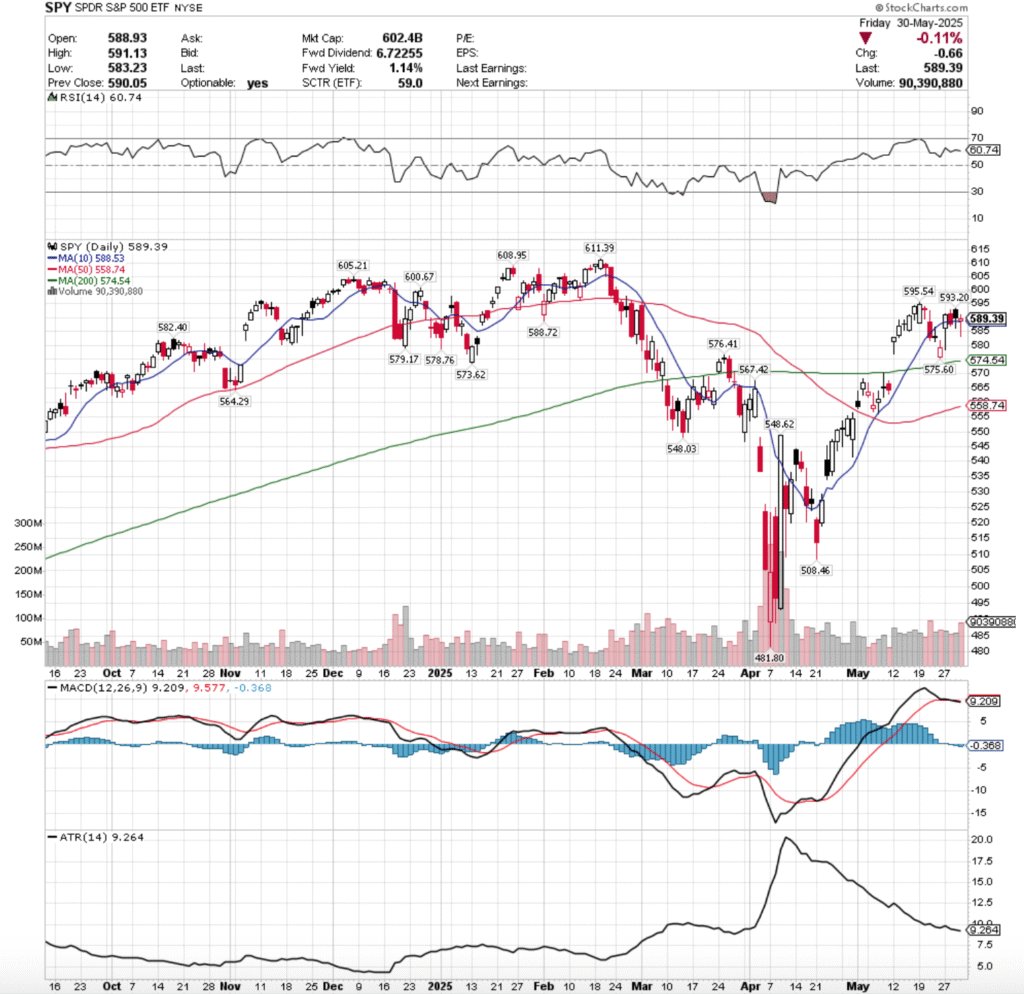

SPY, the SPDR S&P 500 ETF gained +1.78% last week, while the VIX closed the week at 18.57, indicating an implied one day move of +/-1.17% & an implied one month move of +/-5.37%.

Their RSI is relatively flat after last week’s limited price range, currently sitting at 60.74, while their MACD crossed over bearishly, but is also relatively flat.

Volumes were +32.73% above the prior year’s average (75,427,500 vs. 56,826,680), which is an area for concern given the highest volume session was Friday’s profit taking decline & two other sessions were cause for concern (75% of the week, given it was a holiday week).

Tuesday the week opened on a gap up, but with very shaky footing beneath it.

While the day closed as a +2.08% advancing session, the day’s low had retraced the entire gap range & into Friday’s candle’s body below Friday’s closing price.

While this occurred on the second highest volume of the week, it looked a lot more like an intra-day profit grab on a shortened week vs. an actual solid advancing session.

Wednesday opened slightly higher, but was pulled back down & ultimately broke down though the support of the 10 day moving average, indicating that the short-term trend is possibly in trouble.

Thursday reinforced this hazy outlook for SPY, when on an opening gap up there was no footing to be found & intraday the support of the 10 DMA broke down again as shown by the candle’s lower shadow.

The combination of the week’s second lowest volume, the deep intraday breakdown of the 10 DMA’s support, even if only temporary & the close being lower than the day’s open are all causes for concern, as market participants are clearly not thinking we’re out of the woods just yet.

Friday also did little to inspire confidence for SPY, as the week’s highest volume session opened below Thursday’s closing price, dropped temporarily intraday to below $585/share, before managing to advance above the day’s open into the close, but still resulted in a decline of -0.11%.

The high volume isn’t as bad in this instance as it may have been viewed in an outright declining day, given that there was a good amount of shares changing hands, folks taking profits & some folks buying back in in anticipation of this coming week, which will have aslew of Fed speakers & also some data points that will shed insight into the state of employment & manufacturing in the U.S..

What is alarming though is that the session opened just above the 10 DMA’s support, managed to break down through it -0.97% to the day’s low, and then saw the close wind up just marginally above the day’s open.

The Day-over-Day change in lows is also an area of concern heading into the new week, as it is exposing that there is more & more downside appetite among market participants.

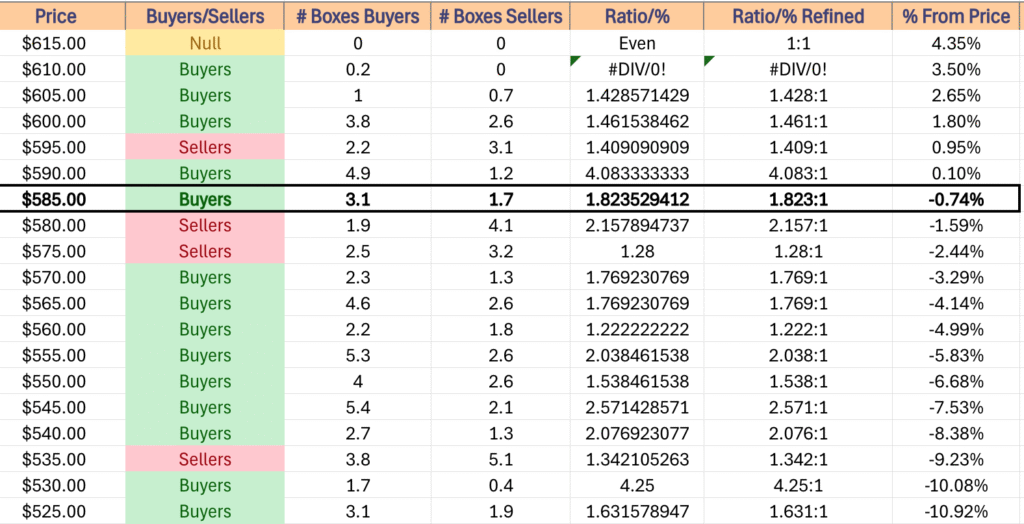

In last week’s market review note we noted that there was going to be an interesting Seller zone cross through in order for price to re-test the 10 DMA & then ultimately if broken through, test the strength of it as a support level.

Most of that was accomplished by Tuesday morning’s gap up open, which should be tread carefully around given that the volume level was second highest of a 4 day week, but nothing that expressed proper conviction behind the move & it’s likely not sustainable.

This week, to the upside there will need to be the same sustainable high advancing volume levels mentioned over the past months now, but the $600.67 mark is an area to watch.

Should prices test this level it means having passed through a Seller zone to the upside, and there may be some high participation that forces prices to continue higher.

In the event of further consolidation, expect price to continue to oscillate around the 10 day moving average as we await a catalyst to the upside or downside.

In the event that it takes a few weeks to reach one (highly doubtful), there may be a slight bump to the upside from the 50 DMA crossing over the 200 DMA bullishly, but this is an extreme case example.

To the downside, the 200 day moving average is an area all eyes should be focused on, as the long-term trendline was only crossed over on a gap up, which was somewhat speculative.

How market participants think of the price in relation to the long-term trend is going to be a key area to watch.

While the past few years show that price zones down to $574.99/share have been Seller dominated, there may be some footing to be found once price has dropped below there, which would alleviate concerns of the 200 DMA being re-tested, but it is certainly an area to be watching.

Price will like oscillate between the 10 & 200 DMAs for a while while we await a further up/downside catalyst in the event that this decline takes place.

SPY has support at the $588.72 (Volume Sentiment: Buyers, 1.82:1), $588.53 (10 Day Moving Average, Volume Sentiment: Buyers, 1.82:1), $582.40 (Volume Sentiment: Sellers, 2.16:1) & $579.17/share (Volume Sentiment: Sellers, 1.28:1) price levels, with resistance at the $593.20 (Volume Sentiment: Buyers, 4.08:1), $595.54 (Volume Sentiment: Sellers, 1.41:1), $600.67 (Volume Sentiment: Buyers, 1.46:1) & $605.21/share (Volume Sentiment: Buyers, 1.43:1) price levels.

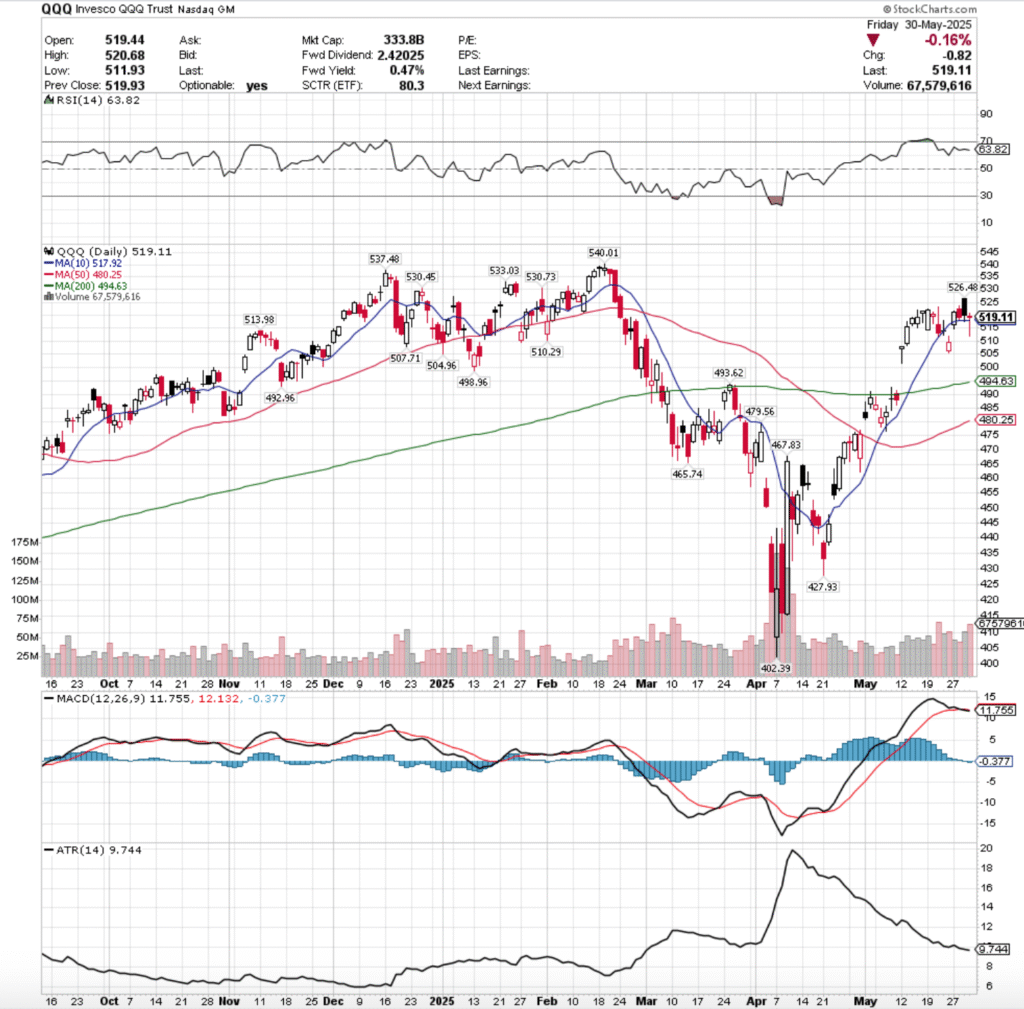

QQQ, the Invesco QQQ Trust ETF advanced +1.94% for the week, as the tech-heavy index was the favorite of the major four index ETFs.

Their RSI has flattened out following last week as well, but currently sits at 63.82, while their MACD is bearish.

Volumes were +45.75% higher than the prior year’s average (55,062,500 vs. 37,779,012), which paints a similar problem as the one mentioned above for SPY.

Tuesday the week opened up a similar gap up, gaining +2.35% on the day on the second lowest volume of the week.

It opened just beneath the 10 day moving average’s support, temporarily dipped below the $515/share level on the low end of the day’s range, before gaining some steam & powering higher to close setting the stage for the week to be above the 10 DMA.

Wednesday opened on a gap higher, tested slightly higher as displayed on their upper shadow, but declined the rest of the day to re-test the 10 day moving average’s support, which was able to hold up & force the day to close above it, despite declining -0.44% on the day.

Thursday is where the concern really began though & cracks began to show, as the session opened on a gap higher, but it was mostly downhill from there.

QQQ declined to dip beneath the support of the 10 day moving average, but was able to rally higher to close lower on the day than it opened, but still for a day-over-day gain of +0.2%.

Thursday was the second highest volume day of the week, and while it can be said that it covered a wide range of prices, it can also be said that it was a day of heavy profit-taking, which reflects negative sentiment & calls into question the strength of the short-term trend line (10 day moving average).

Friday confirmed that there was a bit of blood in the water, as QQQ opened lower, briefly tested to the upside, but was rejected near the close of Thursday’s session, and prices free-fell in a profit taking bonanza that dropped QQQ down to $511.93/share during the day’s low.

While prices climbed back to close the day as a dragonfly doji, this downside appetite doesn’t inspire confidence in the tech-heavy index.

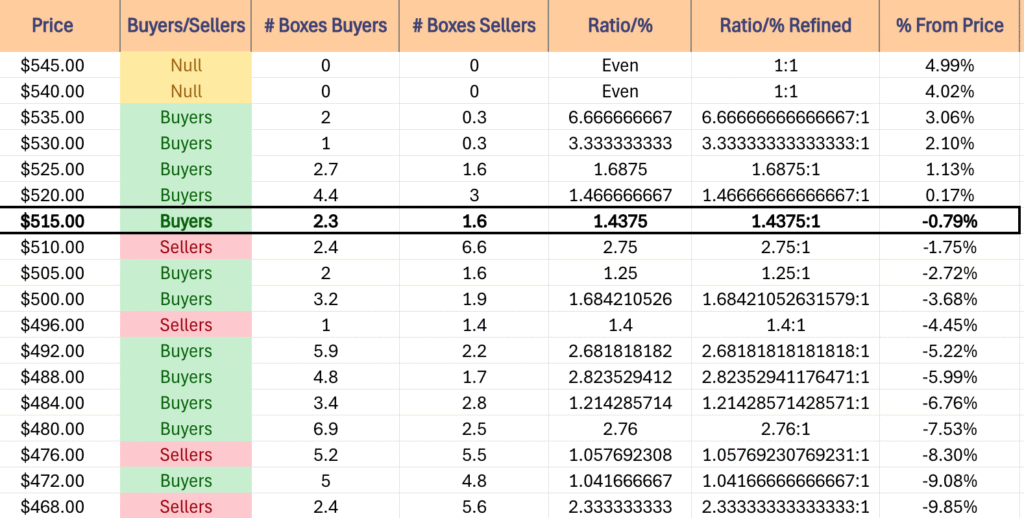

Given the proximity of the short-term trend line & the new downside appetite that made a run at closing the window of Tuesday’s gap (assuming it closed near the lows), it is going to be worth watching for a rugpull in the coming week.

To the upside there are two place to watch, first being the $526.48 level & second being the resistance zone in the $530-531/share level.

While the table below shows that this is all Buyer oriented historically, this looks primed to be a time of ratio dilution with Sellers stepping in, so there will need to be some solid volume behind any upwards moves to make them sustain.

The consolidation case looks like a bit of oscillating around the 10 DMA awaiting an upside/downside catalyst, with a chance up a slight uptick when the 50 DMA crosses bullishly over the 200 DMA, but that’s weeks away, should it occur.

The downside view looks tricky, as in the event that the first support levels of $517.92 breaks down, we enter a Seller zone with two support levels, which should they break down may become problematic, given the window from early May that needs to be closed.

In the event that the gap begins to fill, the strength of the long-term trend line (200 DMA) is going to be key, but more likely to be determined by recent candles near the approach & their volume trends.

QQQ has support at the $517.92 (10 Day Moving Average, Volume Sentiment: Buyers, 1.44:1), $513.98 (Volume Sentiment: Sellers, 2.75:1), $510.29 (Volume Sentiment: Sellers, 2.75:1) & $507.71/share (Volume Sentiment: Buyers, 1.25:1) price levels, with resistance at the $526.48 (Volume Sentiment: Buyers, 1.69:1), $530.45 (Volume Sentiment: Buyers, 3.33:1), $530.73 (Volume Sentiment: Buyers, 3.33:1) & $533.03/share (Volume Sentiment: Buyers, 3.33:1) price levels.

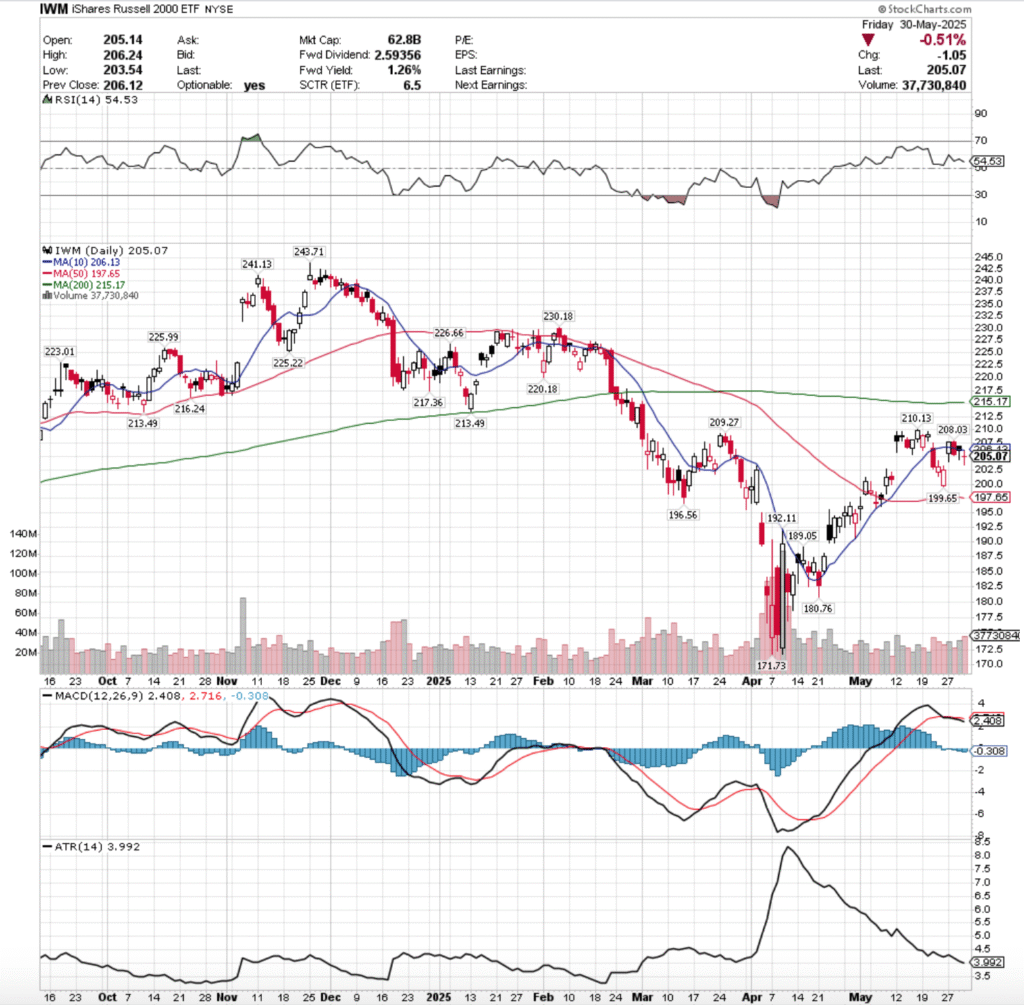

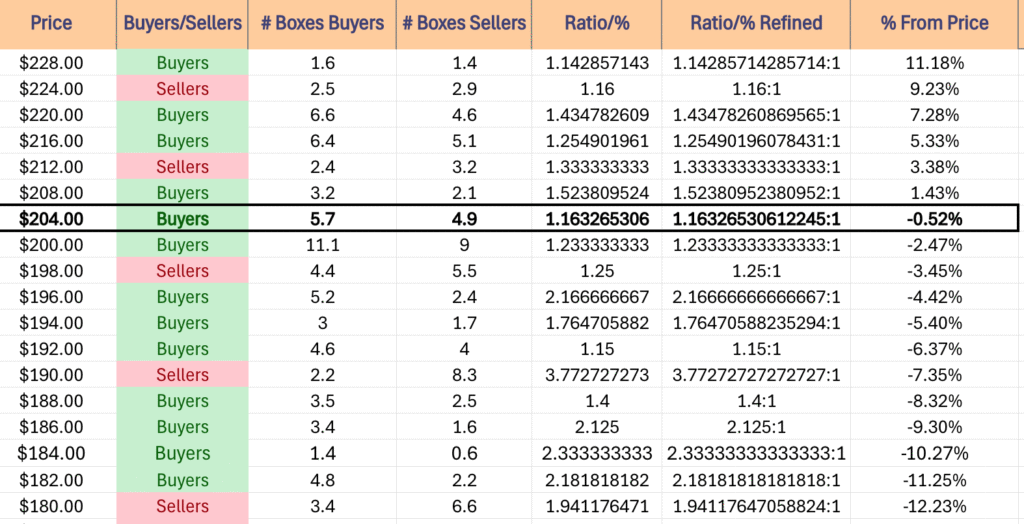

IWM, the iShares Russell 2000 ETF added +1.24% last week, as the small cap index was still the least favorite of the four majors.

Their RSI is trending down towards the neutral 50-mark, currently sitting at 54.53, while their MACD is bearish, but has been relatively flat awaiting a catalyst for the past week.

Volumes were +6.82% above the prior year’s average level (32,070,000 vs. 30,022,411), which like the two aforementioned index ETFs is a cause for concern for IWM & its components.

The story of the week for IWM is similar to SPY & QQQ, however the 10 DMA did not prevail, which is slight cause for concern for the other two indexes.

While IWM is expected to lag them/be more of a slow grower with more oscillations on the way up, the short-term trendline’s breakdown paints a broad weak picture for the others.

Tuesday opened on a gap up, tested lower intra-day, but was able to power higher & close above the support of the 10 day moving average despite opening the day below it.

Wednesday opened in linen with Tuesday’s close, but made short work of sinking down through the 10 DMA’s support on the week’s weakest volume.

Thursday had a unique set up that signaled there was impending trouble on the horizon for IWM.

The session opened midway through Wednesday’s range, then broke out to the downside & was able to close lower than the open but above the day’s low & in-line with the 10 DMA.

Friday the week wound down on a week of skeptical uncertainty, as the week;s highest volume session resulted in a doji candle that opened on a gap lower, was unable to break out above the 10 DMA’s resistance to the upside, and a lot of profits were taken based on the amount of shares that exchanged hands over the last session of the week.

IWM is in a unique spot as it is more influenced by the larger cap indexes at the moment, as the uncertainty we’re surrounded by has folks not eager to jump into small cap names that are relatively unheard of.

As a result, the long-term trend line is the area of focus on the upside, given their state of limbo & that they’re trading below it.

Like SPY & QQQ, they’re going to need an influx in sustainable advancing volume to make a run at the 200 DMA’s resistance, so it’s something to keep an eye on, but not a focal point of IWM’s near-term performance.

In the consolidation case, we’ll see oscillations around the 10 DMA, which may wind up testing some of the other nearby support/resistance levels, which may cause the consolidation range to change, but the oscillations to continue.

The downside case brings all eyes on the 50 day moving average’s support, given that IWM is trading below its long & short-term trendlines.

Seller sentiment can bring IWM to the $197.99/share level, which would place it in the neighborhood of said re-test, which is a safe place to look in the coming week or two.

IWM has support at the $199.65 (Volume Sentiment: Sellers, 1.25:1), $197.65 (Volume Sentiment: Buyers, 2.17:1), $196.56 (Volume Sentiment: Buyers, 2.17:1) & $192.11/share (Volume Sentiment: Buyers, 1.15:1) price levels, with resistance at the $206.13 (10 Day Moving Average, Volume Sentiment: Buyers, 1.16:1), $208.03 (Volume Sentiment: Buyers, 1.52:1), $209.27 (Volume Sentiment: Buyers, 1.52:1) & $210.13/share (Volume Sentiment: Buyers, 1.52:1) price levels.

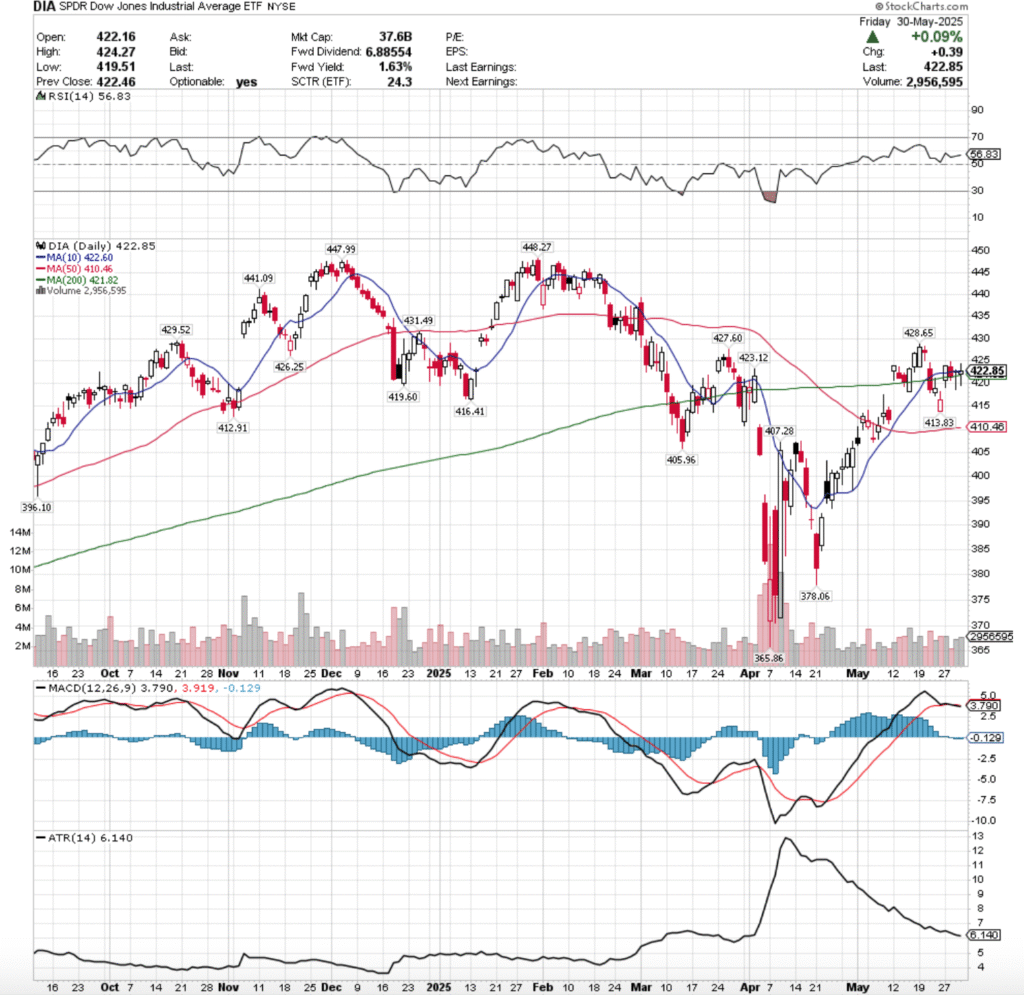

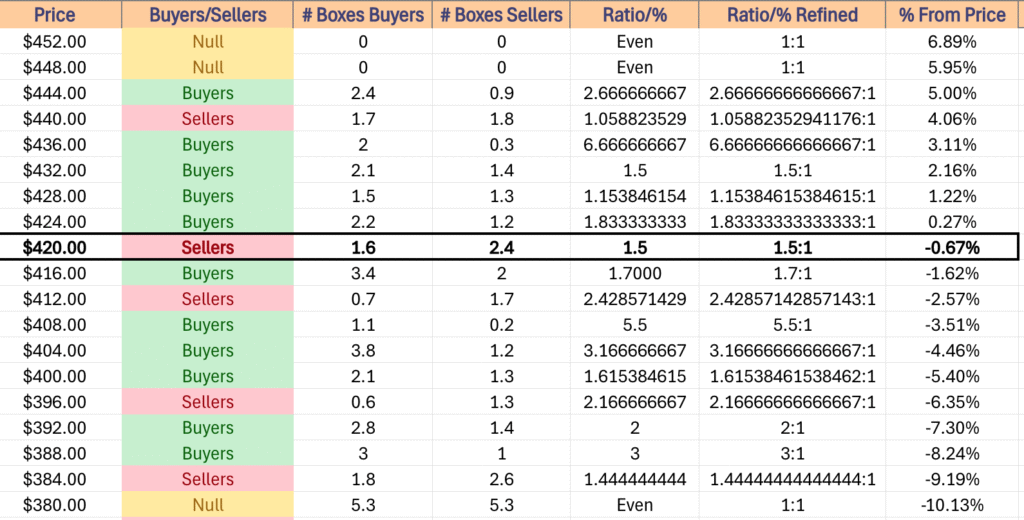

DIA, the SPDR Dow Jones Industrial Average ETF climbed +1.57% last week, but there was an air of caution based on volume levels, as we continue to see a more “buy & hold”/”wait & see” approach from the blue chip index.

Their RSI is currently 56.83, while their MACD is bearish, but relatively flat following last week’s consolidation range.

Volumes were -16.39% lower than the prior year’s average level (2,657,500 vs. 3,178,498), signaling that there are a lot of market participants in “wait & see” mode with the blue chip index & its components.

DIA’s week opened Tuesday with more volume than its peers comparitively speaking & was a gap up open that was able to break above the resistance of the 200 day moving average, but not until after it showed that it had a bit of downside appetite down to the $419.19/share level.

Wednesday opened slightly lower, tried to rip higher, but ultimately sank down to close just above the 200 DMA, after briefly breaking through it to the downside, but forming a bearish harami pattern with Tuesday’s candle.

Thursday things continued to be interesting, as the day opened & closed as technically a bullish harami cross, but there was a major catch.

While the daily candle is a dragonfly doji, looking closely there are a few causes for concern, namely that the session opened & closed in-line with the short-term trendline, but intraday its support broke down, as did the support of the long-term trend line.

Given that the volume was the second lowest of the week but that wide of a price range was covered there is reason for doubt regarding the near-term for DIA.

Friday didn’t settle this fear, opening lower near the 200 DMA’s support, dropping below the $420/share level, before advancing to just short of the $425/share price level & closing just beneath it as a spinning top candle.

The indecision marked by the day’s candle sets the stage for an interesting week.

To the upside, the first resistance levels is in a Seller dominated zone (table below), which as mentioned now for months will require a steady, consistent uptick in advancing volume to break above, even if this past week’s consolidation does become a launch pad.

From there, the high water mark becomes the $431.49/share level, which while there is historic Buyer sentiment all the way up to it, it wanes after the next price level, which makes it worth keeping an eye out to see if Sellers step in, rejecting an advance & diluting the historic ratio.

The consolidation case should prices not break the next resistance levels looks similar to what last week delivered, and shows DIA oscillating around the 10 & 200 day moving averages until we see an upside or downside catalyst.

An area of caution though for that scenario is that we are in a Buyer dominated price zone historically, and that may mean that any slight slips wind up leading to larger declines than expected.

In the event of a downside catalyst, the next two support levels are in a Seller dominated historic price zone.

Should both the long & short term trendlines (10 & 200 DMAs) break down & these levels can’t foot support, watch for the windows created in May to be filled & prices revert towards the 50 day moving average’s support.

Watching Volume levels & comparing them with the historic sentiments in the table below will be beneficial in navigating these markets.

DIA has support at the $422.60 (10 Day Moving Average, Volume Sentiment: Sellers, 1.5:1), $421.82 (200 Day Moving Average, Volume Sentiment: Sellers, 1.5:1), $419.60 (Volume Sentiment: Buyers, 1.7:1) & $416.41/share (Volume Sentiment: Buyers, 1.7:1) price levels, with resistance at the $423.12 (Volume Sentiment: Sellers, 1.5:1), $426.25 (Volume Sentiment: Buyers, 1.83:1), $427.60 (Volume Sentiment: Buyers, 1.83:1) & $428.65/share (Volume Sentiment: Buyers, 1.15:1) price levels.

The Week Ahead

Monday kicks the week off with S&P Final Manufacturing PMI data at 9:45 am, ISM Manufacturing data comes out at 10 am along with Construction Spending data, Fed President Logan speaks at 10:15 am, Fed President Goolsbee speaks at 12:45 pm & Fed Chair Powell speaks at 1 pm.

Before Monday’s opening bell Campbell’s Soup & Science Applications Report Earnings, before Credo Technology Group after the close.

Factory Orders & Job Openings data come out Tuesday at 10 am, before Fed President Goolsbee speaks at 12:45 pm, Fed Governor Cook speaks at 1 pm & Fed President Logan speaks at 3:30 pm.

Tuesday morning’s earnings calls include Dollar General, Donaldson, Ferguson, NIO, Ollie’s Bargain Outlet & Signet Jewelers, before CrowdStrike Holdings, Asana, Couchbase, Guidewire Software, Hewlett Packard Enterprise & Yext after the session’s closing bell.

Wednesday morning brings us ADP Employment numbers at 8:15 am, Fed Presidents Bostic & Cook speak at 10:15 am, S&P Final U.S. Services PMI data comes out at 9:45 am, ISM Services data comes out at 10 am & the Fed’s Beige Book is released at 2pm.

Dollar Tree, Genesco, REV Group, Sprinklr & Thor Industries report earnings before the opening bell on Wednesday, while Argan, Descartes, Five Below, Greif, MongoDB, PVH & Verint Systems report earnings following the session’s close.

Thursday brings us Initial Jobless Claims, U.S. Trade Deficit & U.S. Productivity data at 8:30 am, before Fed Governor Kugler speaks at 12 pm & Fed President Harker speaks at 1:30 pm.

Brown-Forman, Ciena, Cracker Barrell, Hello Group, Toro & Victoria’s Secret all report earnings before Thursday’s open, before Broadcom, Braze, DocuSign, Lululemon Athletica, Mission Produce, Petco Health & Welness, Rubrik, Samsara, Service Titan, Vail Resorts & Zumiez report after the closing bell.

U.S. Employment Report, U.S. Unemployment Rate, U.S. Hourly Wages & Hourly Wages Year-over-Year are all due Friday morning at 8:30 am, followed by Consumer Credit at 3pm.

Friday features ABM Industries reporting earnings after the session’s close.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***