This week I had a look at Weis Markets, Inc., which trades under the ticker $WMK.

Weis Markets, Inc WMK Stock Fundamentals

At the close of trading on 5/1/2020 it traded for $50.39/share, with a P/E (ttm) of 19.9 & a P/B of 1.28

WMK offers a 2.46% Dividend Yield for it’s investors, with a 44% Payout Ratio, making it able to continue to be competitive with other players who also raise their yields annually, and they provide some defense during market downturns & times of uncertainty.

Their -0.15 Beta means they don’t tend to move with the market, making them especially appealing in troubled times like we are entering.

With an Estimated Market Cap of $1.36B, WMK currently recently reported having Total Cash (mrq) of $149.344M, with Total Debt (mrq) of $218.77M, & a Debt/Equity (ttm) of 19.71.

Their % Institutional Ownership is 38.8%.

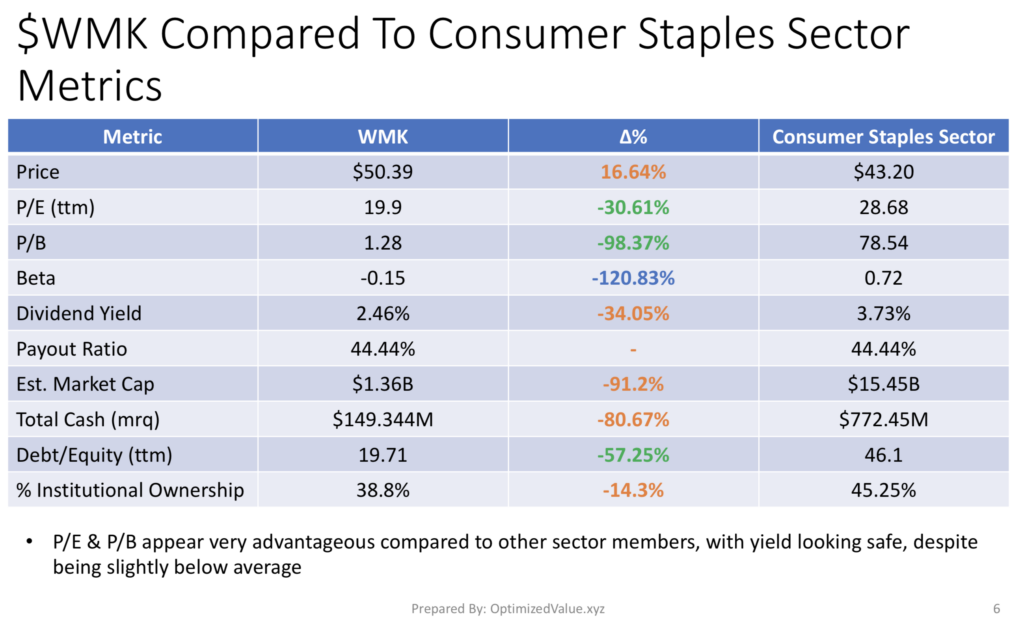

Weis Markets, Inc. WMK’s Stock Fundamentals Vs. The Consumer Staples Sector

WMK costs 16% more than the average consumer staples stock, however they do offer attractive value metrics compared to the sector averages.

WMK’s P/E (ttm) is 30.6% less than the sector average, and their P/B is 98% lower.

Their Dividend Yield is 34% less than the sector average, with an equal Payout Ratio. The Average Market Cap of the Consumer Staples sector is 91% larger than WMK, at $15.45B, leading to WMK having 80% less on hand than the average stock in the sector.

WMK’s Total Debt/Equity (ttm) is 57% better than the sector average, which when combined with their favorable value metrics & their ability to accumulate Total Cash better than competitors gives them an edge in a turbulent market.

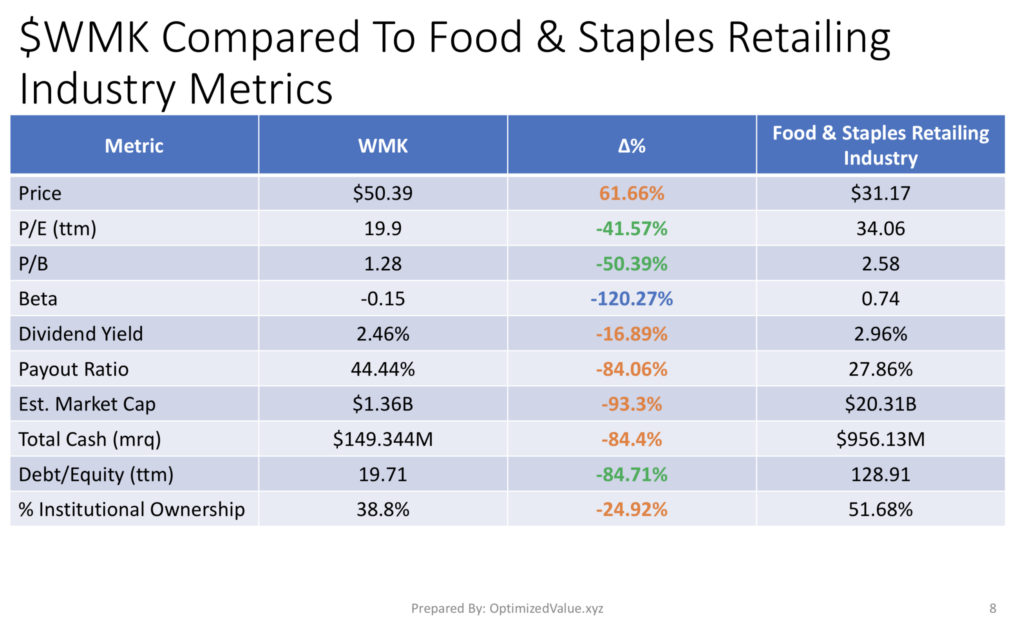

WMK Stock Vs The Food & Staples Retailing Industry Averages

WMK also has similar advantages over the other stocks in it’s industry. It is a smaller player with a 93% smaller market cap than average, that has a more faily valued shareprice, and responsible debt compared to its peers.

WMK’s P/E (ttm) is almost 42% better than the Food & Staples Retailing Industry Average, and their P/B is 50% better.

Pair that with their 120% cooler Beta, and their 84.7% lower Total Debt/Equity (ttm) than average, and you’ll notice that this small company offers a lot of standout strengths vs. it’s peers.

Breaking Down Weis Markets, Inc.’s Technicals

Over the last year, WMK has traded relatively flat, until the COVID-19 virus impact stunned markets. This strength should continue while we remain in these uncertain times.

WMK’s current price of $50.39 is above its 10-Day M/A: 48.75, it’s 50-Day M/A: 41.44 & its 200-Day M/A: 39.31, with an RSI of 71.

This strength should continue to climb as investors seek yield from companies with lower levels of debt.

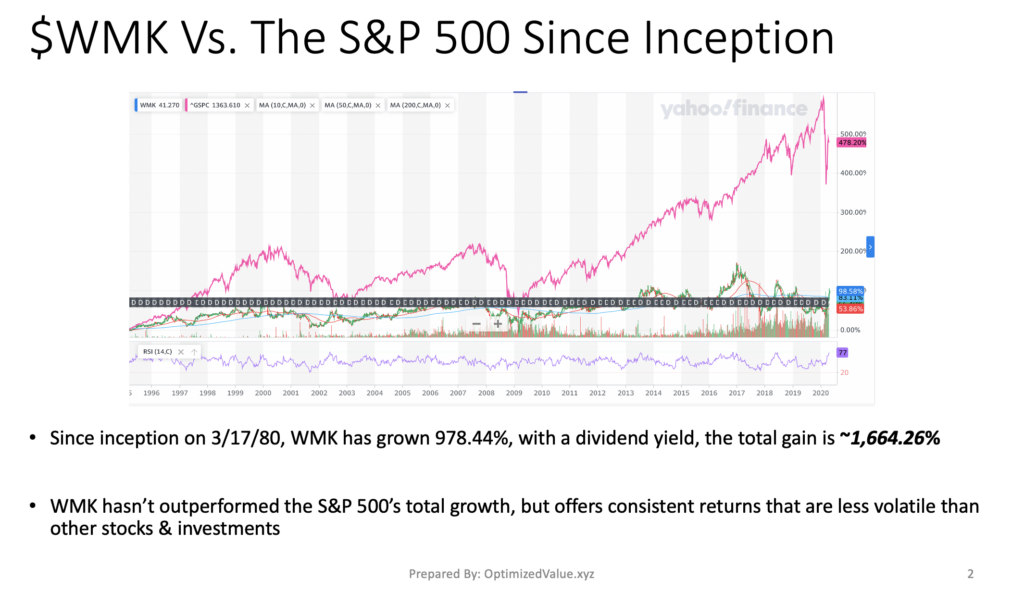

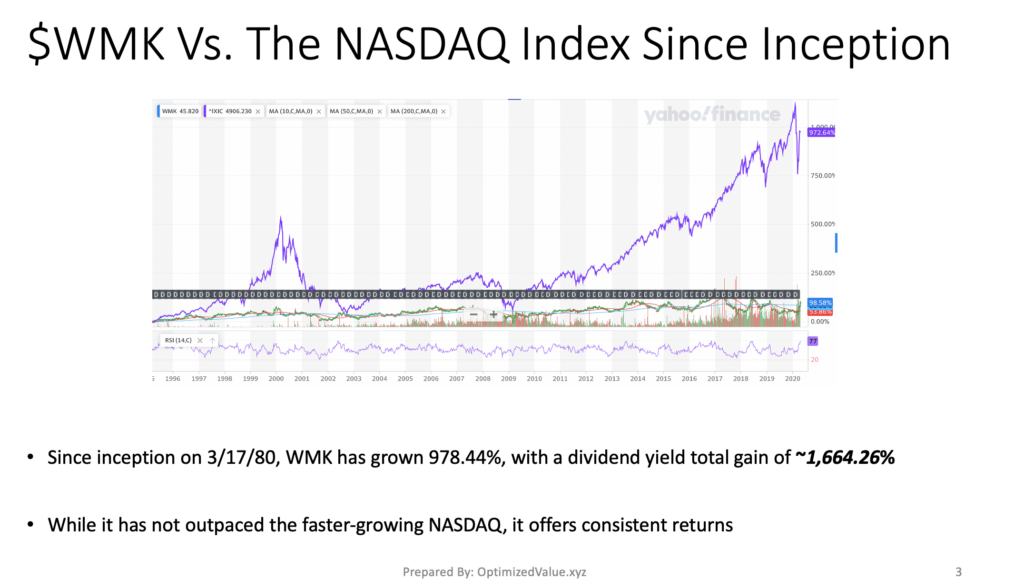

Weis Markets, Inc WMK’s Stock Growth Story

Weis Markets, Inc was under $5 when it first began trading in the 1980’s, and is now 10x that amount. They have also offered a stable dividend that has increased just about annually since 1985.

While the broader indexes are filled with faster growing names, this is still nothing to be ignored. Buying one share of their stock when it opened at ~$4.80 would’ve resulted in over $36 in dividend yield collection alone 35 years later.

It is difficult to compare WMK against the S&P 500 or the NASDAQ given the nature of their negative Beta, but one thing is for certain, consistent income via the dividend & growth.

Tying It All Together

All-in-all, WMK is worth further investigation. As a means of collecting yield from a safer stock, as well as having a negative Beta, it makes it more advantageous in a time where markets are in turmoil. There is always a need for groceries & food, and those businesses continue to operate throughout this pandemic.

Factor in the fact that it is a much smaller player than most of it’s competitors, and it appears even more defensive for times like these.

Right now the price is a little high as it just hit a new high last week, but if it looks to continue climbing it may be more appealing if it re-checks out the ~$48 range depending on how the charts look at that point.

As always, please do your own research & due diligence before making any decisions.

*** I Do Not Own Any Shares Of Weis Markets, Inc, WMK***

For the full PDF: