Weis Markets, Inc. stock trades under the ticker WMK & has shown recent bullishness that traders & investors should research further into.

WMK stock closed at $81.87/share on 3/8/2023.

Weis Markets, Inc. WMK Stock’s Technical Performance Broken Down

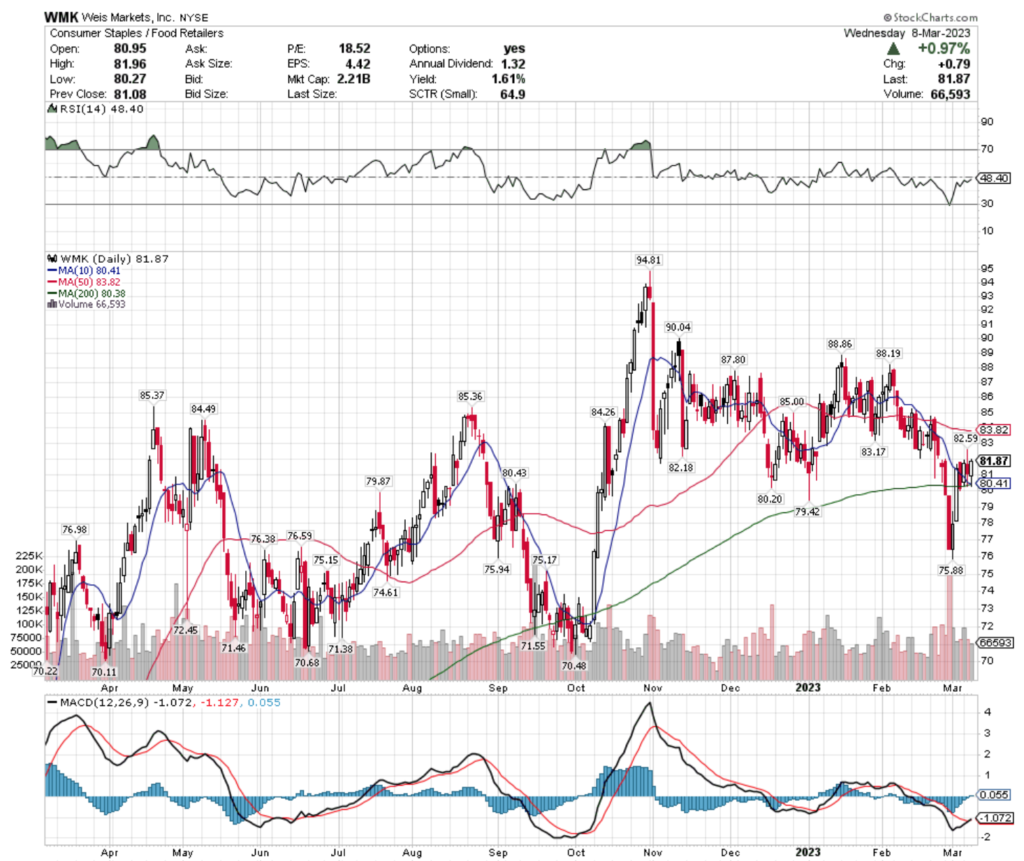

WMK Stock Price: $81.87

10 Day Moving Average: $80.41

50 Day Moving Average: $83.82

200 Day Moving Average: $80.38

Yesterday, WMK stock completed a bullish MACD crossover, gaining +0.97% on the day’s session.

Their RSI is neutral & recent trading volumes have been about average compared to the year prior, as they’ve spent the past week consolidating after some gains at the beginning of the month.

Their recent candlesticks imply that there is weakness on the horizon, which can provide a more opportune entry point for a position.

WMK stock has support at the $80.43, $80.41 (10 day moving average) & $80.38 (200 day moving average), as they try to break out above the $82.18, $82.59 & $83.82 (50 day moving average) resistance levels.

Weis Markets, Inc. WMK Stock As A Long-Term Investment

Long-term oriented investors will like WMK stock’s valuation metrics, with a 17.64 P/E (ttm) & a 1.64 P/B (mrq).

They recently reported 18% Quarterly Revenue Growth Y-o-Y, with 27.7% Quarterly Earnings Growth Y-o-Y.

Their balance sheet is also appealing, with $344.42M of Total Cash (mrq) & $185.95M of Total Debt (mrq).

WMK stock pays a 1.63% dividend, which appears to be sustainable in the long-run, as their payout ratio is 27.96%.

37.63% of WMK stock’s outstanding share float is owned by institutional investors.

Weis Markets, Inc. WMK Stock As A Short-Term Trade Using Options

Traders with shorter time horizons can use options to profit from WMK stock’s price movements, while protecting their portfolios from volatility.

I am looking at the contracts with the 4/21 expiration date.

The $75 & $80 call options are both in-the-money.

The $85 & $100 puts are also both in the money, listed from highest to lowest level of open interest.

Tying It All Together

WMK stock has many interesting characteristics that traders & investors will find appealing.

Investors will like their balance sheet, as well as their dividend yield.

Traders will like their recent technical performance, but may wish their options had more liquidity.

Overall, it is worth taking a closer look into how WMK stock fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN WMK STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***