WW Grainger, Inc. stock trades under the ticker GWW & has shown recent bullishness that investors & traders should take a closer look at.

GWW stock closed at $507.58/share on 2/3/2022.

WW Grainger, Inc. GWW Stock’s Technical Performance Broken Down

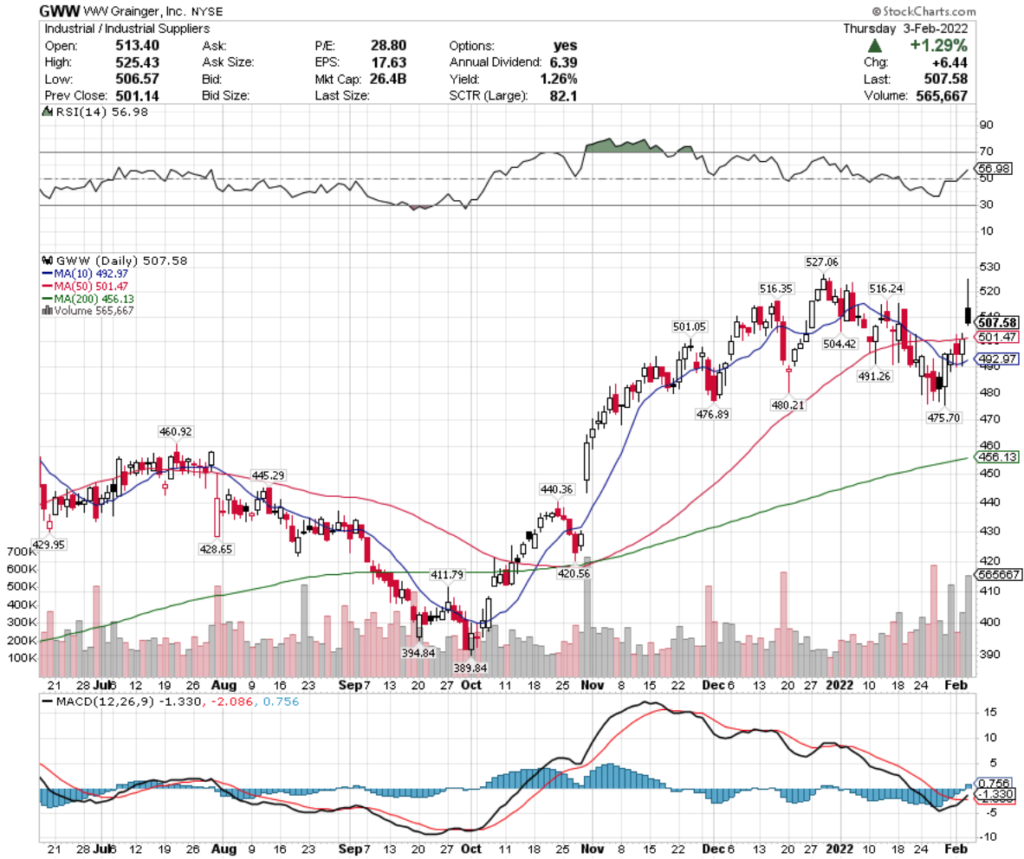

GWW Stock Price: $507.58

10 Day Moving Average: $492.97

50 Day Moving Average: $501.47

200 Day Moving Average: $456.13

RSI: 56.98

MACD: -1.33

Yesterday, GWW stock completed a bullish MACD crossover, while gapping up 1.29% & breaking out above its 50 Day Moving Average.

Yesterday’s trading volume was one of the highest days of the past year & well above average for the year.

With <2% between the 10 Day MA crossing the 50 Day MA & a neutral RSI, there looks to be more momentum in the near-term to come.

GWW stock will need to break out above the $516-level before going on to test against yesterday’s high price of $525.

WW Grainger, Inc. GWW Stock As A Long-Term Investment

GWW stock’s P/E (ttm) may appeal to investors at 28.97, although their P/B (mrq) is a bit rich at 14.31.

Their Quarterly Revenue Growth Y-o-Y was 11.7% & their Quarterly Earnings Growth Y-o-Y was 23.7%.

GWW stock’s balance sheet will require a closer review before investors dive in, with Total Cash (mrq) of $328M & Total Debt (mrq) of $2.37B.

GWW offers a 1.26% dividend yield, which looks stable as their payout ratio is 35.96%.

71.6% of GWW stock’s outstanding share float is held by institutional investors.

WW Grainger, Inc. GWW Stock As A Short-Term Trade Using Options

GWW stock has options that traders can use to capture near-term momentum while fending off broader market risk.

I am looking at the contracts with the 2/18 expiration date.

The $490 & $500 call options look appealing, although illiquid with very low open interest.

The $510 & $500 put options also look interesting, but are also highly illiquid.

Tying It All Together

All-in-all, there are many interesting characteristics to GWW stock that traders & investors may find appealing.

Long-term investors will like their valuation metrics & dividend yield, but will want to look into their debt structure before investing.

Short-term traders will like their current momentum, but be a bit disappointed by their illiquid options market.

GWW stock is worth taking a closer look at as an addition to your portfolio.

*** I DO NOT OWN SHARES OF GWW STOCK ***