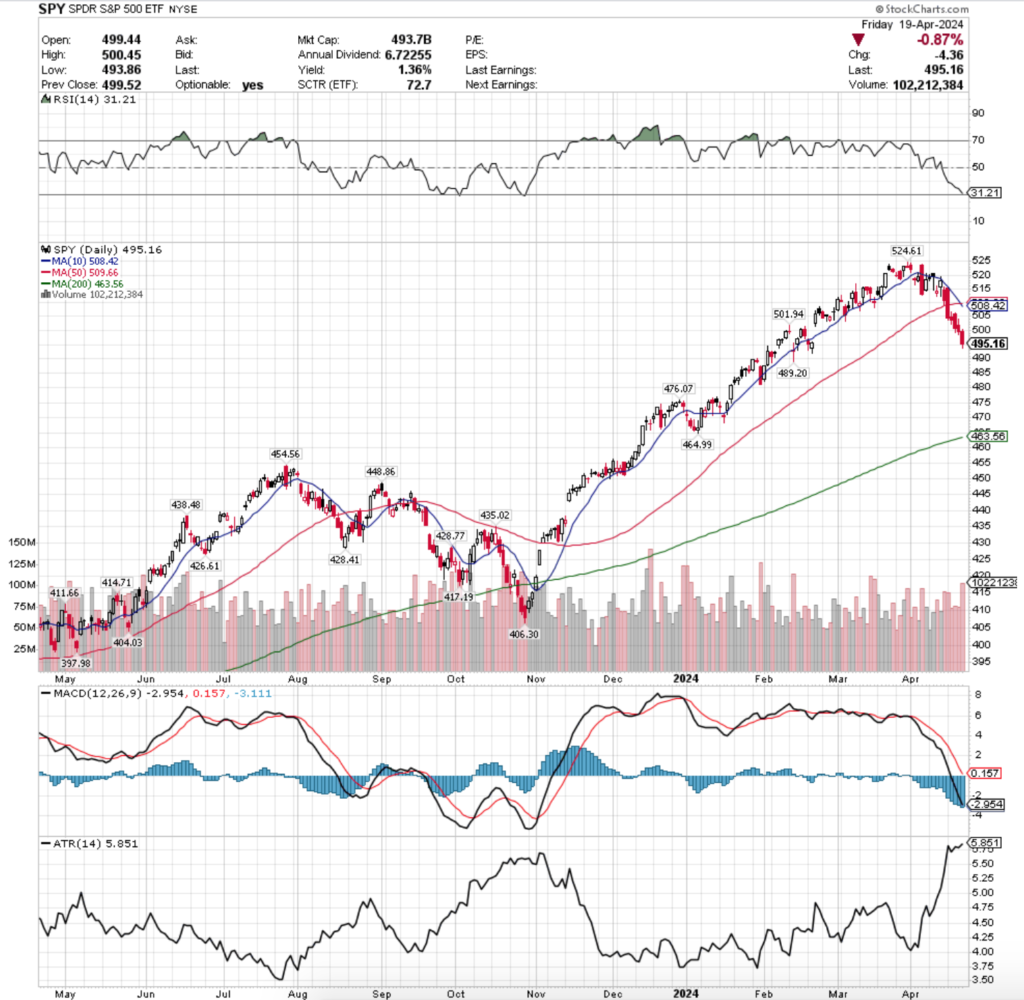

SPY, the SPDR S&P 500 ETF fell -3.07% this past week, having the second worst weekly performance of the major four indexes, in a week where the VIX closing at 18 indicates anticipated one day moves of +/- 1.18% & a monthly anticipated move of +/-3.41%.

Their RSI is approaching oversold territory & currently sits at 31.21, while their MACD continues lower in a bearish trend that began at the beginning of the month.

Volumes were +7.08% above average last week compared to the year prior (83,634,580 vs. 78,101,687), which should be noted by market participants given that all five days of the week resulted in declines.

It’s not unreasonable for folks to begin hopping out of the pool to protect their profits after the rapid ascent SPY has had over the past six months, but it appears that there may be more to it under the hood.

Monday kicked off the week on a very sour note for SPY, with a large bearish engulfing candle that eclipsed Friday’s entire session, while being denied by the resistance of the 10 day moving average & then proceeding to crash below the 50 DMA & close below it.

Tuesday continued the declines, but in a more cautious manner as it didn’t have near the volume of Monday (second highest of the week) & resulted in a spinning top, which cast uncertainty onto how the rest of the week would go.

The sellers came back on Wednesday, forming another bearish engulfing pattern & testing the waters out below the $500/share price level for SPY, although on similar volumes as Tuesday.

Thursday painted a more bearish image, as the declines continued on similar volumes, but price action was focused more towards the bottom of the day’s candlestick in terms of the real body, which has bearish implications.

Friday the week ended on a wildly bearish note, as the 10 day moving average crossed bearishly through the 50 day moving average on the highest volumes of the week, resulting in a -0.87% decline.

While SPY tested above $500/share briefly on Friday, its open & close were both below it, meaning that the $501.94 resistance level is holding strong.

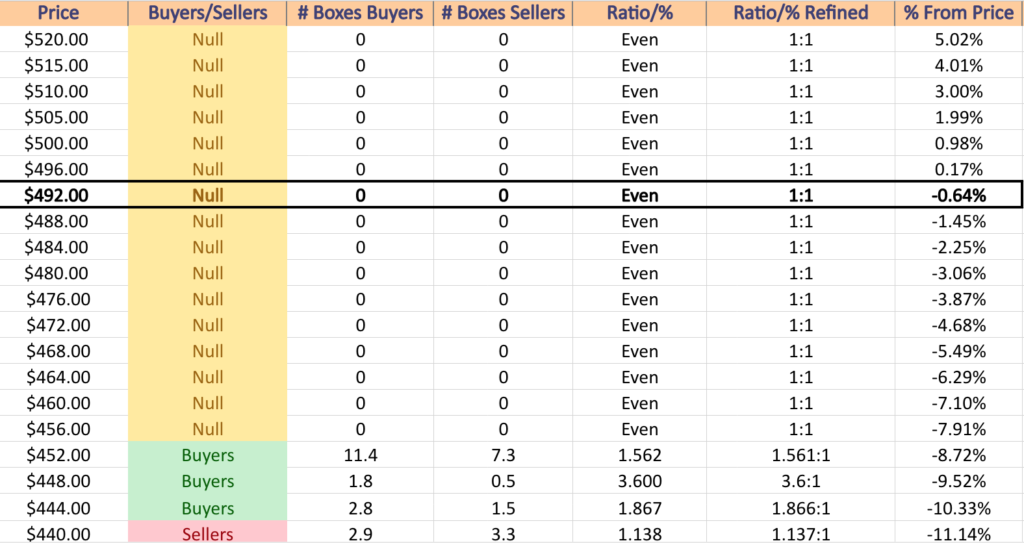

As we enter a new week there will likely be some form of a consolidation range beneath this price mark before a move lower to test the support at $489.20.

With prices now no longer enjoying the support of the 50 DMA, one thing to keep an eye on moving forward is in the event of future declines, how the support levels are spread out.

After SPY’s rapid ascent over the past 6 months or so there are not as many support levels nearby compared to other indexes that grew at more controlled rates.

This leaves SPY open to potential declines as there isn’t much to find footing on should a couple more declining sessions occur in the coming week(s).

Their Average True Range is still climbing after a week rocked with volatility, which will be another area to keep an eye on this upcoming week, as increased volatility will result in the testing of these unstable support levels.

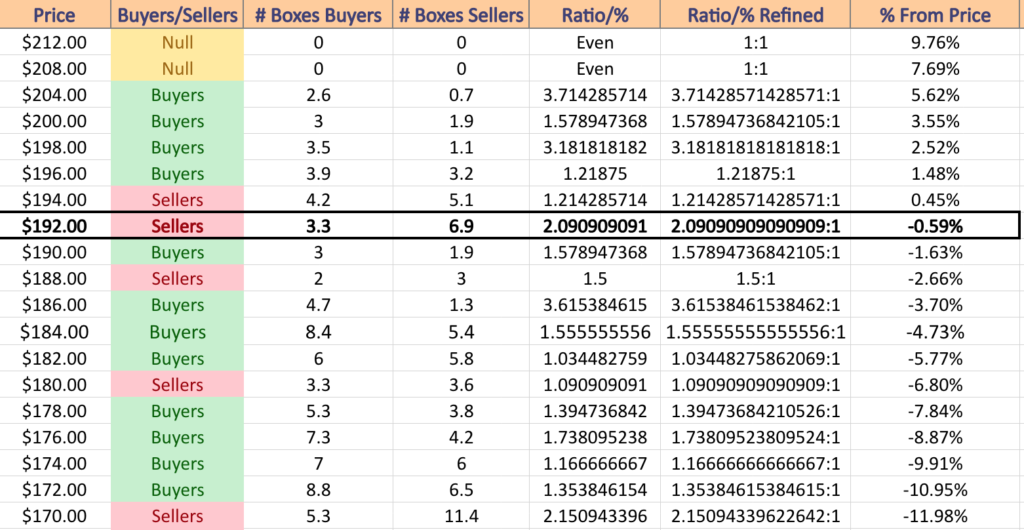

SPY has support at the $489.20 (Volume Sentiment: NULL, 0:0*), $476.07 (Volume Sentiment: NULL, 0:0*), $464.99 (Volume Sentiment: NULL, 0:0*) & $463.56/share (200 Day Moving Average, Volume Sentiment: NULL, 0:0*), with resistance at the $501.94 (Volume Sentiment: NULL, 0:0*), 508.42 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $509.66 (50 Day Moving Average, Volume Sentiment: NULL, 0:0*) & $524.61/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

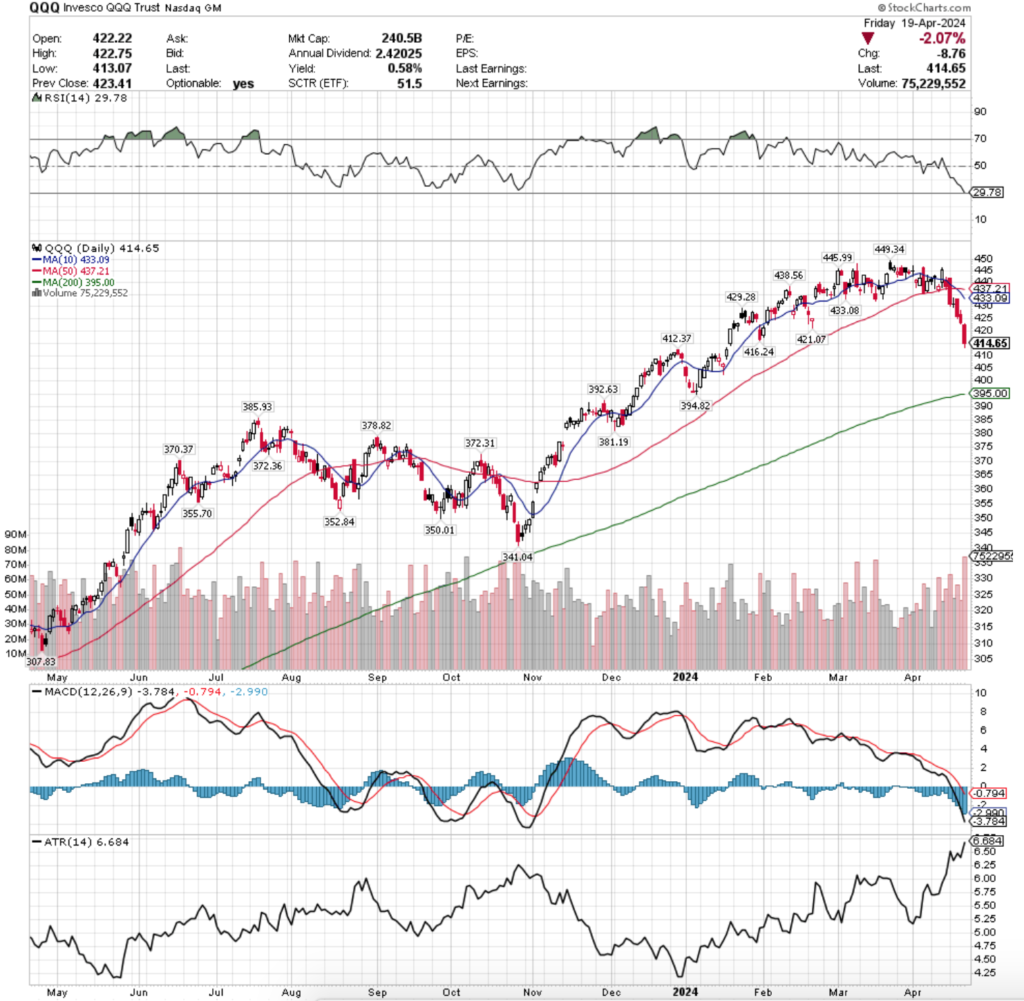

QQQ, the Invesco QQQ Trust ETF that tracks the NASDAQ 100 declined -5.39% last week, as investors & market participants shunned the technology heavy index during a week widely spent profit taking.

Their RSI is in oversold territory & currently sits at 29.78, while their MACD continues its bearish nosedive that began at the beginning of the month.

Volumes were +17.85% above average last week compared to the year before’s average (57,927,820 vs. 49,155,742), which is cause for concern given that there was only one bullish session, which had the second lowest volume of the week.

Much like SPY, QQQ began last week opening above the 10 day moving average, before ultimately declining beneath it & being unable to be supported by the 50 DMA.

Tuesday continued the negative theme for QQQ, as the session resulted in a gravestone doji on the second weakest volume of the week.

The weakness carried into Wednesday when another wide range declining day set a bearish engulfing pattern & volumes were higher than Friday’s “slight advancing” session.

Thursday we saw further declines but on the lowest volumes of the week, which begged the question of if market participants were maybe becoming tired of selling & if they’d be happy with the current price levels.

Friday arrived & showed that they weren’t, as the highest volume session of the week pushed prices down below the $415/share price level to enter the weekend at $414.65/share.

Friday’s volume was also noteworthy as in addition to being the largest of the week, it is one of the largest in the entire past year, and still came in the wake of a week filled with declines, signaling investor sentiment is currently weak.

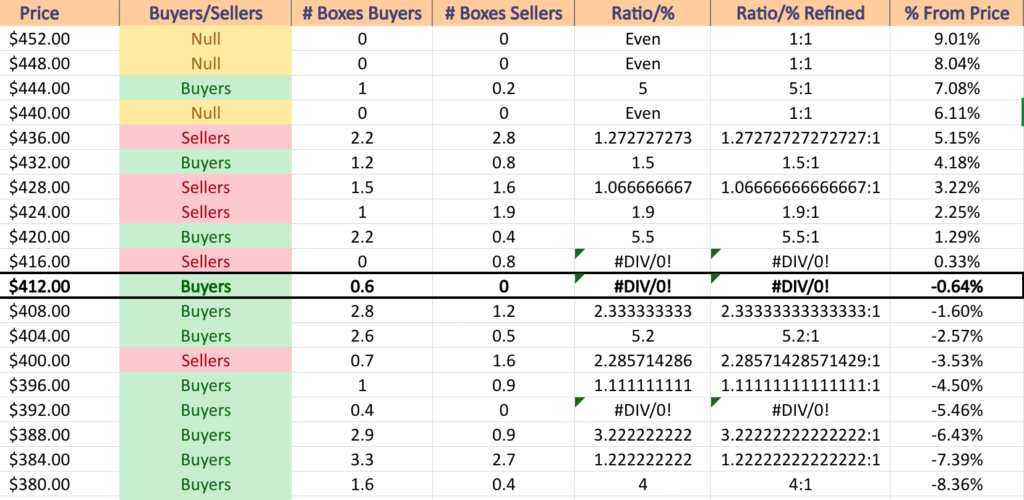

Another area for concern is that after Friday’s close, the next support level for QQQ is ~-0.5% away, and from that support level should it be broken, the next one is an additional ~-4.2% lower from there (~4.7% total decline from Friday’s closing price).

The good news is that the support level is question happens to be the 200 day moving average, but given how slow that average moves it is unlikely to advance much higher & save the decline.

Volatility has kicked up dramatically for QQQ & their Average True Range is nearing the top of its chart as a result.

Like SPY, there should be some form of early week consolidation, particularly with no major economic data being released on Monday.

How long that range can hold up will hinge on the strength of the $412.37 support level, but it should at least provide the decline with a breather & some time for oscillators to cool down.

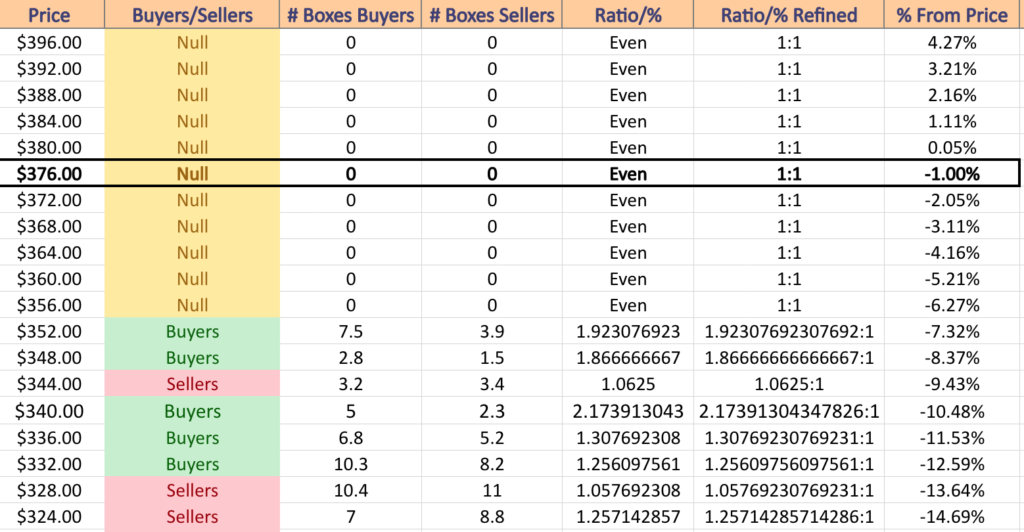

QQQ has support at the $412.37 (Volume Sentiment: Buyers, 0.6:0*), $395 (200 Day Moving Average, Volume Sentiment: Buyers 0.4:0*), $394.82 (Volume Sentiment: Buyers 0.4:0*) & $392.63/share (Volume Sentiment: Buyers 0.4:0*), with resistance at the $416.24 (Volume Sentiment: Sellers, 0.8:0*), $421.07 (Volume Sentiment: Buyers, 5.5:1), $429.28 (Volume Sentiment: Sellers, 1.07:1) & $433.08/share (Volume Sentiment: Buyers, 1.5:1) price levels.

IWM, the iShares Russell 2000 ETF dropped -2.79% this past week, as market participants were eager to sell their small cap holdings.

Their RSI is currently moving away from the oversold level, but sits at 33.79, while their MACD is still suffering from a bearish April.

Volumes were +18.01% above average compared to the year prior (41,142,740 vs. 34,864,840), as market participants were eager to take profits off of the table.

However, Friday’s session had the second highest volume of the week on its only advancing day, which we’ll dive into shortly.

Monday was a wide range declining session that set the stage for the rest of the week’s bearishness.

Tuesday was a high wave candle with a spinning top that temporarily flashed perhaps there was some hope for the bulls as it closed above where it opened, despite being a declining session on what was the highest volume day of the week.

Wednesday IWM completed a bearish engulfing pattern, swiping down any chances of there being bullish sentiment for the week & Thursday’s candle followed suit, trending & testing lower with the candle’s real body showing that at the open & close, market participants were feeling bearish.

Then we get to Friday, which was the primary options expiration date for April of 2024, where it appears that there was quite an appetite for covering positions, as IWM advanced only +0.16%, but on the highest volume of the week.

The small advance on high volume is not bullish, but Monday does not feature any major economic data releases, so there may be momentum carried over into this upcoming week.

Much like SPY & QQQ were noted earlier, it would not be surprising to see IWM form a consolidation range early in the week as we wait for earnings data & economic data to be reported.

IWM has more support levels nearby than the aforementioned index ETFs due to the way it trades in more of an oscillating manner compared to larger cap index peers who trade more in terms of ascent & descent without spending much time in trading ranges.

Their Average True Range is currently declining after the gap down last week had it advancing, but it will likely see an uptick in the coming week(s).

IWM has support at the $189.78 (Volume Sentiment: Sellers, 1.5:1), $189.58 (Volume Sentiment: Sellers, 1.5:1), $188.53 (200 Day Moving Average, Volume Sentiment: Sellers, 1.5:1) & $187.19/share (Volume Sentiment: Buyers, 3.62:1), with resistance at the $195.89 (Volume Sentiment: Sellers, 1.21:1), $196.60 (Volume Sentiment: Buyers, 1.22:1), $198.37 (10 Day Moving Average, Volume Sentiment: Buyers, 3.81:1) & $198.90/share (Volume Sentiment: Buyers, 3.81:1) price levels.

DIA, the SPDR Dow Jones Industrial Average ETF inched forward +0.09% last week, having the only positive week of the major index ETFs.

Their RSI is rebounding from oversold territory, but still sits at 38.74, while their MACD is beginning to curl over, while still remaining bearish.

Volumes were +33.94% above average compared to the year prior’s average volume (4,698,620 vs. 3,508,088), which is interesting as the highest volume session of the week was Friday’s risk-on into the weekend day.

Monday kicked the week off with the second highest volumes of the week, but on a bearish note, with a bearish engulfing pattern created that set the stage for the week’s consolidation range that occurred within it.

Tuesday attempted to open roughly midway through the real body of Monday’s session, but despite opening higher than Monday’s close there was not enough bullish momentum to keep price levels high & the session closed lower than it opened, while also forming a bearish harami pattern.

Wednesday the bearish sentiment got turned up, as the session opened just below Tuesday’s opening price, tested slightly higher, before declining to the lowest point of the week’s consolidation range & setting up a new support level at the $375.94/share price level.

Thursday attempted to recover, opening higher & testing higher, but ultimately ended in a bearish indecisive manner as the session closed lower with a spinning top candle.

Friday gave the most interesting candle of the week though, where the highest volume session resulted in an advance of +0.57%.

This could well have been a side effect of short covering as Friday was the primary expiration date for April 2024.

Based on the size of the upper shadow, there was appetite, even if only temporarily, for higher DIA prices, but market participants shied away from approaching the 10 day moving average.

This week will be important to see how strong the resistance of the 10 DMA holds up & whether or not it is able to push the price of DIA lower, and or if the consolidation range continues & the price then becomes wedged in between the 10 & 50 DMAs.

This is especially true as their RSI is trending back towards the neutral level, which would leave it open again for DIA to be faced with more declines in the coming week(s).

Their Average True Range is still elevated, but has cooled off slightly following the consolidation range of last week where there was limited volatility.

In the event of onset volatility, the issue of one year support levels (or lack thereof) that has been raised multiple times over the past month(s) will become relevant again & something to keep an eye on.

DIA has support at the $378.75 (Volume Sentiment: NULL, 0:0*), $375.94 (Volume Sentiment: NULL, 0:0*), $359.57 (200 Day Moving Average, Volume Sentiment: NULL, 0:0*) & $351.74/share (Volume Sentiment: Buyers, 1.87:1), with resistance at the $381.54 (10 Day Moving Average, Volume Sentiment: NULL, 0:0*), $387.53 (50 Day Moving Average, Volume Sentiment: NULL, 0:0*), $387.66 (Volume Sentiment: NULL, 0:0*) & $398.61/share (All-Time High, Volume Sentiment: NULL, 0:0*) price levels.

The Week Ahead

Monday does not have any major economic data announcements scheduled.

Albertsons, AZZ, Bank of Hawaii, Truist Financial, Verizon Communications & Zions Bancorp all report earnings on Monday before the opening bell, with AGNC Investment, Alexandria RE, Brown & Brown, Cadence Bank, Cadence Design, Calix Networks, Cleveland-Cliffs, Crane, Equity Lifestyle Properties, Globe Life, HealthStream, Hexcel, Independant Bank Group, Medpace, Nucor, Packaging Corp of America, Pinnacle Financial Partners, SAP & Simpson Manufacturing scheduled to report earnings after the closing bell.

S&P Flash U.S. Services PMI & S&P Flash U.S. Manufacturing PMI data will be released Tuesday at 9:45 AM, followed by New Home Sales data at 10 am.

Tuesday morning’s before the bell earnings include Banc of California, Danaher, East West Bancorp, First Bancorp, First Commonwealth, Fiserv, Freeport-McMoRan, GATX, GE Aerospace, General Motors, Halliburton, Herc Holdings, Invesco, JetBlue Airways, Kimberly-Clark, Lockheed Martin, MSCI, NextEra Energy, NextEra Energy Partners, Old National Bancorp, Pentair, PepsiCo, Philip Morris International, Polaris Industries, PulteGroup, Quest Diagnostics, RTX, Ryder System, Sherwin-Williams, Spotify, United Parcel Service, W.R. Berkley, Webster Financial & Xerox, with Tesla, Baker Hughes, Canadian National Railway, Chubb, CoStar Group, Enphase Energy, EQT Corp., Equity Residential, Hawaiian Holdings, IDEX Corp, Matador Resources, Mattel, Range Resources, Seagate Technology, Steel Dynamics, Stride, Texas Instruments, Trustmark, Veritex Holdings, Vicor, Visa, WesBanco & Zurn Elkay Water Solutions all reporting after the closing bell.

Wednesday brings us Durable-Goods Orders & Durable-Goods Minus Transportation data at 8:30 am.

Amphenol, AT&T, Avery Dennison, Biogen, Boeing, BOK Financial, Boston Scientific, Bunge, CME Group, Constellium, Entergy, Evercore, Fortive, General Dynamics, Group 1 Auto, Hasbro, Healthcare Services Group, Helen of Troy, Hilton, Humana, Interpublic, Lennox International, Masco, Mr. Cooper Group, Navient, New Oriental Education & Technology, Norfolk Southern, Old Dominion Freight Line, Otis Worldwide, Owens Corning, Pacific Premier, Silicon Labs, Synchrony Financial, TE Connectivity, Teledyne Technologies, Thermo Fisher Scientific, Travel + Leisure Co, Vertiv Holdings, Virtu Financial, Wabash National & Watsco are scheduled to report earnings Wednesday morning, followed by Meta Platforms, Align Technology, Antero Midstream, Antero Resources, BioMarin Pharmaceutical, Century Communities, ChampionX, Chemed, Chipotle Mexican Grill, Churchill Downs, Community Health, Core Labs, Encompass Health, Ethan Allen, First American Financial, Ford Motor, Graco, International Business Machines, ICON, Impinj, Kaiser Aluminum, Knight-Swift Transportation Holdings, Lam Research, Landstar System, MaxLinear, Meritage Homes, Moelis, Molina Healthcare, Nabors Industries, Oceaneering International, O’Reilly Automotive, Pegasystems, Plexus, Prosperity Bancshares, QuantumScape, Raymond James, Rollins, Sallie Mae, ServiceNow, Sleep Number, Teradyne, Tyler Technologies, United Rentals, Universal Health Services, Viking Therapeutics, Waste Management, Western Union, Whirlpool & Wyndham Hotels & Resorts after the session’s close.

Thursday kicks off with GDP, Initial Jobless Claims, Advanced U.S. Trade Balance in Goods, Advanced Retail Inventories & Advanced Wholesale Inventories data at 8:30 am & Pending Home Sales at 10 am.

A.O. Smith, ADT, Allegion, Altria, American Airlines, Applied Industrial, Arch Resources, Asbury Automotive, AstraZeneca, Bristol-Myers Squibb, Brunswick, California Water, Carrier Global, Caterpillar, CBIZ, Check Point Software, CMS Energy, CNX Resources, Comcast, Cullen/Frost, Dover, Dow, DTE Energy, Expro Group, FTI Consulting, Grainger, Harley-Davidson, Hertz Global, Hess, Honeywell, IMAX, Insteel Industries, Integer Holdings, International Paper, Keurig Dr Pepper, Kirby, Laboratory Corp of America, Lakeland Financial, Lazard, Merck, Mobileye Global, Nasdaq, Newmont, Northrop Grumman, Oshkosh, PG&E, Pool, Reliance, Royal Caribbean, S&P Global, SAGE Therapeutics, Sanofi, Sonic Automotive, Southside Banc, Southwest Air, STMicroelectronics, TechnipFMC, Textron, Tractor Supply Company, Tradeweb Markets, TransUnion, TRI Pointe Homes, Union Pacific, Valero Energy, Visteon, West Pharmaceutical Services, WEX, Willis Towers Watson, WNS & Xcel Energy will all report earnings before the opening bell on Thursday, followed by Microsoft, AllianceBernstein, Alphabet, AppFolio, AptarGroup, Arthur J. Gallagher, Atlassian, AvalonBay, Boston Beer Co, Boyd Gaming, Capital One, Carlisle Cos, Casella Waste, Cincinnati Financial, Columbia Sportswear, CubeSmart, DexCom, Eastman Chemical, Edwards Lifesciences, Exponent, Fair Isaac, Federated Hermes, First Financial Bancorp, FirstEnergy, Gaming and Leisure Properties, Gilead Sciences, Hartford Financial, Healthpeak Properties, Hub Group, Intel, Juniper Networks, KLA, L3Harris, Mohawk, NerdWallet, Olin, Phillips Edison & Company, Principal Financial Group, PTC Therapeutics, ResMed, Robert Half, Roku, Skechers USA, SkyWest, Snap, SPS Commerce, Teladoc, Terex, T-Mobile US, VeriSign, Western Digital, Weyerhaeuser & WSFS Financial after the session’s close.

Personal Income (Nominal), Personal Spending (Nominal), PCE Index, PCE (Year-over-Year), Core PCE Index & Core PCE (Year-over-Year) are all released Friday morning at 8:30 am, followed by Consumer Sentiment (final) data at 10 am.

Friday morning AbbVie, Aon, Autoliv, AutoNation, Ball Corp, Barnes Group, Centene, Charter Communications, Chevron, Colgate-Palmolive, Exxon Mobil, First Hawaiian, Gentex, HCA, LyondellBasell, Newell Brands, Piper Sandler, Roper, Saia, T. Rowe Price, TriNet Group, U.S. Silica & WisdomTree are all scheduled to report earnings before the opening bell.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM OR DIA AT THE TIME OF PUBLISHING THIS ARTICLE ***