Big Lots, Inc. stock trades under the ticker BIG & may present investors & traders with an opportunity to earn profits amid volatile market conditions.

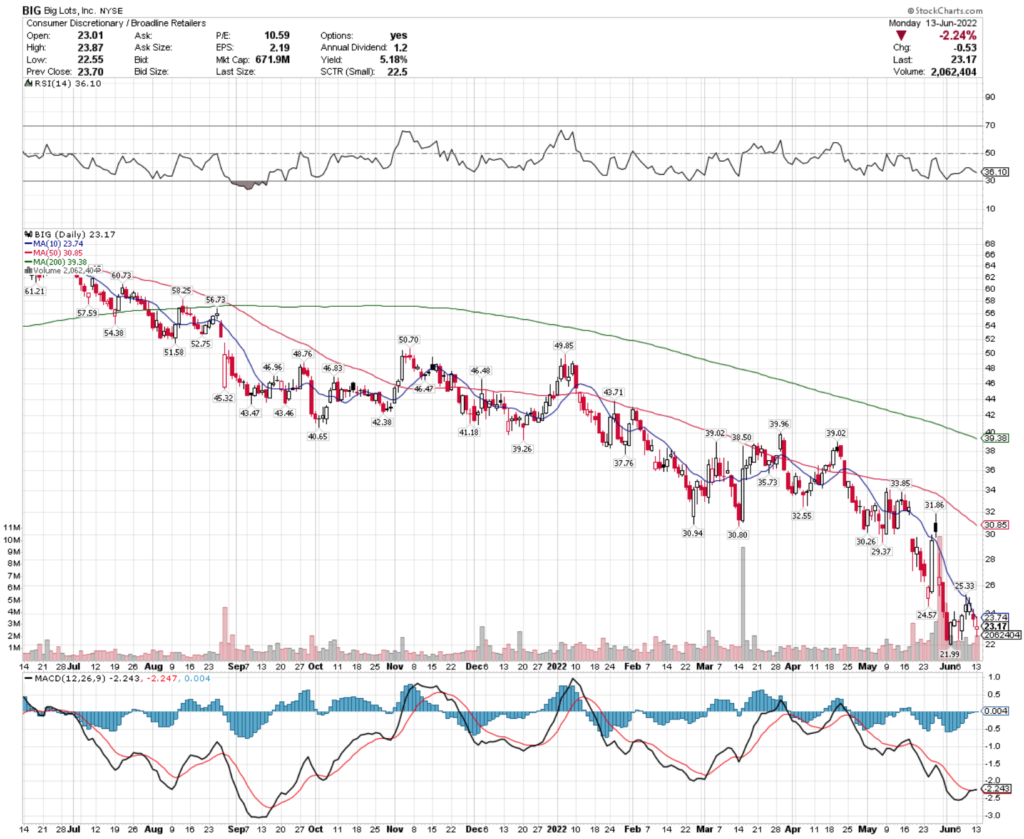

BIG stock closed at $23.17/share on 6/13/2022.

Big Lots, Inc. BIG Stock’s Technical Performance Broken Down

BIG Stock Price: $23.17

10 Day Moving Average: $23.74

50 Day Moving Average: $30.85

200 Day Moving Average: $39.38

RSI: 36.1

MACD: -2.243

Yesterday, BIG stock completed a bullish MACD crossover, despite dropping 2.24% for the day’s session.

The markets as a whole are trending down, as is BIG stock, as shown by their RSI approaching oversold territory.

After being on a decline for the last year, BIG stock needs to stay above its $21.99 support level, otherwise it will continue downward, which makes profitable opportunities for traders using put options.

Big Lots, Inc. BIG Stock As A Long-Term Investment

Long-term oriented investors will like BIG stock’s valuation metrics, with a 5.44 P/E (ttm) & a 0.82 P/B (mrq).

They recently reported -15.4% Quarterly Revenue Growth Y-o-Y, which is disappointing from an investor’s standpoint.

Their balance sheet will require a closer examination before investing, with $61.7M of Total Cash (mrq) & $2.08B of Total Debt (mrq).

BIG stock pays a 5.06% dividend yield, which appears stable in the long-run, as their payout ratio is 51.72%.

80% of BIG stock’s outstanding share float is owned by institutional investors.

Big Lots, Inc. BIG Stock As A Short-Term Trade Using Options

Short-term oriented traders can use options to profit from BIG stock’s price movements, while protecting their returns from volatility.

I am looking at the contracts with the 6/17 expiration date.

The $22.50, $15 & $20 call options are all in-the-money, with the former being the most liquid & the latter being the least.

The $32.50, $30 & $27.50 puts are also in-the-money, with the former being the least liquid & the latter being the most.

Using puts can be valuable in this instance, as while BIG tries to stay above its $21.99 support level traders can collect profits from puts, roll their profits into long-shares, and collect 5% interest on them if they hold for a year or longer.

Tying It All Together

BIG stock has been declining just like the broader market indexes over the last year, which may present an opportunity for profits by traders & investors alike.

Investors will like their dividend yield & valuation metrics, but will want to check in on their balance sheet before making an investment to see how interest rate hikes will impact BIG stock.

Traders will be able to profit from their options, which are relatively liquid across in-the-money strikes.

Overall, it is worth taking a closer look to see how BIG stock can fit into your portfolio strategy.

*** I DO NOT OWN SHARES OF BIG STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***