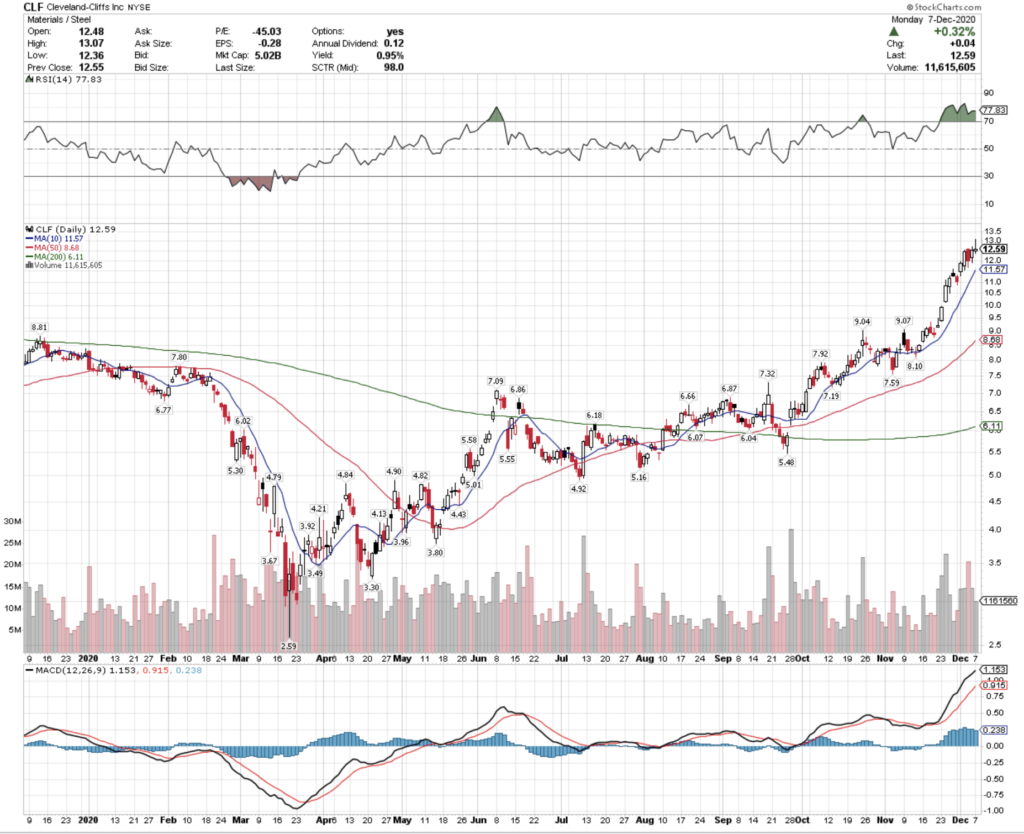

Cleveland-Cliffs Inc. stock trades under the ticker CLF & closed at $12.59/share on 12/7/2020.

CLF stock has been on a solid growth trajectory since mid-November 2020, and shows signs of profit opportunities for short & medium-term traders alike.

CLF Stock Price: $12.59

10 Day Moving-Average: $11.57

50 Day Moving-Average: $8.68

200 Day Moving-Average: $6.11

RSI: 77

With an RSI of 77, CLF is likely going to ease in price in the near-term, offering an opportunity for common-share investors to buy into a more advantageous price as it establishes its new range.

Their MACD trend suggests this as well, so I would be watching these numbers & lines while trying to decide an entry, if I were looking to go long the common shares.

In terms of options, I may look at the $12 calls that are already in the money with a delta that is greater than .74, and or the at-the-money $12.50 calls.

From a puts perspective, the $13 puts has a delta of -0.6956, suggesting that during the correcting of price range, a small amount of movement will move the price of your option in a large way, and as they’re quoted at $0.55 vs. $1.47 for the $14 puts (delta -0.88), you’ll be able to make a little more bang for your buck on that price range establishment.

Overall, CLF stock looks to still have legs under it to continue growing, and their options also look appealing.

I’ll be eyeing their options for a possible trade today & tomorrow.

*** I DO NOT OWN SHARES OF CLF STOCK ***