Northwest Bancshares, Inc. stock trades under the ticker NWBI & has shown recent bullishness that traders & investors should take a closer look into.

NWBI stock closed at $14.23/share on 3/14/2022.

Northwest Bancshares, Inc. NWBI Stock’s Technicals Broken Down

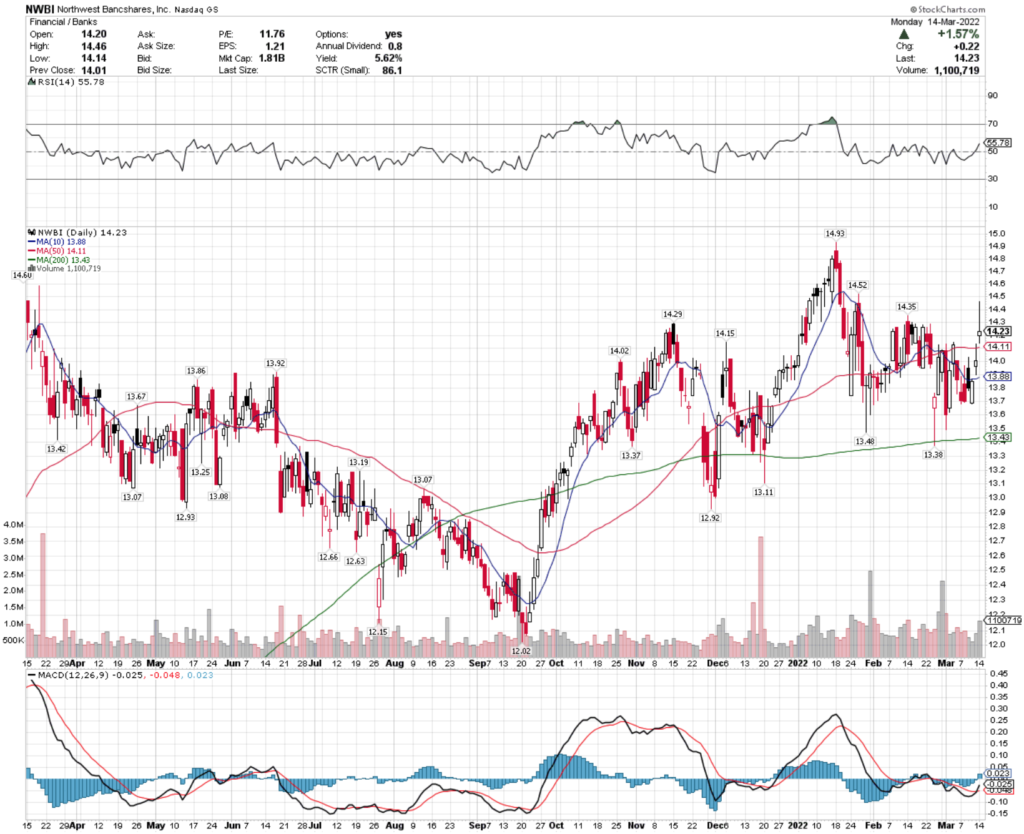

NWBI Stock Price: $14.23

10 Day Moving Average: $13.88

50 Day Moving Average: $14.11

200 Day Moving Average: $13.43

RSI: 55.8

MACD: -0.025

Yesterday, NWBI stock completed a bullish MACD crossover, gapping up 1.57% above its 50 Day Moving Average.

NWBI shares have been trading on above average volume in 2022 compared to the previous year.

Their RSI is still neutral, showing room for more upward momentum.

The next price levels I am watching are the $14.35 & $14.52 resistance levels.

Northwest Bancshares, Inc. NWBI Stock As A Long-Term Investment

Investors focused on the long-term will find NWBI stock’s valuation metrics appealing, with a P/E (ttm) of 11.6 & a P/B (mrq) of 1.12.

Their most recent Quarterly Revenue Growth Y-o-Y was disappointing at -8.5%.

NWBI stock’s balance sheet looks appealing, with Total Cash (mrq) of $1.31B & Total Debt (mrq) of $428.21M.

Northwest Bancshares, Inc. pays a healthy 5.64% dividend, which looks fairly safe in the long-run with a payout ratio of 65.3%.

Despite this, only ~63% of their outstanding share float is held by institutional investors.

Northwest Bancshares, Inc. NWBI Stock As A Short-Term Trade Using Options

Short-term oriented traders can use options to take advantage of NWBI stock’s movement in either direction.

I am looking at the contracts with the 4/14 expiration date.

The $15 call options look appealing, and after this week’s expiration date, I expect more liquidity to be in the $12.50 strike priced contracts.

The puts that are in-the-money all have no open interest yet, but I expect that to change after this Friday & would be looking at the $17.50 & $15 contracts.

Tying It All Together

Overall, NWBI stock has many appealing attributes.

Investors will like their valuation metrics & balance sheet, but may be cautious about their dividend staying so high for a long-period of time due to their high payout ratio.

Traders will like their current momentum, but will want to see more liquidity for next month’s contracts.

NWBI stock is worth taking a closer look into, regardless of your trading style.

*** I DO NOT OWN SHARES OF NWBI STOCK ***