Alphabet Inc. stock trades under the ticker GOOGL & has had a strong 2023, gaining +41.44% since their 52-week low that occurred in November of 2022.

GOOGL is held by many popular ETFs, including VOX (GOOGL: 12.12%, GOOG: 10.04%), XLC (GOOGL: 10.12%, GOOG: 11.7%), IXP (GOOGL: 11.47%, GOOG: 9.92%), FFND (9.83%), GRZZ (9.36%), FFLS (8.89%) & many more.

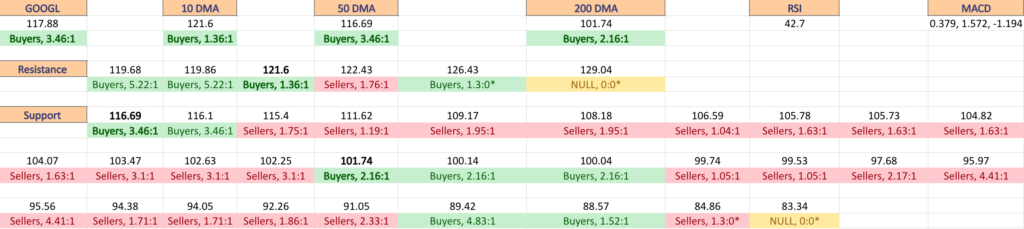

The Price:Volume analysis below seeks to display the volume at specific share-price levels from over the past one-to-two years & is intended to serve as a reference point for how investors viewed GOOGL stock’s value at each level.

It also includes a list of moving averages, as well as support & resistance levels, which will be marked in bold.

Alphabet Inc. GOOGL Stock’s Price:Volume Sentiment Broken Down

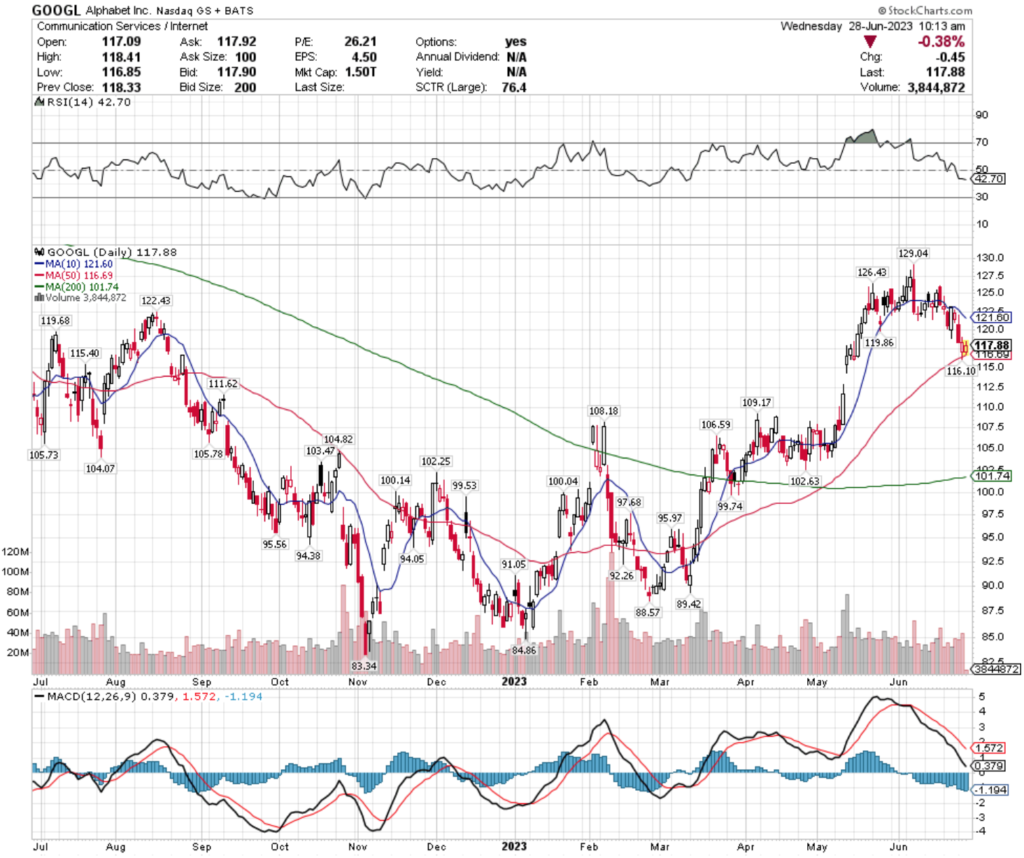

Their RSI is trending towards the oversold end of neutral at 42.7 & their MACD has been in a bearish freefall since the first week of June.

Recent trading volumes have been about average compared to the year prior, signaling that many investors were likely taking profits & rolling them into the rush to more semiconductor & AI-oriented names.

Last week’s candlestick’s gave interesting signals, with Thursday’s candle engulfing Wednesday’s bullishly, only for it to form a bearish harami pattern with Friday’s candle.

There is clear downwards pressure coming from the 10 day moving average, while the 50 day moving average seems to be holding the price up over yesterday & today’s sessions (chart was screenshot at 10:13 am on 6/28/2023).

Monday’s session still signals that the market wants them to consolidate lower, which will be something to watch for as the week winds down.

The bold prices on the image below denote the moving average levels just listed & the bold entries in the list form of the analysis under the images include other levels of support.

Each corresponding price level using a ratio of Buyers:Sellers (or Sellers:Buyers), NULL values denote that there was not enough data, so the ratio would’ve been 0:0.

Ratios with a 0 for the denominator/constant are denoted with an *, but are reported as is, as we are accounting for volume/sentiment.

Also, as there is such a wide spread between many price levels having activity data, many of the levels are marked NULL, as there was limited volume data for them, and they were not included in the long list below unless they were relevant to support/resistance levels.

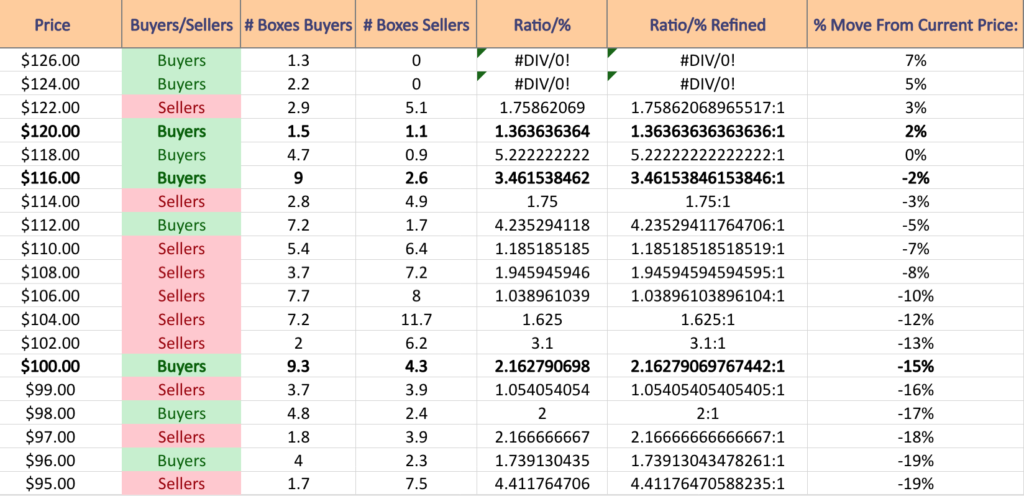

Alphabet Inc. GOOGL Stock’s Volume By Price Level

$126 – Buyers – 1.3:0*, +7% From Current Price

$124 – Buyers – 2.2:0*, +5% From Current Price

$122 – Sellers – 1.79:1, +3% From Current Price

$120 – Buyers – 1.36:1, +2% From Current Price – 10 Day Moving Average

$118 – Buyers – 5.22:1, 0% From Current Price

$116 – Buyers – 3.46:1, -2% From Current Price – 50 Day Moving Average

$114 – Sellers – 1.75:1, -3% From Current Price

$112 – Buyers – 4.24:1, -5% From Current Price

$110 – Sellers – 1.19:1, -7% From Current Price

$108 – Sellers – 1.95:1, -8% From Current Price

$106 – Sellers – 1.04:1, -10% From Current Price

$104 – Sellers – 1.63:1, -12% From Current Price

$102 – Sellers – 3.1:1, -13% From Current Price

$100 – Buyers – 2.16:1, -15% From Current Price – 200 Day Moving Average

$99 – Sellers – 1.05:1, -16% From Current Price

$98 – Buyers – 2:1, -17% From Current Price

$97 – Sellers – 2.17:1, -18% From Current Price

$96 – Buyers – 1.74:1, -19% From Current Price

$95 – Sellers – 4.41:1, -19% From Current Price

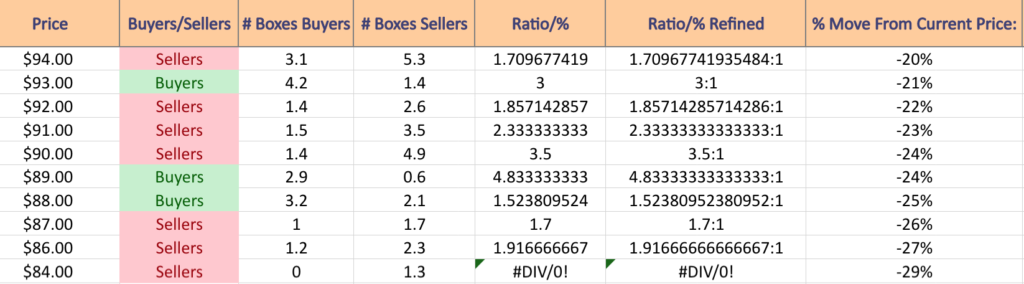

$94 – Sellers – 1.71:1, -20% From Current Price

$93 – Buyers – 3:1, -21% From Current Price

$92 – Sellers – 1.86:1, -22% From Current Price

$91 – Sellers – 2.33:1, -23% From Current Price

$90 – Sellers – 3.5:1, -24% From Current Price

$89 – Buyers – 4.83:1, -24% From Current Price

$88 – Buyers – 1.52:1, -25% From Current Price

$87 – Sellers – 1.7:1, -26% From Current Price

$86 – Sellers – 1.92:1, -27% From Current Price

$84 – Sellers – 1.3:0*, -29% From Current Price

Tying It All Together

The list & image above paint the picture as to how investors & traders have behaved at various price levels that GOOGL has been at over the past one-to-two years.

It is not meant to serve as investment/trading advice, and is simply a way to visualize what investor/trader sentiment has been like at each of the price levels mentioned, as well as what it was at levels of support & resistance that are denoted in the image & list.

As always, do your own due diligence before making investing/trading decisions.

For more on the methodology on how the data was collected & put together, please refer to our original Price:Volume analysis.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN GOOGL AT THE TIME OF PUBLISHING THIS ARTICLE ***