Last week we saw the major market indexes turn around a positive week for the first time in nearly 2 months.

While data being reported & earnings calls did not sound particularly more upbeat, investors felt more confident in taking on more risk, causing markets to rise.

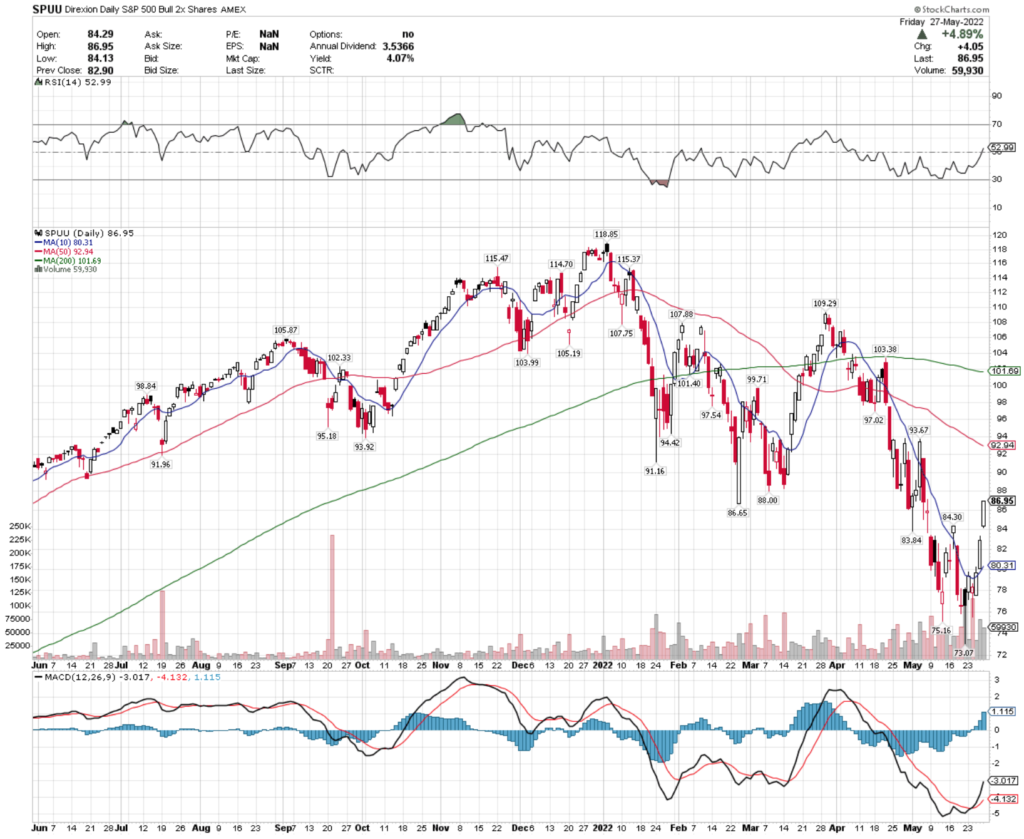

SPUU, the Direxion Daily S&P 500 Bull 2x Shares ETF performed very strong, closing green for 4 of the last 5 days.

While there was temporary relief, their chart does not look to be out of the woods just yet, and this upcoming week looks like we will see more selling than buying.

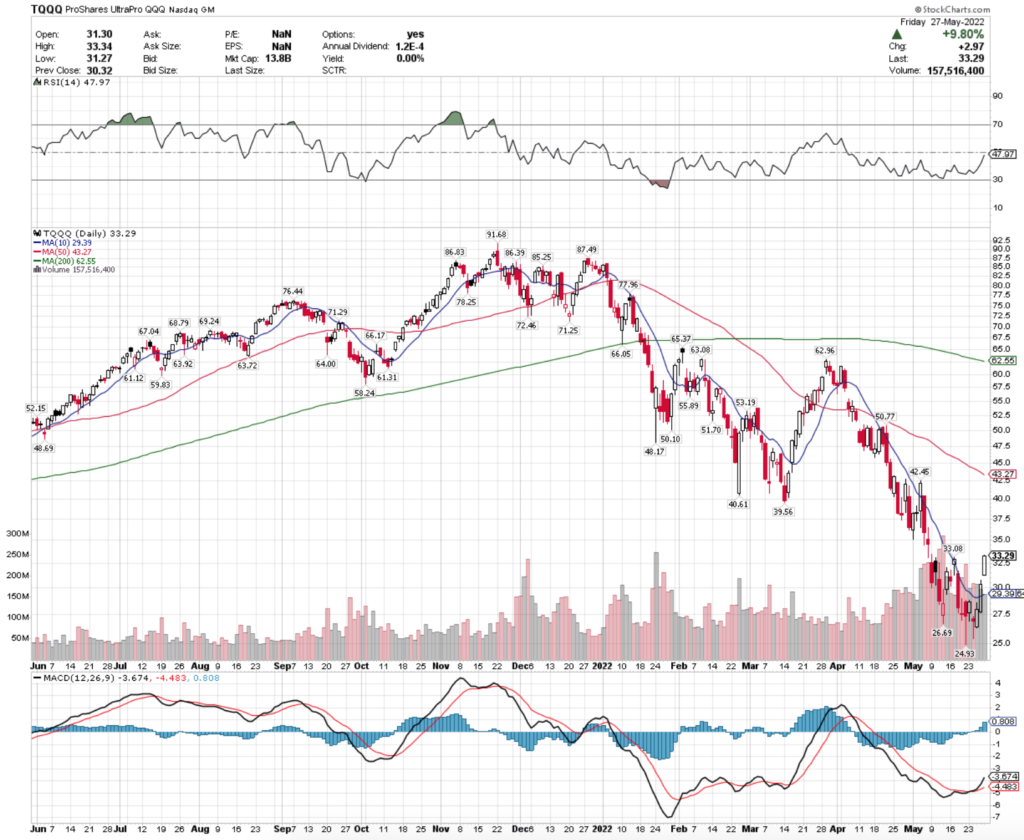

TQQQ, the ProShares UltraPro QQQ ETF also rebounded last week, after a mostly negative last quarter.

Volumes were higher than they have been all year, but the chart is not signaling that it is time to buy in just yet.

Energy Momentum (PXI), UltraShort 20+ Year Treasury (TBT), Chile (ECH) & Metals and Mining (XME) All Bullishly Leading The Market

PXI, the Invesco DWA Energy Momentum ETF has performed strongly since August of 2021.

PXI does look to be cooling off though, as their 10 & 50 day moving averages are pulling tighter together, and their RSI is about to enter into overbought territory.

They look to be due for a shakeout in the near-term, which can be navigated using options as hedging protection, as long-only shares only provide a .55% cushion through their dividend for those who hold the position for a year.

TBT, the ProShares UltraShort 20+ Year Treasury ETF has been climbing steadily since December, as higher interest rate expectations powered it higher.

While they’ve cooled off in May, their trading volume has gone down from the rest of 2022, signaling a lack of investor confidence.

TBT’s MACD has been signaling bearish since the beginning of May & their RSI has gone back to neutral, showing that they may be ready to begin climbing higher again in the near-term.

ECH, the iShares MSCI Chile Capped ETF has performed very strongly since the beginning of May, climbing ~26% over the last few weeks.

ECH offers a 4.13% dividend yield that investors can use as a cushion to protect against future losses, and they also have options that traders can use to reduce risk.

They look primed for a pullback in the near-term, with an overbought RSI, which may present a buying opportunity for some investors.

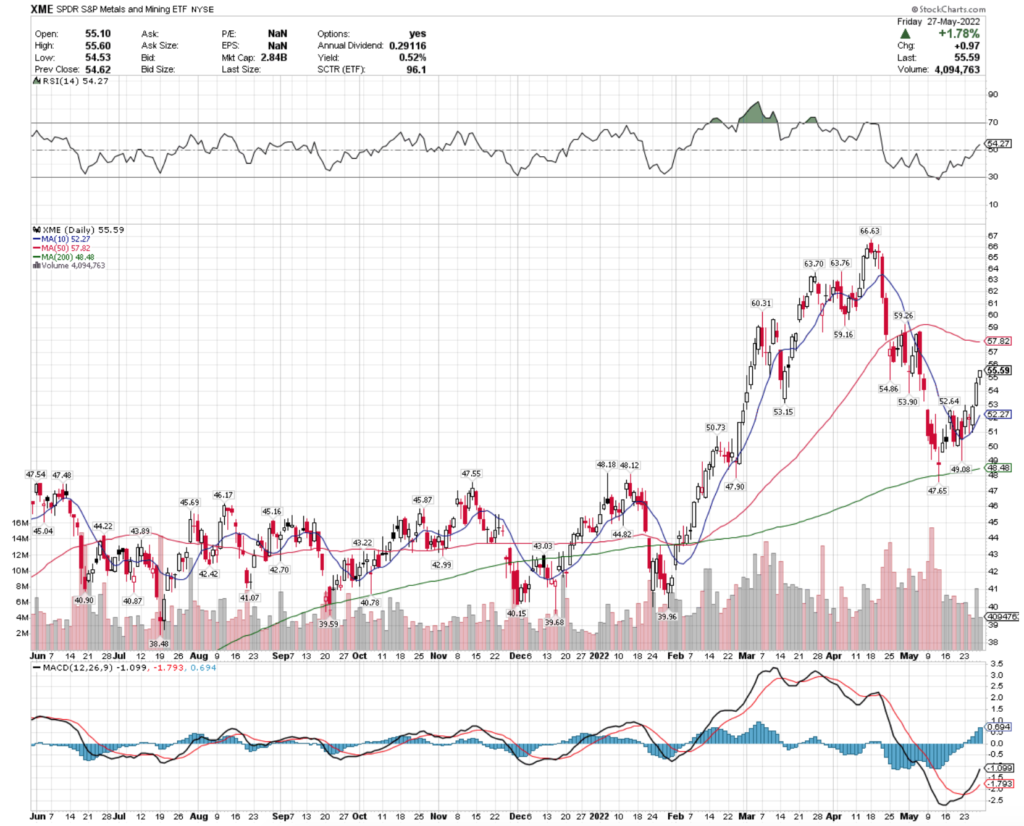

XME, the SPDR S&P Metals & Mining ETF has been trading on higher than average volume in 2022 vs. 2021’s trading volumes.

They look to have momentum to continue climbing in the coming weeks, should their MACD not roll over & begin to turn bearish, as their RSI is currently neutral.

Investors looking to buy into XME should reduce the risks associated in this volatile market environment by leveraging their options, as their dividend yield does not provide much protection from any downside risks.

US Rotation (RORO), Telemedicine & Digital Health (EDOC), Gerber Kawasaki (GK) & Dry Bulk Shipping (BDRY) All Bearishly Lagging The Market

RORO, the ATAC US Rotation ETF has performed poorly since the beginning of 2022, falling ~38% in the last 5 months.

As their RSI begins to return to neutral, investors may begin to think about rotating into a RORO position, as holding the shares for the year ahead yields a 4.3% dividend.

EDOC, the Global X Telemedicine & Digital Health ETF has also been performing poorly since November of 2021.

While they look to be establishing a new floor to build from, there is no dividend yield to provide additional returns for long-term shareholders who establish a new position now.

Their MACD looks like that it may becoming bearish in the near-term, so this is something investors may want to monitor closely in the coming weeks before purchasing shares.

GK, the AdvisorShares Gerber Kawasaki ETF has performed terribly since its inception in July 2021, losing ~36% over the last 8-9 months.

While their RSI is approaching neutral & their MACD looks bullish, this is a name that will experience more near-term pain & is not worth considering entry into a new position in at this time.

BDRY, the Breakwave Dry Bulk Shipping ETF has lost ~50% of its value since October of 2021.

Their MACD is currently bearish, and their 10 day moving average is set to break through the 50 day MA, signaling more pain on the near-horizon.

As they offer no dividend yield, this does not appear to be a good time to begin buying into BDRY.

Tying It All Together

This upcoming week looks to have more volatility in store, after major averages had their first positive week last week in months.

Investors will be interested in PMI data, job openings, jobless claims, construction spending & factory orders data, as well as the Fed’s Beige Book.

Earnings calls will also continue, where guidance offered will help mold future expectations for market performance in the coming year.

Volatility looks to continue, which can offer some discounts for investors willing to take on more risk while purchasing new assets or building on existing positions.

*** I DO NOT OWN SHARES OF SPUU, TQQQ, PXI, TBT, ECH, XME, RORO, EDOC, GK, OR BDRY AT THE TIME OF PUBLISHING THIS ARTICLE ***