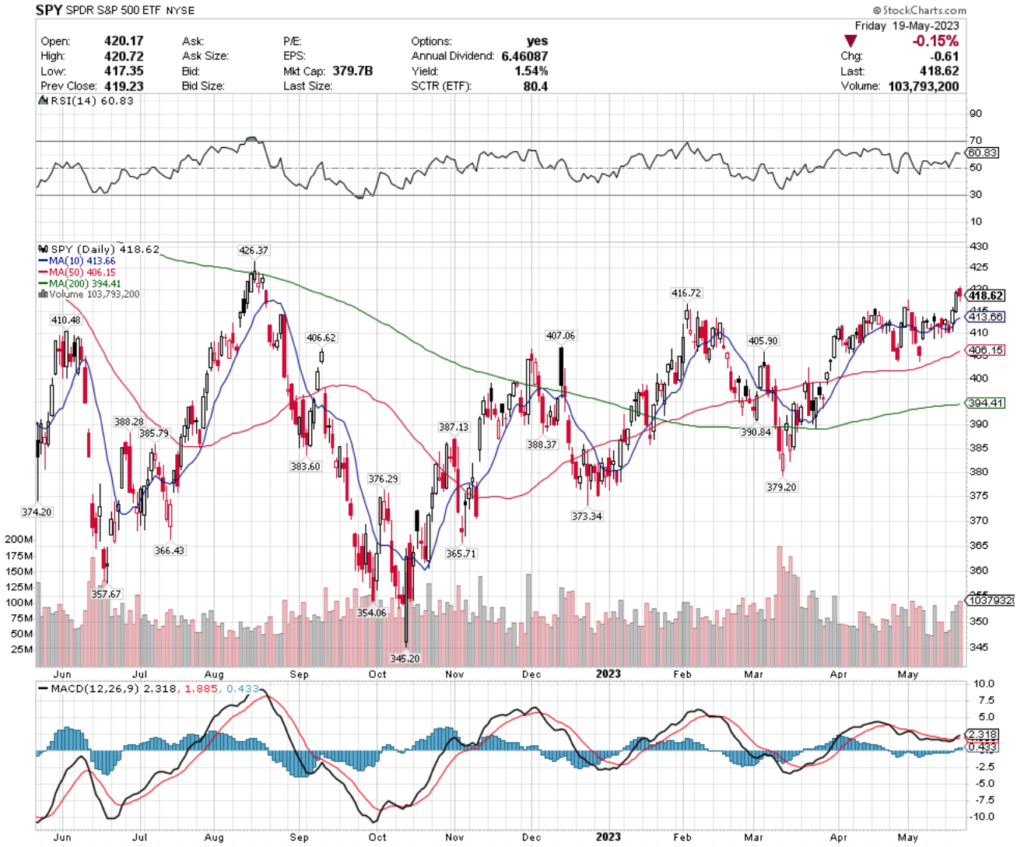

SPY, the SPDR S&P 500 ETF gained +1.71% over the past week, as investors tried to sort through the results of earnings calls, changes in companies’ guidance, the fallout of the bank failure issues, future inflation curbing measures from the Fed & the U.S. Debt Ceiling debacle.

After starting the week off in the same consolidation range as last week, Wednesday & Thursday’s sessions showed signs of optimism from investors, with Friday’s session bringing SPY back to reality a bit after two strong days.

Their RSI is on the overbought end of neutral at 60.83, with last week’s volumes starting off below average compared to the year prior, before increasing Wednesday through Friday.

Their MACD is currently bullish, but Monday’s session will provide more technical insights into which direction they are likely to go in for the next week, as Monday’s session has to the potential to create a Dark Cloud Cover pattern, which would be a bearish signal to kick off the week.

SPY has support at the $416.72 (Volume Sentiment: Sellers, 1.33:1), $413.66 (Volume Sentiment: Buyers, 3:1), $410.48 (Volume Sentiment: Sellers, 1.57:1) & $407.06/share (Volume Sentiment: Sellers, 1.9:1) price levels, with resistance at the $426.37 (Volume Sentiment: Sellers, 1.24:1), $438.53 (Volume Sentiment: Sellers, 1.32:1), $442.12 (Volume Sentiment: Sellers, 1.35:1) & $449.09/share (Volume Sentiment: Buyers, 1.89:1) price levels.

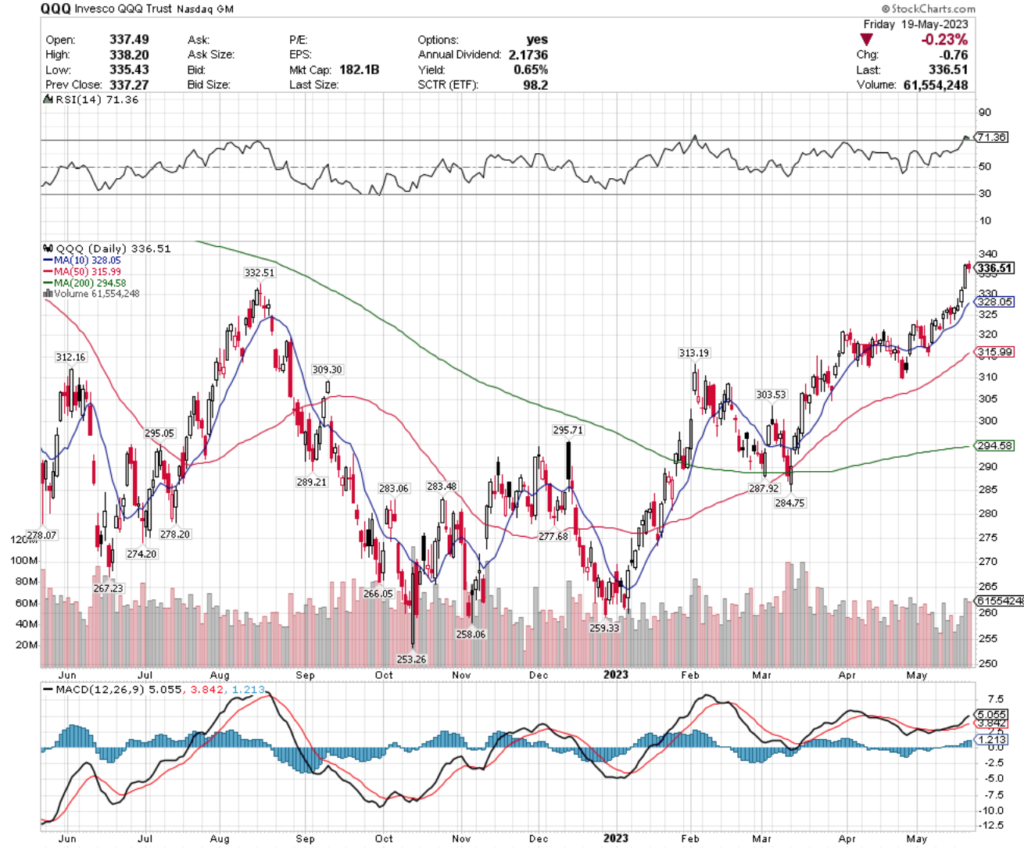

QQQ, the Invesco QQQ Trust ETF jumped +3.53% over the past week, as investors showed favor to the tech-heavy NASDAQ index vs. the S&P 500 & Russell 2000.

Their day-by-day results were quite similar to SPY’s, although Monday & Tuesday were both days of slight gains that remained in last week’s consolidation range, before Wednesday & Thursday’s major bullish sessions & Friday’s spinning top candlestick.

QQQ’s RSI is overbought at 71.36 & their past week’s volume followed a similar pattern to SPY’s.

Their MACD is also currently bullish, but beginning to show signals of rolling over bearishly in the coming days.

QQQ has support at the $332.51 (Volume Sentiment: Sellers, 3.2:1) , $328.05 (10 day moving average; Volume Sentiment: Sellers, 1.8:1), $315.99 (50 day moving average; Volume Sentiment: Sellers, 3.64:1) & $312.16/share (Volume Sentiment: Sellers, 3.64:1) price levels, with resistance at the $346.78 (Volume Sentiment: Buyers, 1.31:1), $368.99 (Volume Sentiment: Buyers, 0.75:0*), $375.07 (Volume Sentiment: Sellers, 1:0*) & $378.49/share (Volume Sentiment: Buyers, 1.33:1) price levels.

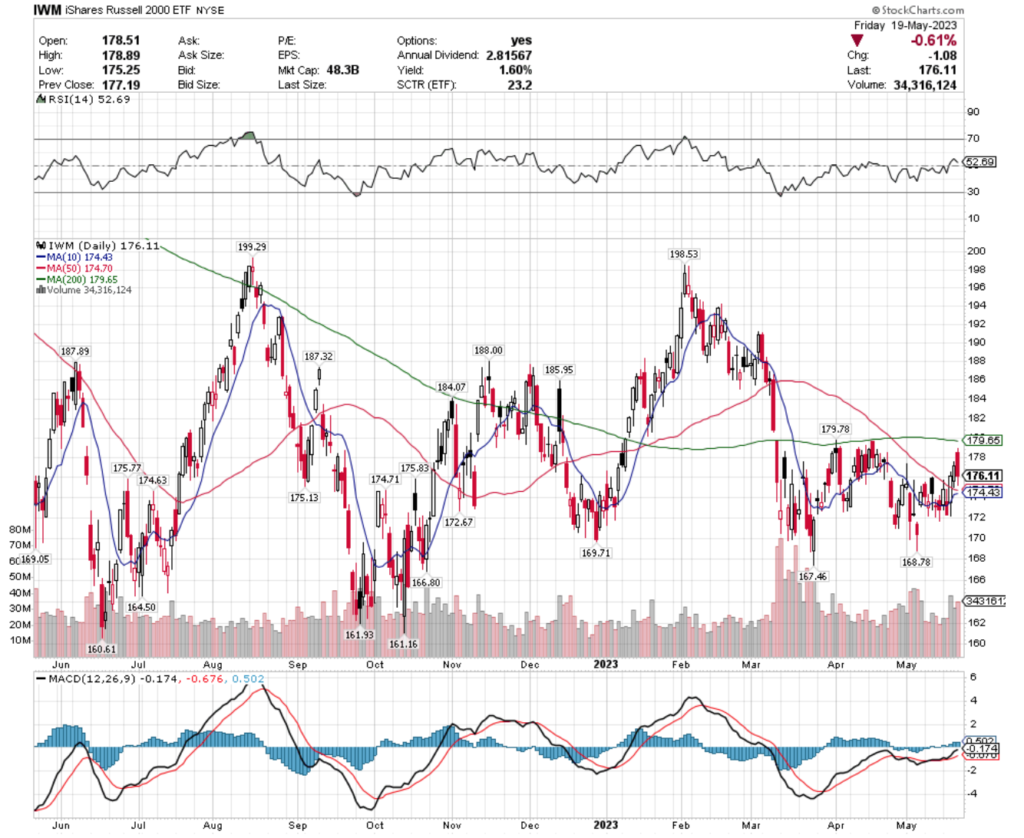

IWM, the iShares Russell 2000 ETF gained +1.96% over the past week, as investors showed more favor to smaller cap stocks than the S&P 500 index, but still were not able to perform as strongly as the NASDAQ names.

They too kicked off the first two days of the week in the same range as last week, before Wednesday & Thursday produced big gains, which were brought back to reality during Friday’s session.

Their RSI is neutral at 52.69, with volumes becoming above average compared to the year prior from Wednesday through Friday of this past week.

Their MACD is also bullish, but beginning to signal that it may roll over bearishly in the coming sessions.

IWM has support at the $175.83 (Volume Sentiment: Buyers, 1.45:1) , $175.77 (Volume Sentiment: Buyers, 1.45:1), $174.71 (Volume Sentiment: Buyers, 1.45:1) & $174.70/share (50 day moving average; Volume Sentiment: Buyers, 1.45:1 ) price levels, with resistance at the $179.65 (200 day moving average; Volume Sentiment: Buyers, 1.84:1), $179.78 (Volume Sentiment: Buyers, 1.84:1), $184.07 (Volume Sentiment: Buyers, 1.75:1) & $185.95/share (Volume Sentiment: Buyers, 1.75:1) price levels.

Let’s dive into some of the best & worst performing sectors, industries & geo-locations based on our technical analysis ratings of their relevant ETFs!

Semiconductors (SOXL), Argentina (ARGT), Germany (EWG) & Telecommunication Services (FCOM) Are All Bullishly Leading The Market

SOXL, the Direxion Daily Semiconductor Bull 3x Shares ETF has fallen -13.76% over the past year, but has recovered a remarkable +180.03% from their 52-week low in October of 2022 (ex-distributions).

They had a very strong week last week, climbing +23.33% during the course of the past five trading sessions.

Their RSI is nearing overbought at 65.33 & recent trading volumes have been below average compared to the year prior, signaling that investors & traders still are feeling uncertain as to where they value SOXL’s shares.

Their MACD is bullish, with their 10 day moving average poised to cross bullishly through their 50 day moving average in the next trading session.

Given their technicals & broader market volatility, it would be wisest to watch their behavior around their support levels, while using a defensive options strategy as insurance, as their 0.7% distribution yield for long-term holders does not provide much cushion against losses.

SOXL has support at the $16.77, $16.51, $16.44 & $15.46/share (50 day moving average) price levels, with resistance at the $17.49, $17.56, $17.80 & $18.34/share price levels.

ARGT, the Global X MSCI Argentina ETF has gained +41.58% over the past year, posting a +75.01% gain since their 52-week low in July of 2022 (ex-distributions).

Their last two sessions have had hanging man/spinning top candlesticks, which is signaling a bearish near-term outlook for ARGT.

Their MACD is signaling a bearish crossover is imminent & their RSI is bearishly moving back towards the neutral point of 50.

Trading volumes for the first three sessions of the week looked above/about average compared to the year prior, but the last two sessions produced limited volume, signaling caution among investors on ARGT.

While they provide a 2.04% distribution yield for long-term holders, a defensive options strategy such as buying puts or selling calls would be wiser than entering a long position now, while waiting to see how their price behaves around their support levels in the near-term.

ARGT has support at the $40.70 (10 day moving average), $40.64, $40.50 & $38.99/share (50 day moving average) price levels, with resistance at the $40.80, $41.59, $41.77 & $41.96/share price levels.

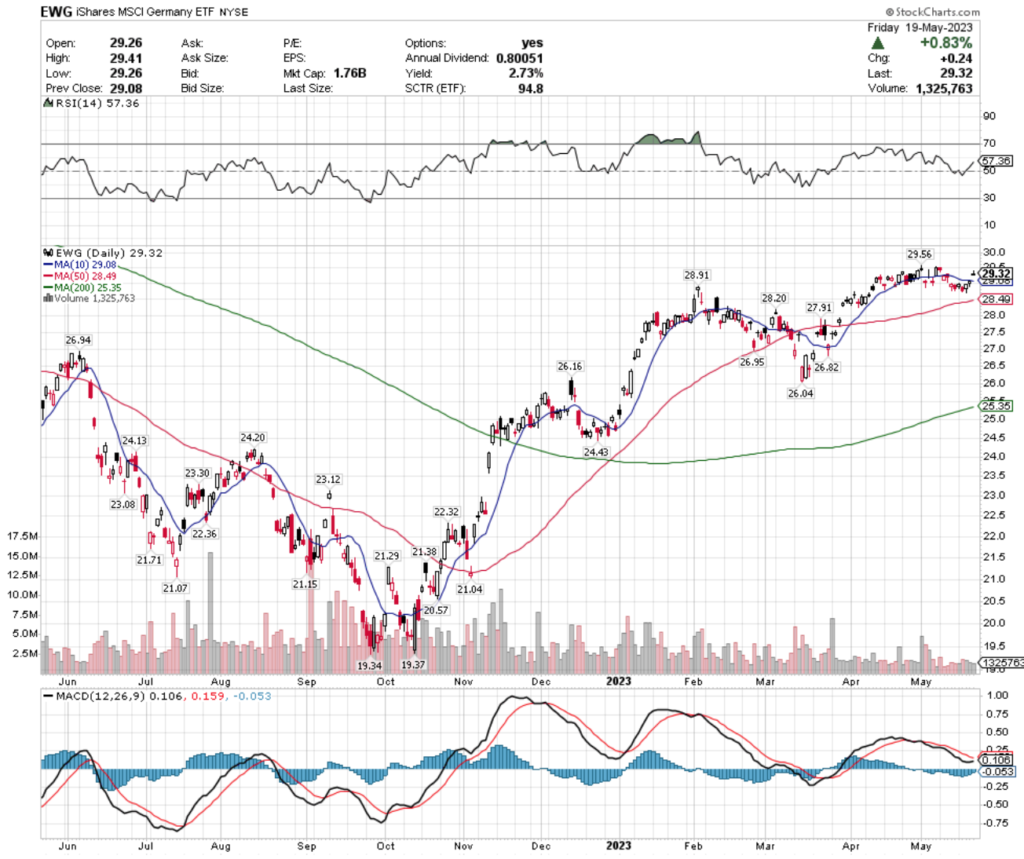

EWG, the iShares MSCI Germany ETF has improved +15.8% over the past year, climbing +51.52% since their 52-week low in September of 2022 (ex-distributions).

Their MACD is currently bearish, but moving towards a bullish crossover in the coming sessions, but a shooting star candlestick from Friday’s session shows that there may be a consolidation coming in the near-term.

Their RSI is on the overbought end of neutral at 57.36, and recent trading volumes have been below average, confirming that uncertainty that investors are feeling regarding their share price.

EWG offers a 2.73% distribution yield for long-term holders which will provide some cushion against losses, but trading options around their current price levels will provide a better form of insurance while waiting to see how they behave at key support levels in the near-term.

EWG has support at the $29.08 (10 day moving average), $28.91, $28.49 (50 day moving average) & $28.20/share price levels, with resistance at the $29.56, $29.86, $30.26 & $30.84/share price levels.

FCOM, the Fidelity MSCI Telecommunication Services Index ETF has gained +1.72% over the past year, climbing +28.37% from their 52-week low in November of 2022 (ex-distributions).

Friday’s session has caused their MACD to begin taking a turn towards a bearish crossover in the coming sessions, but this past week’s volume was also subpar compared to the year prior.

Their RSI is moving back towards neutral from a more overbought position earlier in the week.

Their modest 0.89% distribution yield will not provide much protection against losses, making an options strategy the best bet while waiting to see where to enter a long-term position.

FCOM has support at the $37.89, $37.47, $37.35 (10 day moving average) & $37.16/share price levels, with resistance at the $38.39, $39.35, $39.50 & $40.73/share price levels.

Regional Banking (KRE), Clean Energy (PBW), Metals & Mining (XME) & Turkey (TUR) Are All Bearishly Lagging The Market

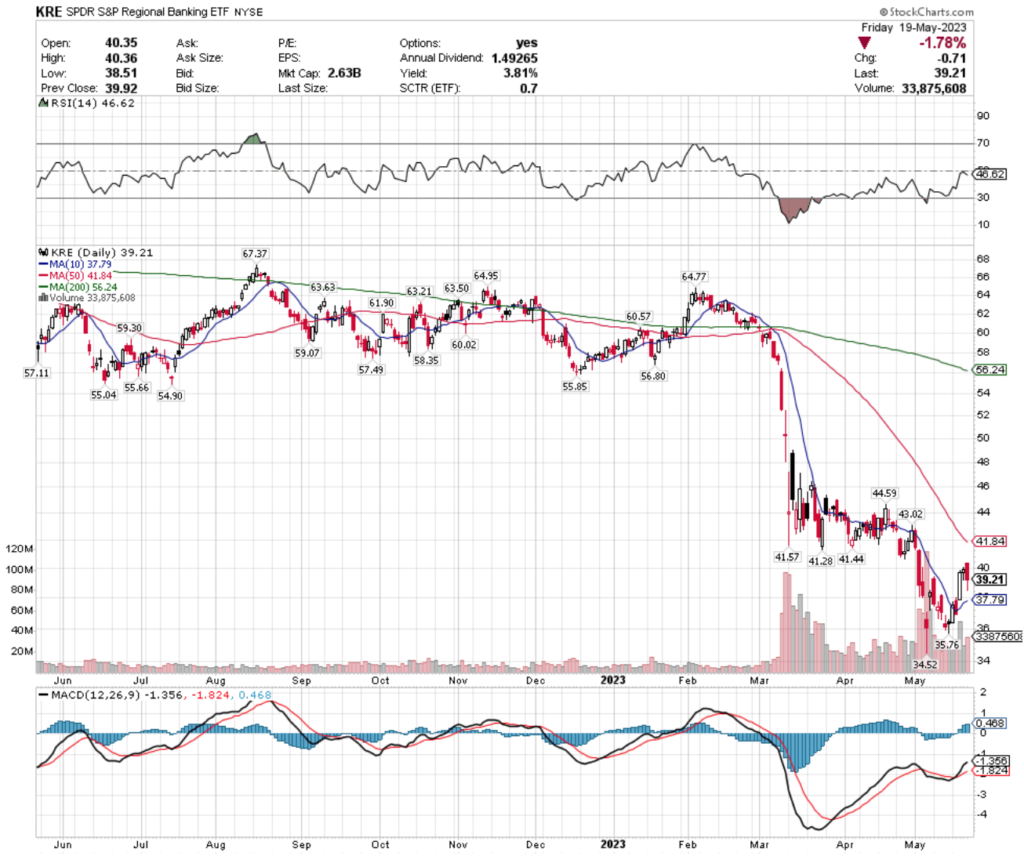

KRE, the SPDR S&P Regional Banking ETF has lost -32.8% over the past year, losing -43% from their 52-week high in August of 2022, but recovering +13.59% from their 52-week low in May of 2023 (ex-distributions).

After a small rebound early in the week, an ominous hanging man candle concluded the week on both Thursday & Friday, signaling that investors are not feeling optimistic on their share price in the near-term.

Their MACD is bullish, but beginning to curl over bearishly & their RSI bounced off of neutral earlier in the week, but has begun bearishly declining again.

While volumes are above average compared to the year prior, they are below average for the last few months, which is when regional banks began to get in trouble, showing more uncertainty among investors.

KRE offers a 3.81% distribution yield, which is a decent cushion against losses for long-term holders, but any position should be accompanied by an options strategy in the near-term, as we wait to see how these banks fare.

KRE has support at the $37.79 (10 day moving average), $35.76 & $34.52/share price levels, with resistance at the $41.28, $41.44, $41.57 & $41.84/share (50 day moving average) price levels.

PBW, the Invesco WilderHill Clean Energy ETF has fallen -24.88% over the past year, losing -44.85% since their 52-week high in August of 2022, while recovering +6.65% since their 52-week low in May of 2023 (ex-distributions).

Their MACD is signaling that momentum is being lost, with their RSI beginning to bearishly decline after crossing over the neutral 50 mark recently.

All of their candles for the past week have been consolidated in a tight range, with very weak volume, signaling that investors are still not confident in their price level.

Their 5.2% distribution yield is a decent cushion for long-term holders, but investors would be wise to wait & see how they behave at their existing support levels before buying long shares, unless they are employing an insurance policy using options.

PBW has support at the $35.73 & $33.67/share price levels, with resistance at the $35.95, $36.11, $36.53 & $36.87 (50 day moving average) price levels.

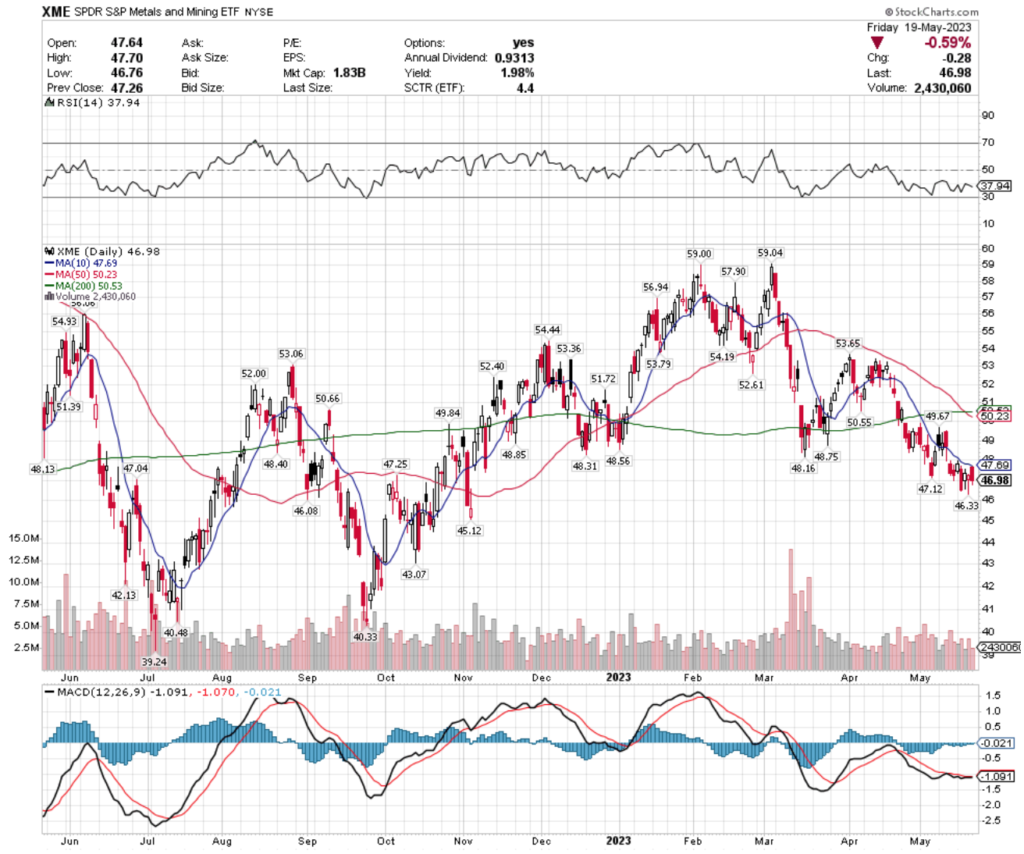

XME, the SPDR S&P Metals & Mining ETF has dropped -5.26% over the past year, losing -20.7% since their 52-week high in March of 2023, but has recovered +17.95% since their 52-week low in July of 2022 (ex-distributions).

After a recent death cross last week, their MACD has been unable to manage a bullish crossover & has moved relatively flat for the past couple of weeks.

Their RSI is moving towards the oversold level of 30, with recent trading volumes being about average compared to the year prior.

Their price has spent the past week consolidated in a narrow range, signaling uncertainty among investors.

XME offers a 1.98% distribution yield for long-term holders, but that provides limited insurance against losses, calling for a defensive options strategy to be in place while waiting out to see how their support levels hold up in the near-term.

XME has support at the $46.33, $46.08, $45.12 & $43.07/share price levels, with resistance at the $47.04, $47.12, $47.25 & $47.69/share (10 day moving average) price levels.

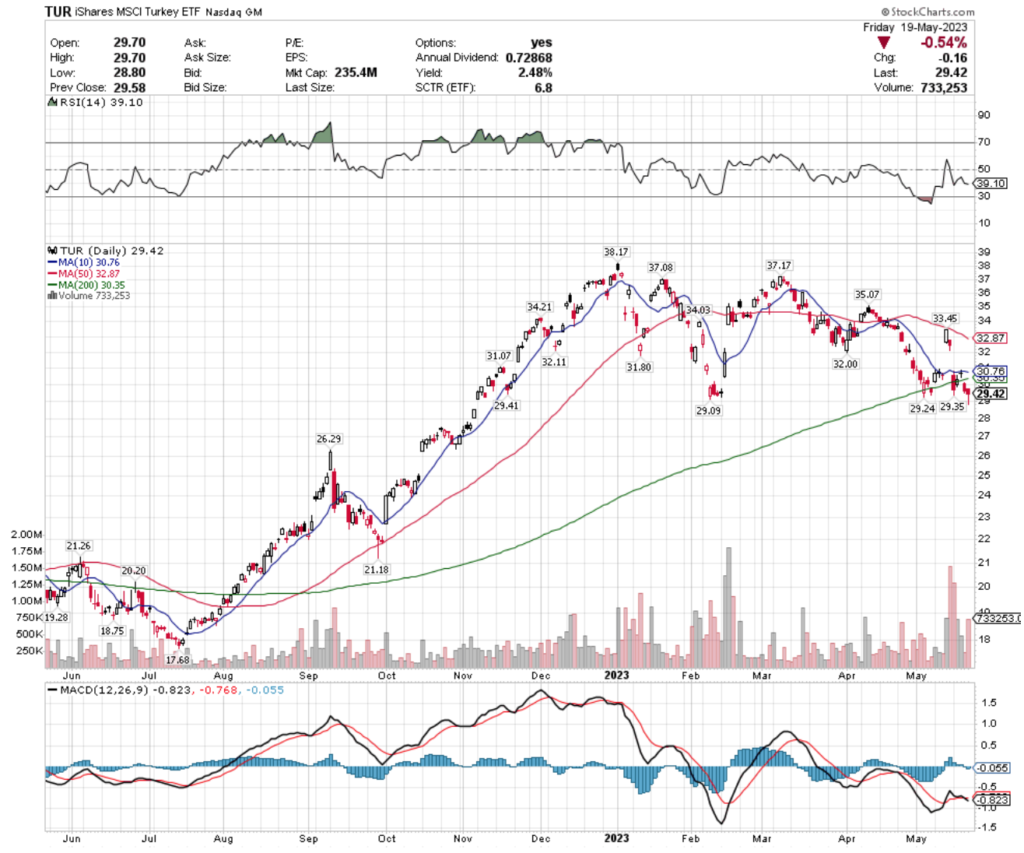

TUR, the iShares MSCI Turkey ETF has gained +50.1% over the past year, including a +66% gain since their 52-week low in July of 2022, but has fallen -22.92% since their 52-week high achieved in the first trading session of 2023 (ex-distributions).

Their MACD is bearish, as is their RSI which is trending its way back towards the oversold mark at 30.

Recent trading volumes have been above average compared to the year prior, signaling that investors think that their price level is valued below their two day gap up range that they tried to establish earlier in May.

With a 2.48% cushion for protection against losses from their distribution yield, there are other gaps that need to be filled in the near-term that support levels may not be able to protect.

TUR has support at the $29.41, $29.35, $29.24 & $29.09/share price levels, with resistance at the $30.35 (200 day moving average), $30.76 (10 day moving average), $31.07 & $31.80/share price levels.

Tying It All Together

This week is relatively quiet on the data front until Friday, compared to prior weeks in terms of the number of announcements.

Monday morning at 8:30 am St. Louis President James Bullard speaks, followed by San Francisco Fed President Mary Daly at 11 am & Atlanta Fed President Bostic & Richmond Fed President Barkin speaking at 11:05 am.

Monday’s earnings calls include Global-E Online, HEICO, Nordson & Zoom Video Communications.

Dallas Fed President Lorie Logan speaks at 9 am on Tuesday, followed by S&P Flash U.S. Services PMI & S&P Flash U.S. Manufacturing PMI data at 9:45 am & New Home Sales data at 10 am.

Lowe’s Agilent, AutoZone, BJ’s Wholesale, Dick’s Sporting Goods, Intuit, Palo Alto Networks, Toll Brothers, Urban Outfitters, Williams-Sonoma & others will report earnings on Tuesday.

On Wednesday Fed Governor Waller speaks at 12:40 pm & at 2pm the Fed’s May FOMC Minutes are released.

Wednesday’s earnings calls include Nvidia, Abercrombie & Fitch, Digital Turbine, Kohl’s, Petco Health & Wellness, Snowflake, Splunk, The Children’s Place & more.

Thursday morning kicks off at 8:30 am with the GDP (second reading) & Initial Jobless Claims data, followed up with Richmond Fed President Barkin speaking at 9:50 am & at 10 am the Pending Home Sales data being reported.

Dollar Tree, 23andMe, Best Buy, Burlington Stores, Costco Wholesale, Deckers Outdoor, Gap, Manchester United, Nutanix, Pinduoduo, Ralph Lauren, Royal Bank of Canada, Titan Machinery, Toronto-Dominion Bank, Ulta Beauty, WMware, Workday & many other names will report earnings on Thursday.

Friday morning at 8:30 am we get the bulk of the week’s data reports, which include Durable-goods Orders, Durable-goods Minus Transportation, Person Income (nominal), Personal Spending (nominal), PCE Index, Core PCE Index, PCE (Y-o-Y), Core PCE (Y-o-Y), Advanced U.S. Trade Balance in Goods, Advanced Retail Inventories & Advanced Wholesale Inventories, with Consumer Sentiment (final) data coming in at 10 am.

Friday’s earnings calls conclude with Big Lots, Booz Allen Hamilton, Buckle & Hibbett reporting.

See you back here next week!

***I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM, SOXL, ARGT, EWG, FCOM, KRE, PBW, XME or TUR AT THE TIME OF PUBLISHING THIS ARTICLE***