Last week we continued to hear earnings calls, including from tech giants Alphabet, Amazon & Apple, as well as from pharmaceutical companies & more.

We also received updated numbers on home prices, construction spending, employment numbers, manufacturing & of course, the Federal Reserves rate announcement.

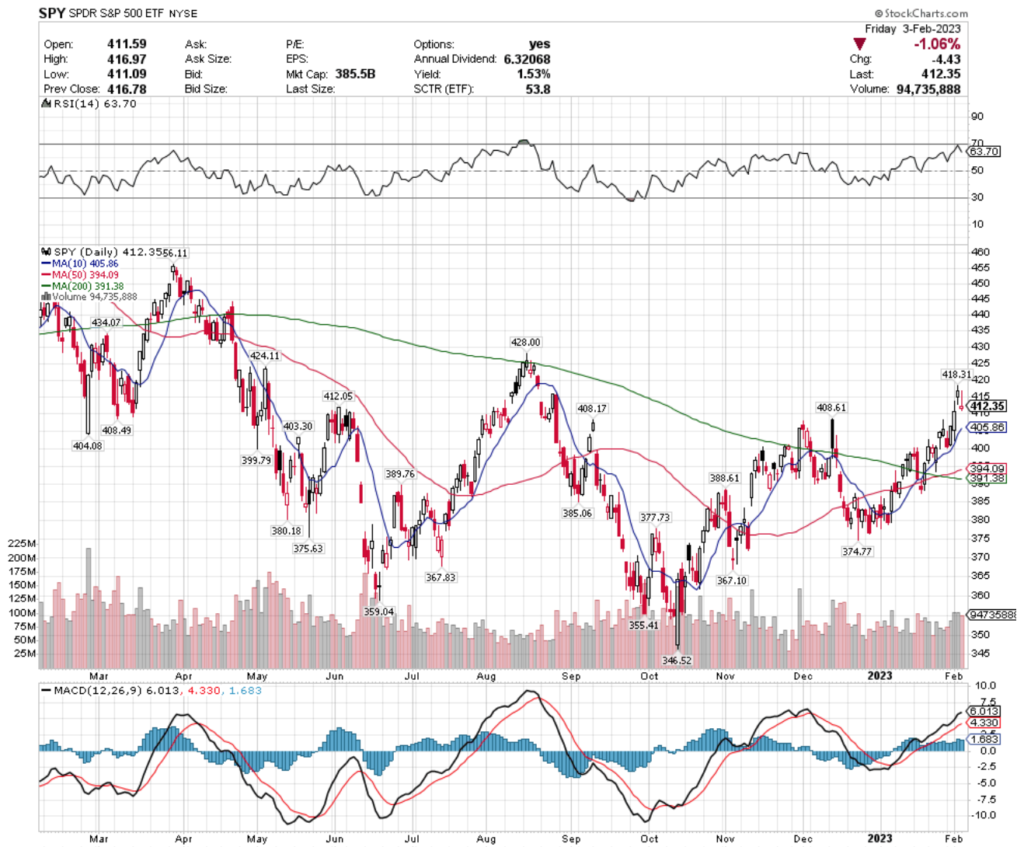

SPY, the SPDR S&P 500 ETF gained 1.64% after a week with losses on Monday & Friday, with gains in the middle of the week.

It has support at $412.05, followed by the $408 price zone, as well as support points at $405.86, $404.08 & $403.30.

The RSI is beginning to look weaker, signaling that there will be near-term weakness before they hit the $418.31 resistance level.

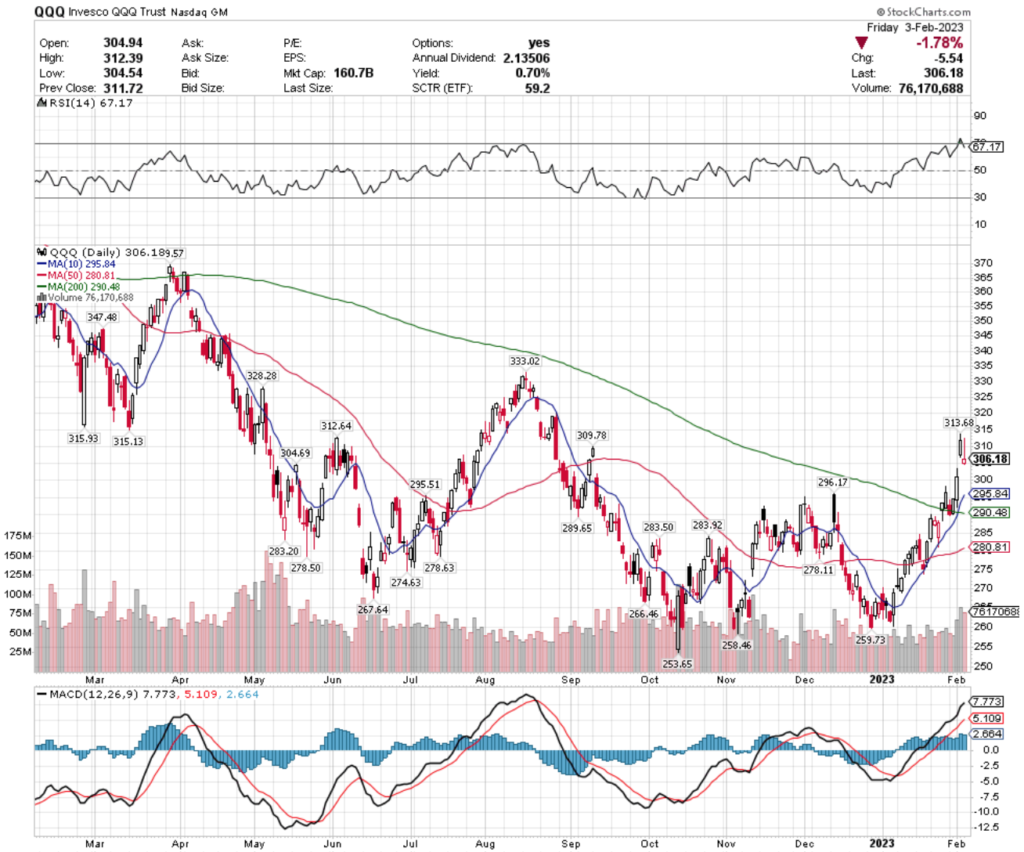

QQQ, the Invesco QQQ Trust ETF climbed 3.35% this week, but it is also signaling that there will be a near-term cool down period based on their RSI retreating from overbought territory.

They have support at the $304.69, $296.17, $295.84 & $295.51, with resistance at the $309.78, $312.64 & $313.68/share price level.

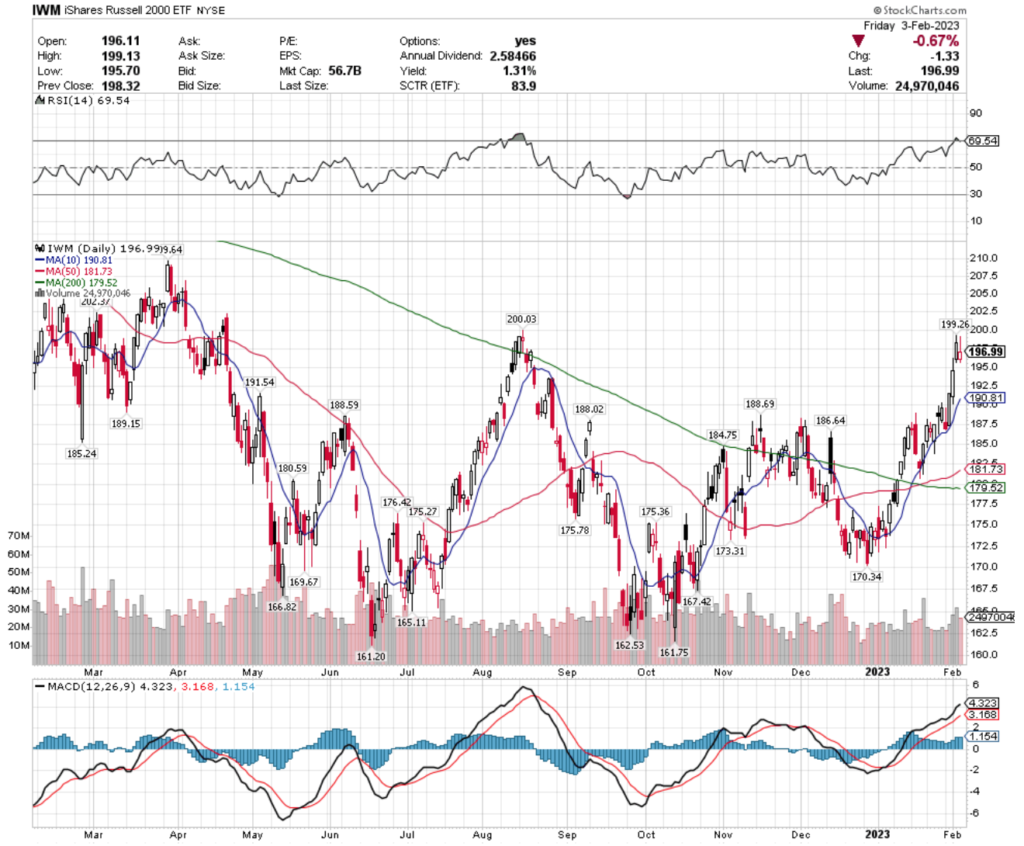

IWM, the iShares Russell 2000 ETF gained 3.91% this week, signaling that smaller cap stocks were favorites of the week.

IWM ETF – iShares Russell 2000 ETF

They too are signaling a near-term cool off, with an RSI that has just dipped back underneath overbought territory.

IWM has support at $191.54, $190.81, $189.15 & multiple touch-points in the $188-range, with resistance at the $199.26, $200.03 & $202.37/share price levels.

S&P Homebuilders (XHB), S&P High Beta (SPHB), France (EWQ) & Global Copper Miners (COPX) All Bullishly Leading The Market

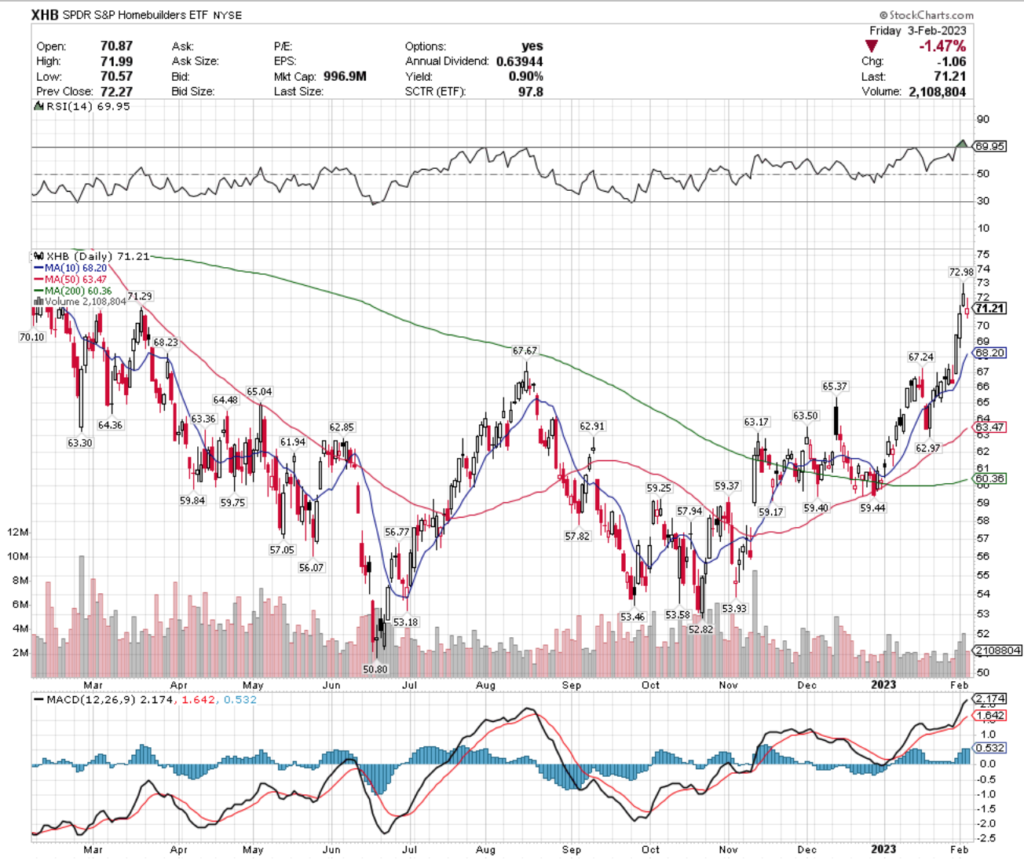

XHB, the SPDR S&P Homebuilders ETF is still 1% below where it was a year ago, however they have climbed 40.2% since their low in June 2022.

While XHB offers a slight cushion in the form of a 0.90% dividend, investors would be wise to wait for their price to correct more.

XHB has overhead resistance at $71.29 & $72.98/share, when looking at the past 52 weeks.

They have support at the $70.10, $68.23, $68.20 & $67.67/share price levels, which are where it will be interesting to see how they behave at.

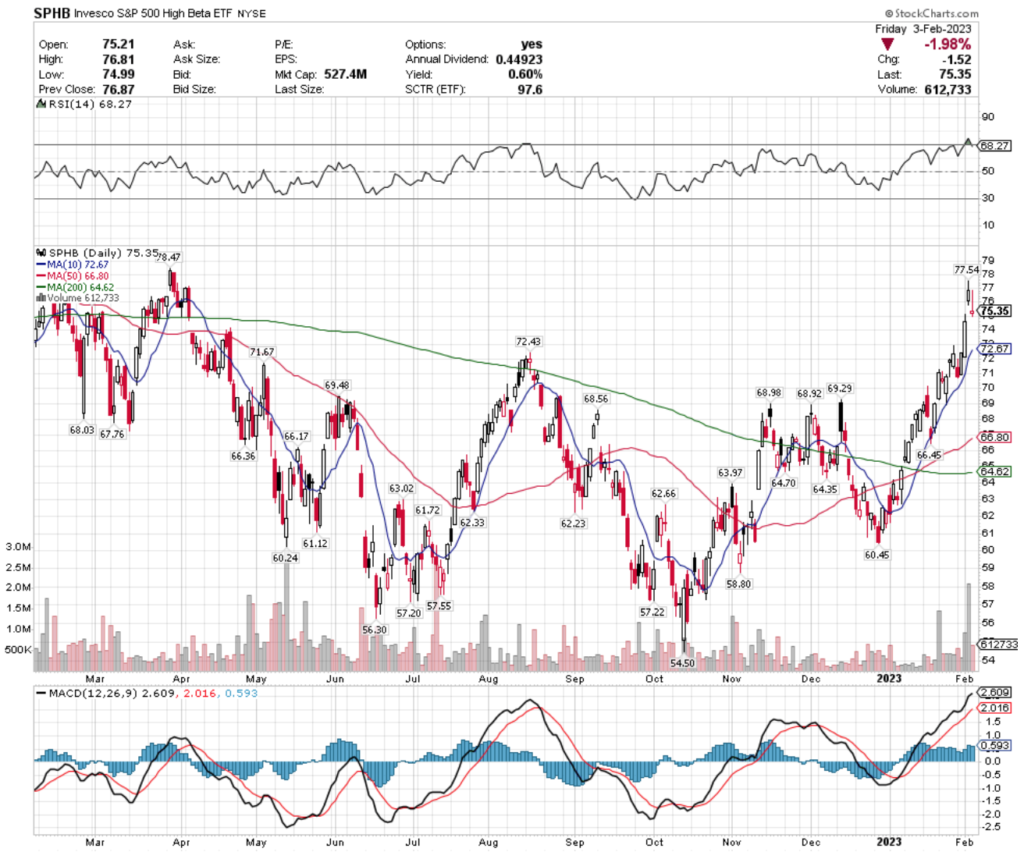

SPHB, the Invesco S&P 500 High Beta ETF has also posted a strong recovery from their mid-2022 lows.

Their RSI & MACD are both signaling that they’re cooling off, and their 0.6% dividend yield does not provide an adequate cushion against losses.

EWQ, the iShares MSCI France ETF has gained 2.81% over the last year, but has climbed 188% since their lowest point in September 2022.

Offering a better cushion than the former mentioned ETFs with their 2.88% dividend, EWQ also looks set to drop in the near-term.

Before investing or adding to a position, it would be wise to watch how EWQ behaves at their support levels, which are $36.96, $35.45, $34.71, $34.62 & $34.52.

COPX, the Global X Copper Miners ETF has gained 9% since a year ago, with a 54.6% improvement from their low in July 2022.

They also provide a decent cushion of 2.8% in the form of dividends for investors who hold the ETF for a year.

However, given their RSI & MACD it would be wise to wait & see how they react around their support levels in the near-term.

COPX has support at the $38.30, $37.84, $37.63, $37.47 & $37.41/share price levels.

DB Energy Fund (DBE), Japan (HEWJ), Colombia (GXG) & Wheat (WEAT) All Bearishly Lagging The Market

DBE, the Invesco DB Energy Fund ETF has gained 2.62% since a year ago, however they have dropped -32.71% from their high in June 2022.

While their RSI is approaching oversold & their MACD is bearish, investors would be wise to wait to see how they react to their $19.92 support level.

With a low 0.84% dividend, there is little cushion against additional losses should they break through support bearishly.

HEWJ, the iShares Currency Hedged MSCI Japan ETF has gained 7.2% in the past year, despite falling -2.64% since their high in December 2022.

Their MACD has begun to curl over bearishly, and their RSI is approaching overbought conditions, signaling that there is more near-term pain to come.

HEWJ has a lot of support in the $27 & $26 range, including $27.95, $27.86, $27.58 & $27.47.

While they offer a 1.53% dividend, it would be wise to watch how they behave around their support zones before investing.

GXG, the Global X MSCI Colombia ETF has fallen 25.6% over the last year, with a -35.3% decrease from their April 2022 high.

Investors intent on holding GXG for a year or longer may be able to begin making a position, as their 12% dividend will protect them for losses up to $18.15/share.

GXG has support at the $20.26, $20.20 & $20.11/share.

WEAT, the Teucrium Wheat Fund ETF has gained 5.49% since a year ago, however they have dropped -35.4% since their high in March of 2022.

They do not offer a dividend & are very close to their 52 week low, signaling that investors should wait to see how they behave at their support levels before buying shares.

WEAT has support at the $7.63, $7.35 & $7.23/share price levels.

Tying It All Together

This week we will continue to hear earnings reports, which will likely contribute to near-term weakness in markets.

Additionally, there are a number of Federal Reserve speakers lined up for the week, which should give more insight into how dovish or hawkish policymakers really are.

Tuesday will also feature international trade deficit & consumer credit numbers, Wednesday we will get wholesale inventories revised numbers, jobless claims data on Thursday & UMich consumer sentiment & inflation expectations data.

One thing to watch will be how the market reacts to earnings & Fed speakers after a year that has been volatile & on a week with limited data being reported.

*** I DO NOT OWN SHARES OR OPTIONS POSITIONS IN SPY, QQQ, IWM, XHB, SPHB, EWQ, COPX, DBE, HEWJ, GXG & WEAT AT THE TIME OF PUBLISHING THIS ARTICLE ***