Last week most market participants’ focus was on the CPI readings that came out largely in-line with expectations, as well as a number of speeches by US Federal Reserve officials, before banks began reporting earnings on Friday.

SPY, the SPDR S&P 500 ETF closed +2.69% this past week, as traders & investors began adding to their holdings after many watched the markets for the first trading week of the year.

Their next test of resistance will be the $399.79/share price level, finding support at their 200 Day Moving Average at $394.10.

Despite many market participants choosing to wait & watch during the year’s first trading week, volumes decreased week-over-week for SPY, signaling investors are still on the fence as earnings calls for Q4 2022 begin kicking off.

The $388-389 price zone will be an area to watch over the coming week(s), to gauge how the index will head next as more & more earnings data comes in.

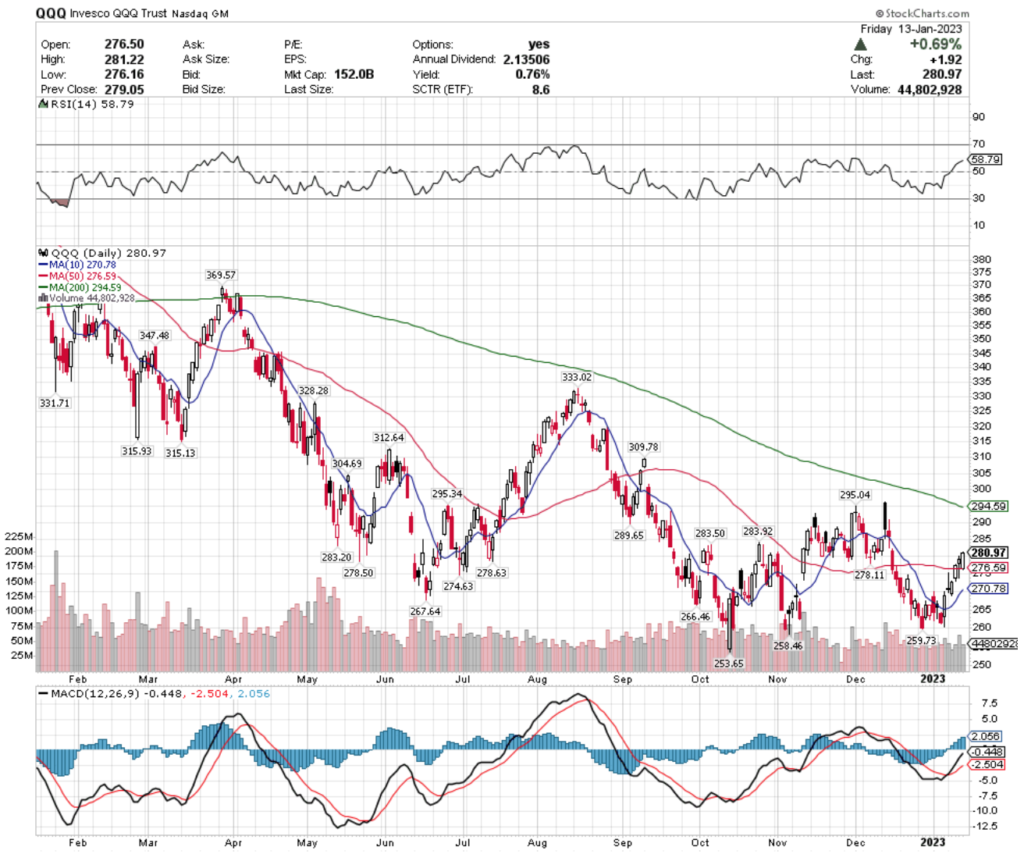

QQQ, the Invesco QQQ Trust ETF gained 4.53% during the last week, trading on higher volume than the previous week (unlike SPY).

Their MACD is beginning to signal a bearish rollover, and it will be interesting to see how much support they find in the $278 range (multiple support points between $278-279), as they look to try to break above their resistance zone in the $283-284 price range.

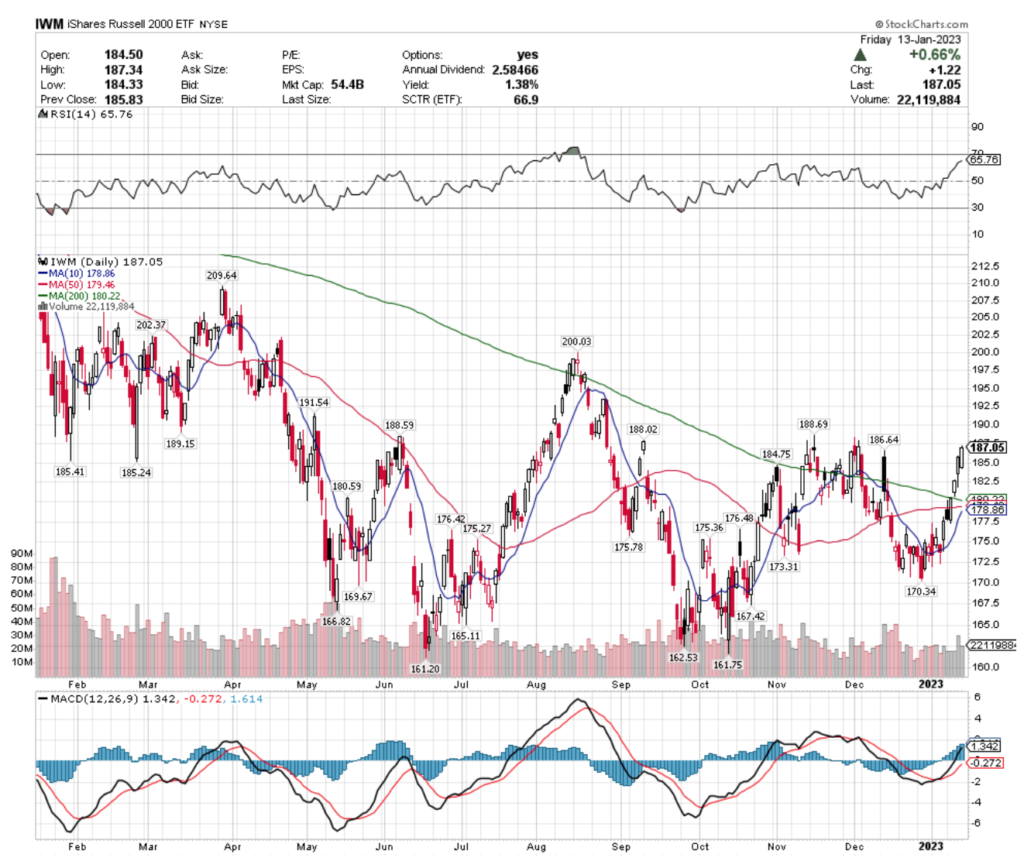

IWM, the iShares Russell 2000 ETF gained 5.33% last week, helping their RSI approach overbought levels at 65.76.

They are set to have a few resistance levels in the $188-189 range, with support at the $186.64/share level.

Small caps look to be more overbought than their larger peers based on the RSI‘s above, but the week ahead’s earnings call results may change that tone.

Let’s get into this week’s out-performers & laggers.

Argentina (ARGT), Copper Miners (COPX), Oil Services (OIH) & Chindia (FNI) All Bullishly Leading The Market

ARGT, the Global X MSCI Argentina ETF has had a strong year, rebounding 70.86% since their July 2022 low.

While they offer protection for investors in the form of their 2.12% dividend, their RSI is currently very overbought at 84.23.

While volumes have been above average for 2023 vs. the year prior, it looks best to wait before investing in a new ARGT position or adding to existing holdings.

Savvy traders can utilize options to create profits in the meantime that can be put towards adding to ARGT shares as their price cools off.

COPX, the Global X Copper Miners ETF has also enjoyed a steep recovery since their July 2022 lows, gaining back ~60% & approaching their 2022 highs from March & April.

Like ARGT, COPX also is currently overbought in the near-term, with an RSI of 76.18.

While they pay a 2.71% dividend to investors who are willing to hold their shares for a year, it may be wise to wait until their share price cools off & to see how they interact with the $40 price level.

With support at $40.04 & $40.03 & gaps before the next support ($38.41), downward momentum may cause this ETF to fall beyond the dividend’s ability to break even & by that point have additional downward momentum.

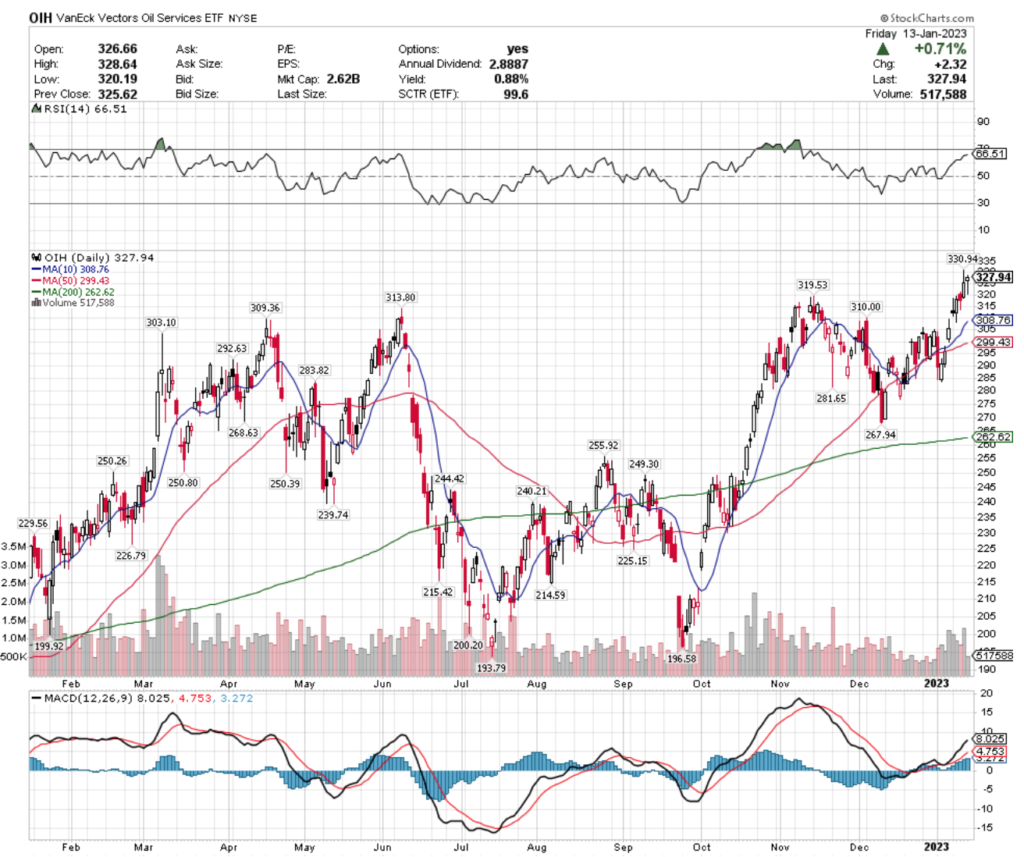

OIH, the VanEck Vectors Oil Services ETF has also had a solid 69.22% recovery since July of 2022, after starting off that year strongly.

While their RSI is still not outright overbought, it is approaching it, signaling to investors that now is not the best time to establish a position, nor to add to an existing one.

With only a 0.88% dividend yield, there is even less of a cushion than the prior two examples, plus they currently only have one resistance level above their current price within the last year & a hanging man candle from Friday 1/13/2023.

While they’re a name to keep on your radar, it looks safest to wait to see how they fare with the $319.53 & $313.80 support levels before entering a new position.

OIH also has options which can be utilized for profits while awaiting to see how they fare moving forward.

FNI, the First Trust ISE Chindia Index Fund has also has a strong end of 2022 into 2023.

Gaining 53% since their 2022 low in October, they now face resistance tests at $43.64 & $43.84/share, while their overbought RSI (72) signals their need to cool off in the meantime.

Given the negligible dividend they offer, this one will not offer much in means of protection against losses & they do not have tradable options, which may further dissuade investors from them.

Colombia (GXG), Battery Metals & Materials (BATT), US Technology (IYW) & Regional Banking (KRE) All Bearishly Lagging The Market

GXG, the Global X MSCI Colombia ETF has recently made a slight recovery from their losses that plagued them into October/November of 2022.

While their overbought RSI signals that they are due to cool off in the near-term, they offer an 11% dividend, which provides protection down to their $19.53 support level.

With this in mind, there is wiggle room for loss on the way down, and GXG does have options that can be utilized for near-term profits even as the ETF declines.

BATT, the Amplify Advanced Battery Metals & Materials ETF has had a strong first couple of weeks in 2023, rebounding from their 52 week low(s) of $11.45/46 by 14%.

Their 3.7% dividend offers some cushion, and their options can be traded while investors wait to see how they handle the $12.56/57 support levels that are just beneath a couple of gaps.

One note, there are additional gaps beneath this support, so it would be wise to pay strong attention to any buying done in this zone, as the ladder could be kicked out from underneath them at any moment.

IYW, the iShares US Technology ETF had a disappointing 2022 & is not off to the strongest of starts in 2023.

They sport a negligible dividend that offers limited protection from further price declines (0.48%).

The $78.12 support level will be important to watch, as if they break below that there is high likelihood that they cross into the $76/share range before finding support & establishing a floor/price range.

KRE, the SPDR S&P Regional Banking ETF also suffered in 2022, and has been attempting to build up positive momentum in the near-term.

While their RSI is still neutral, they will not be immune to broader market sell-offs, and offer only 2.43% of cushion from losses in their dividend.

While they have many support points beneath them, this is a name to be keeping an eye on in the coming weeks, but not necessarily ready for an entry into a position just yet.

Tying It All Together

This week earnings calls continue after our Monday holiday, with Goldman Sachs, Morgan Stanley, United Airlines & others reporting on Tuesday.

On Tuesday the Empire State Manufacturing Index number will be reported, followed by Retail Sales, PPI Final Demand, Industrial Production, Capacity Utilization, the NAHB Home Builder’s Index & the Fed’s Beige Book on Wednesday.

Thursday we hear about initial jobless claims (and continuing), as well as Building Permits, Housing Starts, the Philadelphia Fed’s Manufacturing Index & the Fed’s Brainard will also be speaking.

Friday morning we get Existing Home Sales (SAAR) numbers, and Fed Governor Christopher Waller will be speaking at the Council on Foreign Relations.

Enjoy the rest of the long weekend & see you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS POSTIONS IN SPY, QQQ, IWM, ARGT, COPX, OIH, FNI, GXG, BATT, IYW, or KRE AT THE TIME OF PUBLISHING THIS ARTICLE ***