Earnings calls continued on throughout the week, and markets continued to climb steadily.

Upcoming news about the new Fed chair should be announced in the coming days, which may bring a temporary shock to stocks in the event that Powell is not selected again.

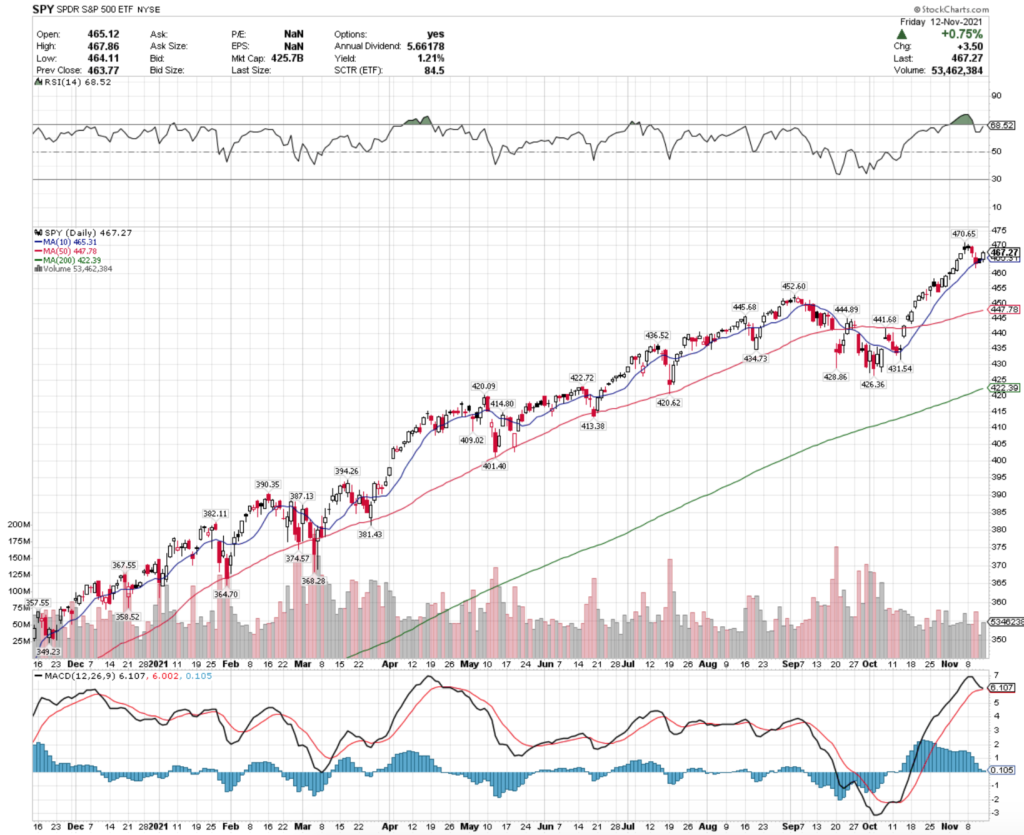

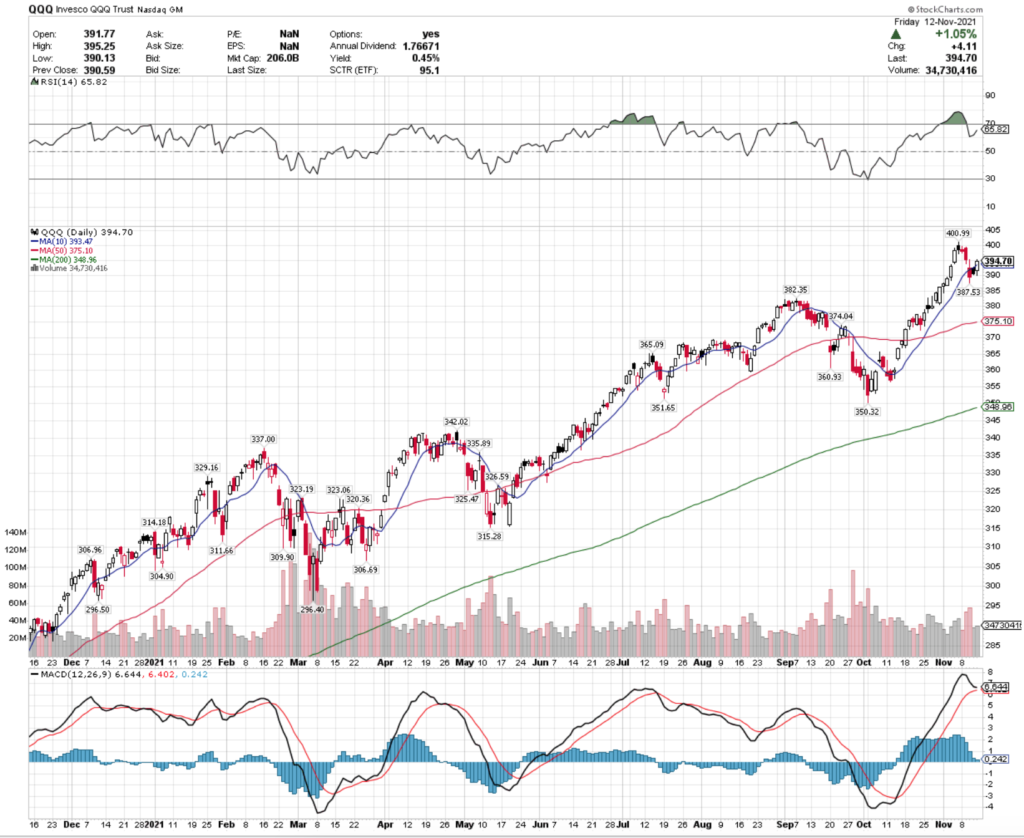

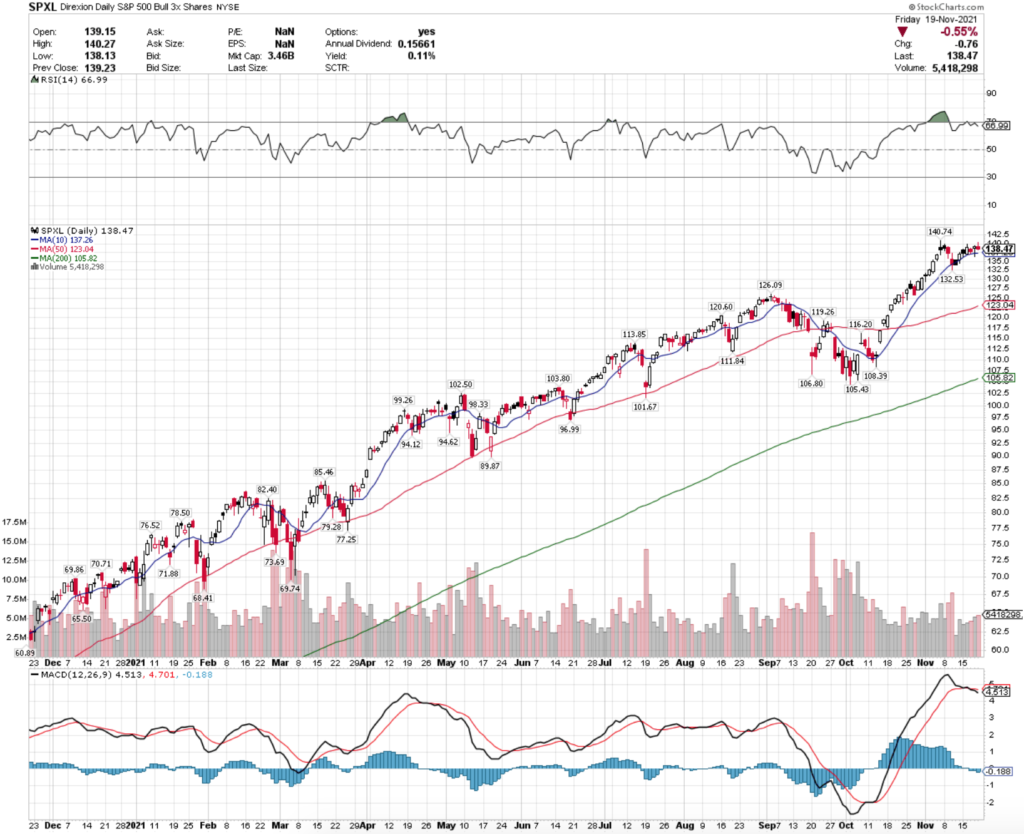

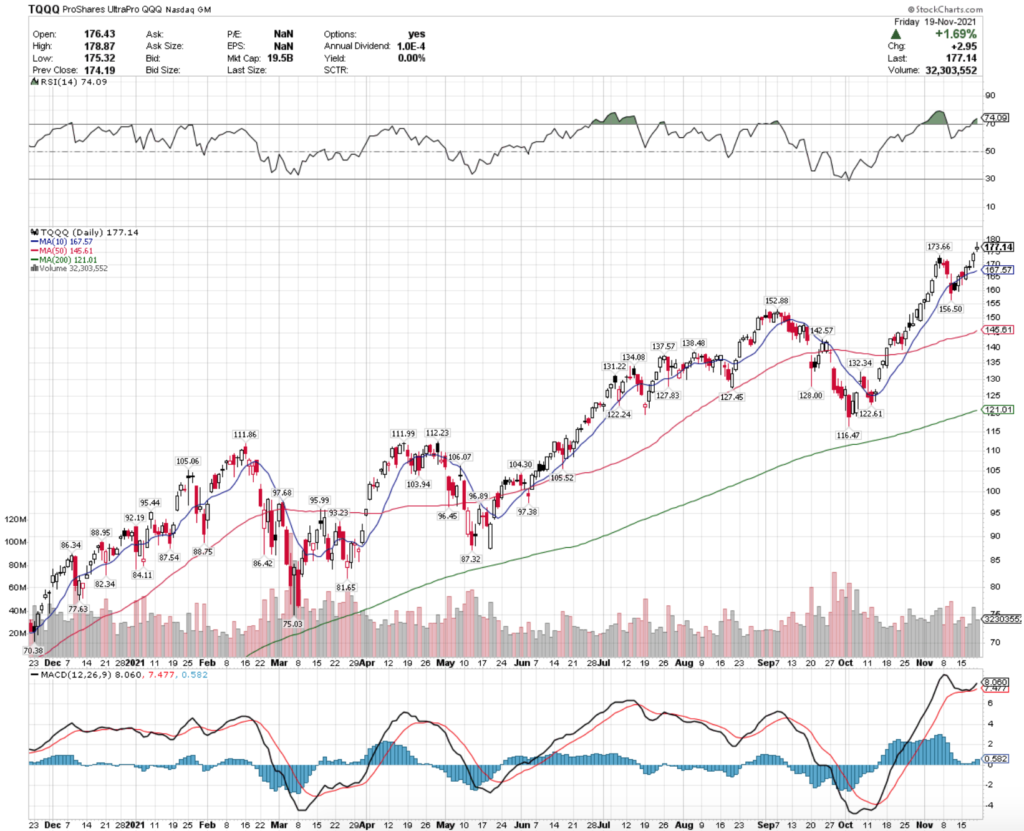

The S&P 500 & NASDAQ are both beginning to signal that there should be a bit of a shakeup in the near future when looking at their technicals

The SPXL ETF that tracks the S&P 500’s MACD had a bearish crossover, although on somewhat weaker than average volume last week, bringing their RSI back from overbought territory.

The NASDAQ tracking ETF TQQQ remains in overbought territory in their RSI, although their MACD has rebounded from what was potentially going to be a bearish crossover.

TQQQ’s volume has been a bit stronger than usual this week.

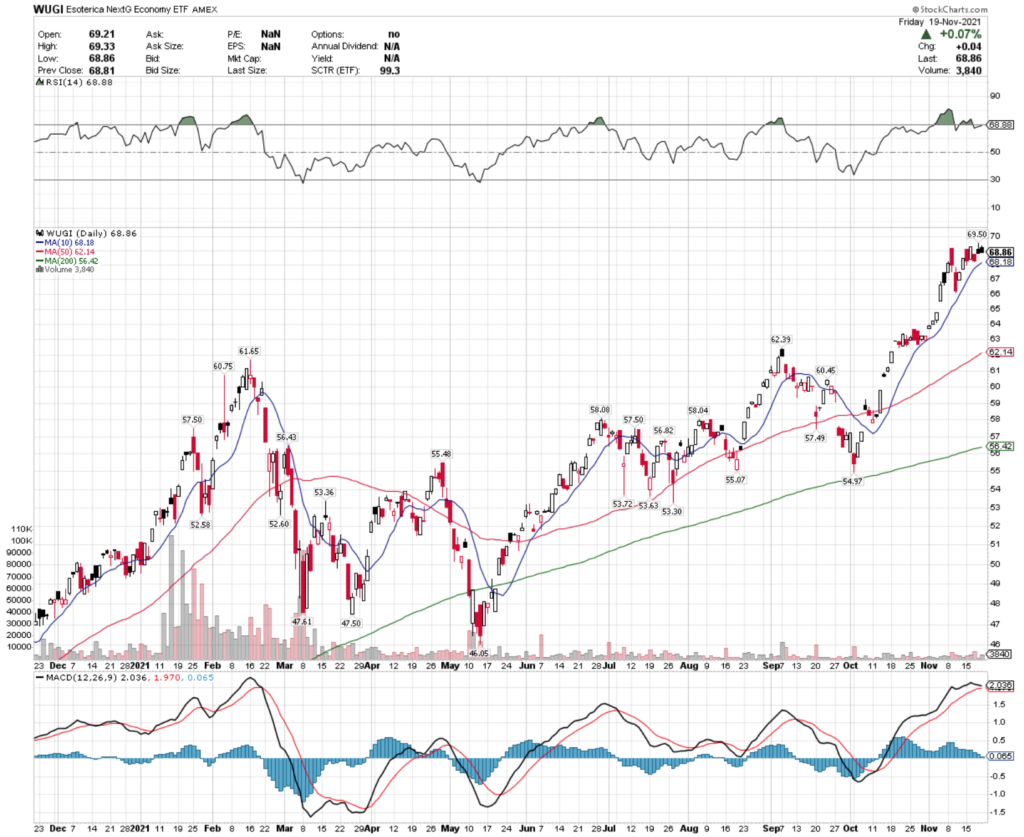

Consumer Discretionary (WANT), Carbon (KRBN), 5G Economy (WUGI) & Russell Growth Over Value (RWGV) All Lead The Pack

The WANT ETF that tracks names from the Consumer Discretionary sector has continued to see success, climbing higher this last week.

They look to have more steam to climb higher based on their MACD, however watch the currently overbought RSI as it may signal that there will be a bit of selling pressure in the near-term.

KRBN, a Global Carbon ETF has been trading on higher than average volume recently, and climbed to new highs for the year.

Again, while their MACD is still bullish, watch their RSI.

At 76, their RSI is still overbought & may indicate a bit of a sell off in the near-term as it begins to establish a new price range, where a better entry price may be possible.

WUGI, an ETF that contains names that are related to 5G & the future of the economy has also been climbing higher recently, although somewhat stalled out this week.

While their RSI was overbought prior & has now dropped back below the 70 level (highly overbought), there may be a bit of a drop in the near-term judging by their MACD.

Their volume has been very light compared to the rest of the year’s average.

Another area to keep an eye on is the growth names within the Russell 1000 index.

RWGV is an ETF that tracks these names, and has seen growth this year.

Their RSI is also high; at 74.7 signaling that they are currently overbought & may have some selling in the near-future.

However, their MACD is still bullish, after coming near a bearish crossover last week.

China (GXC), BioTech (LABU), Dividend Revenue (RDIV) & Global Infrastructure (GII) Stocks & ETFs Are All Lagging The Rest Of The Pack

It’s no surprise that companies in China are not being viewed favorably in the last few months.

GXC, the SPDR S&P China ETF has continued to struggle, having another bearish MACD crossover last week.

With a relatively neutral RSI, this downtrend may continue in the near-term.

LABU, an ETF that tracks biotech names has continued to fall, on higher than average volume.

Their RSI is approaching the oversold level, but their moving averages suggest that there is more pain to come in the near-future.

RDIV is another ETF that’s moving averages seem to suggest more trouble in the near-future.

Last week they had a bearish MACD crossover, and with a neutral RSI of 46 there looks to be more losses to come in the near-term.

Note too though that their volume has been very low recently compared to the rest of the year’s average.

However, they do offer a 4.77% dividend yield, which can provide some protection & cushion against losses.

GII, an ETF that tracks global infrastructure focused stocks & securities has also seen recent troubles, with a gap down on Friday that went below their 50 day moving average.

While their RSI is near the oversold level, their MACD is currently very bearish.

GII has also been trading on weaker than average volume recently.

Tying It All Together

There are still more earnings calls to come this week, there should be plenty of interesting swings in the markets.

With indexes near or at highs & showing overbought conditions, there should be some selling action in the near-term as traders take profits & reposition themselves for the new year.

However, the week will be shorter in observance of the Thanksgiving holiday in the US, which is something to take note of.

*** I DO NOT OWN SHARES OR OPTIONS FOR ANY OF THE NAMES LISTED ABOVE ***