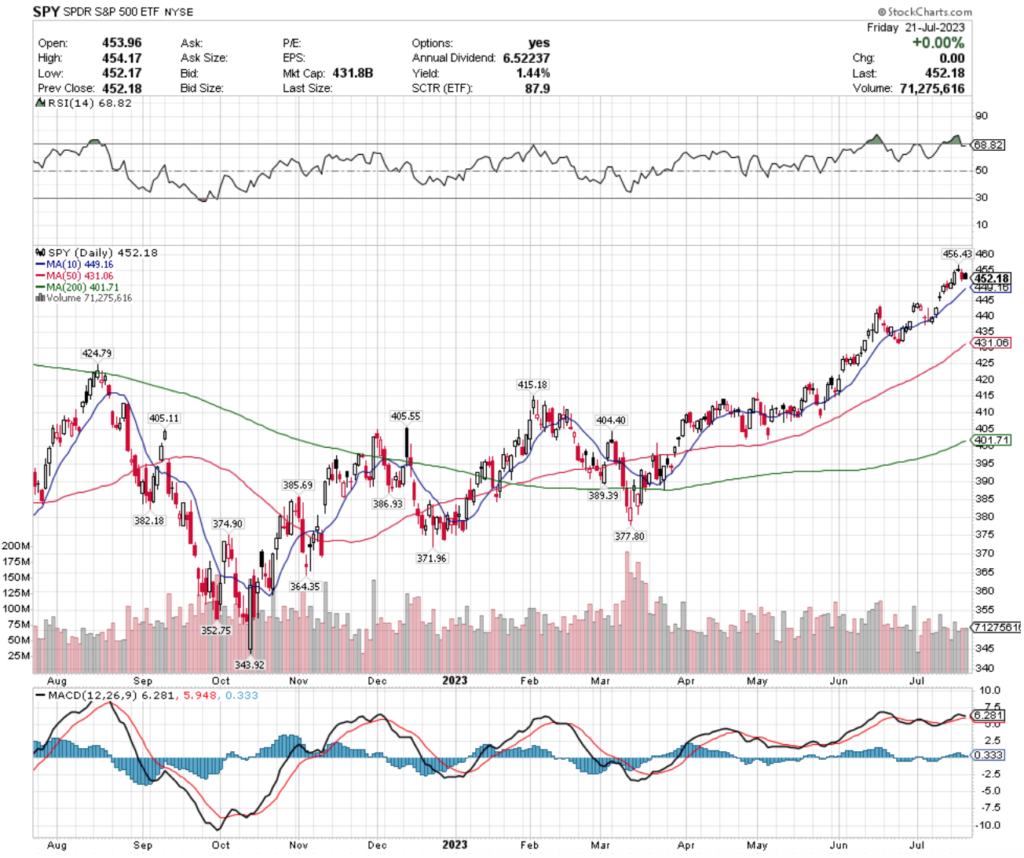

SPY, the SPDR S&P 500 ETF nudged forward +0.65% this past week, as earnings reports began coming in & in a week with limited economic data reported.

Their RSI ducked just inside of being in overbought territory & currently sits at 68.82, but their MACD is signaling a bearish crossover is going to occur in the coming days.

Last week’s average trading volumes were -17.96% below average compared to the year prior (68,485,850 vs. 83,473,641), as investors really didn’t have much conviction one way or the other & are awaiting more earnings reports, as well as the economic data & Federal Reserve Interest Rate announcement that are due this upcoming week.

The 10 day moving average will be interesting to watch this week, as it is the first level of support that SPY will test & all of its support levels are relatively spread out from one another, which will make for an interesting week if they decline as there is not much stable footing nearby below them.

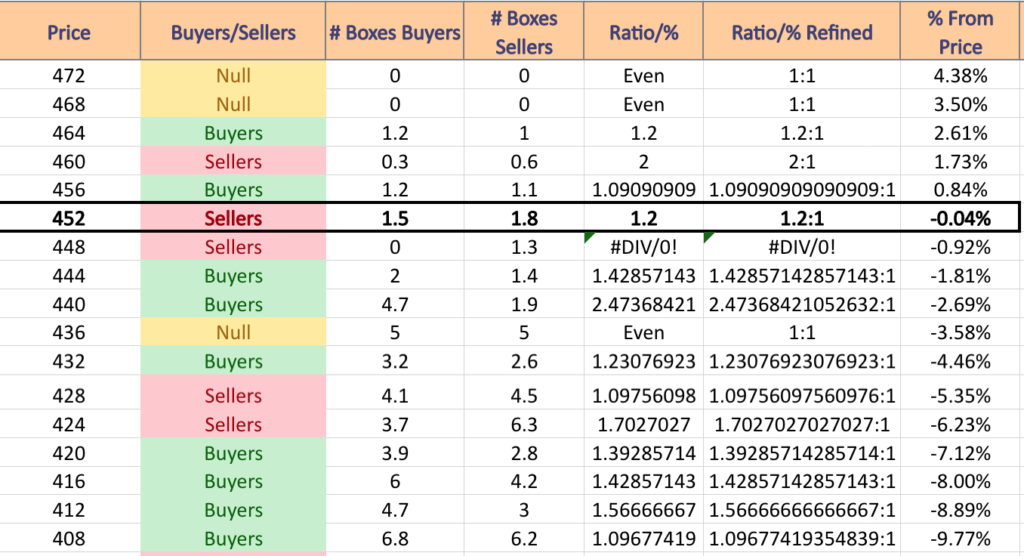

For a list of price levels & their associated volume sentiments refer to the table below.

SPY has support at the $449.16 (10 Day Moving Average; Volume Sentiment: Sellers, 1.3:0*), $431.06 (50 Day Moving Average; Volume Sentiment: Sellers, 1.10:1), $424.79 (Volume Sentiment: Sellers, 1.7:1) & $415.18/share (Volume Sentiment: Buyers, 1.57:1) price levels, with resistance at the $452.69 (Volume Sentiment: Sellers, 1.2:1), $456.43 (Volume Sentiment: Buyers, 1.09:1), $460.87 (Volume Sentiment: Sellers, 2:1) & $468.78/share (Volume Sentiment: NULL, 0:0*) price levels.

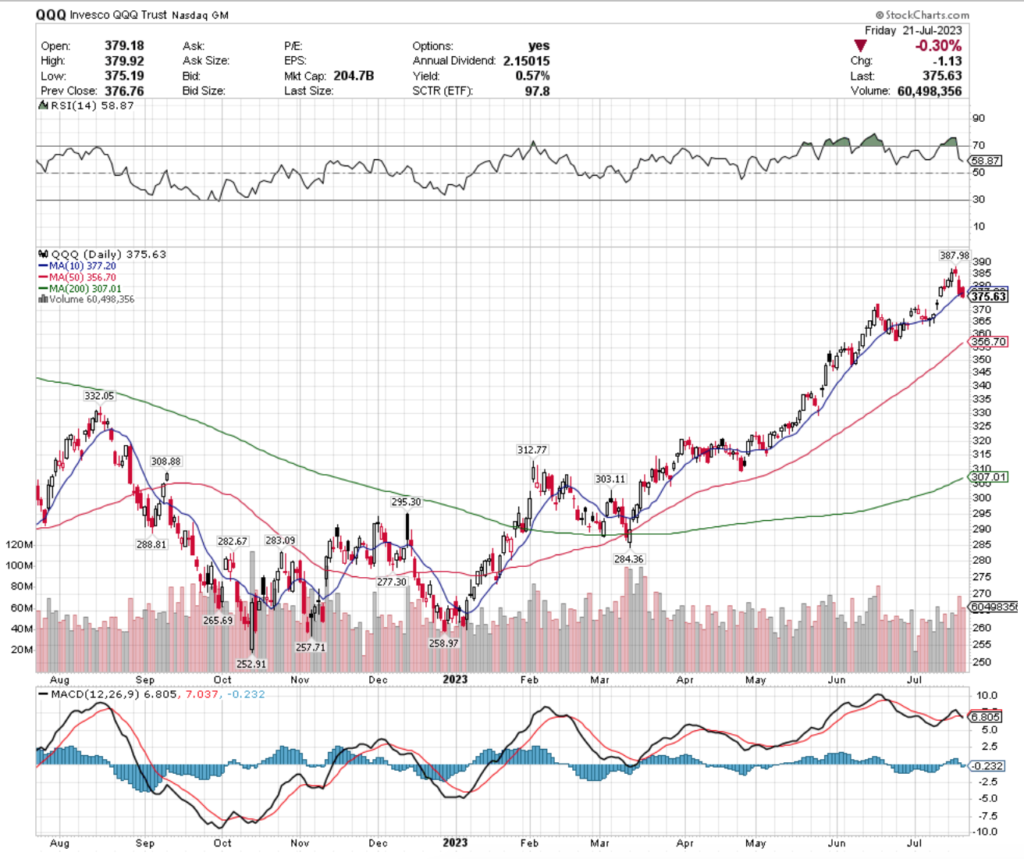

QQQ, the Invesco QQQ Trust ETF declined -0.91% over the past week, signaling the first weakness of the indexes as it was the only one to decline.

Their RSI has retreated from overbought conditions to sitting on the overbought end of neutral at 58.87 & their MACD has bearishly crossed over.

Last week’s average trading volumes were +1.33% above average volumes for the year prior (56,297,367 vs. 55,559,565), signaling that profits were being taken before a rate hike announcement or set of bad earnings calls could send everyone out of the pool in a hurry.

Wednesday’s spinning top candle got the decline rolling, with Friday’s candlestick unable to close above the 10 day moving average, a breakdown of support at that level.

There are two gaps that need to be tested/filled before the next support level for QQQ, which is the 50 day moving average.

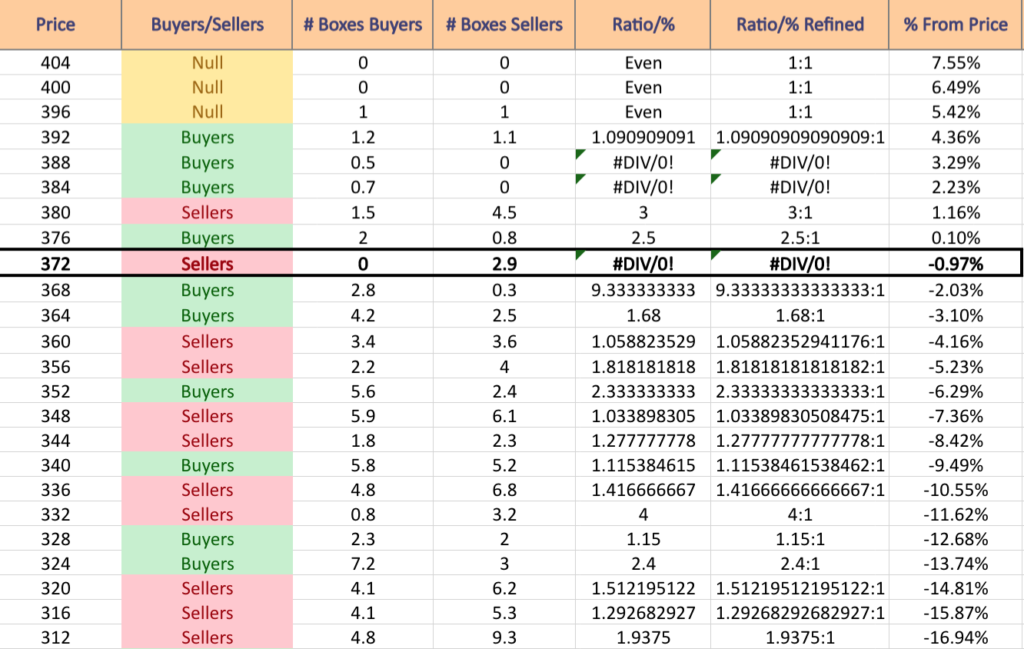

Much like SPY, QQQ also has a wide spread between its current support levels, which makes it worthwhile to check the volume sentiment by price level table below to get an idea as to how market participants may behave at each level listed.

QQQ has support at the $356.70 (50 Day Moving Average; Volume Sentiment: Sellers, 1.82:1), $322.05 (Volume Sentiment: Sellers, 1.51:1), $312.77 (Volume Sentiment: Sellers, 1.94:1) & $308.88/share (Volume Sentiment: Buyers, 1.32:1) price levels, with resistance at the $377.20 (10 Day Moving Average; Volume Sentiment: Buyers, 2.5:1), $387.98 (Volume Sentiment: Buyers, 0.7:0*), $400.45 (Volume Sentiment: NULL, 0:0*) & $404.02/share (Volume Sentiment: NULL, 0:0*) price levels.

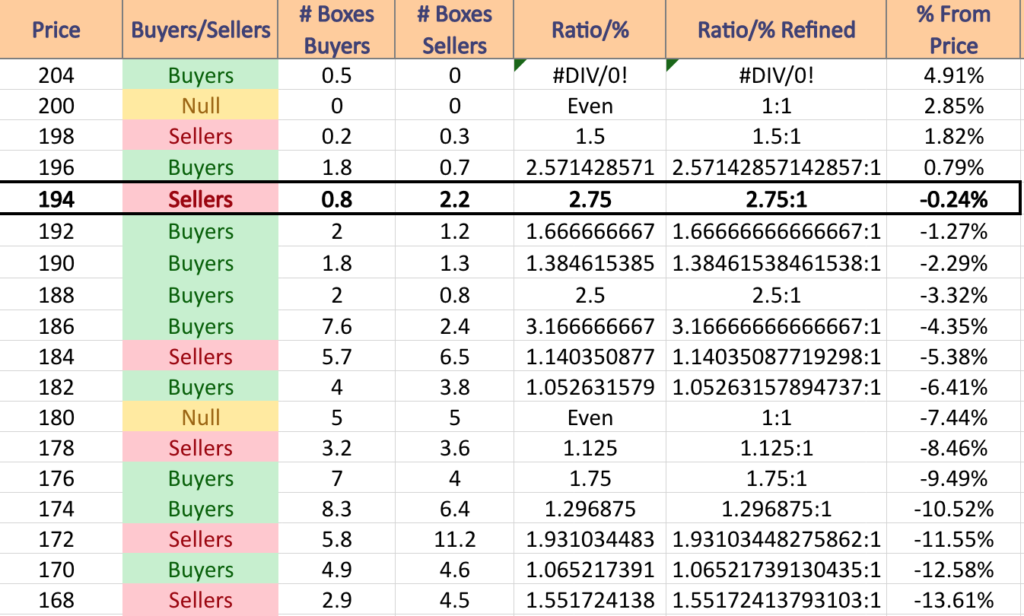

IWM, the iShares Russell 2000 ETF notched +1.53% this past week, second only to their larger cap Dow Jones Industrial Average counterparts.

Their RSI is retreating from near-overbought levels & is currently at 63.25, with their MACD signaling a bearish crossover is set to take place in the coming days.

Last week’s average trading volumes were -1.83% below the average volume for the year prior (27,321,683 vs. 27,829,759), signaling uncertainty among market participants & likely indicating some late in the week profit taking.

Wednesday’s session closed in a doji, which kicked off the running to the door & declines seen the rest of the week, but prices were able to maintain above the open of Tuesday’s session.

Much like the other indexes, IWM’s Price:Volume table will provide key insights into investors sentiment at each of their price levels & should be reviewed before this potentially volatile week begins.

However, IWM has closer support levels than many of their peers which can help to slow down any declines.

IWM has support at the $193.04 (10 Day Moving Average; Volume Sentiment: Buyers, 1.67:1), $187.48 (Volume Sentiment: Buyers, 3.17:1), $186.81 (Volume Sentiment: Buyers, 3.17:1) & $185.44/share (Volume Sentiment: Sellers, 1.14:1) price levels, with resistance at the $197.66 (Volume Sentiment: Buyers, 2.57:1), $197.98 (Volume Sentiment: Buyers, 2.57:1), $198.74 (Volume Sentiment: Sellers, 1.5:1) & $204.46/share (Volume Sentiment: Buyers, 0.5:0*) price levels.

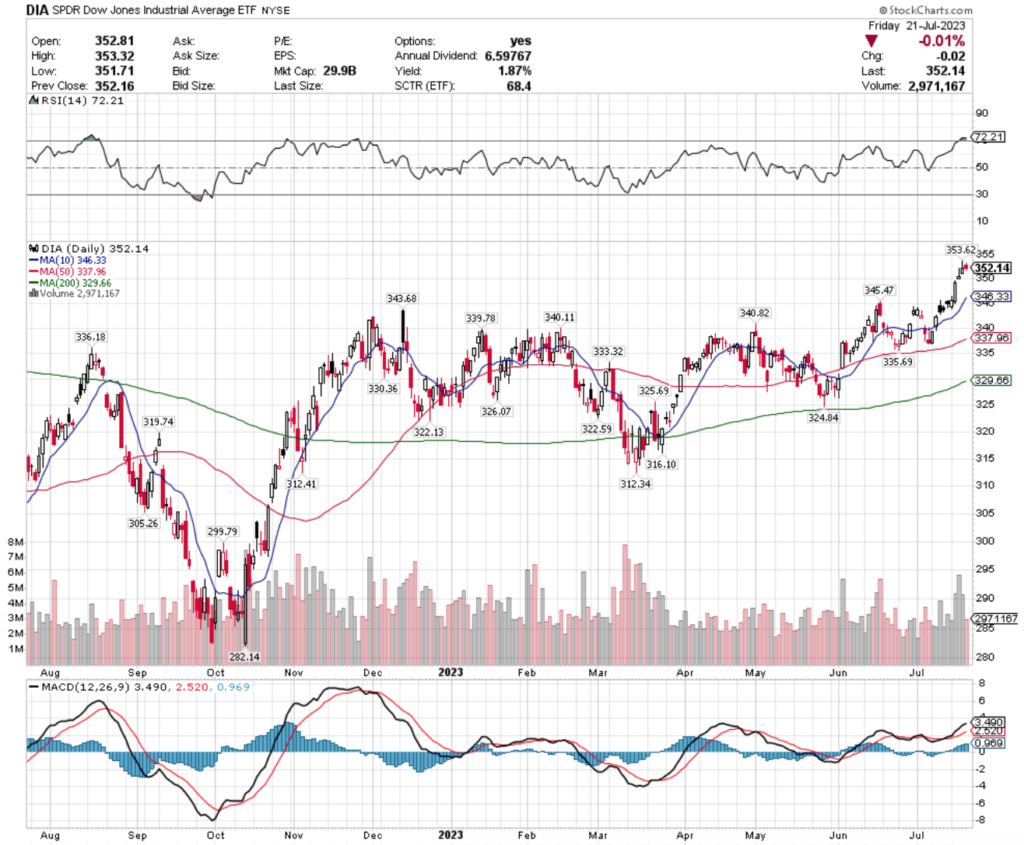

DIA, the SPDR Dow Jones Industrial Average ETF advanced +2.17% over the past week, faring the best of all of the major indexes, as investors looked favorably on large cap names.

Their RSI is overbought at 72.21, with their MACD beginning to signal a bearish crossover is on the horizon in the coming days.

Last week’s average trading volume was +11.46% higher than the average trading volume of the year prior (4,028,917 vs. 3,614,653), with the most volume of the week happening on Wednesday’s gap up session that closed in a shooting star candle, signaling a potential reversal on the horizon.

Thursday also resulted in a shooting star, with Friday’s candle closing as a spinning top, all ultimately showing that investors are walking on egg shells & prepared for the market to reverse at any moment.

DIA has support at the $346.33 (10 Day Moving Average; Volume Sentiment: Buyers, 3.17:1), $345.47 (Volume Sentiment: Buyers, 1.32:1), $343.68 (Volume Sentiment: Buyers, 1.32:1) & $340.82/share (Volume Sentiment: Buyers, 1.32:1) price levels, with resistance at the $353.38 (Volume Sentiment: Buyers, 0.2:0*), $353.62 (Volume Sentiment: Buyers, 0.2:0*) & $358.47/share (Volume Sentiment: NULL, 0:0*) price levels.

Oil Services (OIH), Europe (EURL), Financials (FAS) & Colombia (GXG) Are All Bullishly Leading The Market

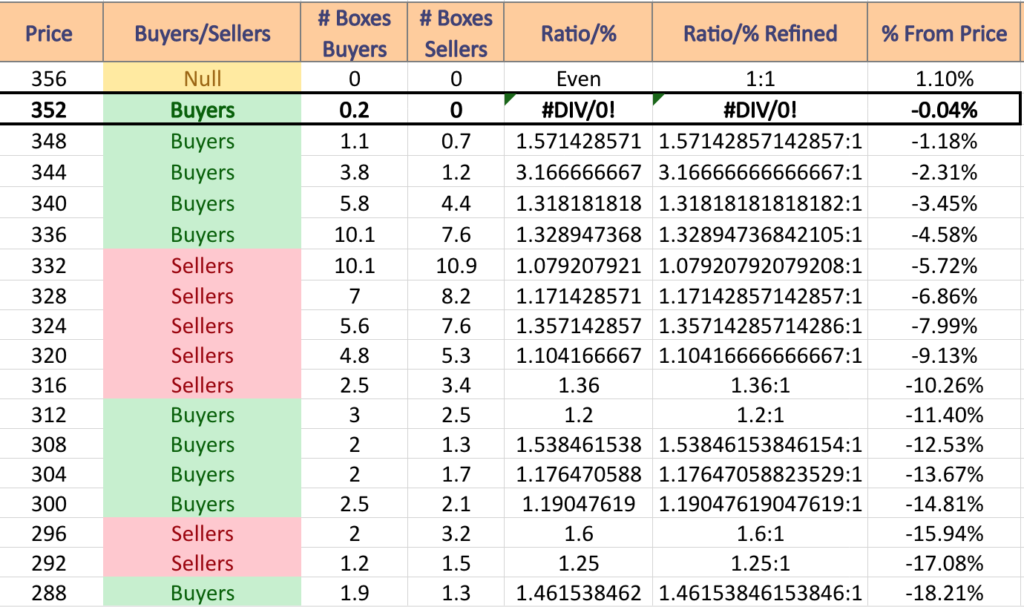

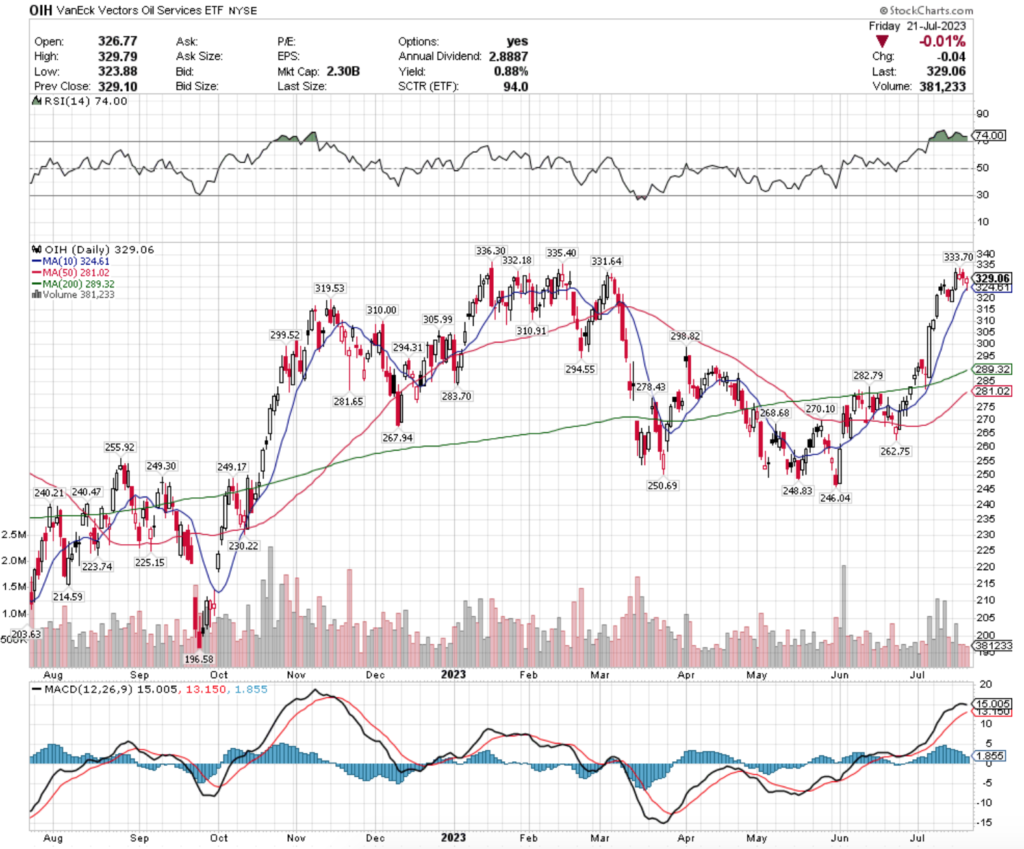

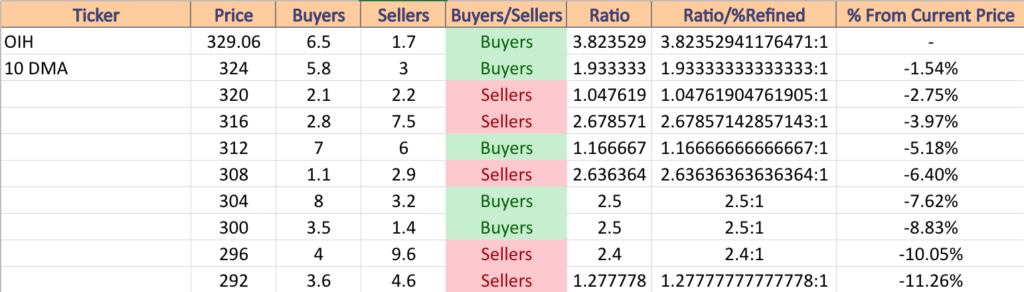

OIH, the VanEck Vectors Oil Services ETF has gained +57.51% over the past year, with +65.7% growth from their 52-week low in September of 2022 (ex-distributions).

Their RSI is overbought at 74 & their MACD is beginning to roll over bearishly, with an impending bearish crossover in the coming days.

Last week’s average trading volume was -30.01% less than the average volume for the year prior (511,100 vs. 730,220), signaling hesitancy among investors.

Tuesday’s session saw the most volume, with the following three sessions reflecting profit taking that resulted in three bearish spinning top candles.

OIH offers a modest 0.88% distribution yield, making it important to have a hedging strategy in place, either by selling calls, buying puts or another options hedging strategy in the near-term.

OIH has support at the $324.61 (10 Day Moving Average; Volume Sentiment: Buyers, 1.93:1), $319.53 (Volume Sentiment: Sellers, 2.68:1), $310.00 (Volume Sentiment: Sellers, 2.64:1) & $305.99/share (Volume Sentiment: Buyers, 2.5:1) price levels, with resistance at the $331.64 (Volume Sentiment: Buyers, 3.82:1), $332.18 (Volume Sentiment: NULL, 0:0*), $335.40 (Volume Sentiment: NULL, 0:0*) & $336.30 (Volume Sentiment: NULL, 0:0*).

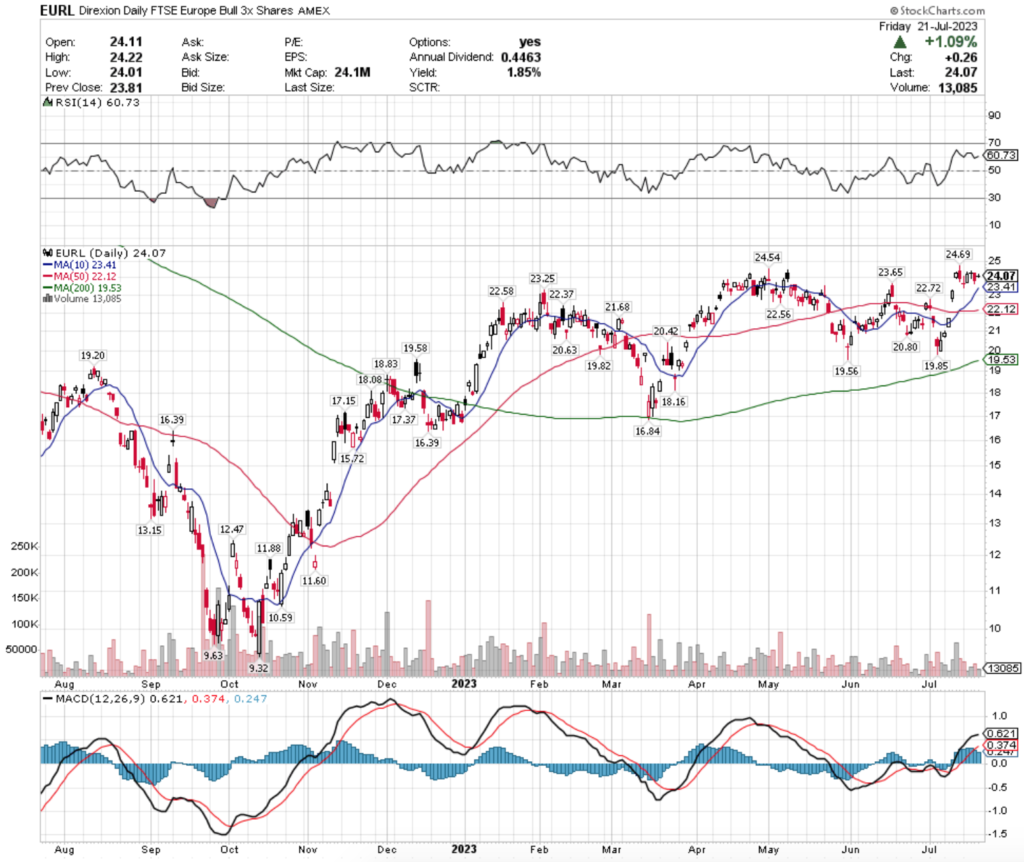

EURL, the Direxion Daily FTSE Europe Bull 3x Shares ETF has advanced +46.47% over the past year & has recovered an astounding +154.44% from their 52-week low in October of 2022 (ex-distributions).

Their RSI is currently at 60.73 & their MACD is beginning to signal weakness & an impending bearish crossover, as prices have spent the last week & a half relatively flat in a consolidation range.

Last week’s average trading volumes were -44.88% lower than the average volumes for the year prior (20,400 vs. 37,011), signaling sever uncertainty & hesitancy on the part of market participants.

The week before ended on Friday with a bearish engulfing pattern, with Monday kicking the week off with a doji candlestick & Wednesday & Friday following suit with the candlestick of uncertainty.

Wednesday’s dragonfly doji hints that the price level is unsustainable & will be reversing in the near-future.

EURL pays a 1.85% distribution yield to long-term holders, which provides some cushion against losses, but a hedging strategy would be wise at this time as the chart is signaling that there is a cool off period coming soon.

EURL has support at the $23.65 (Volume Sentiment: Buyers, 1.35:1), $23.41 (10 Day Moving Average; Volume Sentiment: Buyers, 1.35:1), $23.25 (Volume Sentiment: Buyers, 1.35:1) & $22.72/share (Volume Sentiment: Even, 1:1) price levels, with resistance at the $24.54 (Volume Sentiment: Sellers, 2:1), $24.69 (Volume Sentiment: Sellers, 2:1), $28.80 (Volume Sentiment: Buyers, 3.29:1) & $29.14/share (Volume Sentiment: Buyers, 5:1) price levels.

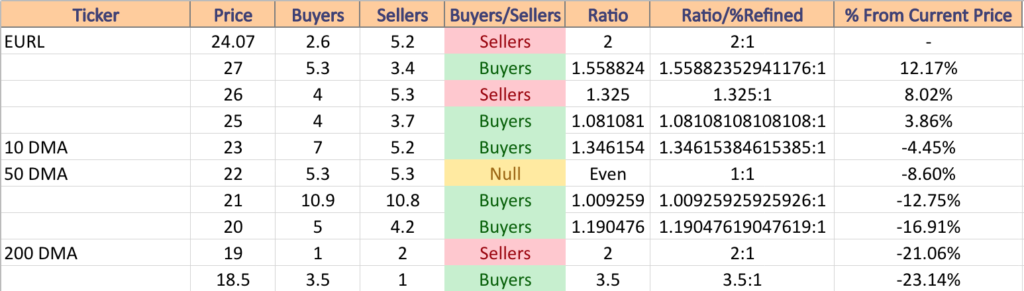

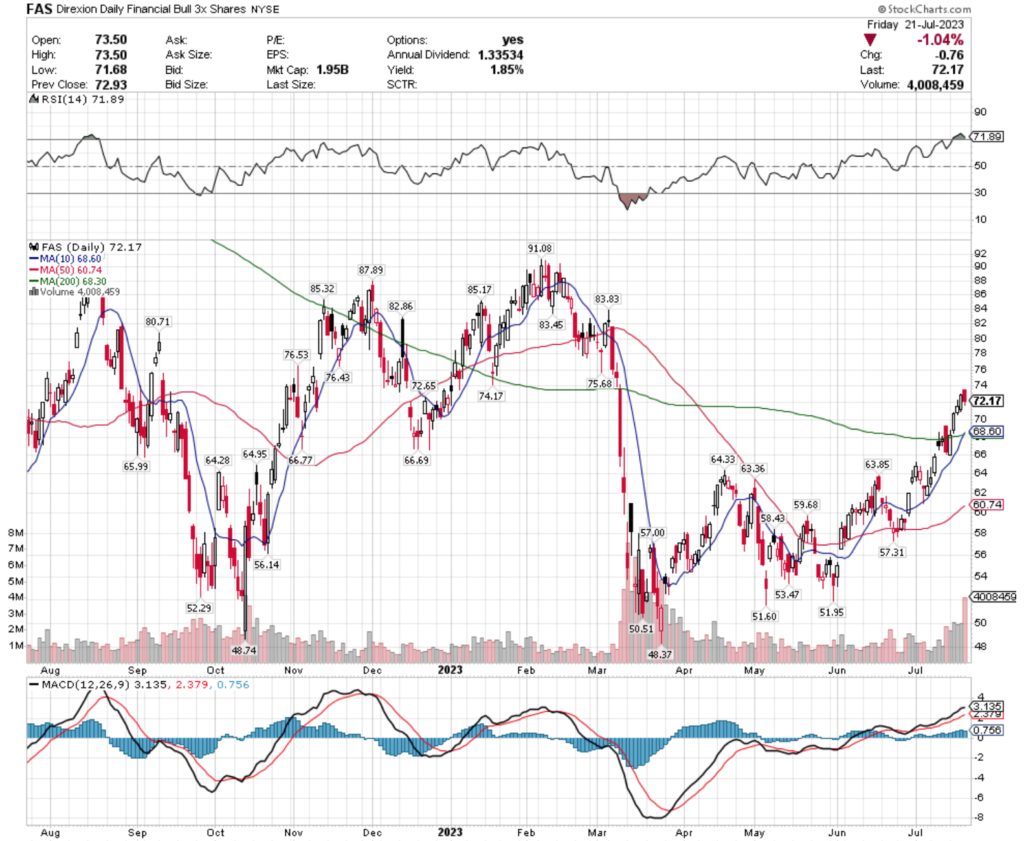

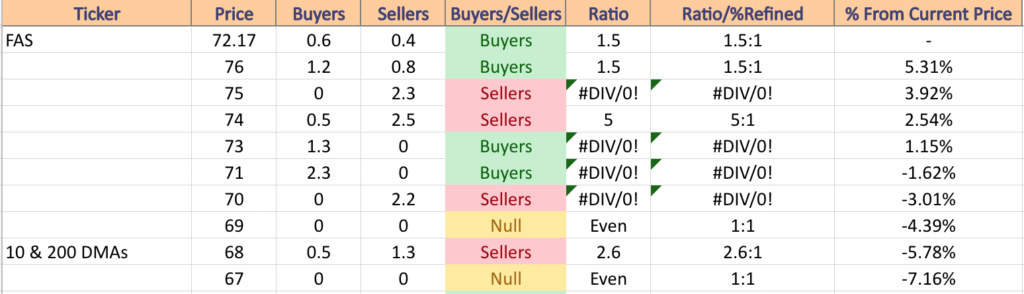

FAS, the Direxion Daily Financial Bull 3x Shares ETF has climbed only +5.46% over the past year, but has improved +47.71% from their 52-week low in March of 2023 (ex-distributions).

Their RSI is overbought at 71.89, with their MACD beginning to signal that a bearish crossover is on the horizon, just as their 10 day moving average is bullishly crossing their 200 day moving average.

Last week’s average trading volume was +76.82% higher than the average trading volume of the year prior (2,559,900 vs. 1,447,726), as investors were eagerly buying the stock all week, before being twice as eager to take profits on Friday.

Friday’s candlestick’s body covered a wide range, with its closing price being about halfway down Thursday’s candle & the lower shadow extending 75% of the way down it, signaling that there is a good amount of downside sentiment at these price levels.

FAS offers a 1.85% distribution yield to long-term holders, which will not provide much protection against a draw down, making it important to examine hedging strategies or consider trimming positions for some profits in the near-term.

FAS has support at the $68.60 (10 Day Moving Average; Volume Sentiment: Sellers, 2.6:1), $68.30 (200 Day Moving Average; Volume Sentiment: Sellers, 2.6:1), $66.77 (Volume Sentiment: NULL, 0:0*) & $66.69/share (Volume Sentiment: NULL, 0:0*) price levels, with resistance at the $72.65 (Volume Sentiment: Buyers, 1.5:1), $74.17 (Volume Sentiment: Sellers, 5:1), $75.68 (Volume Sentiment: Sellers, 2.3:0*) & $76.43/share (Volume Sentiment: Buyers, 1.5:1) price levels.

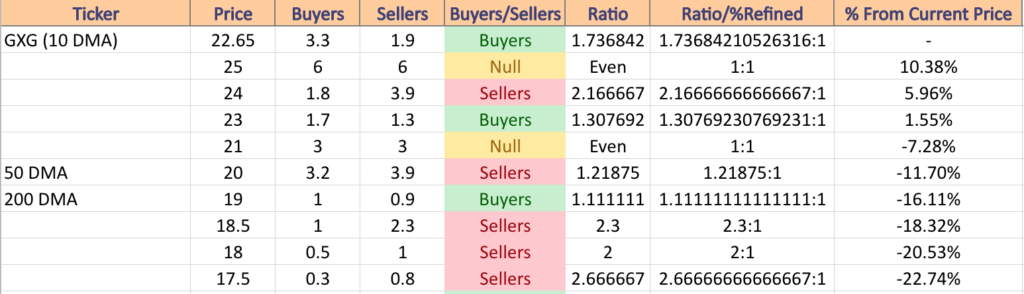

GXG, the Global X MSCI Colombia ETF has risen +7.74% over the past year, including a +29.28% climb from their 52-week low in March of 2023 (ex-distributions).

Their RSI is overbought at 70.2, with their MACD beginning to roll over in preparation for a bearish crossover in the coming sessions.

Last week’s average trading volume was -44.23% lower than the year prior’s average volumes (10,083 vs. 18,080), and the candlesticks further confirm the uncertainty of market participants.

Monday kicked off with a dragofly doji, followed by a gap up Tuesday & a dragonfly doji Wednesday that set the range for Thursday’s session, which was capped off by an ominous hanging man candle on Friday.

The 10 day moving average will be important to watch here, as it near’s the gap that was created last week & would be the support level in that area.

GXG pays a 6.32% distribution yield, which provides some protection against losses, but a hedging strategy or profit taking would be advisable based on the uncertainty reflected in their chart.

GXG has support at the $22.16 (Volume Sentiment: Buyers, 1.74:1), $22.14 (Volume Sentiment: Buyers, 1.74:1), $22.10 (10 Day Moving Average; Volume Sentiment: Buyers, 1.74:1) & $21.50/share (Volume Sentiment: Even, 1:1) price levels, with resistance at the $22.79 (Volume Sentiment: Buyers, 1.74:1), $23.36 (Volume Sentiment: Buyers, 1.31:1), $23.55 (Volume Sentiment: Buyers, 1.31:1) & $24/share (Volume Sentiment: Sellers, 2.17:1) price levels.

Regional Banks (DPST), China Small Caps (ECNS), Base Metals (DBB) & 1-3 Year Treasuries (SHY) Are All Bearishly Lagging The Market

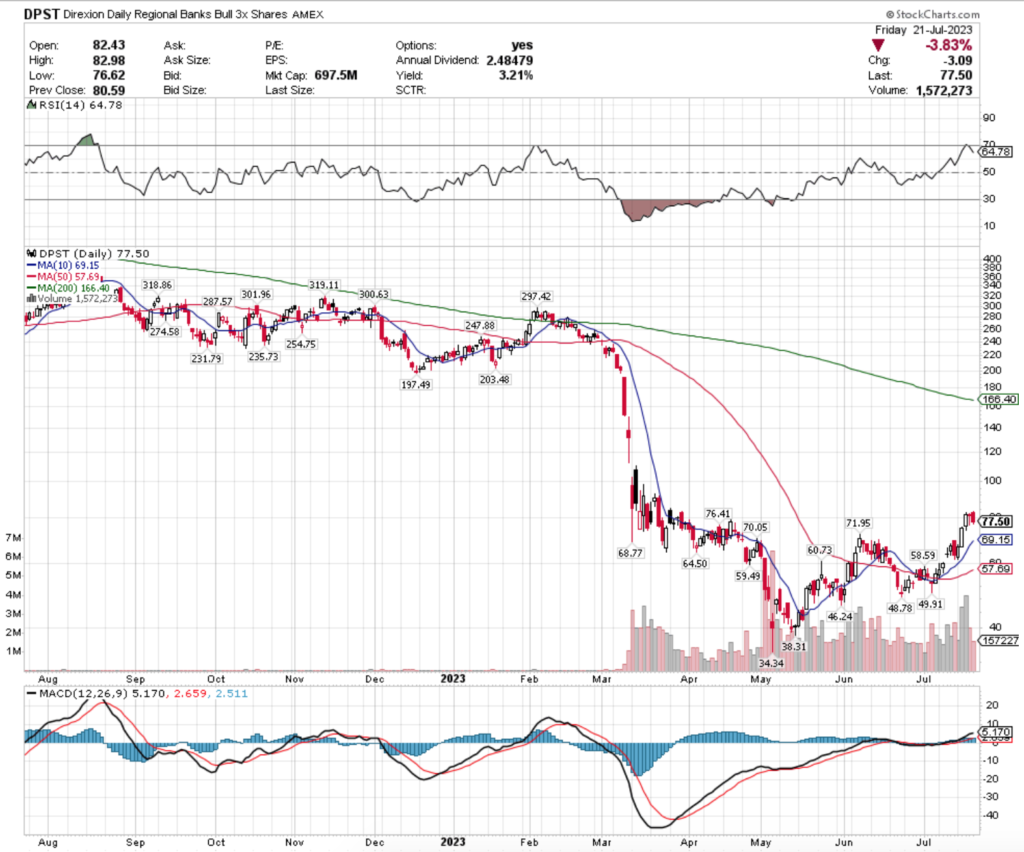

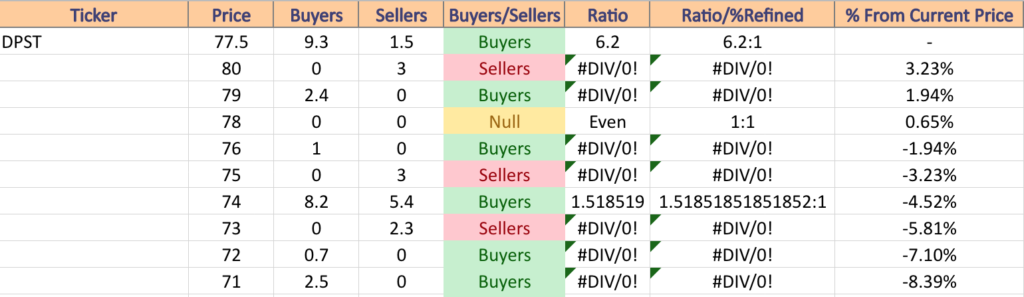

DPST, the Direxion Daily Regional Banks Bull 3x Shares ETF has fallen -71.92% over the past year, losing -80.22% from their 52-week high in August of 2022, but has reclaimed +123.99% from their 52-week low in May of 2023 (ex-distributions).

Their RSI is 64.78 as it retreats back from overbought conditions, with their MACD beginning to signal a bearish crossover on the horizon.

Last weeks average trading volume was +261.84% higher than their prior year’s average volume (2,569,450 vs. 710,111), as Tuesday & Wednesday showed strong investor enthusiasm, with Thursday’s dragonfly doji candle setting the reversal stage for profit taking to continue into Friday.

DPST pays a 3.21% distribution yield, but it is still wise to begin looking for an appropriate hedging strategy to protect holdings from near-term declines.

DPST has support at the $76.41 (Volume Sentiment: Buyers, 1:0*), $71.95 (Volume Sentiment: Buyers, 2.5:0*), $70.05 (Volume Sentiment: Buyers, 2.87:1) & $69.15/share (10 Day Moving Average; Volume Sentiment: Sellers, 6.42:1) price levels, with resistance at the $166.40 (200 Day Moving Average; Volume Sentiment: NULL, 0:0*), $197.49 (Volume Sentiment: NULL, 0:0*), $203.48 (Volume Sentiment: NULL, 0:0*) & $231.79/share (Volume Sentiment: NULL, 0:0*) price levels.

ECNS, the iShares MSCI China Small-Cap ETF has declined -17.12% over the past year, falling -28.39% from their 52-week high in February of 2023, but has reclaimed +10.58% since their 52-week low in October of 2022 (ex-distributions).

Their RSI is on the oversold end of neutral at 46.79, with their MACD already pointing bearishly & crossing over into weakness.

Last week’s average volume was -79.81% lower than the year prior’s average trading volume (3,633 vs. 18,000) signaling extreme uncertainty by market participants.

Monday began the week with a gap down, with Wednesday’s shooting star candlestick pushing the price range even lower into Thursday’s gap down doji candle.

The 10 & 50 day moving averages are now acting as resistance just overhead of ECNS & should be expected to continue applying downside pressure to them.

A 3.41% distribution yield will help protect against some losses, but a more comprehensive hedging strategy or profit taking should be considered at this time.

ECNS has support at the $28.98 (Volume Sentiment: Buyers, 1.87:1), $28.25 (Volume Sentiment: Buyers, 1.87:1), $28.10 (Volume Sentiment: Buyers, 1.87:1) & $28.09/share (Volume Sentiment: Buyers, 1.87:1) price levels, with resistance at the $29.70 (10 Day Moving Average; Volume Sentiment: Buyers, 1.05:1), $29.78 (50 Day Moving Average; Volume Sentiment: Buyers, 1.05:1), $30.11 (Volume Sentiment: Buyers, 1.12:1) & $30.50/share (Volume Sentiment: Buyers, 1.12:1) price levels.

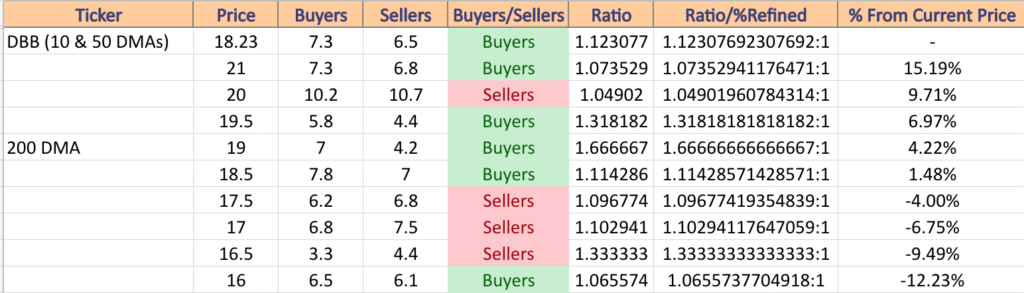

DBB, the Invesco DB Base Metals Fund ETF has lost -0.05% over the past year, declining -18.4% from their 52-week high in January of 2023 & has only managed to recover +4.77% from their 52-week low in May of 2023 (ex-distributions).

Their RSI is neutral at 50.48, with their MACD about to cross over bearishly in the next day or two’s session.

Last week’s average trading volume was -52.29% below the year prior’s average volumes (95,433 vs. 200,043), another signal of uncertainty & weakness for DBB in the eyes of traders & investors.

Monday last week kicked off with a gap down, followed by two more days of declines before two very light volume, but high price range (large full bodies of the candles) trading sessions, which are not indicative of market strength of sentiment.

DBB offers a 1.01% distribution yield for long-term investors, which will not provide much protection against any downside moves, making it worth looking into hedging options for the near-term.

DBB has support at the $18.15 (Volume Sentiment: Buyers, 1.23:1), $18.14 (50 Day Moving Average; Volume Sentiment: Buyers, 1.23:1), $17.65 (Volume Sentiment: Sellers, 1.10:1) & $17.52/share (Volume Sentiment: Sellers, 1.10:1) price levels, with resistance at the $18.31 (10 Day Moving Average; Volume Sentiment: Buyers, 1.23:1), $18.59 (Volume Sentiment: Buyers, 1.11:1), $18.73 (Volume Sentiment: Buyers, 1.11:1) & $18.84/share (Volume Sentiment: Buyers, 1.11:1) price levels.

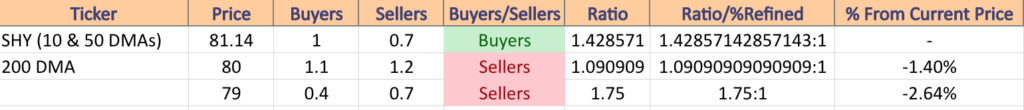

SHY, the iShares 1-3 Year Treasury Bond ETF has inched forward +0.2% over the past year, but has fallen -1.28% from their 52-week high in May of 2023, while recovering +2.51% since their 52-week low in November of 2022 (ex-distributions).

Their RSI is currently neutral at 52.22, with their MACD rolling over to bearishly cross over in the coming week.

Their average volume last week was -12.21% lower than the year prior’s average volume (5,085,816 vs. 5,793,464) as investors are showing hesitancy to do much at these price levels.

Three dragonfly dojis last week confirm the lack of enthusiasm & overall skepticism about the near-term, with one on Monday to start the week, and Thursday & Friday also closing with them right up against the resistance of the 10 day moving average.

SHY offers a 2.31% distribution yield for long-term holders, but given the nature of the last week’s technicals, it would be wise to take some profits or find a hedging solution for the week ahead.

SHY has closed Friday at its 10 Day Moving Average, and has support at the $81.01 (Volume Sentiment: Buyers, 1.43:1), $80.93 (Volume Sentiment: Sellers, 1.09:1), $80.92 (Volume Sentiment: Sellers, 1.09:1) & $80.61/share (200 Day Moving Average; Volume Sentiment: Sellers, 1.09:1) price levels, with resistance at the $81.17 (50 Day Moving Average; Volume Sentiment: Buyers, 1.43:1), $81.19 (2 Touch-points; Volume Sentiment: Buyers, 1.43:1), $81.38 (Volume Sentiment: Buyers, 1.43:1) & $81.43/share (Volume Sentiment: Buyers, 1.43:1) price levels.

Tying It All Together

Next week is going to be busy on both the earnings & market data fronts.

Monday begins with S&P “Flash” U.S. Manufacturing PMI & S&P “Flash” U.S. Services PMI data released at 9:45 am.

On the earnings front, Agilysys, AGNC Investment, Alexandria Real Estate Equities, Brown & Brown, Cadence Design, Cleveland Cliffs, Domino’s Pizza, F5 Networks, Logitech International, Medpace, NextGen Healthcare, NXP Semiconductors, Packaging Corp of America, Range Resources, Simpson Manufacturing & Whirlpool are all set to report earnings data on Monday.

S&P Case-Shiller Home Price Index (20 Cities) data comes out Tuesday at 9 am, followed by Consumer Confidence Data at 10 am.

Alphabet, Microsoft, 3M, Alaska Air, Albertsons, Archer-Daniels-Midland, Ashland, Avery Dennison, Biogen, Cal-Maine Foods, Canadian National Railway, Chubb, Corning, Danaher, Dover, Dow, GE Health Care, General Electric, General Motors, Invesco, Kimberly-Clark, Lamb Weston, Moody’s, MSCI, NextEra Energy, NextEra Energy Partners, Nucor, NVR, PacWest Bancorp, PulteGroup, Sherwin-Williams, Snap, Spotify, Texas Instruments, TransUnion, Universal Health, Verizon Communications, Visa, Waste Management, West Fraser & Xerox will all report earnings on Tuesday.

Wednesday kicks off with New Homes Sales data at 10 am, followed by the FOMC Decision On Interest-Rate Policy at 2pm & Fed Chairman Powell’s Press Conference at 2:30pm.

For earnings calls, Wednesday brings us Alkermes, Align Technology, American Water Works, AT&T, Automatic Data Processing, Boeing, Check Point Software, Chipotle Mexican Grill, Churchill Downs, CME Group, Coca-Cola, eBay, Fiserv, Flex, General Dynamics, Graco, Group 1 Auto, Helmerich & Payne, Hess, Hilton Worldwide Holdings, IDEX Corp, Invitation Homes, Lam Research, Lending Club, Mattel, Meta Platforms, Molina Healthcare, Navient, New Oriental Education & Technology, O’Reilly Automotive, Old Dominion, Otis Worldwide, Owens Corning, Patterson-UTI, Penske Auto, Pilgrim’s Pride, Quest Diagnostics, Ryder Systems, Seagate Technology, ServiceNow, Sun Communities, Teradyne, Thermo Fish Scientific, Tilray, Tower Semiconductor, Union Pacific, United Rentals, VICI Properties, Western Union & Wyndham Hotels & Resorts.

Thursday looks to be busy, with Initial Jobless Claims, Durable-Goods Orders, Durable Goods-Minus Transportation, GDP (Advanced report), Advanced U.S. Trade Balance In Goods, Advanced Retail Inventories & Advanced Wholesale Inventories data all reported at 8:30am & Pending Home Sales data at 10 am.

Amazon.com, AbbView, AGCO Corp, Alliance Bernstein, American Electric Power, American Homes 4 Rent, American Tower, ArcelorMittal, Beazer Homes, Boston Beer, Boston Scientific, Boyd Gaming, Bristol Myers Squibb, Chemours, Cincinnati Financial, Comcast, Coursera, Crocs, Cullen/Frost, Deckers Outdoor, Digital Realty Trust, Enphase Energy, Equity Residential, Essex Property, Federated Hermes, First Solar, Ford Motor, Gaming & Leisure Properties, W.W. Grainger, Harley-Davidson, Hershey Foods, Hertz Global, Hilton Grand Vacations, Honeywell, Internatonal Paper, Intel, Juniper Networks, Keurig Dr. Pepper, Kimco Realty, Labratory Corp of America, LendingTree, Linde, Martin Marietta, Masco, Mastercard, McDonald’s, MDC Holdings, Melco Resorts & Entertainment, Mobileye Global, Mondelez International, Neogen, Norfolk Southern, Northrop Grumman, Olin, Oshkosh, Overstock.com, Peabody Energy, PG&E, Roku, Royal Caribbean, S&P Global, Sketchers USA, Southwest Air, Sweetgreen, STMicroelectronics, Texas Roadhouse, T-Mobile US, Tractor Supply Company, Tradeweb Markets, U.S. Steel, Valero Energy, Verisign, Willis Towers Watson & Weyerhauser are all set to report earnings on Thursday.

8:30 am Friday starts off with Personal Income (nominal), Personal Spending (nominal), PCE Index, Core PCE Index, PCE (Year-over-Year), Core PCE (Year-over-Year) & Employment Cost Index Data, followed by Consumer Sentiment (final) data reported at 10am.

Wrapping up the week in earnings on Friday are Aon, AstraZeneca, Barnes Group, Booz Allen Hamilton, Centene, Chart Industries, Charter Communications, Chevron, Church & Dwight, Colgate-Palmolive, Exxon Mobile, Franklin Resources, Newell Brands, Newmark Group, Procter & Gamble, Saia, Sanofi, T. Rowe Price, W.P. Carey & Wisdom Tree.

See you back here next week!

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN SPY, QQQ, IWM, DIA, OIH, EURL, FAS, GXG, DPST, ECNS, DBB or SHY AT THE TIME OF PUBLISHING THIS ARTICLE ***