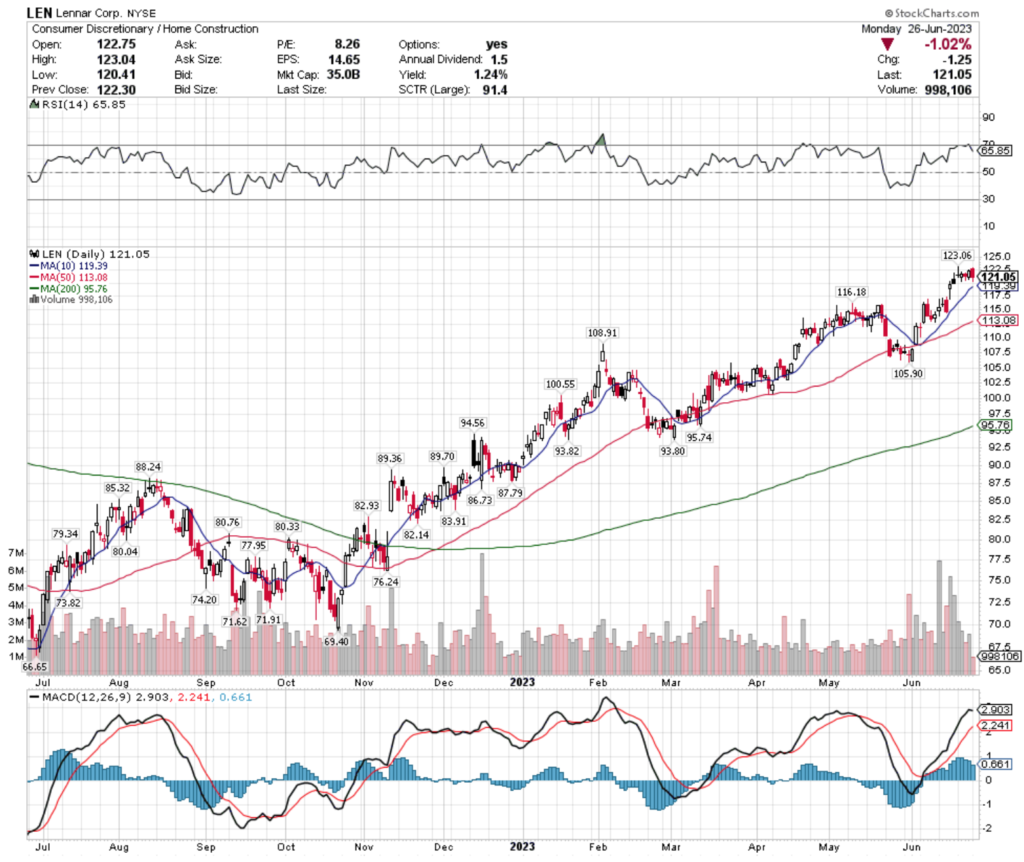

Lennar Corp. stock trades under the ticker LEN & has had a very strong year, along with the other member’s of the homebuilders/construction industry.

LEN stock has climbed +81.62% (ex-dividends) from their 52-week low, which occurred approximately one year ago & set a new all-time high last week.

Some of the popular ETFs that contain LEN stock include ITB (12.65%), PKB (5.02%), XHB (3.88%), FTLS (2.52%), RCD (1.96%), RPV (2.09%), as well as many others.

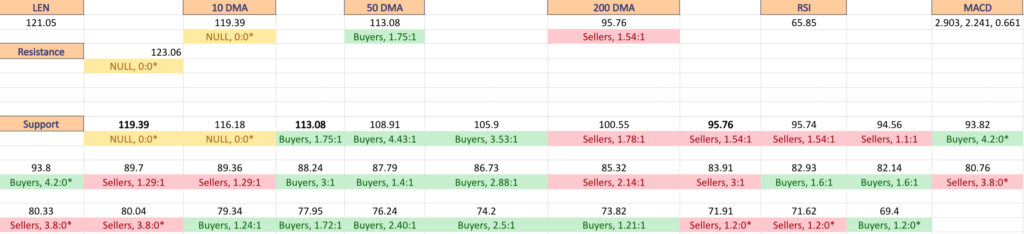

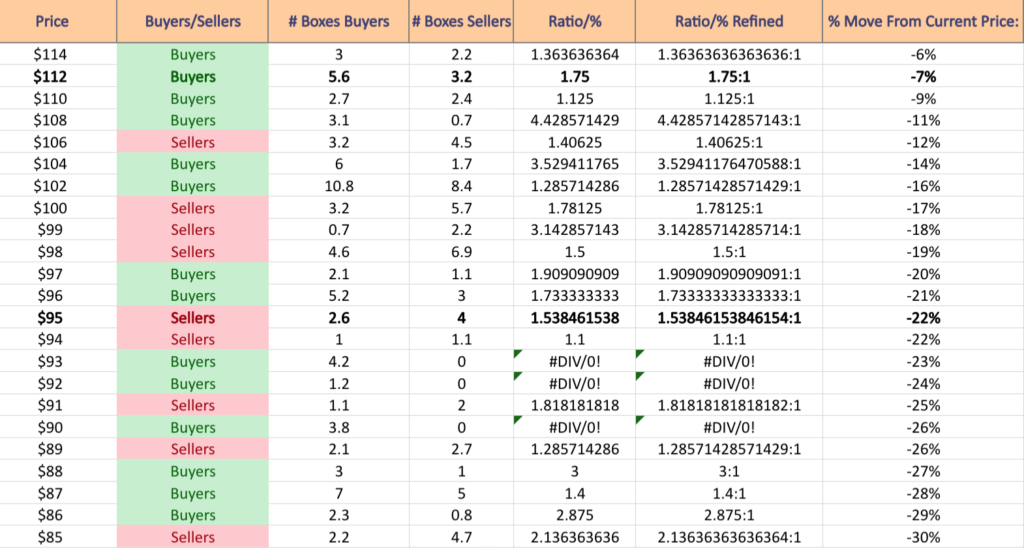

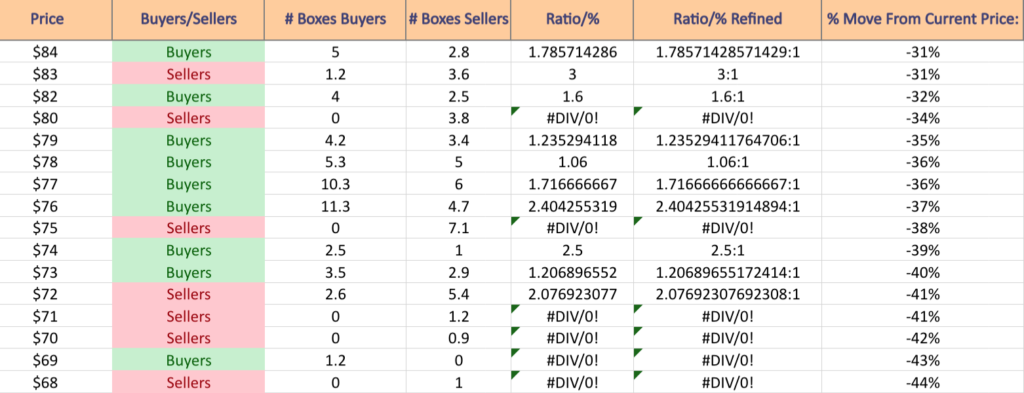

The Price:Volume analysis below seeks to display the volume at specific share-price levels from over the past one-to-two years & is intended to serve as a reference point for how investors viewed LEN stock’s value at each level.

It also includes a list of moving averages, as well as support & resistance levels, which will be marked in bold.

Lennar Corp. LEN Stock’s Price:Volume Sentiment Broken Down

LEN stock’s RSI has dipped back underneath overbought conditions to close at 65.85 yesterday & their MACD has curled over bearishly but remains bullish.

Last week’s volumes were above average compared to the year prior, but yesterday’s session was on very light volume, losing -1.02% on the day.

Yesterday’s candle also engulfed Friday’s candle, with the 23rd (Friday’s) Open = $121.07, High = $122.48, Low = $120.80 & Close = $122.30 & yesterday’s (26th’s) Open = $122.75, High = $123.04, Low = $120.41 & Close = $121.07, indicating a weak, but bearish near-term sentiment.

Their 10 Day Moving Average will be a support level to watch in the coming days, which is currently just a -1.37% decline from their closing price on Monday 6/26/2023.

The bold prices on the image below denote the moving average levels just listed & the bold entries in the list form of the analysis under the images include other levels of support (there is no data for their resistance levels as they are near an all time high).

Each corresponding price level using a ratio of Buyers:Sellers (or Sellers:Buyers), NULL values denote that there was not enough data, so the ratio would’ve been 0:0.

Ratios with a 0 for the denominator/constant are denoted with an *, but are reported as is, as we are accounting for volume/sentiment.

Also, as there is such a wide spread between many price levels having activity data, many of the levels are marked NULL, as there was limited volume data for them, and they were not included in the long list below unless they were relevant to support/resistance levels.

Lennar Corp. LEN Stock’s Volume By Price Level

$114 – Buyers – 1.36:1, -6% From Current Price

$112 – Buyers – 1.75:1, -7% From Current Price – 50 Day Moving Average

$110 – Buyers – 1.13:1, -9% From Current Price

$108 – Buyers – 4.43:1, -11% From Current Price

$106 – Sellers – 1.41:1, -12% From Current Price

$104 – Buyers – 3.53:1, -14% From Current Price

$102 – Buyers – 1.29:1, -16% From Current Price

$100 – Sellers – 1.78:1, -17% From Current Price

$99 – Sellers – 3.14:1, -18% From Current Price

$98 – Sellers – 1.5:1, -19% From Current Price

$97 – Buyers – 1.91:1, -20% From Current Price

$96 – Buyers – 1.73:1, -21% From Current Price

$95 – Sellers – 1.54:1, -22% From Current Price – 200 Day Moving Average

$94 – Sellers – 1.1:1, -22% From Current Price

$93 – Buyers – 4.2:0*, -23% From Current Price

$92 – Buyers – 1.2:0*, -24% From Current Price

$91 – Sellers – 1.82:1, -25% From Current Price

$90 – Buyers – 3.8:0*, -26% From Current Price

$89 – Sellers – 1.29:1, -26% From Current Price

$88 – Buyers – 3:1, -27% From Current Price

$87 – Buyers – 1.4:1, -28% From Current Price

$86 – Buyers – 2.88:1, -29% From Current Price

$85 – Sellers – 2.14:1, -30% From Current Price

$84 – Buyers – 1.79:1, -31% From Current Price

$83 – Sellers – 3:1, -31% From Current Price

$82 – Buyers – 1.6:1, -32% From Current Price

$80 – Sellers – 3.8:0*, -34% From Current Price

$79 – Buyers – 1.24:1, -35% From Current Price

$78 – Buyers – 1.06:1, -36% From Current Price

$77 – Buyers – 1.72:1, -36% From Current Price

$76 – Buyers – 2.40:1, -37% From Current Price

$75 – Sellers – 7.1:0*, -38% From Current Price

$74 – Buyers – 2.5:1, -39% From Current Price

$73 – Buyers – 1.21:1, -40% From Current Price

$72 – Sellers – 2.08:1, -41% From Current Price

$71 – Sellers – 1.2:0*, -41% From Current Price

$70 – Sellers – 0.9:0*, -42% From Current Price

$69 – Buyers – 1.2:0*, -43% From Current Price

$68 – Sellers – 1:0*, -44% From Current Price

Tying It All Together

The list & image above paint the picture as to how investors & traders have behaved at various price levels that LEN has been at over the past one-to-two years.

It is not meant to serve as investment/trading advice, and is simply a way to visualize what investor/trader sentiment has been like at each of the price levels mentioned, as well as what it was at levels of support & resistance that are denoted in the image & list.

As always, do your own due diligence before making investing/trading decisions.

For more on the methodology on how the data was collected & put together, please refer to our original Price:Volume analysis.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN LEN AT THE TIME OF PUBLISHING THIS ARTICLE ***