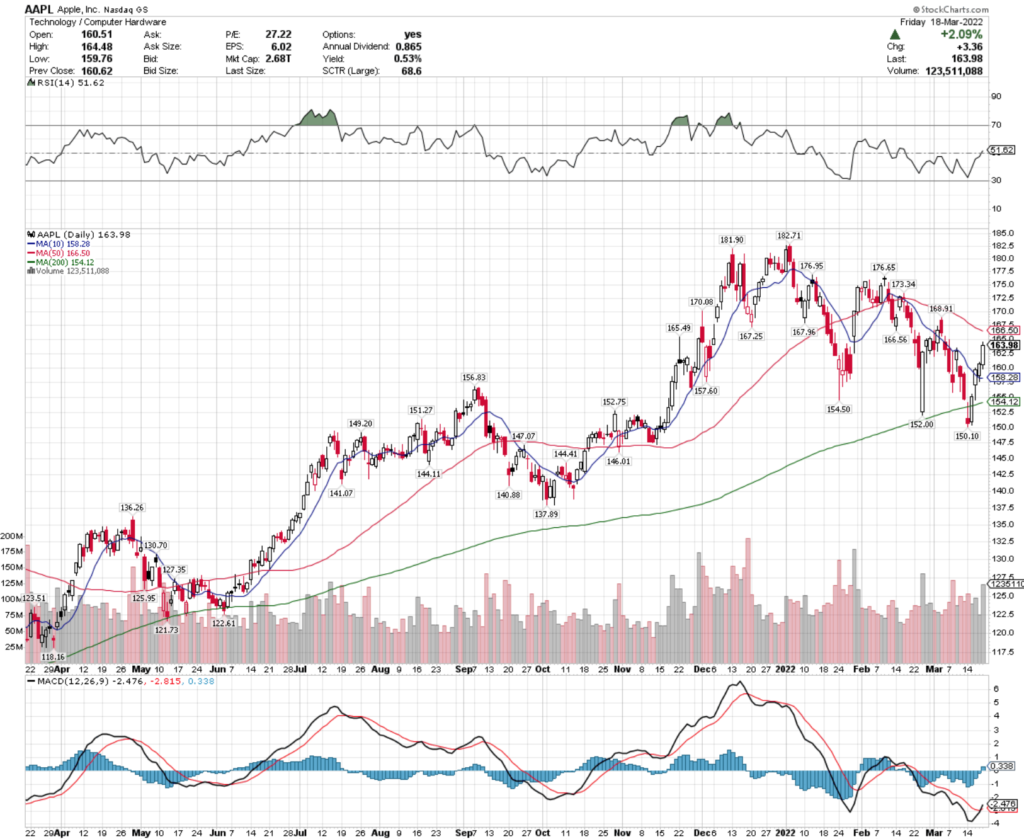

Apple Inc. stock trades under the ticker AAPL & has shown recent bullishness that traders & investors should take a closer look into.

AAPL stock closed at $163.98/share on Friday 3/18/2022.

Apple Inc. AAPL Stock’s Technicals Broken Down

AAPL Stock Price: $163.98

10 Day Moving Average: $158.28

50 Day Moving Average: $166.50

200 Day Moving Average: $154.12

RSI: 51.62

MACD: -2.476

On Friday, AAPL stock completed a bullish MACD crossover, coming within 1.5% of breaking out above its 50 Day Moving Average.

They have been trading at above average volume in the last month compared to the year prior.

With a neutral RSI, there looks to be more momentum to the upside to come in the near-term for AAPL stock.

The $165.02, $165.55 & $168.91 price levels are areas to watch for resistance as they continue climbing.

Apple Inc. AAPL Stock As A Long-Term Investment

Long-term oriented investors may find AAPL stock’s P/E (ttm) of 25.66 appealing, but will find their P/B (mrq) of 35.1 to be a bit too rich.

Their most recent reporting showed 11.2% Quarterly Revenue Growth Y-o-Y, with 20.4% Quarterly Earnings Growth Y-o-Y.

AAPL stock’s balance sheet will warrant a closer review, with $63.91B in Total Cash (mrq) & Total Debt (mrq) f $122.81B.

AAPL stock offers a modest, but safe dividend yield of 0.54%, with a 14% payout ratio.

Only 59% of AAPL stock’s outstanding share float is held by institutional investors.

Apple Inc. AAPL Stock As A Short-Term Trade Using Options

Short-term oriented traders can use options to profit from AAPL stock’s price movement in any direction.

I am looking at the contracts with the 4/14 expiration date.

The $160 & $165 call options both look appealing, and very liquid.

The $170 & $175 puts also look appealing & have high levels of open interest.

Tying It All Together

Overall, AAPL stock has many characteristics that traders & investors alike will find appealing.

Investors will find their P/E (ttm) appealing, and will appreciate their modest dividend yield.

Traders will like the liquidity of their options contracts, as well as their current path of momentum.

AAPL stock is worth taking a closer look into, regardless of your trading style.

*** I DO NOT OWN SHARES OF AAPL STOCK ***