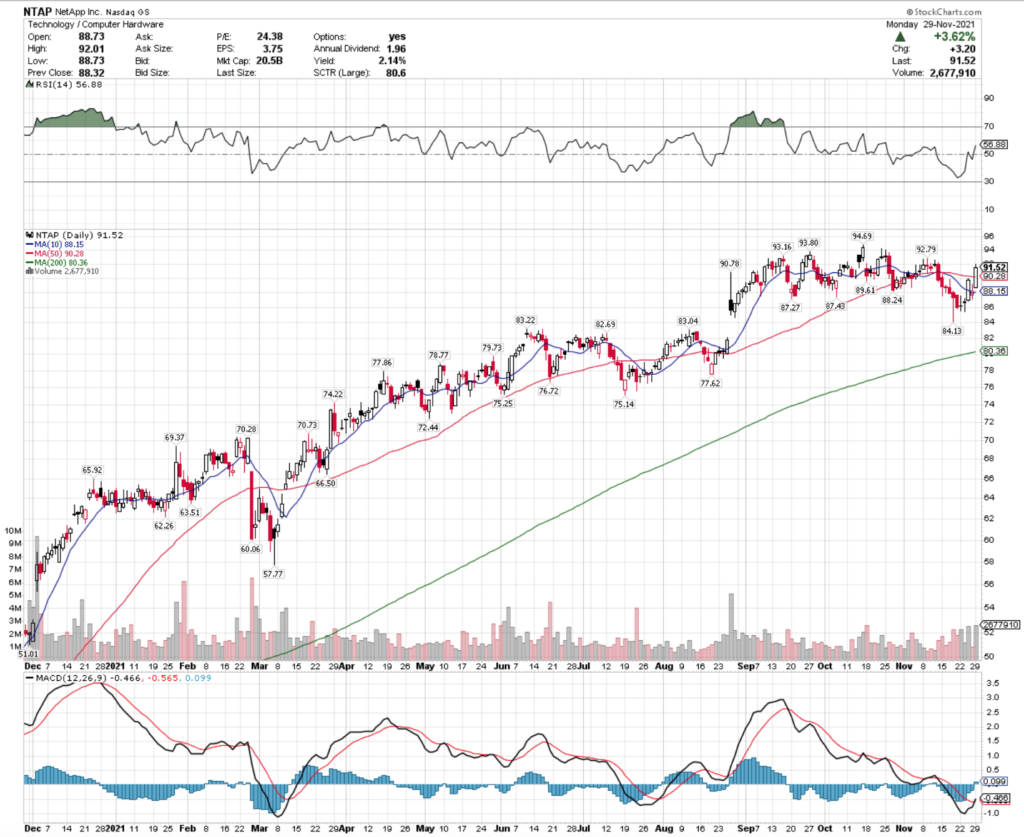

NetApp Inc. stock trades under the ticker NTAP & has shown recent bullishness that traders & investors should take a closer look at.

NTAP stock closed at $91.52/share on 11/29/2021, with more bullish momentum set to push their share price higher.

NetApp Inc. NTAP Stock’s Technicals Broken Down

NTAP Stock Price: $91.52

10 Day Moving Average: $88.15

50 Day Moving Average: $90.28

200 Day Moving Average: $80.36

RSI: 56.9

MACD: -0.466

Yesterday, NTAP completed a bullish MACD crossover, while also breaking out above their 50 day moving average.

Their RSI is still in the neutral range at ~57, signaling that they are not particularly overbought at the moment.

With ~2.4% separating the 10 & 50 day moving averages, there looks to be more room to run in the near-term for NTAP stock.

The next level of resistance is between the $94 & $94.69/share level.

NetApp Inc. NTAP Stock As A Long-Term Investment

Investors will find NTAP’s P/E (ttm) appealing at 23.07, although their P/B is quite high at 26.95.

Their P/B is not as alarming as if they were members of another industry though, as NTAP is a computer hardware company.

Their Quarterly Revenue Growth Y-o-Y is 11.9%.

NTAP stock’s balance sheet looks appealing, with Total Cash (mrq) of $4.55B & Total Debt (mrq) of $2.9B.

NetApp Inc.’s stock offers a dividend yield of 2.2%, which looks relatively safe & stable at a payout ratio of 51.6%.

Due to this, 94.5% of their total share float is held by institutional investors.

NetApp Inc. NTAP Stock As A Short-Term Trade Using Options

Short-term oriented traders can use options to take advantage of NTAP’s current momentum, while fending off broader market volatility.

I am looking at the contracts with the 12/17 expiration date.

The $91 & $92 call options look appealing, although pretty illiquid at the moment.

This may change though as they have weekly contract expiration dates, so as more contracts expire, new ones should be expected to be written.

They currently have no open interest in any puts that look appealing, however if they did I would be looking at the $95 & $96 strike prices.

The $95 puts do have open interest, although with the amount of call:put liquidity it appears that traders expect NTAP stock to continue climbing in the coming weeks.

Tying It All Together

Overall, traders & investors will both find NTAP stock to have appealing attributes.

Investors will like their balance sheet & dividend yield, as well as their P/E (ttm).

Traders will like their current bullish momentum, especially as more & more contracts are written in the coming weeks.

Regardless of your trading style, it is worth taking a closer look at NTAP stock.

*** I DO NOT OWN SHARES OF NTAP STOCK ***