Eli Lilly & Co. stock trades under the ticker LLY & has shown recent bullish behavior that traders & investors should research further into.

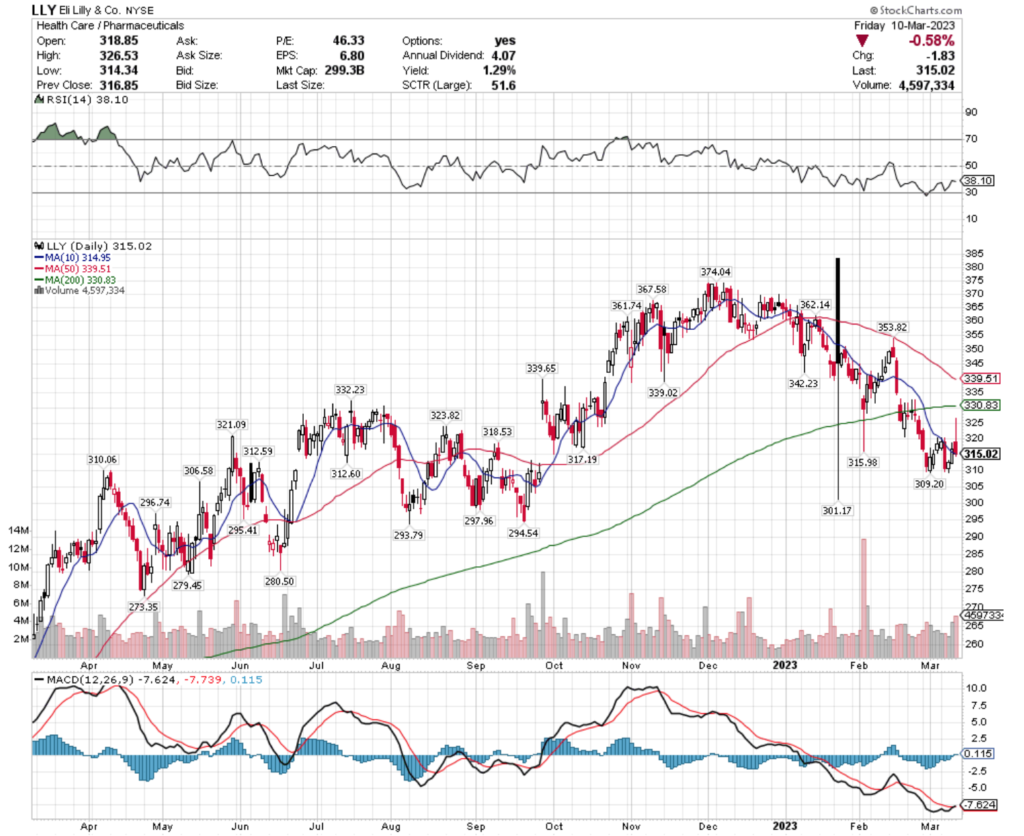

LLY stock closed at $315.02/share on 3/10/2023.

Eli Lilly & Co. LLY Stock’s Technical Performance Broken Down

LLY Stock Price: $315.02

10 Day Moving Average: $314.95

50 Day Moving Average: $339.51

200 Day Moving Average: $330.83

RSI: 38.10

MACD: -7.624

On Friday, LLY stock completed a bullish MACD crossover, despite falling -0.58% on the day’s session.

Their RSI is heading towards oversold & recent trading volumes have been above average compared to the year prior.

While their price has been consolidating over the past couple of weeks after a downfall, it is still signaling more near-term weakness to come, which will provide traders & investors with a better entry point.

LLY stock has support at the $312.60, $312.59, $310.06 & $309.20/share price levels, as they try to break out above their $315.98, $317.19, $318.53 & $321.09/share price levels.

Eli Lilly & Co. LLY Stock As A Long-Term Investment

Long-term oriented investors will like LLY stock’s 46.23 P/E (ttm), but will find their 28.52 P/B (mrq) to be a bit too rich.

Investors may also want to review LLY stock’s recently reported -8.7% Quarterly Revenue Growth Y-o-Y & 12.3% Quarterly Earnings Growth Y-o-Y.

Their balance sheet will also warrant an additional review, with $2.44B of Total Cash (mrq) & $17.14B of Total Debt (mrq).

LLY stock pays a 1.24% dividend, which may be sustainable in the long-run, as their payout ratio is 56.81%.

84.4% of LLY stock’s outstanding share float is owned by institutional investors.

Eli Lilly & Co. LLY Stock As A Short-Term Trade Using Options

Traders with shorter time horizons can use options to profit from LLY stock’s price movements, while protecting their portfolios from volatility.

I am looking at the contracts with the 4/21 expiration date.

The $300, $310 & $280 call options are all in-the-money, listed from highest to lowest level of open interest.

The $320, $330 & $350 puts are also all in-the-money, with the former being more liquid than the latter strikes.

Tying It All Together

LLY stock has many interesting charactertistisc thats traders & investors should research further into.

Investors will like their P/E (ttm) & dividend yield, but may want to look into the makeup of their balance sheet for clues as to how sustainable it is.

Traders will like their recent technical performance, as well as how liquid their options are.

All-in-all, it is worth taking a closer look into LLY stock to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OR OPTIONS CONTRACT POSITIONS IN LLY STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***