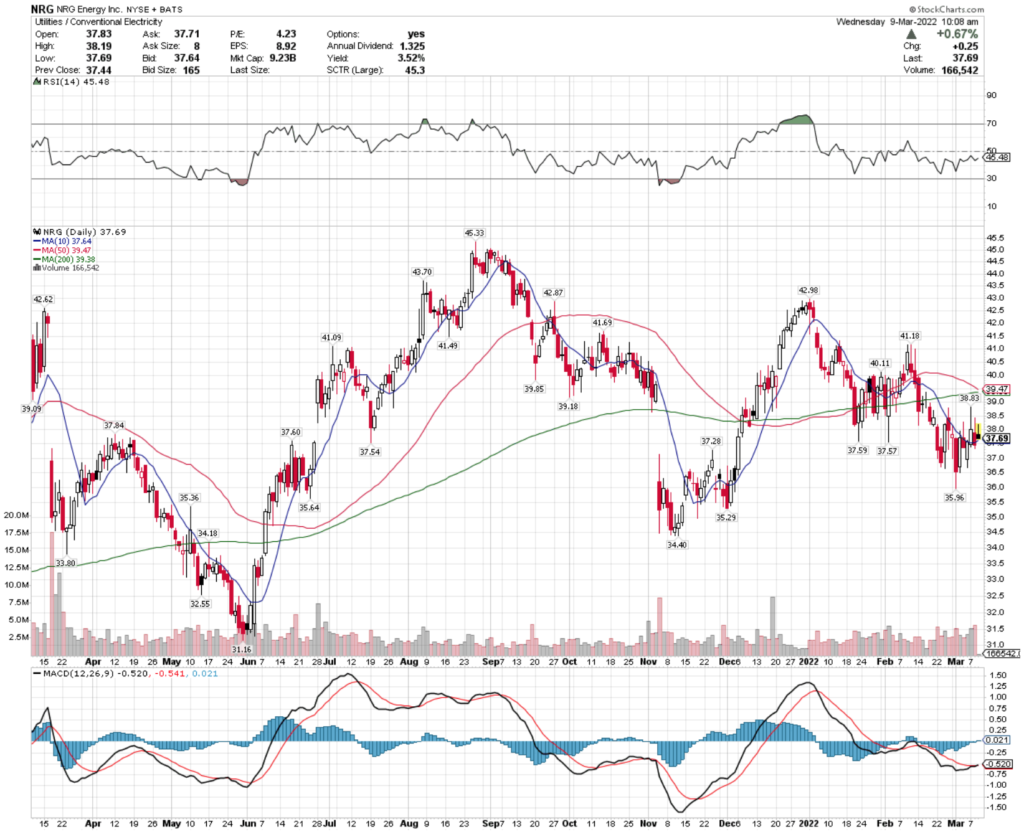

NRG Energy Inc. stock trades under the ticker NRG & has shown recent bullishness that traders & investors may be interested in a taking a closer look at.

NRG stock is currently $37.69 as I write this on 3/9/2022.

NRG Energy Inc. NRG Stock’s Technicals Broken Down

NRG Stock Price: $37.69

10 Day Moving Average: $37.64

50 Day Moving Average: $39.47

200 Day Moving Average: $39.38

RSI: 45.48

MACD: -0.524

Yesterday, NRG stock completed a bullish MACD crossover, while breaking out above its 10 Day Moving Average bullishly today.

They have traded on slightly above average volume in 2022 compared to the year prior, but will have to pass a test of their 50 Day Moving Average bearishly approaching their 200 Day MA (should happen in the next day or two).

How that impacts their near term prices will dictate their near-term price movement, but with an RSI that is already below neutral, there looks to be opportunity for their price to continue higher.

I will be watching their price as it approaches $38.50, as it has only traded above that level twice in the last month or so.

NRG Energy Inc. NRG Stock As A Long-Term Investment

Investors focused on the long-term will like NRG stock’s P/E (ttm) at 4.23, but may find their P/B (mrq) of 2.54 to be a bit rich.

Their recent Quarterly Revenue Growth Y-o-Y was 247.6%.

NRG stock’s balance sheet will need a closer review, with Total Cash (mrq) of $250M, with Total Debt (mrq) of $8.29B.

Moody’s rates NRG Energy Inc.’s debt Ba1, which is the top rating given to speculative, or “junk” debt.

NRG stock’s dividend is 3.54%, which looks fairly safe as their payout ratio is 14.6%.

Despite their speculative debt rating, NRG stock is primarily held by institutional investors.

NRG Energy Inc. NRG Stock As A Short-Term Trade Using Options

Traders interested in the short-term horizon can trade options to take advantage of NRG stock’s price movements.

I am looking at the contracts with the 3/18 expiration date.

The $36 & $37 call options look appealing, but have low open interest.

The $39 & $40 puts also look appealing, and are more liquid than the calls I mentioned above, showing that in the near-term traders see this stock staying below $39.

Tying It All Together

NRG stock has many appealing characteristics to investors, such as their dividend, their valuation metrics & their institutional ownership.

However, their debt will require a closer examination.

Traders will like their current momentum, although they may not like how liquid their options are.

While their open interest levels suggest that most traders see the stock staying below $39 for the next 9 days, NRG stock still has bullish momentum in the near-term.

Overall, it is worth taking a closer look into NRG stock.

*** I DO NOT OWN SHARES OF NRG STOCK ***