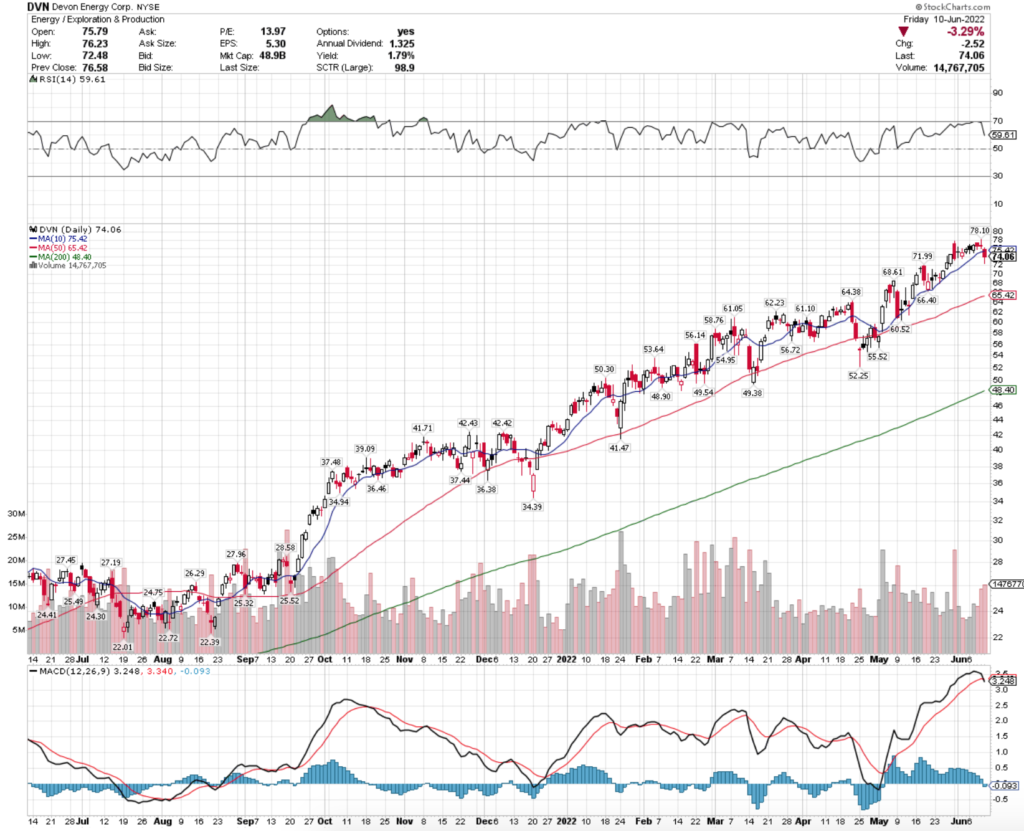

Devon Energy Corp. stock trades under the ticker DVN & has recently shown bullish behavior that traders & investors should research further, as a means of identifying an entry.

DVN stock closed at $74.06/share on 6/10/2022.

Devon Energy Corp. DVN Stock’s Technical Performance Broken Down

DVN Stock Price: $74.06

10 Day Moving Average: $75.42

50 Day Moving Average: $65.42

200 Day Moving Average: $48.40

RSI: 59.61

MACD: 3.248

Yesterday, DVN stock completed a bearish MACD crossover, trading on above average volume compared to the year prior.

Their share price has been steadily climbing since the middle of September 2021, although their current technicals look like there may be more pain to come in the near-term.

This enables traders & investors to enter a new position or add to an existing one as the price goes down, and can also lead to opportunities to capitalize on puts, whose profits can be used to buy new shares using house money.

Devon Energy Corp. DVN Stock As A Long-Term Investment

Long-term focused investors will like DVN stock’s P/E (ttm) of 13.07, but will find its 4.96 P/B (mrq) to be high.

They recently reported 74% Quarterly Revenue Growth Y-o-Y, with 364.3% Quarterly Earnings Growth Y-o-Y.

Their balance sheet will require a closer examination, with $2.46B of Total Cash (mrq) & $6.74B of Total Debt (mrq).

DVN stock pays a 3.49% dividend yield, which appears stable in the long-run, with a 49.9% payout ratio.

85.22% of DVN stock’s outstanding share float is owned by institutional investors.

Devon Energy Corp. DVN Stock As A Short-Term Trade Using Options

Short-term oriented traders can use options to hedge against market volatility, while profiting from DVN stock’s price movements.

This can also be beneficial for acquiring new shares of DVN with the profits from the options, which will then pay dividends.

I am looking at the contracts with the 6/17 expiration date.

The $74, $73 & $72 calls are all in-the-money, although the former is the only one that has a high level of open interest (851 vs. 63 vs. 29).

The $77, $76 & $75 puts are all in-the-money & are much more liquid than the calls.

Tying It All Together

DVN stock has many characteristics that traders & investors will find appealing.

Investors will like their dividend yield & their P/E (ttm), but they may want to review their balance sheet a bit further before investing.

Traders will like their current technical set up, and will be pleased with the liquidity of their put contracts.

Overall, DVN stock is worth taking a closer look into to see how it fits into your portfolio strategy.

*** I DO NOT OWN SHARES OF DVN STOCK AT THE TIME OF PUBLISHING THIS ARTICLE ***